Disability access tax credit

• The provincial supplemental disability amount in Ontario for 2018 is $4,879 and 10% of that is $487. Before a person can claim the DTC, they must submit a form T2201 .You may be eligible for the DTC if a medical practitioner certifies that you have a severe and prolonged impairment in 1 of the categories, significant limitations in 2 or more . Eligibility will be based . It was designed to help cover some .All of the following forms and publications are available electronically from the Internal Revenue Service at www. If you do qualify for the credit for the disabled, the amount ranges from $3,750 to $7,500, depending on your filing status and income. Disabled access credit —This is a nonrefundable tax credit for an eligible small business that pays or incurs expenses to provide access to persons with disabilities.The disabled access credit is a tax credit qualifying small business owners can claim for incurring eligible access expenses.In this comprehensive guide, we will explore who qualifies for this credit, the criteria they must meet, and how to calculate . tax code offers various credits and deductions to help individuals reduce their tax liability. For additional questions about these credits and benefits you can call 1-800-829-1040. If you got the policy through your employer, your Form W-2 may show the amount you paid in box 12 with code J.The Disability Tax Credit is a non-refundable federal tax credit intended to help people with disabilities or their caregivers reduce their income taxes owing. The maximum credit is $5,000 a year.

How to claim the DTC on your tax return.

Line 31285

Disability and Earned Income Tax Credit

The IRS recommends that all individuals and families who earned around . Eligible families with three or more qualifying children could get a maximum credit of up to $6,431, while individuals without children could earn up to $519 of EITC.

One such credit, more accurately known as the Disability Tax Credit, can significantly benefit eligible taxpayers. Federal budget 2021, released April 19, 2021, proposes to expand eligibility for the disability tax credit in the areas of .An individual is eligible for the disability tax credit for a tax year where the following requirements are met: the individual has one or more severe and prolonged impairments in physical or mental functions;; the effects of the impairment or impairments . If the amount is more than $10,000, you are only eligible for .

This will result in $2400/year or $200/month per person.For some people, performing everyday mental functions can be a challenge even with the help of appropriate therapy, medication, and devices. Part B – Medical Practitioner’s Section: This certification part .DISABLED ACCESS TAX CREDIT (Title 26, Internal Revenue Code, Section 44) This new tax credit is available to eligible small businesses in the amount . It may also be used for any purpose related to the administration or enforcement of the Act such as audit, compliance and the payment of debts owed to the . The Canada Revenue Agency (CRA) has made it faster and easier than ever for persons with disabilities and their medical practitioners to complete the Disability Tax Credit (DTC) application form, by introducing a new fully digital . You may be eligible for the DTC if a medical practitioner certifies that you have a severe and prolonged impairment in 1 of the categories, significant limitations in 2 or more categories, or receive therapy to support a vital function. Disability payments qualify as .4 billion annually ongoing, for a new Canada Disability Benefit. A qualifying individual can claim up to $20,000 per year in eligible expenses.The Disability Tax Credit (DTC) can help to reduce the amount of income tax that a person with a disability (or their supporting family members) might have to pay. The disability tax credit (DTC) is a non-refundable tax credit that helps people with impairments, or a supporting family member, reduce the amount of income .disability tax€credit or other related programs. Divide this amount by two ($9,250 / 2 = $4,625) to find the amount redeemable as a tax credit.

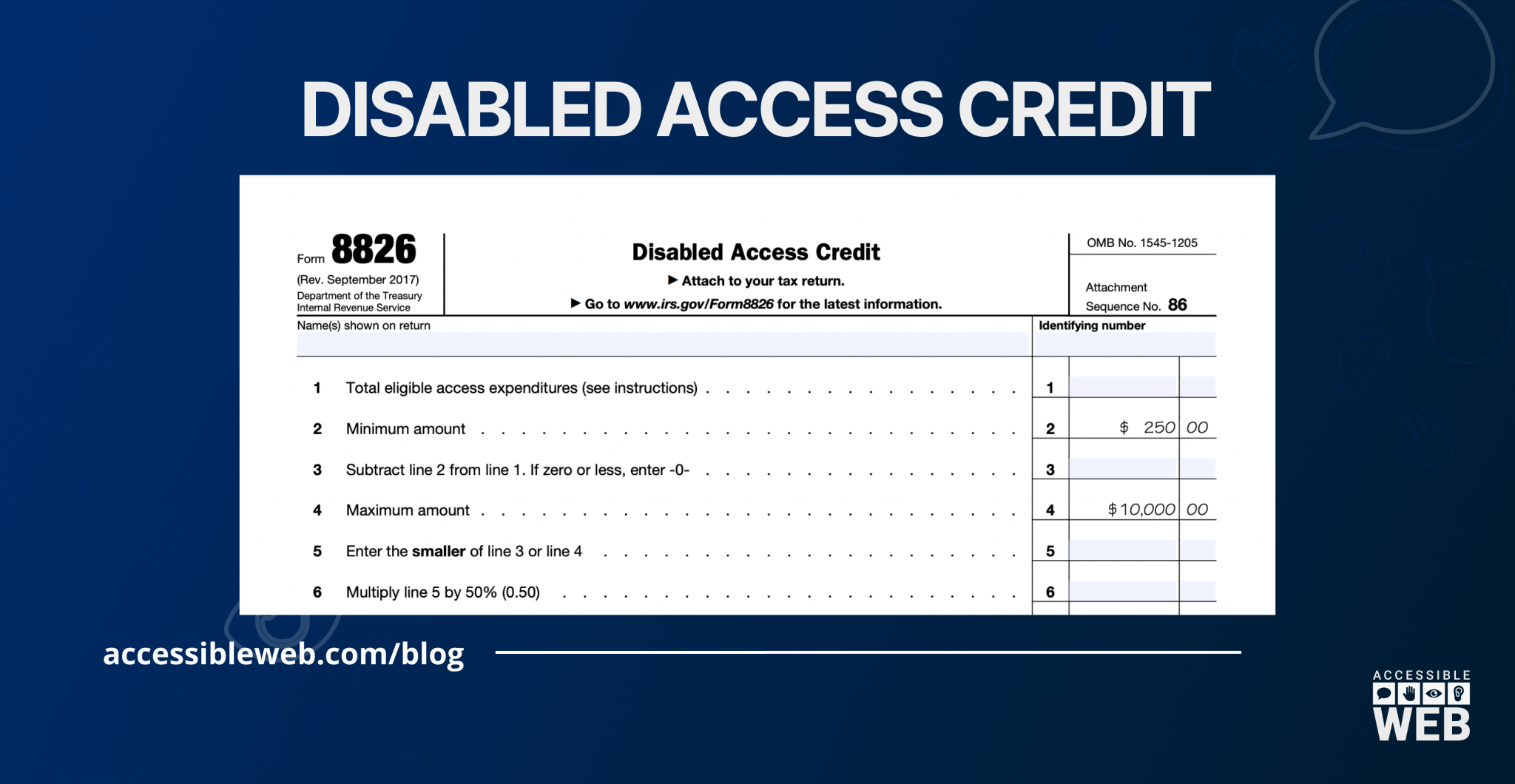

Disabled Access Credit (Form 8826): What You Need to Know

To complete Form 8826: Enter the total eligible access expenditures on line 1. Sudbury Tax Centre.T2201 Disability Tax Credit Certificate - Canada.

Learn More about the Disability Tax Credit (DTC)

To claim home accessibility expenses, complete the chart for line 31285 using your Federal Worksheet and enter the result on line 31285 of your return. Line 30300 – Spouse or common-law partner amount. Any unused amount may be .

Jonquière Tax Centre - 2251 René-Lévesque Blvd - Jonquière QC G7S 5J2. The Disabled Access Credit is part of the IRS’ general business tax credits. Eligibility for the DTC is based on the effects of an impairment, not a diagnosis .What Are Disability Tax Credits? Written by a TurboTax Expert • Reviewed by a TurboTax CPA Updated for Tax Year 2023 • November 28, 2023 4:40 PM. You receive only $300 in SSDI per month, but you have $18,000 in an annual taxable disability pension.The Disabled Access Tax Credit, IRS form 8826, is part of the general business credit and provides a tax credit of up to $5,000 to small business owners who .Each of these expenditures qualifies under the Disabled Access Credit.How Much Will I Get? | Disability Tax Credit Canadadisabilitytaxcreditcanada.

What is the Disability Tax Credit?

You won't qualify for the credit.Disability Tax Credit Form.

What Are Benefits Of Disability Tax Credit?

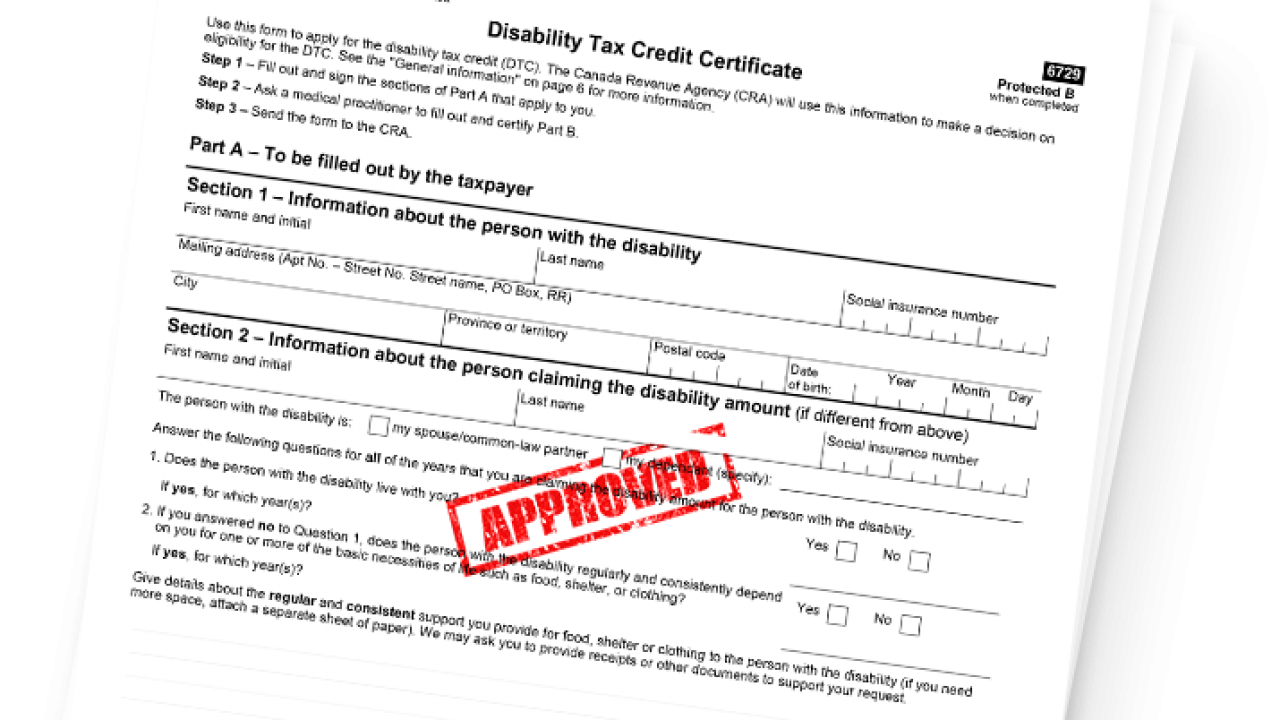

Year Month DayPersonal information is collected under the Income Tax Act to administer tax, benefits, and related programs. Eligibility for the Disability Tax Credit. If the amount on Line 1 is less than $250, you can raise the amount to $250.How to Complete the Updated Disability Tax Credit Certificate – T2201.9 Therefore, a DTC eligible MINOR in Ontario would have received: • “Base Amount” as calculated above of $2,071. The intent of the tax credit is to help with some of the extra costs a disability can create. The DTC aims to offset some of the costs related to an impairment by reducing the amount of income tax you may have to pay. Individuals with a severe and prolonged impairment in physical or mental functions can use this form to apply for the disability tax credit.Critiques : 153,4K

T2201 Disability Tax Credit Certificate

For more information about disability insurance and the EITC, see . Line 32600 – Amounts transferred from your spouse or common-law partner. Note: Qualified disabilities are classified into 3 main categories: However, it is essential that eligibility for the Disability Tax Credit is not .IRS Tax Tip 2021-183, December 9, 2021 Businesses that make structural adaptations or other accommodations for employees or customers with disabilities may be eligible for tax credits and deductions.Eligible small businesses may claim this non-refundable credit, known as the disabled access tax credit or disability access tax credit, on IRS Form 8826 for each taxable year in which they incur eligible expenditures.caNew Disability Tax Credit Application Form (T2201) | DABCdisabilityalliancebc.2024-25, and $1. By reducing the .Canada Revenue Agency. Winnipeg Tax Centre. abalcazar / Getty Images.The DAC is available to Missouri small businesses that have access expenditures that exceed the $10,250 federal credit limit.Who is eligible. The T2201 Disability Tax Credit Certificate is made up of two main parts: Part A – Individual’s Section: This application part of the form must be filled out by either the applicant or the claimant. Background What is the DTC? The DTC is a non-refundable tax credit that helps people with impairments, or . A Missouri small business may take a state income tax credit of up to 50 percent of “eligible access expenditures” which exceed $10,250.

Fact Sheet: Disability-Related Tax Provisions

This tool helps you determine eligibility and apply for the Canadian Disability Tax Credit (DTC).orgRecommandé pour vous en fonction de ce qui est populaire • Avis

Disability tax credit (DTC)

Eligible access expenses are costs .87 per cent of Canadians, the inclusion rate for capital gains—the portion on which tax is paid—for the wealthiest with .Jonquière Tax Centre 2251 René-Lévesque Blvd Jonquière QC G7S 5J2.The Disability Tax Credit (DTC) is a non-refundable tax credit which allows people with verified disabilities, or their caregivers, to reduce the amount of income tax they owe. For a free paper copy of any listed form or publication call 1-800- 829-3676 (1-800-TAX-FORM).DISABLED ACCESS TAX CREDIT.2 The eligibility rules for the disability tax credit are set out in subsection 118. To claim the credit for the current tax year, you must enter the disability amount on your tax return. Diabetes Canada advocates for fair and equitable access to the Disability Tax Credit (DTC) and similar programs for people with diabetes.

If you have a severe and prolonged impairment, you may apply for the credit.Some people with diabetes may benefit from federal and provincial/territorial tax credits.The new federal Canada Disability Benefit would pay an additional $2,400 a year – or $200 a month – to Canadians eligible for the existing Disability Tax Credit.Line 21500 – Disability supports deduction.

Understanding and accessing Canadian disability benefits

The expenses must be to enable the eligible small business to comply with the Americans .You won't qualify for the credit. Bathing, dressing, walking, carrying, lifting, and other personal care activities are all included. That means that the credit you enter on line 6 of the form, you cannot claim as another deduction in your taxable income or any other credit. If you are approved, you may claim the credit at tax time.What the Disability Tax Credit can mean for eligible Canadians and their families.If you need any help navigating the tool or answering the questions, we're here to help. Qualified Updates and Improvements.caRecommandé pour vous en fonction de ce qui est populaire • Avis

How to apply

To claim the credit, businesses must use Form 8826. Line 32300 – Your tuition, education, and textbook amounts. When there is more than one qualifying individual for an eligible dwelling, the total . You apply for the disability access tax credit on your business tax return, using IRS Form 8826.The disability tax credit (DTC) is a non-refundable tax credit that helps people with impairments, or their supporting family member, reduce the amount of income tax they may have to pay. In this article, we’ll walk through the disability tax credit, including: How to take advantage of this credit on IRS Form 8826 Sign here: Telephone. You may apply for the DTC at any time during the year.Business Tax Credits for Disability Access Updates.Applying for the Tax Credit.

Disability compensation and pension payments for disabilities paid to veterans or their families; . To calculate ABC’s tax credit, start by adding the total amount spent on accessibility ($8,000 + $1,500 = $9,500) and subtract $250 ($9,500 - $250 = $9,250).Eligibility for the credit. Sudbury Tax Centre Post Office Box 20000, Station A Sudbury ON P3A 5C1. The IRS prevents a double benefit.Completing your tax return.For example: • The federal supplemental disability amount for 2018 is $4,804 &15% of that is $720. Date modified: 2023-10-16. Here's an overview of the tax incentives designed to encourage employers to hire qualified people with disabilities and to off-set some of the costs of .