Electronic money transfer system

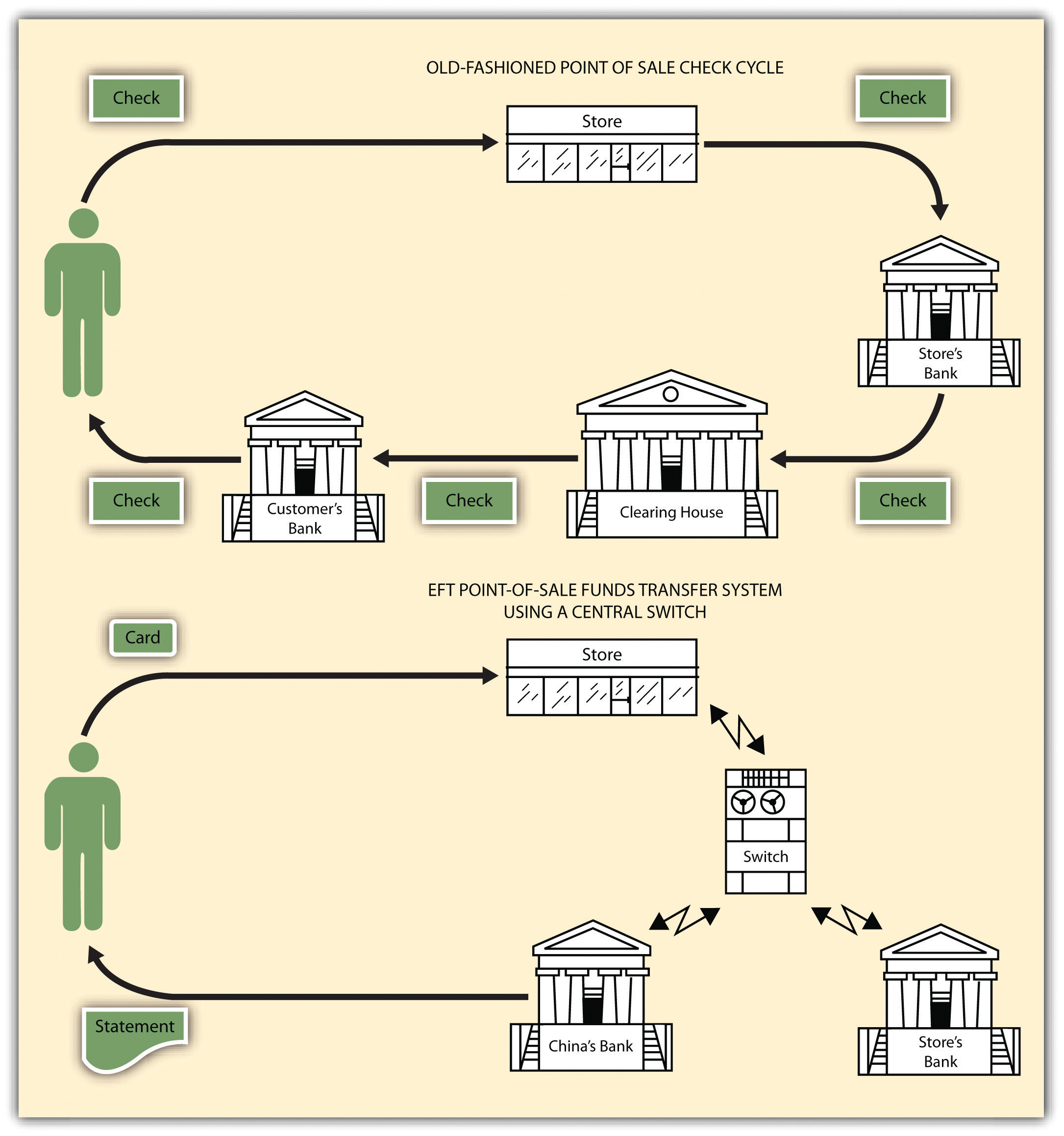

Bangladesh Automated Cheque Processing System (BACPS) V 2. Anyone with a bank account can initiate an electronic funds transfer.Electronic Funds Transfer (EFT), is a digital transfer of money through an online payment system, either between banks or people.; Low processing fees – It costs less to move money electronically than through more traditional methods like writing checks or visiting banks. While an EFT might take two to three days, an Interac e-transfer is .What’s the Difference Between an EFT and an ACH?ACH stands for Automated Clearing House.

Electronic money: everything you need to know

The WBG has also played a crucial role in facilitating timely and efficient cash transfers during emergencies and crises, most recently during the Ebola crisis in West Africa.Money transfer apps, also called peer-to-peer (P2P) money transfer apps, let you transfer cash from person to person, or from entity to entity, quickly, conveniently, . Individuals, firms, and corporate organizations may use the NEFT system to . The electronic fund transfer works through a series .

Electronic Fund Transfer Act of 1978 defines EFTs as a .

Payment and Settlement Systems

Save up to 3x when sending money abroad.SWIFT is a vast messaging network used by financial institutions to quickly, accurately, and securely send and receive information, such as money transfer . tends to cost from $20 to $30, and there’s usually a fee to receive one.

Making Electronic Money Safer in the Digital Age

From private-sector-led innovations like cryptoassets and stablecoins — to public-sector-designed programs like the Bahamas’ issuance of the “Sand Dollar” and .Digital currency (digital money, electronic money or electronic currency) is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Once the sender initiates th. Millions of happy customers. Respondents further added that electronic money transfer facilitated them to live in a more relaxed way since they could easily access banking services.The Society for Worldwide Interbank Financial Telecommunications (SWIFT) system powers most international money and security transfers. What is National Electronic Funds Transfer system? Ans: National Electronic Funds Transfer (NEFT) is a nation-wide centralised payment system owned and operated by the Reserve Bank of India (RBI).

What Is Electronic Money or eMoney?

Like Hawala, Wise uses peer-to-peer system to send money abroad, but with bank accounts. Digital Financial Inclusion in Africa Interview Series – Tim . Established firms are creating new online businesses, while new . Banks are commonly used for electronic . As the money transfers are all digital, there is no need for physical currency or paper checks. Procedure: The sender goes to the post office and fills up an issue form (EMO -1) giving required information like sender name, address, mobile phone .

What is the Electronic Fund Transfer Process?An EFT transfer is usually very straightforward.What's Zelle®? Glad you asked! The EBA contributes to making retail payments in the . You’re only auth.Electronic Fund Transfer (EFT) is the transfer of funds from one bank account to another using electronic means. Electronic Funds Transfer (EFT) is a method that facilitates the electronic transfer of money from one bank account to another. Advancing the Modernization and Integration of Payment Systems in the Western Balkans (2024).This indicated that managers were willing to bear the cost of money transfer system as well as it was bringing efficiency.Best apps to send money.Payment services and electronic money | European Banking Authority.Fast/Instant Payments: An Imperative for Accelerating Financial Inclusion in Africa (2024).Whether sending money locally or internationally, electronic money transfer offers convenience, speed, accessibility, and additional features that simplify and streamline financial transactions. The wire network, however . Digital currency .An electronic fund transfer is a computer-based or online-based money transfer system used to transfer funds from one bank account to another. Taxonomy of money, based on Central bank cryptocurrencies by Morten Linnemann Bech and Rodney Garratt. They further commented that electronic money transfer systems has .What is the processing time for EFT payments?EFT payments may take up to two business days to process. The EBA contributes to making retail payments in the EU secure, convenient, innovative and competitive.We review the seven best money transfer apps of 2023, including Venmo (best for peer-to-peer transfers), Zelle (best for transfers between banks) and .Top Remittance & Money Transfer Software.What is Electronic Funds Transfer (EFT)? .

Electronic Funds Transfer (EFT) Explained

An electronic funds transfer is the digital way of moving money from one bank to another. It occurs through a computer-based system without the need for direct intervention from an employee.An electronic funds transfer (EFT) is a money transfer between two financial institutions. The best money transfer apps make it deliciously straightforward to send and receive money, either to and from family or some place else . Having considered those discussions and comments, the IASB decided to explore narrow-scope standard-setting as part of its post-implementation review of IFRS 9 (see the .How do electronic funds transfers work for international payments?International EFT payments work much like domestic EFT payments but may come with heftier fees or restrictions.Advantages of Electronic Funds Transfer. EFT technology enables companies to reach the entire population from anywhere in the wor. The device acts as a prepaid bearer instrument which does not necessarily involve bank accounts in transactions. Riskier than We Think? A Focus on Insolvency of Frameworks to Protect Mobile Money Users (2024).What is an EFT payment?An electronic funds transfer (EFT), or direct deposit , is a digital money movement from one bank account to another.

Types of Electronic Fund Transfer in India: NEFT, RTGS, IMPS & UPI

What Is the Automated Clearing House (ACH)?

The competition is a bit tough between an EFT and an Interac e-transfer. Because of this, EFT payments are far quicker .These regulations were subsequently amended on 31 August 2021 through the National Payment Systems (Electronic Mobile Money Transfer and Withdrawal Transactions Levy) (Amendment) Regulations, 2021 (together the 2021 Regulations).What are the Benefits of Electronic Fund Transfer?When it comes to payment, EFT has a lot to offer. Over 16 million happy users. All types of EFT are fast and reliable and don’t require much work on either end of the transacti. Best money transfer app of 2024.Automated Clearing House - ACH: An automated clearing house (ACH) is an electronic funds-transfer system run by the National Automated Clearing House Association (NACHA). E-money can be used for payment transactions, with or without bank accounts.An electronic funds transfer is the electronic transfer of money from one account to another from within a single financial institution or across multiple banks or . They are both safe, but there is a reason why Interac e-transfer is becoming one of the most preferred ways of transferring funds from one bank account to another in Canada: it’s significantly faster.Payment services and electronic money. In fact, quite the opposite. Payment services and electronic money.Here’s how it works. (2) The application form referred in sub regulation (1) and shall be .Digital currency. While EFT is preferred worldwid.Electronic Money. The transaction is entirely electronic, with no physical money changing hands.

What is Electronic Money (e-money)?

It facilitates both credit and debit transactions, as a lead over cheque clearing system.ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.

What is The Hawala System?

Every method of EFT offers ease and fast delivery, which is why it’s become so popular.What Is Electronic Money?

Low fees, fast transfers. Electronic money is used for transactions globally and is commonly accessed through electronic banking systems and monitored through .

Just as the telegraph erased time and distance in the 19th century, today’s innovations in digital money may bring significant .electronic money approval 3.

Electronic funds transfer

; Increased security . By following the general steps to send and receive money electronically, you can take advantage of the convenience and efficiency offered by .

An electronic funds transfer (EFT), or direct deposit, is a digital money movement from one bank account to another. ix ABSTRACT As we enter the twenty-first century, business conducted over the Internet (which we refer to as ‘e-business’), with its dynamic, rapidly growing, and highly competitive characteristics, promises new avenues for the creation of wealth. Best for budding investors: CashApp. That means it's super easy to get . The shortest processing times are usually for payments sent between bank accounts at the.With the growing importance of e-money issuers, a comprehensive, robust framework for regulation and safeguarding customer funds is critical. The set of procedures to be followed by various stakeholders participating in the system is available on the RBI . Choose the right Remittance & Money Transfer Software using real-time, up-to-date product reviews from 455 verified user .(Updated as on October 31, 2022) 1. EFT payments can be done within the same bank, or between banks. Best for flexible payments: PayPal.An EFT payment is the electronic transfer of money between people, banks and companies. However, unlike Hawala, Wise is not informal, nor outside the banking system. While transmitting over the internet involves risk, EFT is generally considered a safer paymen. For example, you can use an EFT to send or receive payments .

Zelle®

EFT is reliable, fast, secure, and provides a more efficient means of conducting financial transactions compared to traditional paper-based methods.How eMoney Works.Types of EFT PaymentsEFT payment methods vary .

Wise takes what’s good about Hawala and marries it to strong and reliable banking regulations that keep your money safe.All Electronic Money Transfer Service locations (post offices) are equipped with computer, internet connectivity and/or mobile phones which are used to send the issue or payment request to the server.

What is Electronic Funds Transfer (EFT)?

But what is EFT, . It allows individuals and businesses to make payments and transfer money without the .Federal law defines an electronic funds transfer as “any transfer of funds that is initiated through an electronic terminal, telephone, computer, or magnetic tape for the purpose of ordering, instructing, or authorizing a financial institution to debit or credit a consumer’s account. It can be used for various purposes, such as paying bills, . Different types of EFT transactions include .

Digital forms of money—including central bank digital currencies, privately issued stable coins, and e-money—continue to evolve and find new ways to become more integral in people’s day . To that end, the EBA develops requirements aimed at reducing payment fraud and brings about a level playing field in the EU for the authorization and supervision of payment services providers. SWIFT is a vast messaging network used by .Electronic money (e-money) is a digital store of a medium of exchange on a computerized device. It basically means that any digital transaction that .

Best Remittance & Money Transfer Software in 2024

These transfers take place independently from bank . Best for sending money .Overview

Digital currency

Reserve Bank of India

Are Electronic Fund Transfers Safe?One of the best features of the EFT is its security.