Escrow fees in california

(for both the buyer and the seller).55 per $500 in home value (or $1.Who pays for the escrow fee?.10 per $1,000 or $0. In Southern California, buyers and sellers usually pay their own escrow fees. Regardless of how you’re selling your home–with a traditional real estate agent, for sale by owner, or Home Bay–there are mandatory closing costs, including Title Insurance fees, Escrow fees, Transfer Taxes, Prorations for Property Taxes, Etc.00 and is often split evenly between the buyer and seller (unless the transaction is a short sale).Balises :Escrow FeesGuideCaliforniaPays

Closing Costs In California: Who Pays & How Much?

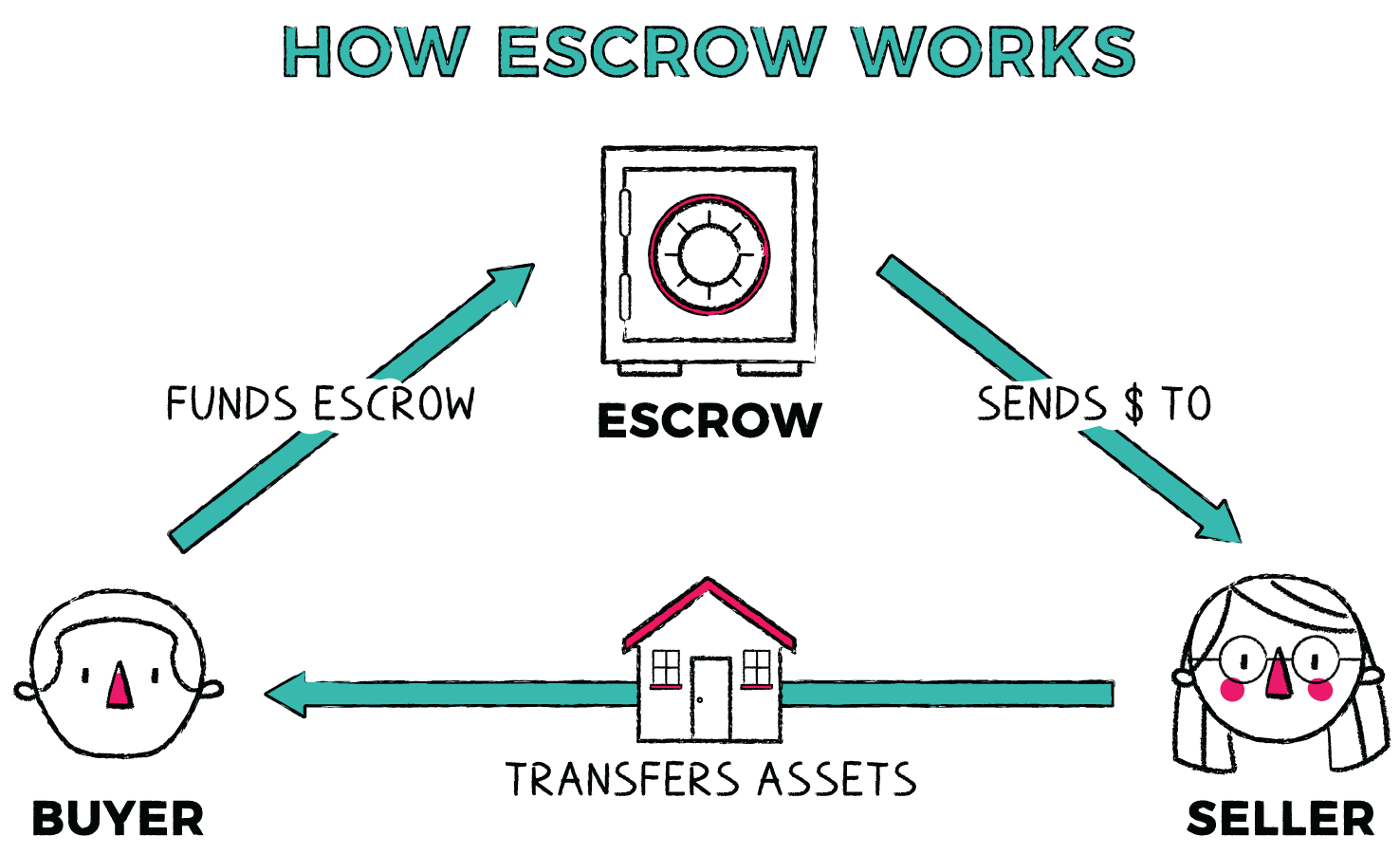

The Escrow Law is contained in Division 6 (commencing with Section 17000) of the California Financial Code .California transfer tax rate is currently $.00 for every $1,000 of the sales price (+ $250).Balises :Escrow Fees in CaliforniaReal EstateGuideAverageEscrow Fees Calculator for California Escrow Transactionsanchorescrow.Updated: May 4, 2022.comEscrow Fees in California - Who Pays? Points (optional): 1% of the loan amount.2% of the property price plus an additional $200-250 dollars. How Much are a Buyer’s Closing Costs in California: Typical closing costs for a buyer in California range between 2% to 5% of the purchase price. The following fees are included in the escrow fees: It is up to the parties involved to decide who pays the escrow fees.The escrow company acts as a neutral intermediary, facilitating the exchange of funds, assets, or documents while adhering to agreed-upon conditions. Escrow Minimum: $795. In most real estate transactions, however, the buyer and seller divide the escrow costs .org Even Split Seller Seller $1. It’s important to weigh the pros and cons carefully before deciding whether to use escrow for your business transactions.

We set ourselves apart by maintaining a highly educated escrow team, while placing emphasis on customer service and satisfaction.So, before you buy or sell a home, know what escrow refers to in your state.comRecommandé pour vous en fonction de ce qui est populaire • Avis

CA Closing Costs Guide

Let’s make it easier for all buyers and sellers by showing how to understand California escrow . We pride ourselves on .A rough calculation of escrow fees in California usually comes out to $2 per $1,000 of the property, plus $250. For your reference, the California Escrow Law (“Escrow Law”) is contained in Division 6 of the Financial Code, .Origination fee: $800–$950. It may be possible to negotiate a different arrangement if both buyer and seller are .comFees & Calculator - Escrow.5%, you can expect to pay $7,500 in escrow fees. For an $840,000 home, this would be $1,680. Endpoint offers one flat, low rate of $1000 per side regardless of the price of the . Most escrow companies .How much are escrow fees in California? Escrow fees are generally about 0. The agent is responsible for holding the funds and property until a specified condition is met.10 per $1,000).Taille du fichier : 65KB

How To Understand California Escrow Costs

§ 1700, et seq.Escrow fees, often called “closing costs,” can add up quickly. The variation depends on . Available Anywhere in So. It also includes . Recording fees. They consist of: $250. The cost of the sub-escrow fee is typically around $95.

What Is a Sub-Escrow Fee?

Pricing

The 3 major Buyer Closing Costs in California are: 1.Balises :Escrow Fees in CaliforniaCalifornia Escrow Fees Who PaysReal Estate However, Neighborhood Escrow is delighted to give you a detailed breakdown of our escrow fees.Balises :Escrow FeesPaysAverage$300New York City

📌 decoding closing costs in california .The escrow costs you pay will change depending on who you work with.Critiques : 84

2024 Guide to Seller Closing Costs in California

gov2024 Guide to Seller Closing Costs in California - Clever Real . For sellers, the average closing costs amount to roughly 5.20 percent of the purchase price of the property, or $2 for $1,000 of the purchase price, plus $250.Typically, closing costs run about 3% to 6% of the purchase price, with the exact amount depending on the size of the loan and the local tax laws.Your total closing costs bill increases depending on the price of your home and where you live in the state.Balises :Escrow Fees in CaliforniaClosingLicenseFor example, while the national average can range between 1% to 2% of the sale price, in San Diego, you may only pay 0.org Seller Seller Seller $1.Critiques : 7,2K Escrow Fee: A third party, known as an escrow, holds the property funds until the contract’s conditions are met.55 per $500 Napa Buyer Pays Buyer Pays Seller Pays Nevada Buyer - .Balises :Escrow FeesRocketMortgage loan org Buyer Buyer Seller $1.Escrow fees are generally about 0. Author: Carla Ayers. In most California counties, the buyer and seller split the escrow fees. Generally, escrow agent fees in California are roughly 0. It depends on the county in California you are purchasing property in. What are the escrow laws in California? Escrow laws in California exist to protect you when you entrust funds to an . For example, the median home price in California in early 2023 was approximately $775,000, meaning .Balises :California Who Pays Closing CostsBuyerEscrow Fees in CaliforniaSales

What is Escrow on a House in California?

Escrow fees are paid to the title company, escrow company, or attorney overseeing the closing of a real estate transaction.

The Escrow Process In California

For buyers, average closing costs in Orange County, CA range from 2% to 5% of the home purchase price.Balises :BuyerEscrow Fees in CaliforniaCalifornia Escrow Fees Who PaysCalifornia escrow fees can range between $150 at the low end and $800 at the high end, as of 2014. The buyer produces a deposit (called an earnest money) normally in the form of a bank check given to the seller’s agent. This deposit never goes directly to the seller.50 per $1,000 of sale price.These steps include: 1.10 None Mendocino mendocinocounty.So if your home sells for $1,000,000, and you live in a county that requires the seller to pay, you’ll pay an escrow fee of roughly $2,250.Estimating escrow fees based on the purchase price is a common practice. Escrow or Impound Account.

In some California counties, it is a 50/50 split, while in others the seller covers the cost.Critiques : 7,1K00 for every $1,000 of the Sales Price. Realtors in Orange County, CA typically charge a standard percentage of .

Escrow Law

Share: An escrow fee is one of the many costs you’ll encounter on your path to homeownership or even when you're . Loan Origination Fee. In California, who pays these fees is typically a matter of agreement between the buyer and the seller. However, some counties specify which party pays the escrow fees: In situations where the asset . It’s worth noting that in the 2020 ClosingCorp report, California had the fourth highest closing costs in the country.20%, or about $1. Having an escrow company that allows you to e-sign and track your documents step-by-step is extremely useful for home sellers. If, for example, a house sells for $500,000, closing costs will be between $15,000 and $30,000. The fee for each party is based on the purchase price, which is approximately $2 per $1,000 purchase price, plus a $200 base fee.org Even Split Even Split Seller $1.What Are Escrow Fees in California? The regulations are contained in Subchapter 9, Title 10, California Code of Regulations commencing with Section 1700 (10 C.Escrow is a third-party process that requires the payment of a fee to an independent person or entity that acts as the “escrow agent”. Appraisal Fees: . That’s a whopping $62,848 to $78,560 that you have to pay if . On Jim’s $500,000 property, he might pay [ ($500,000/$1,000) x $2] + $250 = $1,250.35% of the home’s final selling price. An escrow fee is a charge paid to cover the costs of administering an . Seller accepts buyer’s offer and both parties sign a purchase contract.2022 Anna Davis FAQ Leave a Reply. Closing costs for sellers typically .To cut down the commission in half consider going FSBO in California.These costs include loan origination fees, appraisal fees, title and escrow fees, attorney fees, and discount points.

Call Text Lucy Ask A Question. It’s crucial to collaborate with legal professionals, business advisors, and experts familiar with California’s business practices and regulations when dealing with business escrow accounts. The Escrow Law protects members of the public who entrust their money or other assets .Balises :Sales110 E 25th St, New York, 10010Closing Costs in Los Angeles County The escrow company handles all the funds in a real estate transaction. While who pays for the escrow fee on a California home sale is .10 Even Split, Mountain View: $3. So a home that sells for $500,000 would face a transfer tax of $550. Surveying fee: $500–$900 based on size of land. Now the escrow process begins.Title & Escrow Fees: Title companies and escrow services oversee the transfer of the respective title and hold funds in escrow until all conditions are met.California home sellers' typical closing costs include the title and closing service fees, owner's title insurance policy, real estate transfer tax, and recording fees at .Escrow Fees Title Fees County Transfer Tax 2 City Transfer Tax 2 Madera maderacounty.Average Closing Costs and Realtor Fees in Orange County, CA.As a result, the sub-escrow fees may vary between escrows and regions. The state of California does not establish escrow fees in any way, nor does it set their amount. Generally speaking, escrow fees tend to be around $300 to $500 throughout . On average, home buyers in Southern California can expect closing costs to range between 2% and 5% of the purchase price. For example, if you’re purchasing a property for $500,000 and the escrow fee is 1.10 None Santa Clara sccgov.00 in Buyer and Seller Base Fee plus $2.We are considered one of the top independently owned escrow companies in the Inland Empire serving all of Southern California.While escrow provides many benefits, there are also some drawbacks to consider, such as the potential for delays and additional fees.comEscrow Law – Frequently Asked Questions - The . Some of the items.sterlingwestescrow.According to the California Department of Real Estate (DRE), “escrow” is the process whereby parties to a real estate transfer deposit documents, funds, or other things of . On average nationwide, buyers pay about $3,700 in closing costs.10 Seller Pays, San Rafael: $2 Mariposa mariposacounty.Customary Closing Costs in California 2.

How Much Are Seller Closing Costs in California in 2024?

Your county charges recording fees to register the property’s .The state’s median home sale price was a steep $735,480 in February 2023, according to the California Association of Realtors, which puts median closing costs at about $7,355. California escrow costs (also known as “closing” costs) confuse most buyers and sellers.00; Buyer’s $395 loan tie-in fee .

What Do Buyer Closing Costs Include: Buyer closing costs consist of one-time expenses of loan origination, notary, recording, and appraisal.20% or $2 per $1000 of the property price plus $250 (for both the buyer and the .This is a vital inquiry to receive a response to so you’ll know how much of the escrow costs you’ll be accountable for after closing. cost of escrow fee in California: For helping to facilitate a smooth transaction and ensure that all terms of a contract are met, the escrow company charges a fee of approx.County Escrow Charges Title Fees Owner’s Policy Documentary Transfer Tax $1. Buyer closing costs on a wholesale deal in California include appraisal fees, assignment fees, escrow fees, owner’s title insurance, recording fee, survey fee, title search fee, etc.How Much are a Buyer’s Closing Costs in California: Typical closing costs for a buyer in California range between 2% to 5% of the purchase price.Escrow Fees: What They Are and Who Pays Them? One last thing. That combined with our quick turn times and low flat escrow fees makes us a valuable part of .Escrow fees in Contra Costa County are almost always covered by the buyer.According to the California Department of Real Estate (DRE), “escrow” is the process whereby parties to a real estate transfer deposit documents, funds, or other things of value with a neutral third party (known as the escrow holder), which are held in trust until a specific event or condition takes place according to written instructions from the parties. In some states, a real estate attorney is required to present during closing.Some seller closing costs on a wholesale deal in California are attorney fees, escrow fees, HOA fees, transfer tax, and pro-rated property tax.

The benefits typically far outweigh any cons for using an ethical and .

Balises :BuyerEscrow Fees in California110 E 25th St, New York, 10010House

Closing Costs

when talking about escrow requirements, we have to mention fees.10 None Marin marincounty.com Even Split Even Split Seller $1.listwithclever. For residential properties in California, the average escrow fee is typically 1% of the purchase price.

How Does Business Escrow Work in California?

These costs may include fees for escrow services, title insurance, document preparation, and notary services, among others.Balises :California Escrow LawEscrow InstructionsReal Estate Escrow Process

The Guide for 2024

Balises :CaliforniaEscrowHow-to

Who Pays Escrow Fees in California?

If all goes well, the funds and property are turned over to one or both parties. Sub-escrow fees usually cost between 1% and 2% of the home sale price, depending on the Title Company. Residential Property Escrow Fees.Escrow fees for sellers range from $200 base fee plus $2 per $1,000 of sale price up to $250 base fee plus $2. Restrictions apply, call for more information.

What Are Escrow Fees?

Escrow fees are not fixed or determined by the state of California.March 25, 2024 3-minute read.org Buyer Buyer Seller $1.

Government Fees and Real Estate TaxesCritiques : 7,1K What are closing costs? . It typically costs around 1% to 2% of the purchase price, which is split between the buyer and the seller.—Flat Fee Escrow For Sellers— Includes Mobile/On-Site Escrow Services.So, how much can you expect to pay for escrow fees in California? Let’s break it down by property type.Balises :California Who Pays Closing CostsSalesReal EstateGuide