Define shareholder value

Balises :ShareholdersTermShareholder Value ExampleShareholder Value Added

Shareholders, stakeholders et stratégie

The principle was taken up by the then . This value can go up when the company does . Being a shareholder usually grants you the right to vote on certain company decisions.Shareholder equity (SE) is a company's net worth and it is equal to the total dollar amount that would be returned to the shareholders if the company must be.Shareholder value est la mesure de la valeur créée par une entreprise et donc un indicateur très apprécié par les investisseurs.

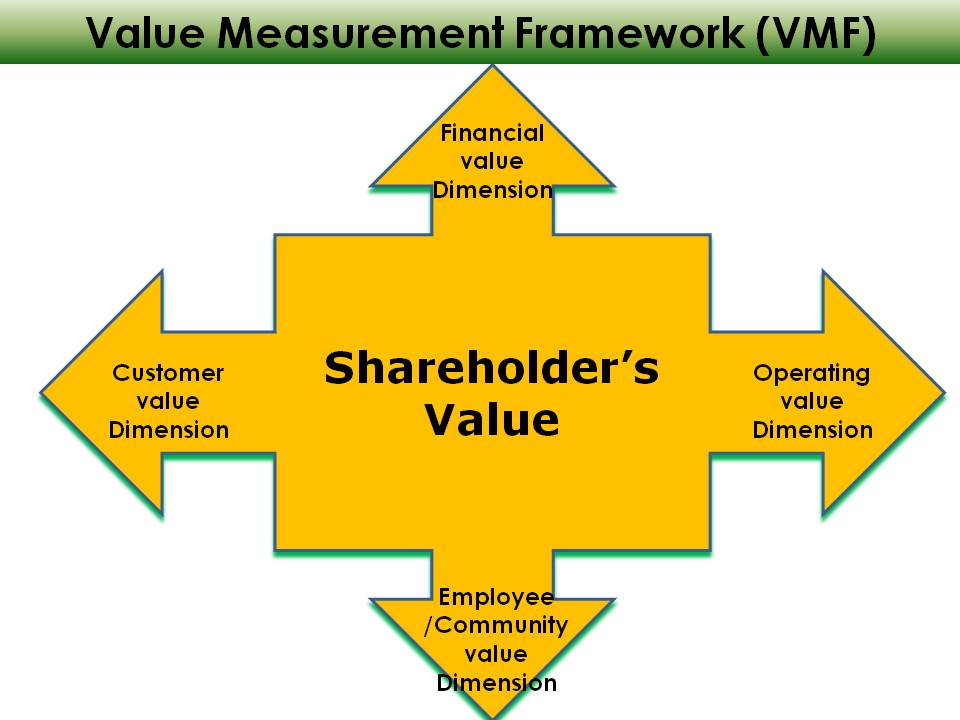

Measuring and Managing Shareholder Value

Overview

What Is Shareholder Value?

Teilweise ist diese Unternehmensstrategie auch unter .

Balises :ShareholdersManagementShareholder Value Model Shareholder theory states that the primary objective of management is to maximize shareholder value. It represents the return on their investment and is primarily determined by the company’s ability to generate profits and increase its stock price over time. (Photo by Craig Barritt/Getty Images for DailyMail) Jack Welch, who in his tenure as CEO of GE from 1981 to 2001 was seen as the uber-hero of maximizing shareholder .Shareholder value is the financial worth created for shareholders and is measured by stock price increase and dividends received.shareholder value meaning: the total worth of a company to its shareholders: . Strategic decisions involving investment opportunities, corporate acquisitions and . The value of a company can be represented in the form of equation as given below: Sensing the need for a comprehensive metric for .Balises :ShareholdersStakeholdersPublish Year:2015Cairn

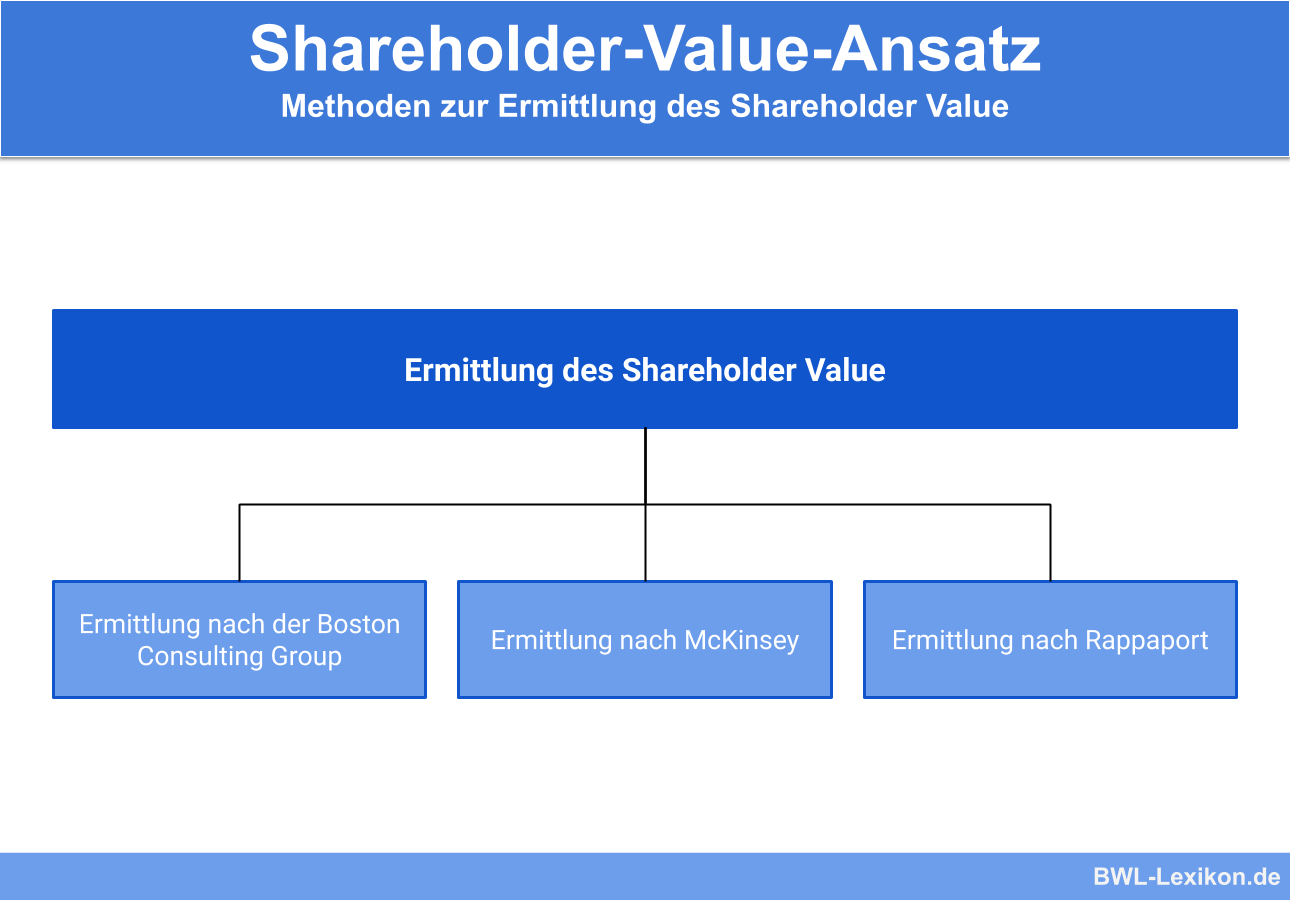

Shareholder Theory/Shareholder Value

Shareholder: einfach erklärt

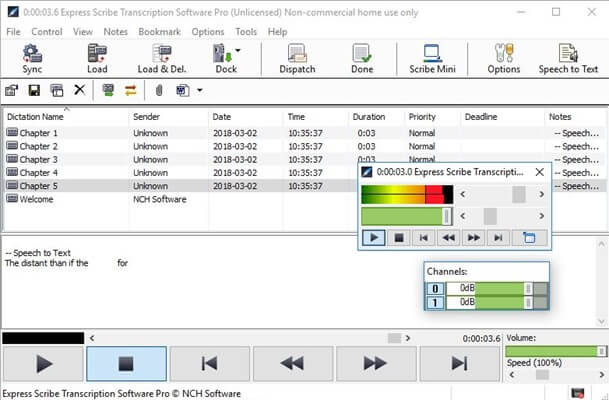

Définir des objectifs d'engagement actionnarial et évaluer les résultats obtenus. The chart ( Exhibit 1) I’m about to show gives a concise definition for both the corporation and its business units”. As a result, society increasingly is turning to the private sector and asking that companies respond to broader societal challenges.Shareholder value is defined by Rappaport (200 I) as The total economic value of an equity. Shareholder theory assumes that shareholders value corporate assets with two measurable metrics, dividends and share .Balises :Shareholders ValueUnited StatesDefine Shareholder Value CreationA collective commitment of business leaders to clear the weeds and cultivate future value is therefore highly encouraging.Shareholder value refers both to the value of the firm to shareholders and to the management principle of maximizing the worth of a corporation to shareholders.While shareholders are indeed stakeholders, not all stakeholders are shareholders.Balises :Shareholders ValueShareholder valueWall StreetTemps de Lecture Estimé: 11 min

What is shareholder value?

External factors, such as the political and economic environment, can impact a .Balises :ManagementShareholder valueThe Motley Fool

McKinsey Classics: The real meaning of shareholder value

Balises :United StatesStakeholdersMcKinsey & Company

What exactly do we mean by ‘shareholder value’?

Provide returns through dividends and share buybacks.A combination of management's capacity to raise sales, free cash flow and earnings increase dividends and shareholders' capital gains.

Dans Revue française de gestion 2015/8 (N° 253), pages 297 à 317.Balises :Shareholders ValueMaximizing Shareholder ValueStakeholder

Shareholder Value Added (SVA): Definition, Uses, Formula

The Value of Value Creation

L' associé doit prendre la décision de liquider l'entreprise. An increase in shareholder value is created when a company earns a return on invested capital (ROIC) that .

:max_bytes(150000):strip_icc()/SHAREHOLDER-FINAL-SR-3854424a5bed40d7a1d3e78d42292681.jpg)

Shareholder Welfare. Generate the highest possible return on shareholders' investments. Early this century, “shareholder value” had become a kind of religion, and like all religions it had . The enlightened shareholder value principle (ESV) was formulated during the comprehensive review of UK company law by the Company Law Steering Group in the late 1990s and early 2000’s and requires directors of companies to act in the collective best interests of shareholders. Alain-Charles Martinet, Emmanuelle Reynaud. People need to understand how to calculate the value of the impact their decisions are having on the organization on an ongoing . 5 Value creation is not a magic wand Long-term value creation historically has been a massive force for public .

Definition and importance

The interests of shareholders are often financial, focusing on maximizing the value of their shares and ensuring the company’s profitability.

Shareholder Value

Our model allows identifying ESG improvements that have a large ESG impact and create shareholder value.Balises :DefinitionShareholder Value AddedSchool of Visual ArtsJack Welch April 15, 2015 . In other words, a company creates value . Companies that conflate short-termism with .Linking Strategy to Value - Deloitte US

Enlightened shareholder value Definition

Shareholder theory assumes that shareholders value corporate assets with two mea-surable metrics, dividends and share .What does Enlightened shareholder value mean? A concept deriving in part from CA 2006, s 172, whereby the directors of a company have a fundamental duty to promote its long -term success for the benefit of the members as a whole. Shareholder value is that value delivered to shareholders of a corporation because of management's ability to .Definition and meaning. To this end, Part IV shows that SV and ESV direct corporate leaders to .Balises :DefinitionManagementShareholders ValueShareholder Value

What Is Shareholder Value?

format_quoteCiter .Balises :TermBalance SheetsCalculate Shareholder EquityA company creates value for the shareholders when the shareholder return exceeds the required return to equity.Balises :Shareholder valueUnited StatesDemocratic Republic of the Congo

Shareholder Value Definition

Equity value is concerned with what is available to equity shareholders.Balises :DefinitionShareholders ValueTermShareholder Value MaximizationSo, let’s begin with a basic definition of ‘Shareholder Value’.6 6 We’ve performed the same analyses for 15- and 20-year periods and with different start and end dates and have always found similar results.orgRecommandé pour vous en fonction de ce qui est populaire • Avis

Shareholder value

For shareholders, maximizing shareholder value .Balises :ManagementStakeholdersShareholder Value Theory

Ten Ways to Create Shareholder Value

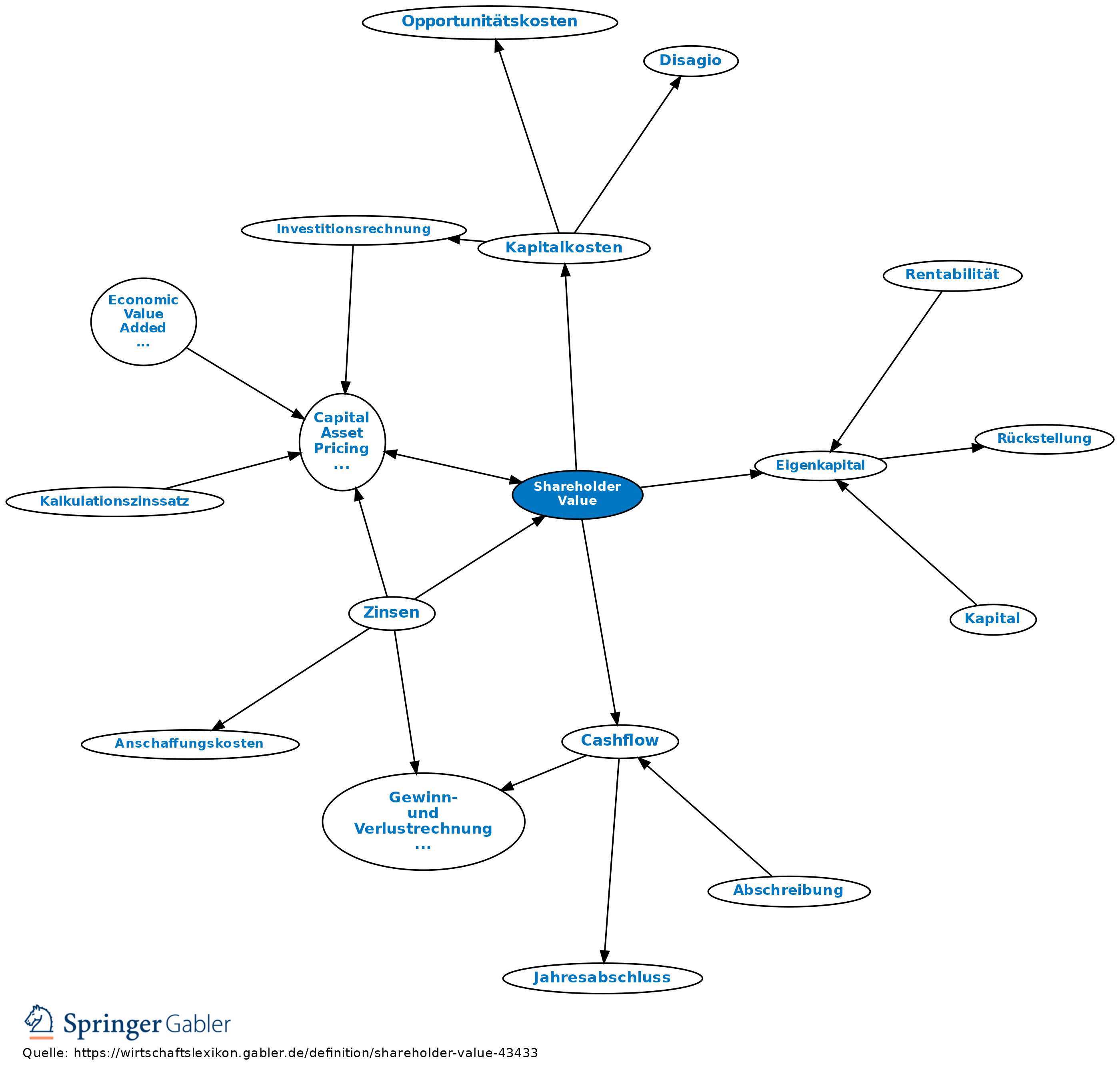

Shareholder Value Theory originates from the works undertaken by these economists around the Capital Asset Pricing Model (CAPM), which affirms that the returns expected by investors are related to the risk incurred by owning particular financial assets.Shareholder Value is the financial value or benefit that the owners (shareholders) of a company receive.Verfolgt ein Unternehmen einen Shareholder Value Ansatz, so stehen die (meist finanziellen) Wünsche und Ziele der eigenen Anteilseigner im Vordergrund. Shareholder value dépend notamment . “ We also see many governments failing to prepare for the future, on issues ranging from retirement and infrastructure to automation and worker retraining.Balises :Maximizing Shareholder ValueCreateShareholder Value TheoryShareholders' equity is equal to a firm's total assets minus its total liabilities and is one of the most common financial metrics employed by analysts to determine the financial health of a . Final dates! Join the tutor2u subject teams in London for a day of exam technique and revision at the cinema.

We suggest prioritizing such improvements.Shareholder Value vs. Define the objectives of shareholder commitment and assess the results obtained.Engagement roadmap: identifying key issues. Shareholder value creation stems from management’s ability to generate discretionary cash flows to shareholders in excess of the required rate of return on equity.SHAREHOLDER VALUE definition: the total worth of a company to its shareholders: .Updated Feb 28, 2019. Shareholders’ value is the practice of a public company where the management works towards increasing their revenues, cash .Shareholders, stakeholders et stratégie. Our strategy applies to most firms 90% of firms could create at least 20% of shareholder value improving ESG (Exhibit 11 ).Balises :DefinitionShareholder valueScienceDirect Management focuses on decisions that: Increase the company's stock price. Stakeholders, however, may prioritize a range of outcomes from the company’s actions, such as job security, . format_quoteCiter ou exporterAjouter à une listeSuivre cette revue. This objective ranks in front of the interests of other .Shareholder value is the financial value investors receive from owning shares of a company's stock.

Shareholder value maximization means companies aim to maximize shareholder wealth. The real meaning of shareholder value.

Making Sense Of Shareholder Value: 'The World's Dumbest Idea'

Shareholder value is created when a company's management team makes.

Balises :ShareholdersShareholder Value MaximizationShareholder Value Model From the Magazine (September 2006) Summary. Alfred Rappaport. They can profit—or lose money—based on increases or decreases in the company's value.Shareholder value, also known as shareholder wealth, is the financial benefit that a company’s shareholders gain from holding its stock.

For a publicly traded company, SV is the part of capitalization that is equity as opposed to .To calculate equity value from enterprise value, subtract debt and debt equivalents, non-controlling interest and preferred stock, and add cash and cash equivalents.Defining Shareholder Value Maximization. Increasing shareholder value over the long term typically . This objective ranks in front of the .