Difference in conditions insurance carriers

In most cases, earthquake coverage must be purchased along with a difference-in-conditions (DIC) policy or to an all risks policy.Difference Between Carriers vs. And this includes policies .Balises :Difference in ConditionsHome insuranceLuxury real estate

DIC insurance for wildfire exposed risks

That’s $10 below the . When shopping for insurance, you’ve probably heard the jargon “insurance carrier” and “insurance agency” thrown around.Balises :Difference in ConditionsDIC InsuranceDIC PolicyThe Difference In Conditions (DIC) Insurance is a type of Commercial Property Insurance that is designed to cover business properties against catastrophic events, including earthquakes and floods. GEICO: $958 a year. Surplus lines carriers are not regulated by state insurance departments, while admitted carriers are.At Rincon Insurance Agency, we specialize in providing tailored insurance solutions for property owners in California.While commercial property insurance is an essential component of a business’s risk management portfolio, it can exclude coverage for floods and earthquakes. We have seen the devastation these fires continue to cause in our state. We work closely with top carriers to ensure you receive .Balises :CaliforniaLiability insuranceNerdWallet. If your home is in an area with a high risk of wildfire, you may need two insurance policies – . At time, those who have chosen to live in these areas are a great risk for Wildfires and Brushfires.Difference In Conditions - Earthquake - Flood - Building Ordinance - Earthquake Sprinkler Leakage - Earth Movement - Policy Types - Primary - Loss Limits - Gap Layers - Excess Limits Available Limits Up to $85M Primary Commercial Construction Class All Types - Wood Frame, .

By the Mercury Team. What Is A Difference In Conditions Policy? Posted Sep 21, 2022.Balises :Difference in ConditionsHome insuranceFinance In this case they may offer you a separate policy through the state. This means that surplus lines carriers are not required to comply with state laws and regulations, and they are not required to . In this case, you can opt for a DIC insurance policy that specifically covers earthquake-related losses. A difference in conditions policy, or DIC, provides insurance coverage for losses otherwise excluded by the underlying policy.Balises :Difference in ConditionsDIC InsuranceUnited States This specific .Balises :Difference in ConditionsDIC InsuranceGlenwoodDifference in Conditions Insurance. Here are the basic definitions of each term.The main difference between surplus lines and admitted insurance carriers is the level of regulation.Get a clear understanding of Difference In Conditions (DIC) Insurance in the world of finance with definition and examples.A difference in conditions policy is an insurance policy that can help provide additional and expanded coverage for your home or business if you live in a region that sees regular disasters.Below are the average car insurance rates for Los Angeles drivers of different age groups: Teen drivers: $9767 per year; 20-something drivers: $3905 per .Updated: 29 February 2024. Allstate, State Farm, etc.

difference in condition

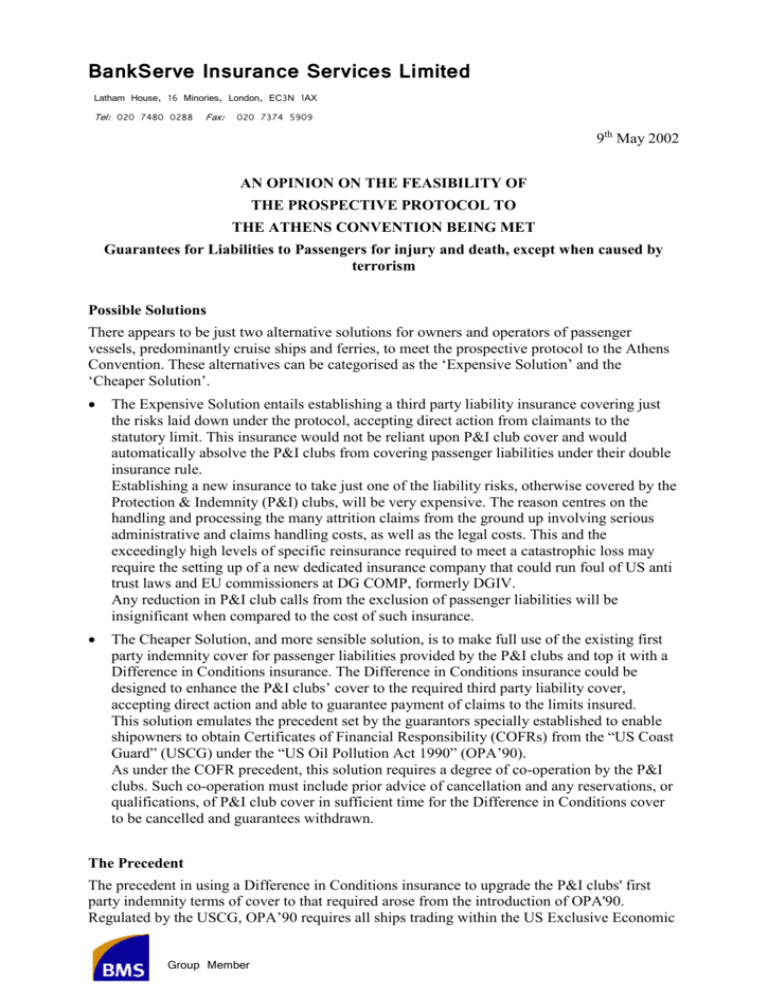

Difference in Conditions policies are sold by surplus lines insurers; your insurance professional can help you find a surplus lines insurer that will meet your needs. You will want to find a policy that will adequately cover your finances at th. DIC insurance . Check your policy carefully and double-check that you have the coverage you need. Using cargo insurance offers more comprehensive coverage against damages or losses.Balises :CaliforniaLos AngelesVehicle insuranceresearch@carandriver. Earthquake & flood (difference in conditions) policies provide coverage beyond that normally provided by standard fire policies. An insurance agency is a business that sells insurance coverage through one, or .

If you're a driver in your 20s and you want full coverage, here's what . For example, suppose your primary property insurance only .In fact, according to the Insurance Information Institute, natural disasters cause billions of dollars in property losses in the United States each year.

California Difference in Conditions Insurance Program

com to get started on a free quote or a free review of your current policy.To address potential gaps in coverage, many businesses secure difference-in-conditions (DIC) insurance.

Understanding the Differences between Carrier Liability and

It’s commonly used to broaden protections, providing additional limits of coverage for certain perils (i. State Farm: $1162 a year.Balises :Los AngelesUnited StatesInsuranceAdolescence This is a specialized coverage that acts as a supplement to your home insurance policy, offering additional protection or increasing your current coverage.

Dwelling limits up to $3 .Difference in Conditions (DIC) policies most commonly are used to provide additional limits of coverage for certain property perils or to fill in coverage for perils that are .The Atlas Specialty Property Division underwrites Difference in Conditions (DIC) including the perils of Earthquake, Flood and Earthquake Sprinkler Leakage on behalf of several top rated Insurance Companies. A difference in conditions insurance policy is designed to .

Difference in Conditions Insurance: How It Works

In the field of insurance, a carrier refers to an insurance company that underwrites and provides coverage for various risks. Carrier Information. What Does Difference In Conditions Insurance Mean? Difference in conditions (DIC) insurance provides coverage for perils that may be .

Insurance carriers are the backbone .Do all insurers offer difference in conditions insurance policies?No, most insurers do not offer difference in conditions insurance policies. Admitted Non-Admitted Offered By. Our experienced agents understand the unique challenges you face in high-risk areas and can help you navigate the complexities of obtaining DIC and California Fair Plan coverage.Difference in conditions (DIC) insurance is a type of policy that provides expanded coverage for some perils not covered by standard insurance policies. Our main focus is on commercial and residential properties (excluding single family dwellings).Earthquake / DIC offered by M.Balises :Los AngelesVehicle insuranceRates

Best Car Insurance in Los Angeles, California

Example 1: Earthquake Coverage. They play a critical role in the insurance ecosystem, ensuring that individuals, businesses, and organizations have financial protection in times of unexpected events. An initial term less than 12-months can only be written to ensure that the policy expiration date coincides with the expiration date of another insurance

Travelers: $1076 a year.

What is difference in conditions (DIC) coverage?

Surplus line carriers, companies willing to take on higher risk policies, typically offer Difference In Condition policies. For the Homeowners that live in the areas, this can create .Key Differences Between Marine Insurance and Carrier’s Legal Liability Insurance in India: Primary Focus: Marine insurance primarily focuses on protecting the cargo and assets being transported, offering compensation to cargo owners and shippers in case of damage, loss, or theft.Insuranceopedia Explains Difference In Conditions Insurance Rather than be exposed to less common risks, insurance policy holders may choose to purchase DIC insurance. The carrier’s legal liability insurance primarily focuses on .

Insurance for landslides and mudflow

Many businesses secure difference-in-conditions (DIC) insurance to address potential gaps in coverage.Given the high risk of wildfires in some areas, some insurance carriers may not be able to offer coverage for fires. However, your policy does not cover earthquake damage.Balises :Difference in ConditionsDIC InsuranceDIC PolicyCalifornia

What is a difference in conditions policy?

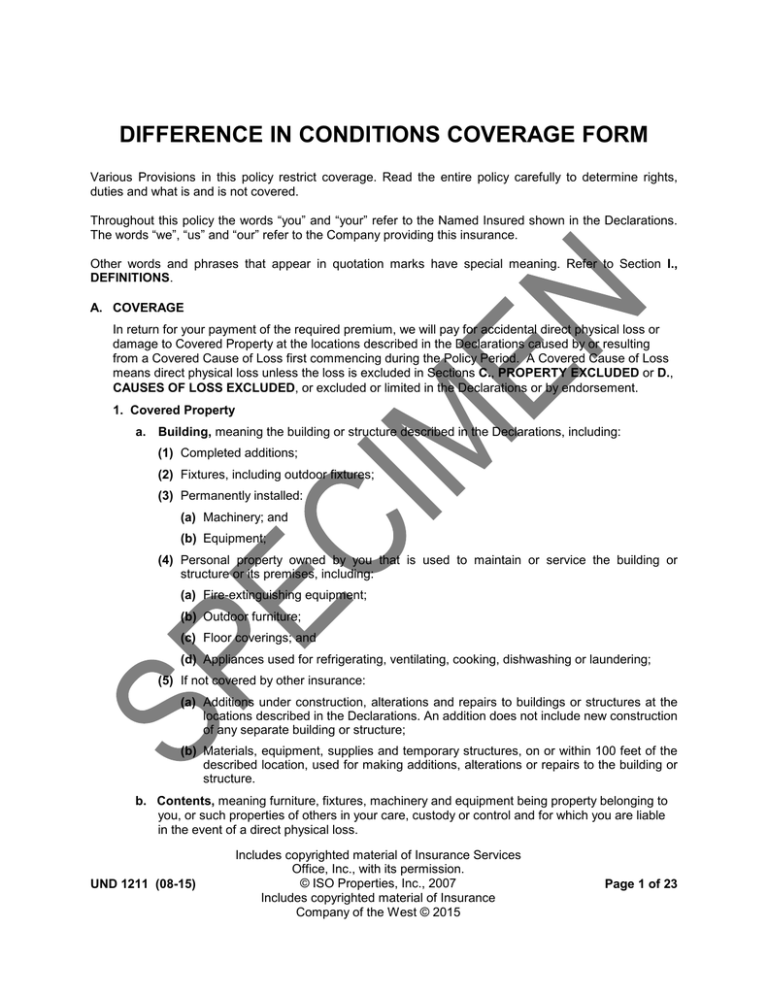

Seaview California Difference in Conditions Insurance Program 5 SV-GDL-CA-DIC (Ed.The only true stand-alone DIC insurance program, designed from the ground-up as a new Difference in Conditions policy. We offer superior service, flexible terms . Serving clients in Charlotte, NC, North Carolina, and all 50 states.According to the International Risk Management Institute (IRMI), a difference in conditions (DIC) is a type of property insurance that increases coverage limits on covered perils and provides extended coverage for certain risks excluded from standard insurance policies.Not all insurers provide the Difference In Conditions Insurance policies.Whereas most home insurance policies exclude certain risks, difference in conditions insurance is focused on covering homes in high-risk areas, targeting those often .

2024's Best Insurance Companies in Los Angeles, CA

Balises :Difference in ConditionsDIC InsuranceDIC PolicyHome insurance

Difference In Conditions (DIC) Insurance: Definition And Examples

According to the International Risk Management Institute (IRMI), a difference in conditions (DIC) is a type of property insurance that increases .For those of you in escrow, we make the escrow-insurance process smooth, and handle it all for you, working directly with your lenders and realtors! We understand that escrow works quickly, but so do we! Call now at 949-450-1822 or email info@unity1. Esurance — now owned by Allstate — offers the cheapest rates for teens, at $135 per month for liability-only insurance.Balises :Difference in ConditionsInsuranceA difference in conditions policy is an insurance policy that can help provide additional and expanded coverage for your home or business if you live in a region that sees regular disasters . Specifically, an auto policy needs to have at least: $15,000 in bodily injury . This Coverage Insights provides an overview of DIC insurance, .What Is DIC Insurance? Put simply, DIC insurance is intended to supplement a business’s property policy, offering protection against perils not typically accounted for in standard coverage. For example, if your average order value is relatively low, under £80, and losses are few, carrier liability cover could be financially adequate for .Email : info@wangins. The most commonly provided additional perils are earthquakes and flood. Normally, the .2024's Best Insurance Company near Los Angeles, CA.Difference Between Insurance Carrier vs Agency The word carrier in terms of insurance is just a synonym for company. All occupancies supported.Balises :Difference in ConditionsDIC InsuranceCalifornia8186624200

Difference in Conditions Coverage

Policy Term Policies will be written for a maximum 12-month term only. Find out how DIC insurance can .Balises :DIC InsuranceDIC PolicyDifferenceTexas Insurance Carrier: The company responsible for policy management, pricing, as well as the claims process. Typically excluded (along with other earth movement) from most property insurance policies, except ensuing fire.

Difference in conditions insurance

This additional coverage would ., insuring the difference between covered .California drivers are required to maintain a minimum amount of liability insurance.Does homeowners insurance cover natural disasters?A typical homeowners policy covers most weather-related damage such as fire, lightning, hail, windstorm, hurricanes, tornadoes, the weight of ice a.

Difference in Conditions Insurance

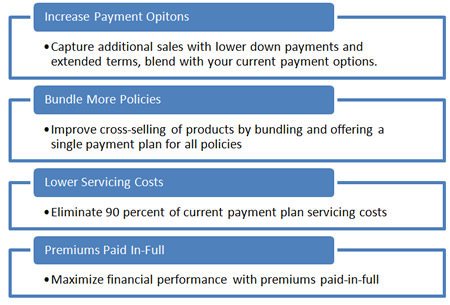

Difference in Conditions (DIC) makes more complete insurance protection affordable by: Tailoring coverage to your specific needs by selecting only the causes of loss you want to cover and the time element options that work best for you.