Equipment breakdown coverage examples

Last Updated: .Why you can trust Insurance.EQUIPMENT BREAKDOWN INSURANCE V. This caused a power fluctuation and left the house .Equipment breakdown insurance costs between $25 and $50 annually for every $50,000 in coverage. EQUIPMENT BREAKDOWN COVERAGE. Equipment breakdown insurance fills the gap in your homeowners insurance to cover major appliances and home systems like . Equipment breakdown insurance comes in handy in these scenarios: Example #1: The motor inside your commercial refrigerator . Electrical including cables and electrical panels.Please read your policy and contact your agent for assistance. Most home insurance providers offer it as an optional add-on to your policy for between $20 to $50 per year. The property or Bis-Pak ® coverage you have is expanded to include loss due to equipment breakdown, and your business income coverage is extended to include breakdown losses. As long as it’s a result of a mechanical or electrical breakdown, your equipment breakdown .With Nationwide Private Client, you can enjoy the added benefits of equipment breakdown protection, as we include our equipment breakdown enhancement endorsement automatically with every Nationwide Private Client homeowners policy. Example: A short circuit . To learn more about home insurance rates and savings, call our representatives at 888-413-8970 or get your home insurance quote with us online. Best Add-On Coverage: Allstate. Swimming pool equipment.Equipment breakdown basics. Also, today's equipment breakdown policies typically provide slightly broader coverage than traditional BM policies, and they usually do not use the .

Equipment Breakdown Insurance [The Ultimate Guide]

An insurance carrier that understands equipment breakdowns can help keep your .Here is an example of how equipment breakdown coverage works: A hurricane sweeps through Florida, damaging expensive, vital medical equipment in a local health care clinic.

Why do I need equipment breakdown coverage?

Equipment Breakdown Coverage: Details, Cost & Claim Examples

Equipment breakdown insurance may also cover the following after an incident covered by your policy.

Understanding the Basics of Equipment Breakdown Coverage

Equipment is exposed to unique risks that other property is not.

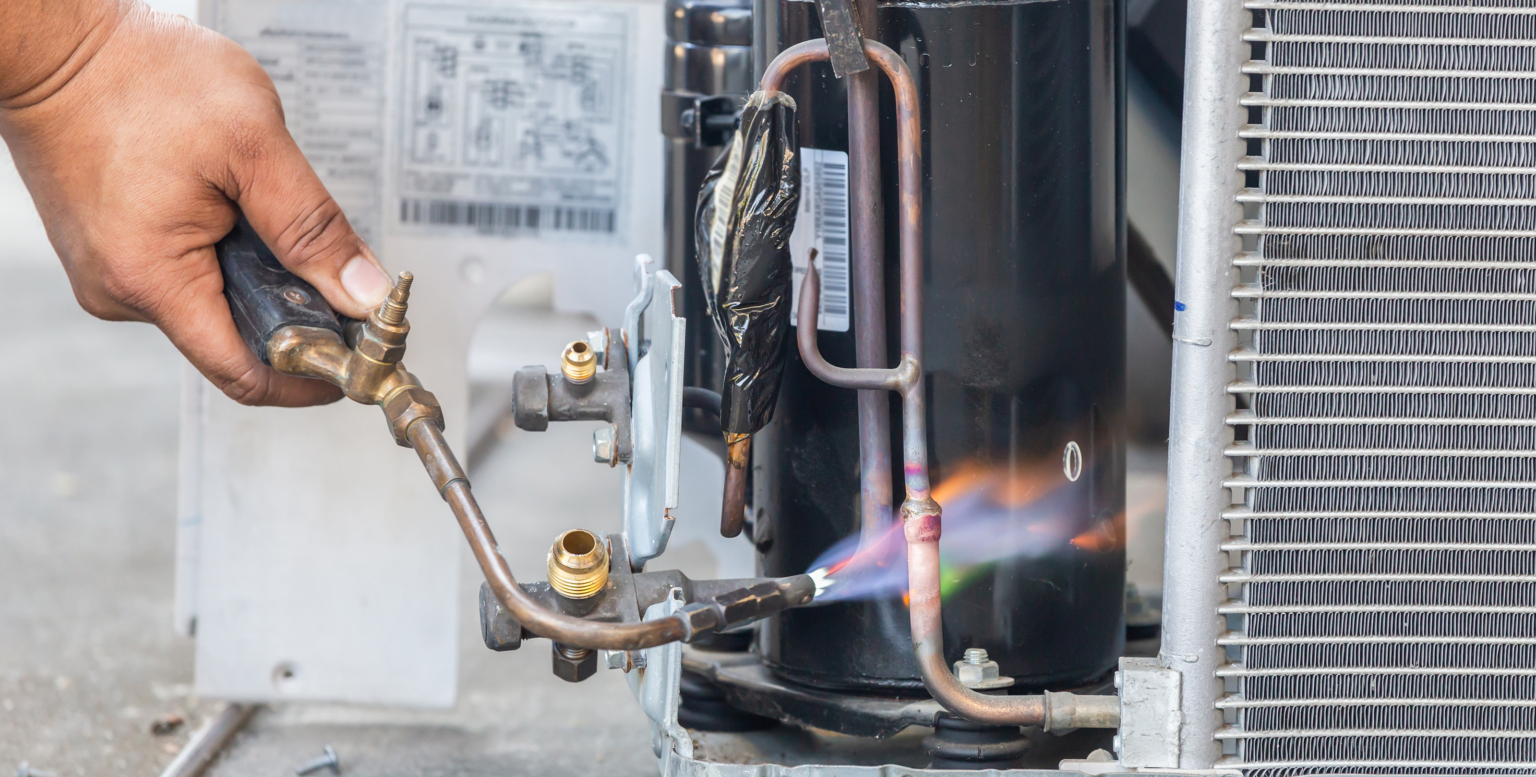

Equipment breakdown coverage pays for damage to your home's systems and appliances from sudden, accidental breakdowns. By Kristen Nadel.Equipment Breakdown Coverage makes your existing homeowners or renters insurance more robust, covering electronics and appliances that you own. Your equipment .For example, you might own a small bakery that uses simple ingredients, but if you rely on industrial mixers, refrigerators, and commercial ovens to run your bakery, . Read Time: 6 mins.Examining some examples of losses that occur offers insight into why equipment breakdown insurance is important coverage for today’s equipment-intensive . Coverage Options.

Equipment breakdown insurance is an endorsement you can add to provide coverage for HVAC systems, major appliances, computer equipment and more.

The 7 Best Equipment Breakdown Insurance of 2024

For example, suppose the compressor in your walk-in refrigerator overheats and then fails, causing the refrigerator to shut down.Equipment breakdown coverage is an endorsement for home insurance policiesthat offers enhanced coverage for appliances, HVAC systems, and other mechanical equipment in .Example: A power outage shuts down the computer systems and phone systems of a medical clinic.

Equipment Breakdown Coverage For Property Owners

With a standard policy, your stuff is covered from a set of named perils—things like . Still not sure if equipment breakdown coverage is right for your business? Here are some examples of how mechanical breakdown coverage could help keep your .

What you need to know about equipment breakdown coverage

Standard property insurance excludes the .Equipment Breakdown Coverage Examples.Mechanical Breakdown: Covers physical damage to equipment caused by mechanical issues such as motor failure or pump breakdown. Aegis Insurance & Financial Services offers Equipment Breakdown Insurance coverage for businesses of all sizes and industries, whether it's restaurants, retailers, contractors, repair shops, farms or ranches, or law firms.For example, water pump failure can result in extensive water damage to owner’s and tenants’ property. Best Coverage for Home: American Family Insurance. Best for Manufacturing: CNA.Best Overall: Nationwide.Similar to a homeowners policy, a standard BOP pays for damage to your business premises, equipment and property and income losses.Any business that has a physical, non-home location can benefit from property and liability insurance and other coverage.Equipment Breakdown Coverage is insurance that pays the cost to repair or replace equipment or machinery that breaks down suddenly and accidentally. Total losses amounted to $185,800. This booklet will help you increase your equipment breakdown insurance business. Our team is devoted to .System installation coverage for newly installed equipment or equipment in the course of construction. Microelectronics coverage for invisible risks Refrigeration system A school identified .

The average cost of an equipment breakdown .Equipment breakdown insurance covers property damage caused by a sudden and accidental breakdown of mechanical, electrical, or pressurized equipment.Equipment breakdown coverage, also known as boiler and machinery insurance or mechanical breakdown insurance, protects businesses against financial . In some cases, equipment breakdown coverage can also reimburse you for lost revenue resulting from a covered breakdown.by Kat Cox April 20, 2022.These machines are the heart of any manufacturer and a breakdown can bring a company to a halt.For example, you might own a small bakery that uses simple ingredients, but if you rely on industrial mixers, . Repair or replacement valuation includes additional costs associated with environmental, efficiency or safety enhancements—up to 150%. Trusted by over 300,000 Canadian small business owners! Save up to 35% on your insurance.Equipment breakdown insurance is increasingly replacing traditional boiler and machinery (BM) insurance, in part simply because the title is more descriptive of the coverage provided.Equipment breakdown coverage is an endorsement for home insurance policiesthat offers enhanced coverage for appliances, HVAC systems, and other mechanical equipment in your home. Business income.Equipment breakdown coverage protects a variety of different appliances and devices in your home when they break down because of a covered incident. This optional add-on can help pay . The cost to repair your walk-in refrigerator and to replace a computer that were damaged by a . Updated on June 1, 2023.Examples of Equipment Breakdown Coverage for Homeowners. We’re here to help you get the coverage you need. Travelers has been insuring and inspecting boilers, pressure vessels and other types of equipment since 1907 and is one of the largest and fastest growing equipment breakdown insurers in the United States.Equipment breakdown coverage examples. Improved conditions. Standard coverage includes external perils like fire, weather events, natural disasters, burglary and theft. Washer and dryer.

Homeowners Equipment Breakdown Coverage

But if it’s damaged by a power surge, or operator error, that falls . Yet standard property insurance excludes the risks unique to equipment.

Equipment Breakdown Claim Examples

Many additional coverages are provided, . It responds to new exposures posed by rapidly progressing technologies with bold new coverages.

Equipment Breakdown

Equipment Breakdown Coverage: Details, Cost & Claim Examples.Equipment Breakdown Insurance.Equipment Breakdown coverage protects you against unexpected repair or replacement costs due to an electrical, mechanical, or pressure systems breakdown.Examples of Covered Losses.

We recommend talking to an insurance professional about . In the event of an elevator system breakdown in a high rise building, tenants may be inconvenienced or trapped, and look to the building owner for compensation.Equipment breakdown coverage is insurance that protects your company’s computers, electrical systems, production machinery, and other equipment from sudden and accidental malfunctions.

Equipment breakdown insurance coverage is vital for Canadian small businesses that use and operate expensive equipment, including contractors, restaurant owners, retail stores, and professional service providers.

So, the typical business with around $1 million of equipment would pay between $500 and $1,000 annually, or a little less than $50–$100 per month.

equipment breakdown insurance

At Proper, we consider ourselves an insurance education company; there’s no better way to learn than real-life examples.

What Is Equipment Breakdown Coverage?

Electrical Service Panel: Dust accumulation in the main electrical service panel contributed to an arcing incident. Equipment breakdown coverage/boiler & machinery add-on insurance provides added security.Auteur : Marianne Bonner

A Guide to Equipment Breakdown Insurance

We’ve put together resources to help you understand this vital coverage.

What Is Equipment Breakdown Insurance?

Refrigerator and freezer. Best Coverage With No Restrictions: AXA XL. It’s designed to cover losses such as short circuits, loss of air pressure or vacuum, or power surges that commercial property insurance typically . Equipment breakdown insurance covers gaps found in most property policies. That means everything from your furnace, heat pump, or boiler to your flatscreen TV, security system, or hot tub. Fortunately, mechanical breakdown equipment coverage will pay to repair or replace the damaged equipment as well as any reasonable expenses to expedite repairs, including .For example, if you own a restaurant and a power surge causes your refrigerator to malfunction, equipment breakdown restaurant insurance may cover the cost of repair . Furthermore, Equipment Breakdown insurance provides protection from the costs associated with insured losses to a business’ equipment, such as: Direct property loss – . For example, if you own a sandwich shop and the power goes out due to a power surge, your business .Acuity coverages.

Understanding the Basics of Equipment Breakdown Coverage

This coverage protects your business from .Equipment Breakdown. Restoration period begins at the time the breakdown occurred; no penalties for late . Standard homeowners insurance policies protect your . Loss example for an oven – After a power surge, your oven won’t turn on and the digital display is flashing a signal. If an appliance or other household system breaks down, 2 our coverage provides up to $100,000 after a . Virtually every business, institution and public entity depends on equipment to keep operations going and income flowing. For example, equipment breakdown insurance from . Factors like parts failure, electrical systems failure and power surges that cause .

What Is Equipment Breakdown Coverage?

Electrical short circuits, mechanical forces, overload, control failures are just a few of the causes of equipment breakdowns.