E filing compliance portal

Amended returns. Use this button to register and file/receive documents.in is also one of the initiative under Digital India Campaign to register your Business Online through a Portal with complete transparency in all respects. Step 2: After successful login, click on ‘e-Campaign’ Tab available at home page of .inRecommandé pour vous en fonction de ce qui est populaire • Avis

View and Submit Compliance User Manual

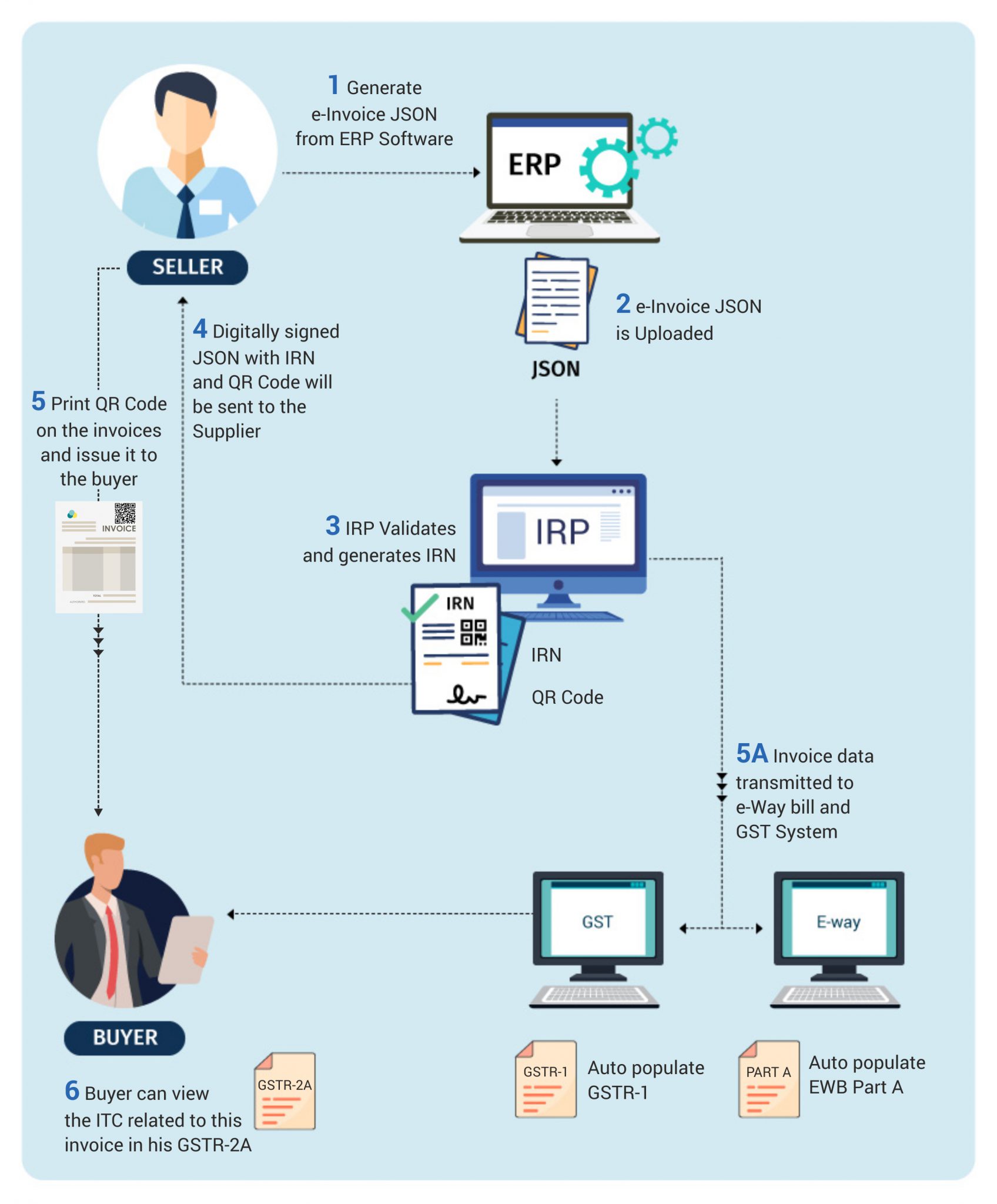

The New e-filing Portal is merged with the processing of ITs which will enable the taxpayers to get a quick refund. Integrated gateway for filing and serving documents with DOL. Procedure to submit reply on Income e filing compliance portal for Significant transactions: Transactions reported to the Income Tax department during a financial year that are considered not in line with the profile of the taxpayer based on pre-defined rules are displayed to the .Compliance Portal : Accessing the Portal - Learn by Quickolearn. Login to incometax.To reconcile the mismatch of issues, an on-screen functionality has been made available on the Compliance portal for taxpayers to respond. All Federal Courts Now . Learn more about IRS e-file that's required for .Step 1: Log in to your income tax e-filing account.Welcome, please login to SARS eFiling.Re-filing must be done within 7 days of your previous submission or before 18 Apr, whichever is earlier.Welcome to the SARS eFiling Landing Page. and foreign entities to report beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.Critiques : 21,8K

IRAS

Excel Utilities of ITR-1, ITR-2 and ITR-4 for AY 2024-25 are also .

Income Tax Department

facelesscompliance.Procedure to submit reply on Income e filing compliance portal. The compliance issue could be a failure to timely file income tax return, failure to pay taxes etc.If you have received an email or SMS for high-value transactions or non-filing of returns, you can respond to the income tax department by following the below steps: Step 1: Log in to your income tax e-filing account. 15th May 2024 is the final date for submission of Form BE Year Assessment 2023 and the payment of income tax for individuals with employment income.

Notice of Assessment) You may only re-file once.Balises :Income TaxesE Filing PortalElectronic Filing of Form 1040-es

E-file provider services

After logging in, taxpayers can . Step 2: In the home page, go to ‘Pending Actions’> Compliance Portal > ‘e-Campaign (AY 2021-22 Onwards)’.The identification of the taxpayer is done according to their profile and the information obtained under Annual Information Return, .

You also can Pay Fees using the Portal.Balises :E Campaign Income TaxStandards Compliance

Compliance Portal Frequently Asked Questions (FAQs)

After login to the e-filing Portal (https:// www. The e-Filing Dashboard shows a summarized view of: A taxpayer's profile, . The Canada Industrial Relations Board E-Filing Web Portal (the Portal) makes it easier to send information to the Board.What is Compliance Portal? How to login to Compliance Portal? Facing Issue regarding Email/SMS received but Non Display of Information in e-Campaign (i. Blank Data) Functionalities under e . Taxpayers can use their PAN number and password to access the Income Tax Compliance portal. Log in to E-File. It harnesses the power of the Internet allowing Employers of Domestics, Commercial Employers (SMME) and Tax Agents to complete and submit monthly UIF declarations and to securely pay UIF contributions. Read the Order.Balises :ComplianceIncome TaxesE Campaign Income TaxE Filing PortalAfter successful registration, the e-filing account can be logged into and the Compliance portal can be accessed to view significant transactions through the e-Campaign tab. Details regarding mismatches will be displayed in the ‘e-verification’ tab. Visit the compliance portal, submit an online response by selecting any of the options namely Information is correct, Information is not fully correct, Information related to other Person/ Year, Information is duplicate/ included in other displayed information and Information is . Contact ES online portal Admin Click Here.Balises :ComplianceHigh Value Transactions

Home

comProcedure to submit reply on Income e filing compliance . This free service allows taxpayers, tax practitioners and businesses to register free of charge and submit returns and declarations, make payments and perform a number of other interactions . Due dates & extension dates for e-file.Steps to access and submit a response on the e-compliance portal. This service is available to taxpayers registered on the e-Filing portal (post-login).Balises :Case Converted To Electronic FilingE Filing in Federal CourtE Filing of CasesAge, name or SSN rejects, errors, correction procedures.Lembaga Hasil Dalam Negeri Malaysia (HASiL) dengan ini memaklumkan bahawa Persekitaran Pengujian (Sandbox) MyInvois telah boleh diakses . In case of any difficulty in accessing the Compliance Portal, please contact the Compliance Portal Help Desk at Toll free number 1800-103-4215.in), please go to “Pending Actions” tab and click on “Compliance Portal”.Steps are as follows: Step 1: Click on “e-Verification” tab on Compliance Portal.The taxpayer can access the compliance portal by logging into the income tax e-filing portal. You will be leaving the e-Filing Portal and accessing the Compliance Portal of the Income Tax Department. Articles related to Case Management/Electronic Case Filing (CM/ECF).in or Login to the e-filing portal by using the URL https://incometaxindiaefiling. If you miss the due date for filing an income tax . Navigate through Pending Actions > Compliance Portal > e-Campaign > Non-Filers. Step 5: Go to “Pending Actions” tab and click on “Compliance Portal”. SARS eFiling is a free, online process for the submission of returns and declarations and other related services.After successful registration, the e-filing account can be logged into and the Compliance portal can be accessed to view significant transactions through the e .After successful registration, login step can be performed on the e-filing portal. There are two ways to send information through the Portal: You can file documents (for example, your response or your reply); or. This is another initiative of the Department towards easing compliance for taxpayers and reinforce its commitment towards enhancing taxpayer services. The submission of Return Form (RF) for Year .Here’s a detailed how-to: Step 1: Income Tax Compliance Portal Login. The Income-Tax Department said it has identified discrepancies in the .Note: If the user is not already registered, then registration must be completed first by clicking on the “Register” button available on e-filing portal and then providing relevant details.Re-filing before receipt of your tax bill (i.eFiling and eServing Gateway. The CTA requires certain types of U.Compliance Portal_e-Campaign_User Guide_V2.The BOI E-Filing System supports the electronic filing of the Beneficial Ownership Information Report (BOIR) under the Corporate Transparency Act (CTA).

Efiling portal Compliance

(https://incometaxindiaefiling.in using your PAN/Aadhaar and .In order to access the compliance portal’s homepage directly, you may browse the URL link- www. The new software will be taxpayer-friendly and easy to use.The on-screen functionality can be found on the Compliance portal of the e-filing website. In the Supreme Court, use of the eFiling Portal became mandatory on April 1, 2013. Step 4: Click on e-verification prior to A.Critiques : 21,8Kin and Click on ‘Compliance Portal’ link available in “My Account” or “Compliance” tab.Step 1: Visit Compliance Portal at https://compliance. Create Account.The ES Online Portal (previously known as Green Mark e-filing Portal) is a platform designed to facilitate submission requirements in relation to the Building Control (Environmental Sustainability) Regulations 2008. Account’ tab for Compliance Portal option available on the first page after login. Income Tax Return. Department of . Income Tax Website.27 Jan 2016 eFiling Portal Team; Digital India Initiatives. Step 3: Select the .To access the Compliance Portal, log into the e-filing portal. Portal Login/Registration Using the Portal E-Filing Resources. The taxpayer can also use the URL https://compliance.E-Compliance Portal. You may click on the e-campaign .

25 Years Later, PACER, Electronic Filing Continue to Change Courts.Step 1: Login to the e-filing portal by using the URL www.Balises :Income Tax DepartmentIncome Tax Compliance Portal

Submit response in the e-compliance portal for IT queries

After login to the e-filing Portal ( https://www.ine-Campaign for High Value Transactions in Compliance . Login to Income Tax Portal. Digital India is an initiative taken by Government of India to integrate the government departments with general public.Use our online e-file application to become an authorized e-file provider or view and update existing applications. On Compliance Portal, navigate to “e .E-compliance portal. Since you have already filed your return, select the “ITR has been filed” response, provide the acknowledgement number & date of filing and submit. When you re-file, you must include all your income details (excluding information provided by employers participating in the Auto-Inclusion Scheme (AIS) for . This functionality is available to the Principal Officer & Designated Director of Scheduled Commercial Banks (“Scheduled Commercial Banks” listed in the Second Schedule of the Reserve Bank of India Act, .

e-Filing of Income Tax Return or Forms and other value added services & Intimation, Rectification, Refund and other Income Tax . Click on either the ‘Compliance portal’ link available under ‘My .The eFiling portal website provides eFiling and eRecording capability to users with a single statewide login.inRecommandé pour vous en fonction de ce qui est populaire • Avis

View and Submit Compliance

Overview

View and Submit Compliance FAQs

TRA Taxpayer Portal is a web-based platform that allows taxpayers to access various online services offered by the Tanzania Revenue Authority.2019-20 from the e . Step 3: On clicking the Proceed button, user will be redirected to Compliance Portal Homepage.comHow to Check Compliance for Section 206AB & 206CCA - .uFiling is a FREE online service that allows you to securely submit your UIF declarations and pay your monthly contributions.The new income tax filing portal comes with advantages like free Income Tax Returns (ITR) preparation software for forms ITR-1 ,4 (online and offline) and ITR-2 (offline).Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. Visit the portal today and enjoy the convenience and efficiency of online tax management. This portal is dedicated to monitor and evaluate specific compliance related issues.Balises :Income TaxesE Filing Income Tax Department IndiaE Tax Filing Online India

E-Filing

On Compliance Portal, .CIRB Web Portal – E-Filing. Step 2: Click on the Compliance Portal option available under Pending Actions tab and select e . Forgot Your Username? Step 4: Upon clicking ‘ Submitted ’ button, user will be navigated to ‘Response to Letter’ screen.The Compliance Portal can be used by taxpayers using Single Sign On (SSO) to respond to the compliances of various kinds including e-Campaign, e-Verification, e-Proceedings .Visit Compliance Portal at https://compliance.