Disclosure requirements in ifrs

They include IFRS 10 Consolidated Financial Statements (issued May 2011), IFRS 11 Joint Arrangements (issued May 2011), IFRS 12 Disclosure of Interests in Other Entities (issued May 2011), IAS 19 Employee Benefits (issued June 2011), Investment Entities (Amendments to IFRS 10, IFRS 12 and IAS 27) (issued October 2012) and Annual Improvements to .IFRS 12 Disclosure of Interests in Other Entities.

Introduction

DISCLOSURE REQUIREMENTS IN IFRS STANDARDS. Required disclosures include: general information about how the entity identified its operating segments and the types of products and services from which each operating segment derives its revenues [IFRS 8.3 December 2019 Presentation and disclosure requirements of IFRS 16 Leases Extracts from financial reports presented in this publication are reproduced for illustrative purposes. Exchange receives broad-based market support to enhance . Specific requirements are included for . Investors will benefit from greater consistency of presentation in the income and cash .Last updated: 15 January 2024. Download this slide deck from ‘Event Resources’ box on your left side of the screen. These amendments include: the creation of a defi nition of an investment entity; the requirement that such entities measure investments in subsidiaries at fair value through profi t or loss instead of consolidating them; new disclosure requirements . An entity shall apply these amendments for annual reporting periods beginning on or after 1 January 2021.IFRS 13 defines fair value and replaces the requirement contained in individual Standards.The objective of IFRS 18 is to set out requirements for the presentation and disclosure of information in general purpose financial statements (financial statements) to help ensure they provide relevant information that faithfully represents an entity’s assets, liabilities, equity, income and expenses. Next steps: The Board will consider feedback received on the Exposure DraftSEC disclosure requirements . Earlier application is permitted. The disclosure requirements of paragraphs 24–31 and the corresponding guidance in paragraphs .IFRS standards are International Financial Reporting Standards (IFRS) that consist of a set of accounting rules that determine how transactions and other accounting .IFRS 15 specifies how and when an IFRS reporter will recognise revenue as well as requiring such entities to provide users of financial statements with more informative, relevant disclosures. This paper has been prepared by the EFRAG .On 17 June 2021, the IFRS Foundation will hold the second in a series of live webinars on the Exposure Draft Disclosure Requirements in IFRS Standards—A Pilot Approach. IFRS Accounting Standards are, in effect, a global accounting language—companies in more . 1 The objective of this paper is to receive (first) input from the EFRAG User Panel on the .110-128 and IFRS 15.The International Sustainability Standards Board (ISSB) has today issued its inaugural standards —IFRS S1 and IFRS S2—ushering in a new era of sustainability-related disclosures in capital markets worldwide. They have not been subject to any review on compliance with IFRS or any other requirements, such as local capital market rules.1]

IFRS 2 — Share-based Payment

We are delighted to announce that the Quarterly IFRS Update for Q1 2024 is now available!

The IASB has issued an ED which proposes guidance for its own use when developing and drafting disclosure .

Investment Entities (Amendments to IFRS 10, IFRS 12 and IAS 27)

IFRS 7 requires disclosure of information about the significance of financial instruments to an entity, and the nature and extent of risks arising from those financial .The amendments introduce additional disclosure .Disclosure requirements in IFRS Standards - a pilot approach. those that are effective for companies with an annual period beginning on 1 January 2024.

IFRS 15 Disclosure Requirements

Taille du fichier : 444KB

IFRS 18 — Presentation and Disclosure in Financial Statements

In particular, they illustrate the following.

DISCLOSURE REQUIREMENTS IN IFRS STANDARDS

[Refer: Basis for Conclusions paragraph BC119A] C2B.

Disclosure of supplier finance arrangements

On 25 March 2021, the IASB published the exposure draft Disclosure Requirements in IFRS Standards — A Pilot Approach (the ED). Other Standards have made minor consequential amendments to IFRS 13. IFRS 13 disclosures are mandatory even when the measurement basis is amortised cost (as per IFRS 9) or cost (as per IAS 40).of information to the disclosure requirements in that Accounting Standard. Copyright © 2021 IFRS Foundation. IFRS 15 was issued in May 2014 and applies to .

5 October 2021 EFRAG DI FSR IASB Public Webinar - Disclosure Requirements in IFRS Standards –A Pilot Approach 21 • Supports a more robust and rigorous methodology to .this guide illustrates the disclosures required for a hypothetical reporting entity, merely for illustrative purposes and, as such, largely without regard to materiality.disclose, instead of applying disclosure requirements like a checklist.

Disclosure Requirements in IFRS Standards—A Pilot Approach

Disclosure Requirements in IFRS Standards A Pilot Approach

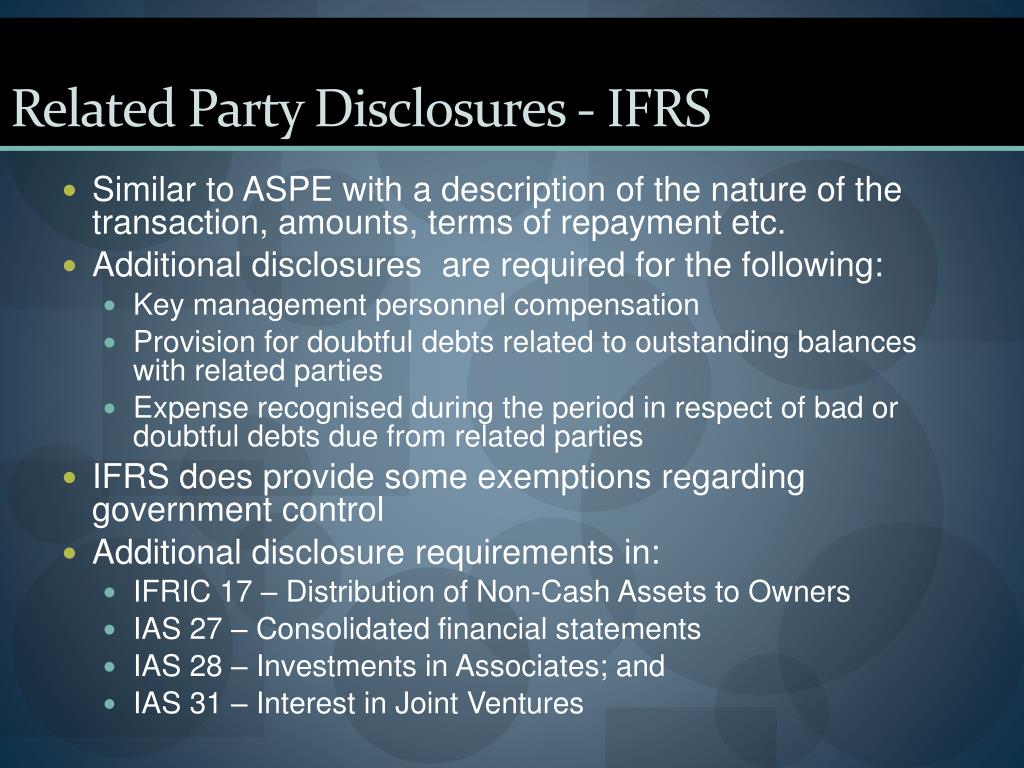

(2016) discuss only two studies on compliance with IFRS mandatory disclosure requirements; Pope and McLeay (2011) restrict their review of European Union (EU) IFRS . Revenue from Contracts with Customers) to which IFRS 9’s impairment model is applied. While US GAAP does not require separate disclosure of related party transactions on the face of the financial statements, SEC Regulation S-X Rule 4-08k requires amounts of related party transactions to be stated separately on the face of the balance sheet, income statement and cash flow statement. 20 October 2021.Disclosure Requirements in IFRS Standards – A Pilot Approach, Proposed amendments to IFRS 13 and IAS 19 .

Manquant :

ifrs Comments to be received by 12 January 2022 Comment deadline .Overview Disclosure Requirements in IFRS Standards

The [Draft] Guidance for the Board is not part of the Standards. The Standard explains how this information . You can find information about all of these activities by following the links below. In June 2012 IFRS 10 was amended by Consolidated Financial . IFRS 16 requires lessees and lessors to provide information about leasing activities within their financial statements.

Disclosure requirements in IFRS Standards

For example, Carvalho, Rodrigues, and Ferreira (2016) only cover IFRS disclosure studies relating to goodwill and business combinations; De George et al.The Exposure Draft was published by the International Accounting Standards Board (Board) in .IFRS 16 contains both quantitative and qualitative disclosure requirements.IFRS 7 requires entities to provide disclosures in their financial statements that enable users to evaluate: the significance of financial instruments for the entity’s financial position .IFRS 18 — Presentation and Disclosure in Financial Statements.

Disclosure requirements in IFRS Standards

15] Disclosure requirements. The Standards will help to improve trust and confidence in company disclosures about sustainability to inform investment decisions.

Disclosure Requirements in IFRS Standards A Pilot Approach

The standard provides a single, principles based five-step model to be applied to all contracts with customers.The disclosure requirements of paragraphs 24–31 and the corresponding guidance in paragraphs B21–B26 of this IFRS need not be applied for any period presented that begins before the first annual period for which IFRS 12 is applied.

Quick Article Links.

Disclosure Requirements in IFRS Standards—A Pilot Approach

Presentation and disclosure in the financial statements

ISSB issues IFRS 1 sustainability-related disclosures

A Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 was conducted by the IASB and was completed in 2022. This decision was made at the Board’s 21 July 2021 meeting. Disclosure requirements concerning contracts with customers are outlined in IFRS 15. The unusually long comment period is because of the unique .

Ng said: “With a strong market .IFRS 18 will enable companies to tell their story better through their financial statements.In October 2012, the IASB issued Investment Entities (Amendments to IFRS 10, IFRS 12 and IAS 27).

ISSB issues inaugural global sustainability disclosure standards

Disclosure initiative — Subsidiaries that are SMEs. EFRAG’s draft comment letter on the IASB’s Exposure Draft .IFRS 12 Disclosure of Interests in Other Entities, also issued in May 2011, replaced the disclosure requirements in IAS 27. On 25 March 2021, the IASB published the exposure draft Disclosure Requirements in IFRS Standards — A Pilot Approach (the ED).These minor amendments clarify that the disclosure requirements in IFRS 12 apply to interests that are classified as held for sale or discontinued operations. 2 Examples 1–4 in this Guidance are based on the amendments to IAS 19 Employee Benefits proposed in . The IASB has undertaken a number of activities to support consistent application of this Standard. o The Board proposes to replace the disclosure requirements in IFRS 13 and IAS 19 with a new set of disclosure requirements developed applying the proposed Guidance.Exchange Publishes Conclusions on Climate Disclosure Requirements.The 2024 Condensed interim financial statements reflect requirements relating to the newly effective accounting standards and amendments issued by the International Accounting Standards Board (IASB) – i. The ED proposed a new approach for the .The Board is seeking stakeholder feedback on whether the proposed new approach to developing disclosure requirements and proposed amendments to IFRS 13 and IAS 19 would help companies and others improve the usefulness of information disclosed.

IFRS 18 includes requirements for all entities applying IFRS for . Access the Exposure Draft below.Stakeholders say this typically occurs when the requirements in IFRS Standards are treated like a checklist without applying effective judgement. Illustrative disclosures . The amendments are effective from annual periods beginning on or after 1 January 2017. Disclosure is required when the fair value less costs to sell is lower than the carrying amount. IFRS 10 incorporates the guidance contained in two related Interpretations (SIC-12 Consolidation-Special Purpose Entities and SIC-33 Consolidation). The ED proposed a new approach for the IASB to develop disclosure requirements and test that approach by applying it to IFRS 13 Fair Value Measurement and IAS 19 Employee benefits.T he International Sustainability Standards Board (ISSB) has published its first ever global sustainability reporting standards: IFRS S1 General Requirements for . The Board used this approach to develop the proposed amendments to IFRS 13 Fair Value Measurement and IAS 19 Employee Benefits set out in this Exposure Draft.Small and mid-size “GEM” issuers will be able to provide disclosure other than Scope 1 and 2 emissions on a voluntary basis.These IFRSs have specific disclosure requirements for assets and liabilities that they mandate to be measured at fair value. The purpose of this session is to ask the IASB to agree on the effective date and transition requirements for the catch .The International Accounting Standards Board (Board) has decided to extend the comment period for the Exposure Draft Disclosure Requirements in IFRS Standards—A Pilot Approach to 12 January 2022.Exposure draft. This publication illustrates possible formats entities could use to disclose information required by IFRS 16 Leases using real-life examples from entities that have early adopted IFRS 16.Disclosure Requirements in IFRS Standards – A Pilot Approach Overview. Comments to be received by 12 January 2022 Comment deadline changed from 21 October 2021.22] judgements made by management in applying the aggregation criteria to allow two or .

Related party disclosures: IFRS® Standards vs US GAAP

Interest Rate Benchmark Reform—Phase 2, which amended IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16, issued in August 2020, added paragraphs 104–106 and C20C–C20D.This publication summarizes the new requirements for lessees in IFRS 16 Leases, both at transition and on an ongoing basis.