Disclosure of accounting policy examples

Disclosure of material accounting policies

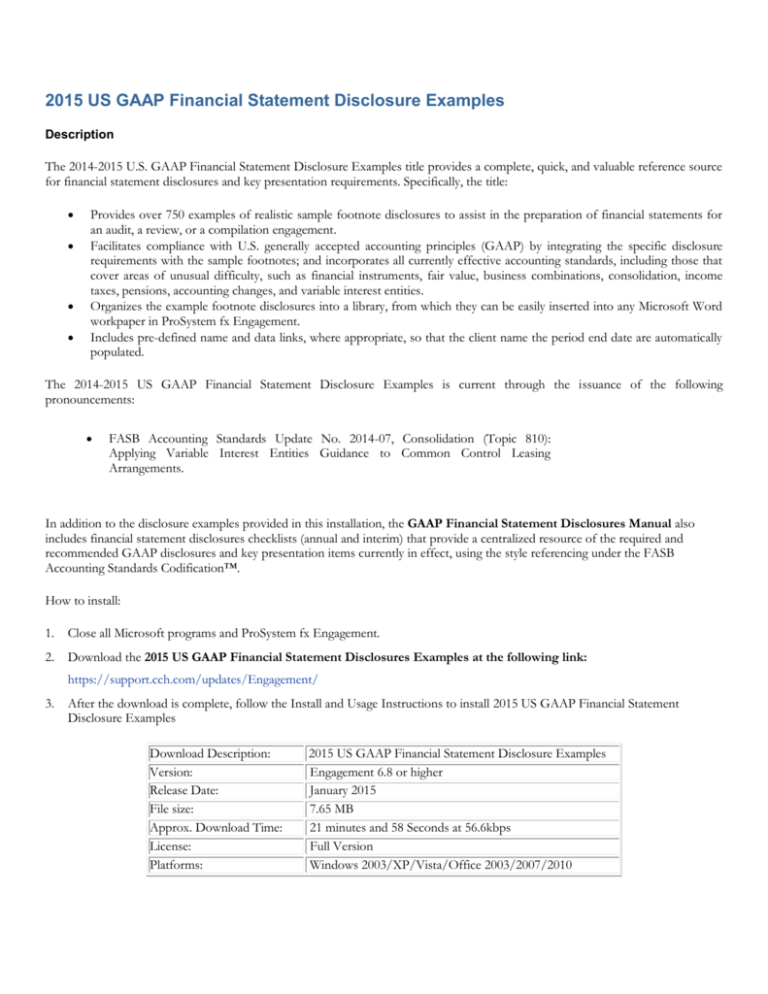

This example has been drafted to .10 Paragraph 2.93 Examples of systematic ordering or grouping of the notes include: .accounting policy disclosures in the financial statements.106 b Disclosure IAS 8. Depreciation was charged at 20% per annum on SLM. Standardised information and information that duplicates the requirements of IFRS Standards (Agenda Paper 20) In August 2019 the Board published Exposure Draft ED/2019/6 Disclosure of Accounting Policies, which proposed amendments to IAS 1 and IFRS Practice Statement 2.

Presentation of Financial Statements IAS 1

This is in line with the new amendments to MFRS 101 “Disclosure of Accounting Policies” which are effective for annual reporting periods beginning on or after 1 .Increase (decrease) due to changes in accounting policy and corrections of prior period errors [member] Disclosure: Member: IAS 1. Example Disclosure IFRS 15 Revenue from contracts with customers. (ii) material significant accounting policy information policies applied (see paragraph 95); .Disclosure Accounting policy information.10 of the 18th Edition 2021/22 of our publication Insights into IFRS.Applying the amendments, an entity discloses its material accounting policies, instead of its significant accounting policies. For example, companies are allowed to value inventory . Disclosures relating to changes in accounting policy caused by a new standard or interpretation include: [IAS .The Board proposes to amend IAS 1 to require an entity to disclose its material accounting policies.

Immaterial accounting policy information need not be disclosed. The Board amended paragraphs 117–122 of IAS 1 Presentation of Financial Statements to require entities to disclose their material accounting policy information rather than their significant accounting policies.117 to disclose their material accounting policy information. At its meeting on December 14-16, 2020, the IASB met to discuss sweep issues arising from the balloting process. 3 Revenue from contracts with customers. The change is to be disclosed in the year or years in which it has an impact on financial statements.Disclosure of material accounting policies - assets.accordance with AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors. Accounting policies can be used to legally manipulate earnings. Note 45 to the financial statements) to indicate that the paragraph relates to recognition and measurement requirements, as . It also cuts down on the possibility of manipulation or misuse of investors’ funds. HKAS 8 should be read in the context of its objective and the Basis for Conclusions, the Preface to Hong Kong Financial Reporting Standards and . Scenario 1 The following example addresses boilerplate or generic information being disclosed in accounting policies that are material to the financial statements (see paragraph 15). For example, an entity is likely to consider an accounting policy to be . Paragraph 117B of MFRS 101 provides illustrative examples of accounting policy information that is likely to be considered material to the entity’s financial statements. Disclosures of accounting policies on revenue recognition.Accounting policies are rules and guidelines that help a company prepare and present its financial statements. Further, the amendment to IAS 1 clarifies that immaterial accounting policy information need not be disclosed.For example, if the entity is not exposed to a certain risk to which many other entities in its industry are exposed, information about that lack of exposure could be material information. Transitional relief explained . Change in accounting policy : Any change in accounting policy should be disclosed. Therefore, we believe the “what disclosures” dimension of item (e) should rather be included in the guidance in .28 f (i) Disclosure IAS 8.

STAFF PAPER March 2019

Disclosure of accounting . The proposed amendments are intended to help entities: • identify and disclose all accounting policies that provide material information . The Board tentatively decided not to add transition requirements and an effective date to the amendments to IFRS Practice . 3 (a) Disaggregation of revenue from contracts . The amount each .Taille du fichier : 255KB

Disclosure of Accounting Policies

Accounting policies and significant judgements.Do the two examples included in Appendices B and C demonstrate effectively how the concept of materiality can be applied in making decisions about accounting policy .4 Disclosure of accounting policies.

com2021 Example Financial Statements - Grant Thornton .Disclosures relating to changes in accounting policies.

Guide to annual financial statements

This Insights illustrates how the amendments could be applied in the following examples: 1. Classification of Liabilities as Current or Non . An entity shall apply the amendments to NZ IAS 1 for annual reporting periods beginning on or after 1 January 2023.

Guide to Selecting and Applying Accounting Policies—IAS 8

From 1 st April 2018, he decided to switch to WDV retrospectively.

Disclosure of Accounting

The disclosure of some of the accounting policies followed in the preparation and presentation of the financial statements is required by law in some cases.Let us understand the change in accounting policy and its effect on the financial statement with the help of the following example: On 1 st April 2015, Hari purchased a machine for Rs.Notes to the Financial Statements - PwCpwc. The proposals state that information about an accounting policy is material if, when considered together with other information included in an entity’s financial statements, it can influence primary users’ decisions about the entity.Hong Kong Accounting Standard 8 Accounting Policies, Changes in Accounting Estimates and Errors (HKAS 8) is set out in paragraphs 1-56 and Appendix C.

retail mortgages, credit cards, commercial real estate etc.Taille du fichier : 612KB

Accounting Policies

49 b (i) Disclosure: 610000, 901000: Increase (decrease) due to voluntary changes in accounting policy [member] Disclosure: Member: IAS 8.Disclosure of accounting policies shall identify and describe the accounting principles followed by the entity and the methods of applying those principles that materially affect .annual financial report in accordance with Australian Accounting Standards – Simplified Disclosures, and that also meet statutory requirements under the Corporations Act 2001 for financial years ending on or after 30 June 2022. (c) following the order of the line items in the statement(s) of profit or loss and other comprehensive income and the statement of financial position, such as: . To support the .

However, if it is disclosed, it should not obscure material accounting policy information.Paragraph 117B of the amendment provides illustrative examples of accounting policy information that is likely to be considered material to the entity’s financial statements.Disclosure initiative: Accounting policies.The importance of full disclosure in the corporate and financial world is essential.

Example Accounting Policies

The IASB has amended IAS 1 and PS 2 to add guidance on applying materiality judgment to . Example Simplified Disclosures Proprietary Limited is a for-profit entity preparing consolidated financial statements.Applying IFRS: Disclosure of accounting policy information | EY - Global. IFRS 15 Revenue Disclosures Examples. XYZ Group: Consolidated statement of comprehensive income and retained earnings for the year ended 31 .not all accounting policies relating to material transactions, other events or conditions are themselves material. However, if it is disclosed, it should not obscure . Paper topic Examples of circumstances in which an entity is likely to consider . A government charges a levy on entities as soon as they generate revenue in 2021. Further amendments to IAS 1 are made to explain .29 d Disclosure: 610000, .about accounting policy disclosures. Disclosures of . In deciding whether a particular accounting policy should be disclosed, .globalRecommandé pour vous en fonction de ce qui est populaire • AvischThe Disclosure Initiative – IASB amends accounting . Project Disclosure Initiative: Accounting Policies.In 2024, a major change has taken place whereby “Significant Accounting Policies” will be replaced with ‘Material Accounting Policy Information’ in financial statements.In February 2021, the International Accounting Standards Board (IASB or the Board) issued amendments to IAS 1 Presentation of Financial Statements in which it provides . Disaggregation of revenue.Disclosure: A company must disclose what accounting policy they have been following.than two examples for accounting policy disclosure may give undue weight to this topic in the Materiality Practice Statement.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Disclosure of Accounting Policies

15/04/2021 by 75385885. Ensures transparency. In the Ind AS 1 amendment, specific guidance has been added to help entities determine when accounting policy information is material and, therefore, needs to be disclosed.This Practice Aid provides guidance on the disclosures of the accounting policies in the light of the narrow-scope amendments to IAS 1 and includes the following . Since accounting standards represent items in many ways, proper . If quantification is not possible the facts should be disclosed. Other potential disclosures.

Disclosure initiative: Accounting policies

Illustrative disclosures for banks

The standard requires a complete set of financial statements to .Disclosure Initiative – Accounting Policies – International Accounting Standards Board. The transitional provisions explained below must be .disclosure of significant accounting policies (e.

Increased transparency in the corporations’ operations and management makes it easier for investors to make informed decisions.

IAS 1 — Presentation of Financial Statements

Accounting Standard 1 (AS 1)

Disclosure of accounting policies shall identify and describe the accounting principles followed by the entity and the methods of applying those principles that materially affect the .improve accounting policy disclosures so that they provide more useful information to investors and other primary users of the financial statements; and ; distinguish changes in accounting estimates from changes in accounting policies. Following feedback that more guidance was needed to help companies decide what . Entities are mandated by IAS 1. Example reflects full set of illustrative financial statements with the notes block as well as detail tagged.Examples from Illustrative financial statements for Small and Medium-sized Entities (SMEs) which have been tagged with XBRL.Approval by the Board of Classification of Liabilities as Current or Non-current—Deferral of Effective Date issued in July 2020. Example: Change in method of .The IASB has amended IAS 1 and PS 2 to add guidance on applying materiality judgment to accounting policy disclosures. Note 45 to the financial statements) to indicate that the paragraph relates to recognition and measurement requirements, as opposed to presentation and disclosure requirements. An accounting policy is material if information about that accounting policy is needed to understand other material information in the financial statements.Example accounting policies guidance Whether to disclose an accounting policy. NCI

Illustrative examples

Example 1—A levy triggered when an entity generates revenue in two years.