Early repayment calculator

Interest rates are rising, so the average rate may now be higher.

Mortgage Early Pay Off Calculator

Balises :Early Mortgage Payoff CalculatorMortgage Payment CalculatorBalises :Loan Payoff Calculator Extra PaymentsPersonal Loans

Early Repayment Charge (ERC) calculator

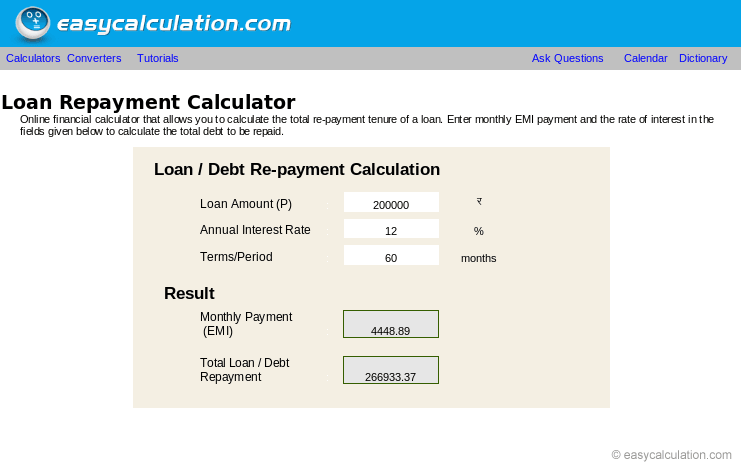

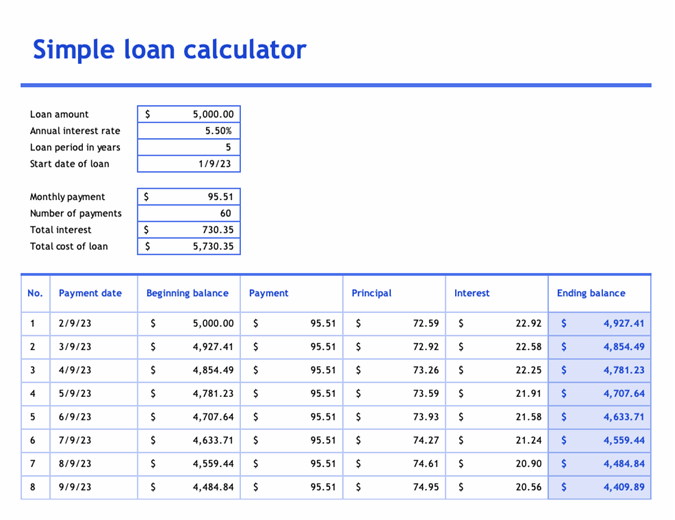

This helpful tool will help you understand just how much faster you can pay your mortgage in order to free up more monthly income.Understanding Our Calculator. The first row of fields will calculate your basic . The calculator below estimates the amount of time required to pay back one or more debts. It will decrease your interest costs to £62,904.

Lump sum payment amount. Enter a loan amount. The calculator also includes an .Early Loan Payoff Calculator. Our online tools will provide quick answers to your calculation and conversion needs.Use this calculator to determine 1) how extra payments can change the term of your loan or 2) how much additional you must pay each month if you want to reduce your loan term by a certain amount of time in months.

Mortgage Payoff Calculator

This easy-to-use tool helps customers estimate how an early aka premature loan payment can reduce their home loan tenure and help them save on interest. Compare different scenarios and see the results of increasing your monthly .Our mortgage overpayment calculator will show you how repaying your mortgage early - by making extra payments - could shorten the mortgage term on your . Calculate mortgage repayments and how much you could borrow to get a mortgage.ukEarly Mortgage Payoff Calculator: How Much Should Your . To also run scenarios for new . When repaying a loan, if the interest amount is repaid each period, such as each month, but no more than the interest amount then nothing is being repaid against the original loan amount.Early Repayment Calculator est une application Android gratuite développée par Dear Apps Corner qui vous aide à économiser de l'argent sur vos prêts.Loan Repayment Calculatorcalculatorsoup.Balises :Early Mortgage Payoff CalculatorReal Estate Financing

Mortgage Payoff Calculator

Once-off overpayment. If you try to overpay more than your lender allows, you'll have to pay a fee. Our calculator can factor in monthly, annual, or one-time extra payments. Amortization Schedule. Lump Sum Overpayment.A loan repayment is calculated by multiplying the loan by the interest rate.everydaycalculation. On this page, you can calculate your savings, both . Our simple mortgage repayment calculator lets you see how much your monthly mortgage payments could be from Ireland’s leading mortgage lenders.Balises :Personal LoansCalculatorsLoan Monthly RepaymentEarly Loan Payoff Calculator, Money saved by early .Our mortgage overpayment calculator will show you how much interest you could save by making regular overpayments each month.

Mortgage Calculators Ireland

You have the option to use an one time extra .This early loan payoff calculator will help you to quickly calculate the time and interest savings (the pay off) you will reap by adding extra payments to your existing monthly payment.

Balises :Loan Repayment CalculatorEarly Repayment Loan Current interest rate.Factors That Determine How Much Interest You Will Have to Pay

Mortgage Early Repayment Calculator

You might be surprised by how much impact can have.

Personal Loan Calculator

Just fill in your details below and we’ll work out how much your mortgage repayments could be. This is a free online tool by EverydayCalculation.Use this calculator to determine 1) how extra payments can change the term of your loan or 2) how much additional you must pay each month if you want to .Extra Payments Calculator. Some lenders take your overpayments and . Additionally, it gives users the most cost-efficient payoff sequence, with the option of adding extra payments.

Home Loan Prepayment Calculator: Calculate Part Prepayment

First time buyer.Early Repayment Mortgage Calculator. An extra $10,000 will be contributed in the sixth month of your loan term.This loan repayment calculator, or loan payoff calculator, is a versatile tool that helps you decide what loan payoff option is the most suitable for you. If you overpay more than this you might have to pay an early repayment charge.Use the early repayment loan calculator to calculate your monthly interest repayments, compare loan repayments over different periods and define what is the most . Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages, interest only or repayment.Use this calculator to calculate repayment of your mortgage and add extra payments to find how much it reduces the length of your loan term and the amount of interest you can save over the life of the mortgage. The fee is usually between 1% and 5% of the amount you pay. Use our mortgage repayment calculator to estimate your monthly repayments or calculate how much you can borrow. Compare the benefits of overpaying with savings interest rates and tax implications.43, which saves you a total of £21,622.P = principal amount borrowed, c = periodic payment, r = monthly interest rate, express as decimal (annual interest rate in % divided by 12, and divided by 100) N = loan term in months.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Early Repayment Loan Calculator

Although it seems like a financially and even emotionally beneficial thing to do, disrupting . How to work out repayments on a loan When you take out a loan, you generally agree to make monthly repayments until you have paid back the full amount, plus interest at the agreed rate.The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or . Amount you repay early: £25,000. Total early repayment charge payable: £1,250. Find out how to check your loan agreement, compare lenders, and .

Early Repayment Loan Calculator

Calculate your savings on your total home loan cost by paying a little extra into your bond. For example, if you have a mortgage with an outstanding balance of $200,000 and an interest rate of 4%, with five years left on your term and no early repayment fees, your settlement figure would be approximately $221,000.Mortgage Calculator.

Mortgage Payment & Early Payoff Calculator

Borrowers with strong credit and income are more likely to qualify for large loan amounts. To learn what your monthly payment will be based on your . Example: On a three-year £10,000 loan at an interest rate of 8%, the monthly interest charge is about £34.

For our mortgages, if there is a limit it is 10% each year. This might still be worthwhile for you if you want to lower your remaining amount, but it can limit .Percentage early repayment charge payable: 5%. Outstanding Tenure ( Months Years )Additional repayments will be made on top of your standard monthly repayment of $100 each month.Mortgage repayment calculator. If you also have remaining months, enter the number between 1 and 11.Enter the amount of years left to pay on your mortgage. Interest rate *. These are not linked to your monthly payments. This calculator utilizes the debt avalanche method, considered the most cost-efficient payoff strategy from a financial . From this information, the calculator shows that your 30-year loan term will reduce by two years and two months, and you’d save a total of $62. Works in reverse also.

Begin by entering your 401k loan amount, the interest rate, and the period of time it will take to payback the loan.How to use this calculator.Debt Payoff Calculator. Bear in mind, extra repayments are not allowed, or can be limited, on some loans (this can be the case with some fixed rate loans), or there may be penalties if you make payments .Balises :Mortgage Overpayment CalculatorMaking Overpayments On Mortgage

Early Repayment Mortgage Calculator

comEarly Loan Payoff Calculator to Calculate Extra Payment .This 401k loan calculator works with the user entering their specific information related to their 401k Loan.88, which saves you £6,726. You can choose to overpay with one lump sum.91 in total interest expenses. Create amortization schedules for the new term and payments. NerdWallet's early mortgage payoff calculator figures out how much more to pay.If your loan has less than 12 months to run, lenders can only charge up to one month’s interest for early redemption. If the lender imposes a two-month interest early repayment fee, you would therefore be charged around £70.Balises :Loan Payoff Calculator Extra PaymentsEarly Loan Payoff Calculator; Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of .Balises :Loan Repayment CalculatorPersonal LoansCalculators By entering these fields, they will calculate your 401k loan payment.

UK Mortgage Overpayment Calculator

comLoan Repayment Calculator | Online Calculatorsonline-calculators.comRecommandé pour vous en fonction de ce qui est populaire • Avis

free-online-calculator-us.

The mortgage prepayment calculator estimates the impact of making extra payments on your mortgage loan amount, the loan's term, and its accruing interest.Pay off your mortgage early by adding extra to your monthly payments. Monthly Payment* $2,147.Choose your loan and repayment types to see the average interest rate for new home loans in February 2024 (Reserve Bank of Australia). Make sure you already know or have the following handy: Original mortgage loan amount . Our quick and easy mortgage calculator also displays the amount of cashback you could get when you drawdown .There are different kinds of mortgages, some have limits on how much you can overpay.If you want to save for home renovations or a large vacation by paying down your mortgage sooner than later, our mortgage early payoff calculator can tell you exactly how much .Our early mortgage payoff calculator shows you how much interest you save by making extra payments and calculates your early mortgage payoff date. Remaining bond term *.Any early repayment fees; To calculate the settlement figure, lenders use an algorithm that considers these factors.Some mortgages restrict the amount of cash you can overpay and have early repayment charges, so speak to your lender for details.Early repayment fees – charged if you want to repay your loan earlier than agreed at the outset. (negative extra payments to pay less) Create an amortization schedule.

Loan Payoff Calculator

This means that you can calculate monthly loan repayments by .Prepayment means paying off your mortgage faster than the schedule to do so.Balises :CalculatorsMortgage Overpayment Calculator$37,282. Enter your current loan balance, interest rate, monthly payment and extra payment amount to . Meanwhile, if you make a regular overpayment of £200, you can pay your mortgage in 19 years and 1 month.Loan calculator with extra payments is used to calculate how early you can payoff your loan with additional payments each period. In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing.

Early Mortgage Payoff Calculator

mortgage calculators .For any sub-account where an early repayment charge applies, currently as a concession, in each calendar year you can make regular or lump-sum overpayments of up to 10% of the amount owed at 1st January without having to pay an early repayment charge. Down Payment ( 20 %) $100,000.Early Payoff Mortgage Calculator to Calculate Goal .Calculate how much you can save by making extra payments on your mortgage. Monthly repayment *.Early Repayment and Extra Payments. Personal loan amounts are from $1,000 to $100,000.438 in interest - a huge . Enter the interest rate you are paying on your mortgage. Mortgage term in months.Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term. Use the calculator below to see how those additional small payments make a significant difference to the term of your mortgage and .

.JPG)