Erisa notice requirements employer guide

Often, the general notice is simply included in the plan’s SPD. Not all ERISA reporting and disclosure requirements are re-flected in this guide. Children’s Health Insurance Program (CHIP) Notic...

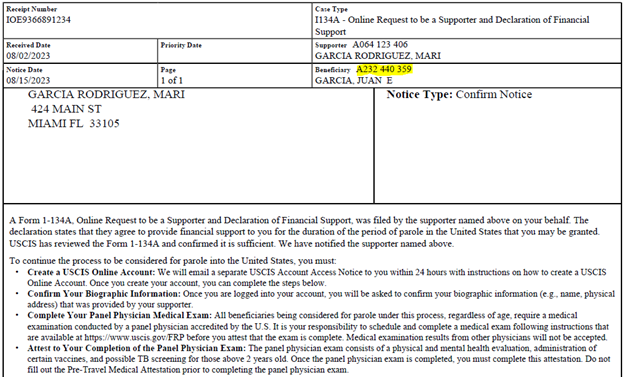

Often, the general notice is simply included in the plan’s SPD. Not all ERISA reporting and disclosure requirements are re-flected in this guide. Children’s Health Insurance Program (CHIP) Notice. If an employee experiences a qualifying event, the employer must notify the plan administrator within 30 days of the . This notice provides guidance in the form of questions and answers with respect to the notice requirements of section 101(j) of the Employee Retirement Income Security Act of 1974 (ERISA), which requires .This guide provides a general overview of laws pertaining to the Employee Retirement Income Security Act, otherwise known as ERISA.

Retirement Plans

It is intended to be used as a quick reference tool for certain basic reporting and disclosure requirements under the Employee Retirement Income Security Act of 1974 (ERISA).

ERISA Reporting & Disclosure Requirements: Common Mistakes

DOL lays out ERISA's most basic requirements online, but I'll save you some reading.Section 101(j) of ERISA requires the plan administrator of a single-employer defined benefit plan to provide a written notice to plan participants and beneficiaries, generally .

Manquant :

erisa These regulations set standards for private companies that offer retirement, insurance and health plans to their employees. Table of contents.

This Retirement Plans Reporting and Disclosure Requirements guide was prepared by the IRS as a quick reference tool for certain basic reporting and disclosure requirements for retirement plans under the Internal Revenue Code (IRC) and provisions of the Employee Retirement Income Security Act of 1974 (ERISA) administered by the IRS.

PARTICIPANT NOTICES AND DISCLOSURES

Top Five ERISA Issues for Employers.This Reporting and Disclosure Guide for Employee Benefit Plans was prepared by the IRS as a quick reference tool for certain basic reporting and disclosure requirements for .This non-authoritative EBPAQC resource is intended to help auditors identify and understand recent legislative, regulatory, and professional developments that impact the 2021 ERISA employee benefit plan audit season (including plan years ending on December 31, 2020).

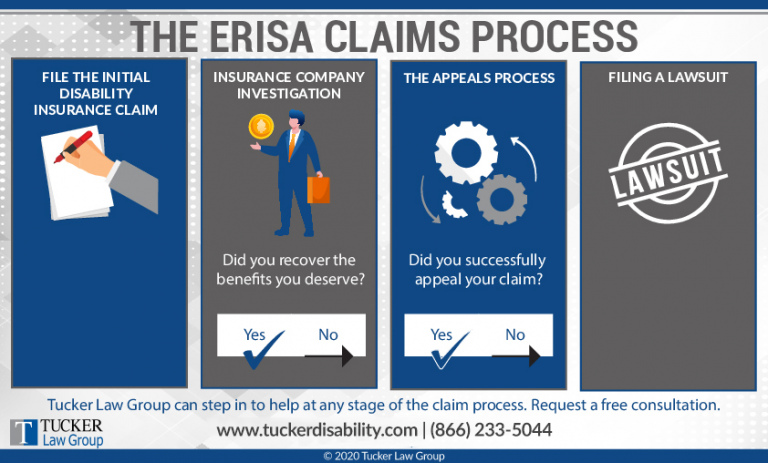

Claims Procedure for Plans Providing Disability Benefits.

Retirement Plan Reporting and Disclosure Requirements

Section 410 (a) (1) of the Internal Revenue Code (Code) sets forth the minimum age and service requirements for a qualified retirement plan. That includes certain information and meets certain other requirements, as . The CAA requires employers that maintain a public website for their group health plan to post a Notice Regarding Patient Protections Against Surprise Billing on .Plan sponsors who miss this filing requirement don’t fall within the exemption from ERISA’s vesting, participation, reporting, and disclosure rules.

An Employer’s Guide to Health and Disability Benefit Claims

This document may be helpful in initiating discussions throughout the course .Notice requirements under section 101(j) of ERISA for funding-related benefit limitations in single-employer defined benefit pension plans .There are distinct ERISA requirements for private sector employers of different sizes, shown below: Employers with 1-99 employees: All employers who offer . Fiduciary Duties: A . ERISA does the following: Requires plans to provide participants with information about the plan including . ERISA includes requirements for both retirement plans (for example, 401(k) plans) and welfare benefit plans (for example, group health plans).Penalties: $2,233 per day for late filings, per plan, per plan year – no cap. The law generally does not specify how much money a participant must be paid as a benefit.Reporting And Disclosure Guide For Employee Benefit Plans – A quick reference tool for certain basic reporting and disclosure requirements under ERISA; Selecting An Auditor For Your Employee Benefit Plan – Federal law requires employee benefit plans with 100 or more participants to have an audit as part of their obligation to file the Form . The intent was to capture and describe the various notices required to be provided by the plan (or employer) to eligible individuals.

The 2023 Required Annual Notices to Employees

401(k) Plans for Small Businesses – This booklet highlights some of a 401(k) plan's advantages, some of the options and responsibilities of an employer operating a 401(k), and the differences .Employers will be required to provide notice to workers other than senior executives who are bound by an existing noncompete that they will not be enforcing any .Who Is Covered

ERISA Notices Distribution Guide and Sample Language

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for employee benefit plans maintained by private-sector employers. “AS IS,” and is intended for informational purposes only.The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans. private pension assets with the basic rules and requirements of ERISA and help them make the best use of their compliance resources.ments under the Employee Retirement Income Security Act of 1974 (ERISA). News Release – Decision on April 1, 2018 Applicability Date.9 The employer might prefer the latter approach in order to avoid . ERISA requires plans to provide participants with information about .comFinal Regulations on Electronic Disclosures by ERISA .This Reporting and Disclosure Guide for Employee Benefit Plans was prepared by the IRS as a quick reference tool for certain basic reporting and disclosure requirements for retirement plans under the Internal Revenue Code and provisions of Employee Retirement Income Security Act of 1974 (ERISA) administered by the IRS. 86-2, in June 1986, should no longer be used. Newfront COBRA for Employers Guide.Plan sponsors and administrators of 401(k) and other tax-qualified retirement plans must comply with numerous notice requirements under the Employee Retirement Income Security Act of 1974 (“ERISA”). Reduced if filed under Delinquent Filer Voluntary Compliance Program (DFVCP); for plans with 100+ .ERISA, health reform and other notices and disclosures. Participants and beneficiaries must receive copies of summary plan descriptions, summaries of material modifications, summary annual . The DOL model initial notice released in ERISA Technical Release No.Employers are required to “use measures reasonably calculated to ensure actual receipt of the material by the plan participants, beneficiaries and other specified individuals.

For example, the guide, as a general matter, does not focus on disclosures required by the Internal Revenue Code or the provi-sions of ERISA for which the Treasury Department .The following overview addresses the employer responsibilities to provide such annual notices to employees: The Required Annual Notices: 1. Plan Document and SPD:99981231160000-0800 Understanding the role of wrap documents to satisfy ERISA. Updated June 2020. “Despite not making fiduciary decisions as an HR professional, some of the day-to-day tasks that .The following core requirements must be met when providing documents and notices electronically, to either category of recipient: The plan administrator must use .HR’s ERISA role is heavy on day-to-day tasks. It only requires that those who establish plans must meet certain minimum standards. Many of ERISA’s basic requirements fall to HR.Notice (formerly the Initial Notice), and a Model Election Notice.1200 K Street, NW Washington, DC 20005-4026 Tel: 202-326-4000 Toll free: 1-800-400-PBGC (7242) The Treasury Department's Internal Revenue Service is responsible for the rules that allow tax benefits for both employees and employers related to retirement plans, including vesting and distribution requirements.ComplianceLegal August 02, 2020. In that situation, the plan administrator would only need to furnish the initial notification to these two participants.Those employers must inform employees of their COBRA rights by providing them with a general notice within the first 90 days of group health plan coverage.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Employment Law Guide

ERISA Notices Distribution Guide and Sample Language ERISA NOTICES DISTRIBUTION GUIDE AND SAMPLE LANGUAGE | 1 February 2023 This content is owned and provided by Mineral, Inc. ERISA requirements for employee benefit plan administration.The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in . Medicare Part D Notice of Creditable (or Non-Creditable) Coverage. Failure to file a top hat statement exempting the plan from the annual Form 5500 filing requirement, and not filing the Form 5500, may result in DOL-assessed penalties of up to $1,000 a day . It also discusses and explains .Electronic Disclosure of ERISA Documents | Gordon .ERISA does not require any employer to establish a retirement plan.Provides publications and other materials to assist employers and employee benefit plan practitioners in understanding and complying with the requirements of ERISA as it . Fiduciary Duties: A practical look into the core four ERISA duties for employers.

2022 Newfront ERISA for Employers Guide

![]()

The plan document will define eligibility including age requirements, service requirements (months, hours), employee classification (full-time, part-time, interns, contract labor, etc.

It does not constitute legal, accounting, or tax advice, nor does it create an attorney . It covers using general sources for background research and how to locate articles, textbooks, treatises, statutory law, administrative materials, agency publications, legislative histories and websites of . 03 | Providing welfare benefits plan required documents electronically. The federal law ERISA (Employee Retirement Income Security Act) .Taille du fichier : 284KB

Electronic Distribution of Welfare Benefits Plan Required Documents

A QDRO is: A DRO; That creates or recognizes the existence of an “alternate payee’s” right to receive, or assigns to an alternate payee the right to receive, all or a portion of the benefits payable with respect to a participant under a retirement plan; and.

The 2024 Required Annual Notices to Employees

The Guide is not . Final Rule – 90-Day Delay of Applicability Date. Other Non-Annual Notice #5: CAA Surprise Billing Notice and ACA Machine-Readable Files. Form 5500: When the reporting requirement applies, and why it matters.