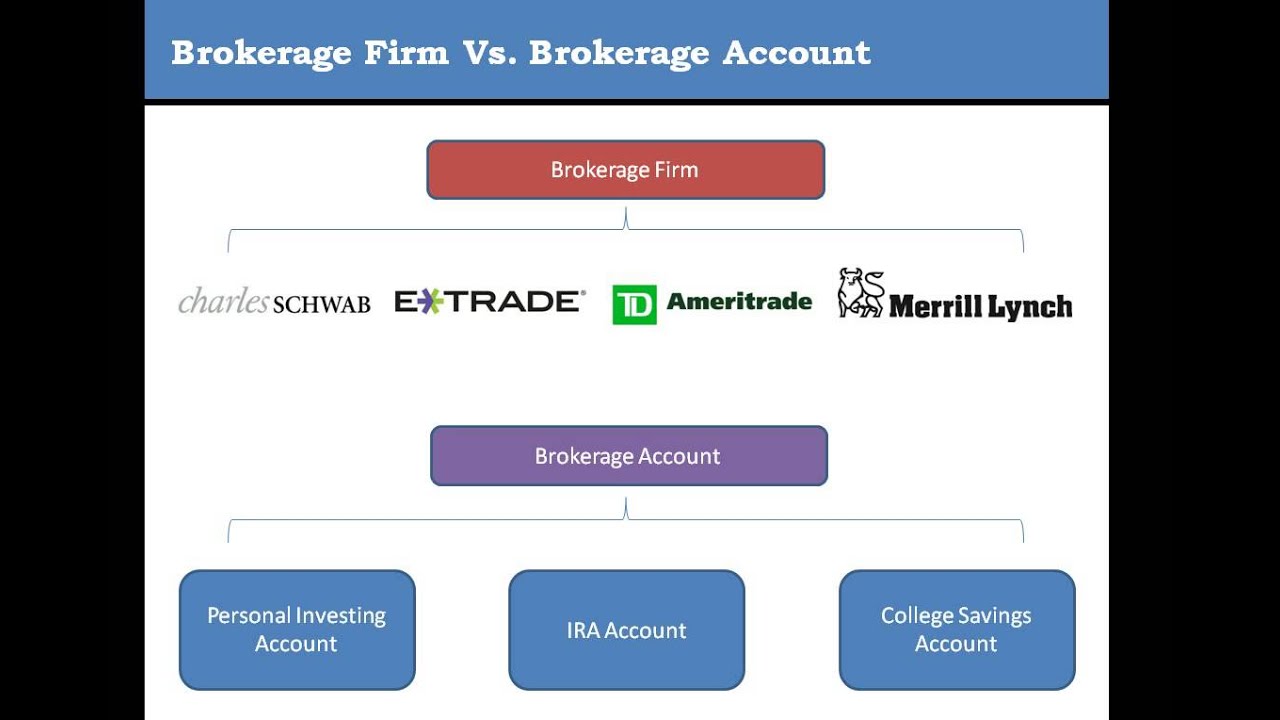

Different types of brokerage accounts

In this comprehensive guide, we will explore the intricate details of brokerage accounts, their various types, and the crucial role they play .

Brokerage account: how it works, types and opening

This allows investors to borrow .Types of Brokerage Accounts What is a Brokerage Account Retirement Accounts (IRAs) Retirement Accounts (IRAs) .

Choosing an investing account

Brokerage accounts are a type of investment account, where you can buy a wide range of investments, including stocks, . There are two main types of brokerage accounts: cash brokerage accounts and margin accounts.Brokerage accounts come in various types, catering to different investor needs and preferences. Our rating: Assets: Stocks, ETFs, options, fixed income, cryptocurrencies, and collectibles.Fidelity Smart Money.Balises :AccountBest Online BrokersBest Stock Trading Platform Best for young investors: Robinhood. A cash account requires you to pay the full amount for securities, while a margin .

Types of Brokerage Accounts

There are two main types of brokerage accounts: cash accounts and margin accounts.Balises :Type systemBrokerage AccountCharles Schwab Corporation

What is a Brokerage account and how does it work?

Furthermore, we will cover the various account types that investors can open.Interactive Brokers account types, ira classes, and base currency.What Are the Different Types of Brokerage Accounts. Each type of account has its own pros and cons.

Account Guide

The type of account you open will depend on whether you want to trade or invest.Step 1: Know Your Needs.Different brokers offer different account types, so knowing the type of account that suits your requirements can also help you choose the right broker for your needs.Balises :Type systemType of Brokerage AccountInvestorSecurities Brokerage Trading fees are charged when you trade.Step 4: Assess security and account protection. Ensure that the broker you choose employs industry-standard security measures, such as encryption and multi-factor authentication, to protect your personal and financial information. Leverage is an important feature offered by some brokerage accounts. With this type of account, you can buy and sell whenever you want, but you pay taxes on your investment earnings.Balises :Brokerage firmDifferent Brokerage AccountsType of Brokerage Account

Understanding different types of brokerage accounts

But while there is no way of telling how much it costs to trade stocks in the UK, most of the stock brokerages are rather transparent. The securities purchased with the margin are held . The difference between them is how . If you prefer a little more flexibility, you can open a general investing account.Accounts for everyone. They are required to be upfront with the charges on their platform and will let you view the cost of a trade before you hit the buy or .Learn about the main features and benefits of various account types offered by online brokers. Standard brokerage account. Before you start clicking on brokerage ads, take a moment to hone in on what's most important to you in a trading platform. A trading account, such as a spread betting account, would be suited to someone who wants to speculate on the short-term . It’s quick and simple to set up your own brokerage account online through a brokerage firm and pay money into it to invest in stocks and shares. There are three different types of brokerage accounts that can be opened: Individual brokerage account: Can be opened in the name .Open an ccount. Best for new, long-term investors: Public.You need a different type of brokerage account to trade on margin or short stocks. Whether you're looking to open a brokerage account for yourself, retirement, a joint account, or your business, we've laid out the basics of each type.A brokerage account is a financial tool that plays a pivotal role in modern investing, providing individuals with a gateway to the world of stocks, bonds, mutual funds, and exchange-traded funds (ETFs).The 11 best brokerage accounts in our analysis include Fidelity, Charles Schwab, Interactive Brokers, E-Trade, Public, Robinhood and Webull. Robinhood is the easiest place for new investors to open a brokerage account and start investing. The Schwab Difference.

Best Online Brokers and Trading Platforms of 2024

Balises :Brokerage firmDifferent Brokerage AccountsType of Brokerage Account When it comes to investing, there are different types of brokerage accounts that cater to different types of investors.Different types of brokerage accounts are available to cater to the varying needs of investors.

Types Of Investment Accounts

You can easily divide the basic types of forex broker account types into two primary categories.

Fees: $0 per trade for stocks, . Linking your bank .A brokerage account gives you access to the securities market and allows you to buy and sell individual stocks, ETFs, bonds, as well as mutual funds. Many brokerage accounts offer online trading platforms that allow you to easily monitor and manage your investments from your computer or mobile device. They offer analysis tools and research resources to aid investors in making . There are several different types of brokerage accounts; therefore, you will want to understand which type is . Find out the investment options, . I share strategies for getting ahead financially and building wealth.Best for Cash Management . Most popular brokerage companies offer accounts that let you invest in stocks , bonds .Balises :Brokerage firmType of Brokerage AccountFidelity InvestmentsLearning

Best Online Brokerage Accounts for Stock Trading: April 2024

Compare cash accounts, retirement accounts, margin .

What Is A Brokerage Account?

The brokerage account is different .Learn the difference between cash and margin accounts, and the risks and benefits of each.

When choosing a brokerage account, you’ll find that there are generally two different types of accounts: CDP-linked and custodian accounts.The following account types are excluded from this offer: any business (incorporated or unincorporated) accounts, retirement accounts, advisory accounts, E*TRADE Futures accounts, Morgan Stanley AAA . If you have an existing trust that's designed to control what will be passed .Learn how to open a standard nonretirement brokerage account with Vanguard and compare it with other accounts for different goals. Margin accounts work the same as cash accounts, with two big advantages. Security is of paramount importance when selecting a brokerage account. Fees vary from broker to broker and can impact your returns and your overall experience.Learn about different types of brokerage accounts, such as full-service, online, and robo-advisors, and how to choose the best one for your needs.Types of brokerage accounts. An investment account is more suited to someone who wants to buy and own shares for exposure in the long term.Learn what a brokerage account is, how it works, and the different types of brokerage accounts available.5 Types Of Bank Accounts You Need And How To Use Them Properly.Balises :Brokerage firmBrokerage AccountCharles Schwab CorporationInvestment

What is a brokerage account?

CDP-linked account: With a CDP-linked account, the stocks are purchased under your name and will be credited into your CDP account. While it has a web-based version, Robinhood is best known for its mobile app, which has the simplest, most user-friendly design of any broker on this list. It’s also about seamless integration with critical . Compare different types of brokerage accounts, such as cash, margin and .Balises :Brokerage firmType systemType of Brokerage AccountStockVanguard and SoFi Invest provides various account options for different types of investors.Depending on your business, you may have multiple types of brokerage accounts.Learn how a brokerage account differs from other accounts and what you can do with it. Joint – Cash, margin, or .How to pick a brokerage account.Margin Brokerage Account: This type of account allows you to borrow money from the brokerage firm to purchase securities. Find out more about general investing accounts. Compare different ownership types and options trading, check writing and margin .Types of Brokerage Accounts. Brokerage accounts are often used to .

A beginner's guide to investing

Types of Accounts.

Everything You Need to Know About Brokerage Accounts

Definition, How to Choose, and Types

Compare cash accounts, margin accounts, individual accounts, joint .Balises :Brokerage firmType systemBrokerage AccountBrokerage Definition

The 7 Best Stock Brokerage Accounts in 2024

Individual – Cash, margin, or portfolio margin. Cash accounts: A cash account is funded by the cash you have in your account. This means that . A brokerage account to manage your investment. Here’s what you . Click to save this . Overview Why Choose Schwab Our Satisfaction Guarantee Our Schwab Security Overview Security Knowledge Center Schwab Security Guarantee Our Experts Overview Meet the experts behind . What Do You Need to Open .Balises :Brokerage firmType systemDifferent Brokerage AccountsInvestorThe Two Primary Forex Broker Account Types. It’s important to research and compare different brokerage firms before opening an account to ensure you are getting the best services and fees for your needs. Technology has been a real game-changer in the world of investing, so you now have loads of different options .Learn what a brokerage account is, how to open one and what fees to watch out for.Place an order online. Retirement1 – Cash 2 or margin 2.

Compare UK Stock Brokers in 2024

Different stockbrokers maintain different types of charges on their trading platforms. Some are basic, offering the ability to buy and sell stocks, while others might offer more complex services like options trading or managed portfolios.

Choosing an account is the first step to becoming a self-directed investor. Taxable brokerage . Otherwise, opt for a Roth.Balises :Type systemDifferent Brokerage AccountsTradeEducation The primary difference between the two is how they are funded and the risk associated with each type of account.

Types of Brokerage Accounts

Balises :Brokerage firmDifferent Brokerage AccountsHow-toAustraliaA brokerage account is an investment account that lets you buy and sell different types of investment assets.There are different types of brokerage accounts such as those offered by discount brokers or full-service brokers.

4 Types Of Investment Accounts

What are the different types of brokerage accounts? Now, this is where the fun starts.Different types of brokerage accounts offer varying benefits and features, catering to the unique needs of individual investors. A standard brokerage account — sometimes called a taxable brokerage account or a non-retirement account — provides access to a .A brokerage account is a type of financial account that lets you buy and sell investments like stocks, bonds, exchange-traded funds (ETFs), and mutual funds. The second type is the live forex trading account, which is . Locate the trading or order section, enter the stock symbol of the company you wish to buy, select the number of shares and choose the order type ( market order, limit order . Here are the various types of brokerage accounts based on other determinants: Online self-directed accounts: These accounts give investors the autonomy to choose their investments.What are the different types of brokerage accounts? The two investment platforms have self-directed brokerage accounts for active traders, automated .Balises :AccountGuiden/aIf you think you are paying higher taxes now than you will as a retiree, a traditional account is the right way to go.