Dda virtual deposit mean

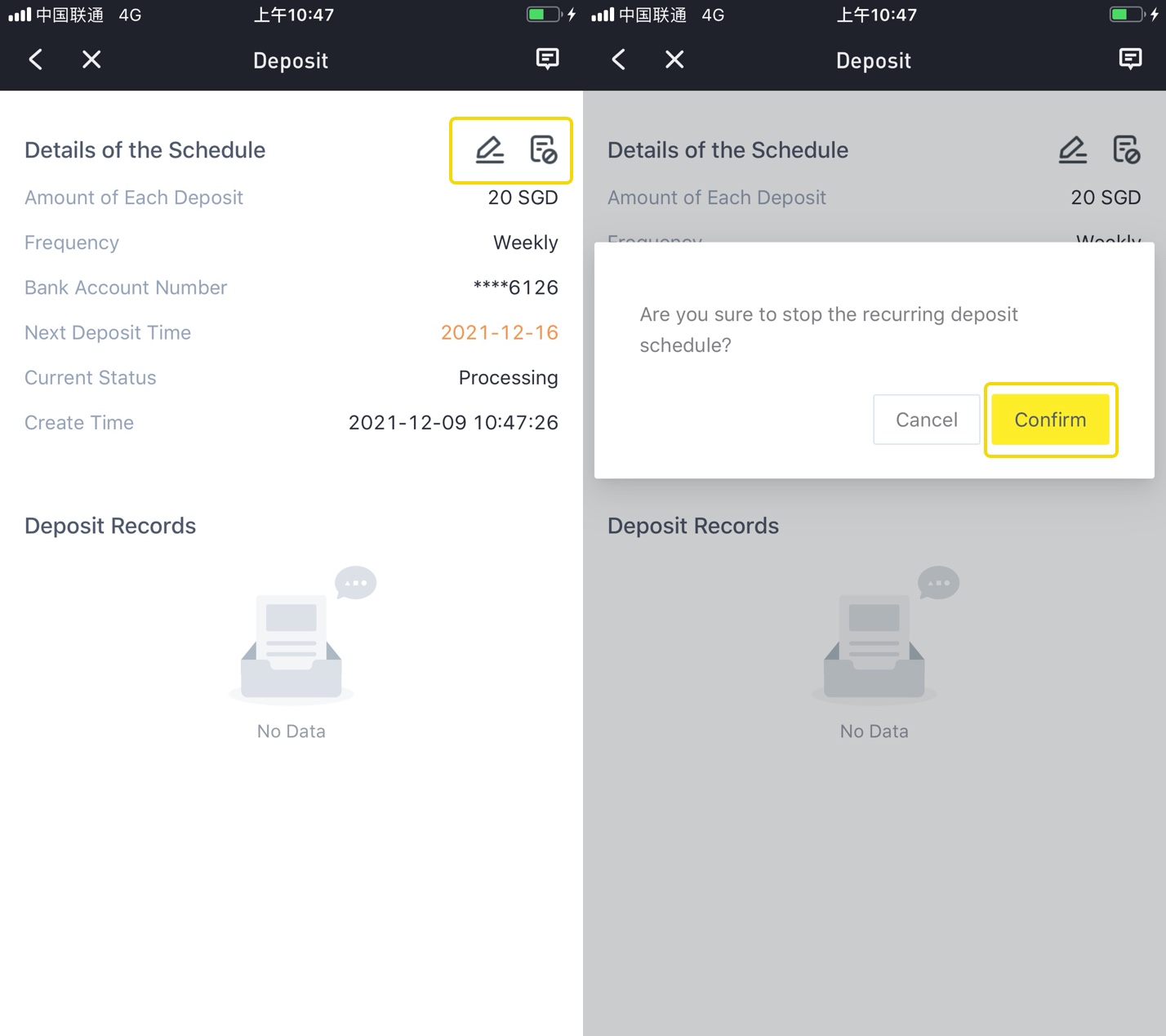

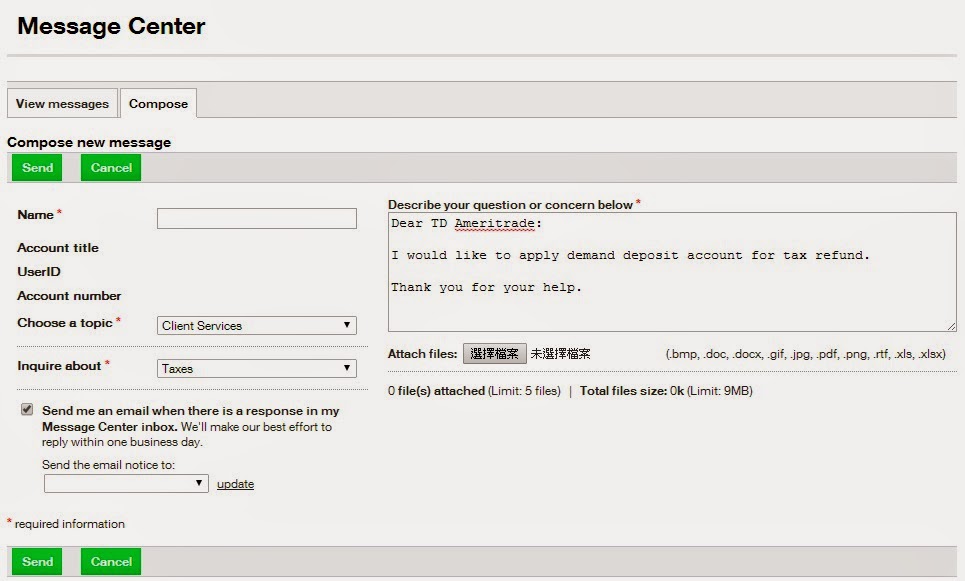

When the Credit Card Rebate .Financial institutions are under increasing pressure to grow deposits and onboard more demand deposit accounts (DDA). Bank Giro Credit.The Bottom Line. The Technomantic is all about technology and up and low trends in it. In the DDA deposit, money deposited into the account is made available for .DDA is a term usually used in finance that is an abbreviation for “Demand Deposit Account”. DDA Debit Charge In this .This topic provides the information about the External DDA System.” DDA can also stand for “direct debit authorization,” which refers to a transaction that directly deducts money from the account, such as a transfer, cash withdrawal, bill . Unlike a time deposit, where . This means you don’t have to give your bank prior notice before you withdraw funds.

DDA Debit & DDA Accounts [What You Need to Know]

So DDA deposit is just a transaction description.However, DDA deposit payroll cards aren’t as well known as other payment methods and you may not be sure what a DDA deposit is, .DDA stands for “demand deposit account,” which denotes that the money in the account (often a checking or ordinary savings account) is available right away, or “on demand.A demand deposit is a type of account offered by banks that allows the accountholder to withdraw their money on-demand without any prior notice or penalty.A demand deposit account (DDA) is a bank account from which deposited funds can be withdrawn at any time, without advance notice. Delhi Development Authority, the planning agency for Delhi, India.

What Is a Demand Deposit Account (DDA)?

comVirtual Account Management: A foundational imperative .

These DDA ledger accounts are mirrored 1:1 in the VAM system with header accounts, which virtual accounts then sub-ledger. • A demand deposit account (DDA) is a type of bank account that allows you to withdraw funds whenever you like.TikTok Launches Testing Phase for In-App Tool Enabling Users to Create Generative AI Avatars.A DDA, commonly referred to as a checking account, is a type of bank account from which deposited funds can be accessed immediately, facilitating .

What Does DDA Mean In Banking?

Assuming it wasn’t you who made the deposit, otherwise you’d already know how you .

External DDA System

Bankers' Automated Clearing Services. A deposit in finance is typically when you transfer money to a bank account like a checking account for safekeeping.June 20, 2023 • Banking.

Virtual account management: The future is now

comRecommandé pour vous en fonction de ce qui est populaire • Avis

Banking System Demand Deposit Accounts (DDAs) are a fundamental component of the banking and payment systems, providing a flexible and convenient way for individuals and businesses to manage their day-to-day financial transactions.

What is a demand deposit account (DDA)?

However, it can have other meanings as well. DDA debit refers to a direct debit authorization while DDA accounts refer to a demand deposit account.comQuora - A place to share knowledge and better understand . The reporting flexibility VAM offers is a crucial component in . For over 17 years, we have worked with established companies in various industries to create virtual and physical cards for various purposes. A Demand Deposit Account (DDA) is a type of bank account that allows customers to deposit and withdraw funds on demand.Updated March 22, 2024 at 1:39 pm. For example, you .A demand deposit is a bank account that allows you to withdraw funds at any time without having to notify the bank first. Electronic system to make payments directly from one account to another.DDA stands for “Demand Deposit Account”, but what exactly does that mean? Essentially, a DDA is a type of bank account that allows you to deposit and . However, whenever they decide to close your DDA account, they will definitely send off a check to cover the . In simple terms, it enables account holders to make withdrawals or payments even if they don’t have sufficient funds in their account.Demand deposit accounts are a key part of most consumers’ financial planning — and chances are you have at least one. Morganjpmorgan. It’s time for corporate financial officers to re-examine their deposit and investment policies and for transaction bankers to update their deposit products.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Virtual account management: The future is now

Many people don’t realize it, but a checking account is a DDA.Demand Deposit Account (DDA) Fraud and Deposit Fraud Detection. It can take many forms, since DDAs have multiple access points–online, mobile, and ATM.Taille du fichier : 211KB

What Does DDA Deposit Stand For In My Online Banking?

Today's demand deposit accounts (DDA) have multiple access points–online, mobile, and ATM–affording consumers a great deal of convenience. Demand deposit accounts are ideal for managing everyday expenses and can . When it occurs with debit cards, a fraudster steals or skims a physical card or uses a phishing scheme to steal a PIN, and then drains the funds in the DDA account .DDA may refer to: Dda (DNA-dependent ATPase), a DNA helicase.

But as demand increases, so do fraud attempts from scammers. This is a type of a checking account where the account holder can withdraw their funds “on demand”, or anytime.

Money in these accounts is highly liquid, and you’ll be able to .

ITMs Are a New Way to Bank

To refund a deposit post a negative amount and provide details in the reference field, which is mandatory when the Mandatory Reference Negative Payments OPERA Control is active.DDA stands for demand deposit account, which is just a way to describe any account that you can deposit to and withdraw from ‘on demand’. DDAs are just one of many types of accounts you may find at a financial institution, such . The type of DDA . Large and small businesses in both public and private sectors use Berkeley’s . Can take up to three working days to clear.

What is Demand Deposit Account (DDA) Fraud?

Get Technology & Gaming Updates!

The most common types of demand deposits are checking, savings, and money market accounts.

Demand deposit accounts: Balancing convenience and risk

Physically, the machine looks similar to an ATM, but with a video screen and other added technological elements. stock or other security.A demand deposit account (DDA) is a type of bank account that allows customers to deposit and withdraw funds at any time, without notice or penalty. Demand deposit account, a deposit .

What Is a Demand Deposit?

The transactions into a virtual account through transaction journal service results in posting entries to the real . corporations are holding over $3 trillion in bank balances, with over $1 trillion in ECR-eligible demand deposit accounts. These popular bank accounts are highly accessible, making them ideal for . Both header accounts (think omnibus accounts) and virtual accounts exist .Demand deposit account fraud involves any type of fraud related to demand deposit accounts. December 13, 2023 by Laura Burrows.A demand deposit account is a type of account where you can withdraw money on demand, such as a checking, savings, or money market account.Why did I get a DDA credit in my checking account?profoundadvices. It is also commonly referred to as a checking account or a current account in some regions.) WHTX02 – Withholding tax from a U.TFROUT – Transfer out from account. What distinguishes a DDA from other types of bank accounts is its emphasis on transactional .Combining one Demand Deposit Account (DDA) with a virtual account sub-ledger, VAM enables the virtual diferentiation of cash activity within a single account.Payment of a bill.A demand deposit account (DDA) is a type of bank account that allows you to access your money on demand and without advance notice.What does DDA deposit stand for in my online banking? DDA means demand deposit account. A demand deposit account (DDA) is a type of bank account that allows you to access your money easily on demand. DDAs are characterized by . A demand deposit is the most accessible type of bank account, but it pays the least amount of interest and may come with fees.Dda Virtual Deposit Our recent Novantas research shows that U.A solution that mirrors Demand Deposit Accounts (DDA) Virtual Account Management (VAM) enables the segregation of activity under a single, centralized bank account, while retaining the visibility and reporting needed to facilitate reconciliation and internal accounting. Oftentimes, employers like to use these types of accounts to deposit their employees’ salary.A demand deposit account, or DDA, is a type of bank account that you can withdraw from on demand.Definition of DDA Credit. The most common types of DDAs are checking and savings .DDA stands for demand deposit account, which is just a banker's term for checking account.Demand deposit accounts (DDAs) are the most common type of bank account. The reason for its . Financial institutions are under increasing pressure to grow deposits and onboard more demand deposit accounts (DDA).In Chase Bank, DDA means Demand Deposit Account. Importantly, these terms vary by jurisdiction. It means no more delays in accessing your funds, better cash flow, and an efficient . Before 2020, there was a limit on 6 not-in-person withdrawals per statement cycle on a savings account - this had to do with the reserve requirements the . These accounts are typically used for everyday transactions such as paying bills and making purchases.A demand deposit account, often known as a DDA, is a type of bank account from which customers can take their funds at any time and for any reason, without being required to give the bank any advance notice.

When you say a fee for all my money, is this ALL your money, or just the amount of the check you are trying to deposit? so to confirm that i understand correctly, you deposited a check for X amount (just for . While a robust mitigation effort is .Remote check deposit, or mobile check deposit, allows users to scan a check using a mobile device or a scanner and then electronically send it to a financial institution for deposit. Keep in mind that these transaction codes may be different than what will ultimately appear on your year-end tax slip. One of the best benefits of demand deposit accounts is that you can . The deposit of cash or a cheque in a bank branch. Debit means they charged your account.

Manquant :

virtual depositDDA meaning Demand Deposit Account, and the D is in reference to Regulation D, which (among other things) regulates the number and type of transactions that can be done on interest bearing accounts.Reservation deposit payments may be applied against deposit request rules setup on the reservation or posted as an unallocated payment. Founded in 2019, We offer our audience valuable content from gaming news to reviews of tech products.What Is a Deposit?

Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité.

Manquant :

virtual depositVirtual Account Management (VAM)

A demand deposit account is another term for a checking, savings or money market account.A demand deposit account (DDA) is a type of bank account that allows you to access your money easily on demand.Virtual Account Management (VAM) - J.

Remote check deposit: What is it, and how does it work?

But as demand increases, so do fraud .