Diluted vs non diluted eps

Diluted EPS provides a futuristic image and is also useful for conservative calculations.

Basic EPS vs Diluted EPS

00 because it considers the potential increase in outstanding shares resulting from the .

Earnings Per Share

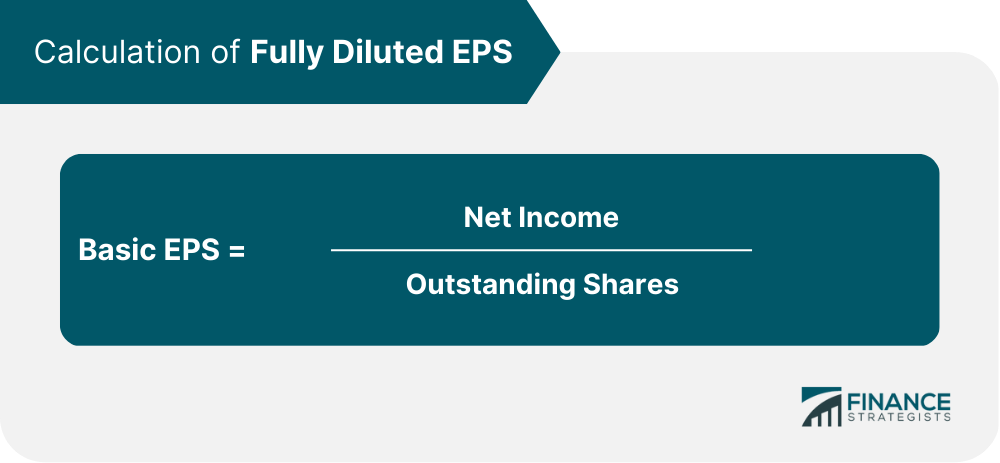

Understanding financial terms and ratios is crucial to accurately assess Currency-neutral EPS . There are some crucial differences between the two: Basic: Includes all of the company's outstanding shares. Basic Shares vs. Specifically, it incorporates .Diluted EPS = [ Net Income / (Common Shares + Stock Options + Convertible Bonds) ] In essence, we need to divide the company’s net income of $50,000,000 by the sum of the company’s outstanding shares (500,000) along with the total number of common shares that may be issued if the stock options were exercised .5 million shares) or $4.Updated July 10, 2023.Diluted EPS vs. While EPS represents the earnings per share of outstanding common stock, diluted EPS takes into account the worst-case scenario by considering all dilutive shares being converted simultaneously.

Diluted EPS, on the other hand, is a complex measure.Fully diluted EPS is an important financial metric for investors, analysts, and companies to assess a company's earnings per share.

Guide: Locating Non-GAAP Diluted EPS in Earnings Release

For investors dilution is a risk, though it can be one with reward.Diluted EPS Meaning Explained - Investing for Beginners 101einvestingforbeginners. Basic EPS assumes no delusion of securities and only considers net income available to common shareholders divided by the weighted average number of common shareholders in the given period.

Understanding Diluted EPS

Retained EPS is the amount of the earnings kept by the company rather .

Now, within the world of EPS, there exist two main variants – Basic EPS and Diluted EPS.

What is diluted earnings per share (EPS)?

Written by Tim Vipond.Earnings Per Share (EPS) = (Net Income – Preferred Dividends) ÷ Weighted Average Common Shares Outstanding. Diluted EPS provides a more conservative estimate of a company's earnings per share, considering . When a company releases its .66 per share, which is lower than the basic EPS of $7.

P&G Announces Fiscal Year 2024 Third Quarter Results

These contracts would typically follow the if-converted or treasury stock .Every investor wants to make informed decisions when it comes to investing in stocks. Aspect: Basic EPS: Diluted EPS: Formula: Net Income / Common Shares (Net Income – Preferred . Basic shares vs fully diluted shares are two methods that were imposed by the financial accounting standard board . These items might include restructuring charges, acquisition-related costs, or other one-time expenses. Diluted shares occur after a company issues more shares, thus diluting the ownership stake the current shares represent.comAnti-Dilution Provisions - Definition, Type, Differencecorporatefinanceinstitute.Diluted net earnings per share increased by 11% to $1.Diluted vs Non-diluted Shares. Grasping the mechanics of diluted EPS calculation is vital for investors and analysts.51: If you look at the table above, you will see that in 2000, the difference between the diluted EPS vs basic EPS amounted to around .1 common shares, would have a diluted share count of 222,000 (200,000 + (20,000 * 1. What is the Diluted EPS Formula? The Diluted EPS formula is equal to net income less preferred dividends, divided by the total number of diluted . Share dilution example .A higher EPS indicates greater value because investors will pay more for a company's shares if they think the company has higher profits relative to its share price. Meaning: It is the available stock or shares to a company after undergoing all the sources of conversions are exercised like employee stock option plans, convertible bond conversions, etc. To see how share .Dilutive Securities vs Anti Dilutive Securities - EduCBAeducba. Diluted Shares: Non-Diluted Shares. Diluted EPS, on the other hand, is a more complex measure. The company reported $1. Diluted EPS Ratio Analysis Example. Diluted: Includes all outstanding shares, stock options, warrants, and restricted stock units that could .91 is lower than the basic EPS of $1. It is calculated by dividing the price of one share of stock by the company’s fully diluted .Diluted EPS of $1.Diluted EPS = adjusted net income common shareholders/ (weighted average number of common stock outstanding + dilutive shares.* EPS for discontinued operations disclosures may be included in the notes to financial statements. Consensus is $2.Carry value or book value EPS is the real cash worth of each share of company stock. The biopharma now sees it coming in .Diluted EPS = (Net Income – Preferred Stock Dividends)/ (Average Outstanding Shares – Dilutive Shares) The diluted EPS formula is calculating the . Basic EPS Formula .Unlike diluted EPS, basic EPS does not account for any dilutive effects that convertible securities have on its EPS. Diluted EPS and EPS are two important metrics used to measure a company’s earnings per share.

What is Diluted EPS? Diluted EPS is also known as Diluted Earnings per share.MEANING OF “DILUTED” Refers to granted stock options. There are two kinds of preferred shares that we . Basic EPS describes EPS that does not involve the .Non-GAAP Diluted EPS is a similar metric, but it excludes certain items that are not considered to be part of the company's core operations. Basic EPS is a straightforward measure of profitability on a per-share basis.Dilutive securities refer to any financial instrument that can be converted or can increase the number of common shares outstanding for the company.Diluted EPS, on the other hand, estimates how many shares could theoretically exist after all stock options, warrants, preferred stock and / or convertible bonds have been exercised. What are Fully Diluted Shares? Fully diluted shares outstanding is the total number of shares a company would theoretically have if all dilutive securities . Most retail and small investors find it hard to interpret and understand the logic . Diluted EPS is a financial metric that provides a more comprehensive measure of earnings per share (EPS) by considering the potential impact of dilutive securities, such as stock options, convertible bonds, and warrants.One of those updates was to non-GAAP diluted EPS for the year.Basic EPS only includes common shares.

Diluted EPS vs Basic EPS: Understanding Earnings Per Share

The price-earnings ratio, or P/E ratio, is a popular way to compare company values.

Diluted EPS

The diluted EPS would then be calculated as ($1,000,000 – $100,000) / 222,000 = $4. Basic EPS is the most suitable but not very . If securities are retired, converted or affected .Fully diluted shares are the total number of shares that would be outstanding if all possible sources of conversion, such as convertible bonds and stock options , are exercised. In Q1, BioMarin missed on the top line but beat on the . On the other hand, Diluted EPS includes all possible shares that . IntelExcerpt: 2001 Annual Report ; Earnings per share from continuing operations: 2001: 2000: Basic EPS: $0.20 Last Year Reaffirms Full-Year 2024 Financial Guidance ATLANTA--(BUSINESS WIRE)-- UPS . Gilead swung to a diluted EPS loss of $(3.0 billion, net income attributable to . For example, if Company ABC has a net income of $5M, $500K in cash dividends to preferred shareholders, $450K in cash .Earnings per share (EPS) take into account only common shares, while diluted EPS includes convertible securities, employee stock options, and secondary offerings.

EPS (Earnings Per Share): Definition and Formula

Diluted Shares Outstanding

However, it’s like looking at a company’s profitability through a narrow lens.comRecommandé pour vous en fonction de ce qui est populaire • Avis

The Differences Between Dilutive Securities and Anti

Where: Net Income → The net income, often referred to as the “bottom line”, is the after-tax residual profits generated by a company in a given period, once all operating and non-operating costs are deducted.Recommandé pour vous en fonction de ce qui est populaire • Avis

Earnings Per Share

上面可以查到美股、台股的稀釋EPS數據,看Diluted EPS欄位。 美股EPS查詢(roic.Diluted Earnings per Share (EPS) = $250mm Net Earnings ÷ $251mm Fully Diluted Common Shares; Diluted EPS = $1.

Diluted EPS: Meaning and How to Calculate It

Non-GAAP diluted EPS guidance was raised to $2.Basic EPS vs Diluted EPS - Top 7 Differences, Comparison . Dilutive effects occur.As a result, the Basic and Diluted EPS for Black Gems would be the following: Basic EPS = ($354,931 – $28,330) / 12,500 = $26. It is a calculation that measures a company’s EPS quality. Adjusted Earnings Per Share is a GAAP (or .There are a few key points to be understood when we look at basic EPS versus the diluted EPS: Basic EPS is a simple measure of profitability and hence it is a lot better understood even for lay investors. EFFECT OF OPTIONS. In contrast, Basic EPS provides real-time projections and is mainly used for current calculations. Diluted assumes all options are exercised. The shares or share stock will be available even before the other .DETROIT, April 23, 2024 /PRNewswire/ -- General Motors Co.Diluted EPS takes into account the potential impact of securities that can potentially dilute the ownership of existing shareholders. This number of . As you can see, the basic shares are increased by the effect of options, warrants, and employee shares that have been issued.Convertible Preferred Shares: 20,000, each converts to 1. Differences in the treatment of convertible debt securities may result in lower diluted EPS under IFRS.2 Diluted EPS —settlement in stock or cash at issuer’s choice. Dilutive shares include options, warrants, .

Diluted EPS (GAAP) takes into account the potential dilution of a company’s earnings from dilutive securities such as options and convertible bonds.Diluted EPS accounts for currently issued convertible securities, employee stock options, and warrants.Basic vs diluted EPS.As you can see, the diluted EPS of $0. In contrast, Diluted EPS is more complex and includes common shares, stock options, debts, warrants, etc. Diluted EPS of $1.57: Diluted EPS: $0.

Basic and Diluted EPS

While basic EPS provides a conservative estimate of a company’s earnings per share, diluted EPS takes into account the potential dilution from convertible securities, offering a more comprehensive perspective. Where to Find Non-GAAP Diluted EPS in an Earnings Release . Increases the number of shares .Diluted EPS, on the other hand, will always be equal to or lower than basic EPS because it includes a more expansive definition of the company’s shares outstanding.Below is an example of how to calculate diluted shares outstanding for a company, as well as basic and diluted EPS. 稀釋每股盈餘是一種保守評估企業未來獲利的方式。 2.Diluted EPS will always be lower than basic EPS if the business creates a profit, because the profits have to be split among more shares. Investors should compare the fully . Ultimately, both basic EPS and diluted EPS have their importance and use cases, depending on the context of the analysis. Net income available to shareholders for EPS purposes refers to net income less dividends on preferred shares. Basic EPS is a simple measure of profitability. Dividends payable to preferred shareholders are not available to common shareholders and must be deducted to calculate EPS.Here are the details and the calculations for the diluted eps vs basic eps. If a company issues more shares to shareholders and other investors, this increases the number of shares outstanding and .

Diluted EPS (Earnings Per Share): Definition, Formula & Uses

Key Differences. The theory goes that because some or all of these investments could be converted or exercised, the number of shares outstanding could increase at any time.