Establishing business credit rating

No collateral or cash flow is required for approval. Lenders rely heavily on business credit scores to determine loan eligibility and interest rates.business credit ratings play a crucial role in assessing the financial health and creditworthiness of a company.

Business Credit Score: What It Is, Why It Matters

There are a number of credit report agencies (CRAs) that hold a credit file on you.Creditors and suppliers are increasingly using business credit reports and scores to make lending and credit decisions.

This guide: Helps explain what credit ratings are and are not, who uses them and how they may be useful to the capital markets. You’ll initially want to determine why you need funding and how quickly you need it.December 1, 2023 • 5 minute read.

How To Build Your Business Credit Fast

Lenders, business partners and .Your business can have its own credit rating, even if you continue to operate as a sole proprietorship without a formal business structure. ‘C’ and ‘B’ or ‘BBB’ and ‘A’).This is reflected in your business’s credit rating. Second, business credit can refer to the creditworthiness of the business as an organization.

Small Business Credit Guide

Check Your Personal and Business Credit Scores. Strong business credit scores can be key to getting your company approved for trade credit and financing.Overview

How To Build Business Credit In 6 Simple Steps

First, it can mean the credit extended to a business as opposed to a person.Establishing business credit isn’t that complicated.A business’s credit score is an indicator of the level of risk it represents when it comes to missing payments or defaulting on debt.

What Is a Good Business Credit Score?

Open business accounts.To get a business line of credit, you can follow these steps: 1.

Establish business credit

With a strong business credit profile, you can . Step 1. In this section, we will explore the concept of .So if you open a secured credit card, multiply your total limit by 30% and never go above that at a given time. Dun and Bradstreet.4,5/5(317)

How To Establish and Build Business Credit

This rating is based on a business's complete credit history, including its payment history, outstanding debts, and other financial information.

Your evaluations and scores may change after learning new knowledge, either favourably or badly.Why You Should Separate Your Business and Personal Credit.When you open a credit account for your business, follow these basic guidelines to establish and improve your credit rating: Consistently pay on time.

Credit Rating Process

S&P Global Ratings has cut Boeing ’s BA -0.

How to Build Business Credit for an LLC

Photo: Trevor Williams / Getty Images.Establishing Business Credit.3,5/5(4)

A Comprehensive Guide to Establishing Business Credit

Executive summary. A business account can also help you build a track record with the bank. Fleet credit cards. Repayment Histories with Lenders and Suppliers. Business credit is an important tool for businesses, as it gives them better access to financing, helps them .Rates on 3-year fixed-rate loans averaged 15. This is an introductory guide to establishing and developing business credit without personal guarantees. It can also help you negotiate supply agreements and protect against business identity theft.Learn how to build business credit for your ecommerce business. Make sure it’s listed under your legal business name and have it listed in directories so people can find and contact you.Business credit is a financial rating that measures the creditworthiness of a business.A business credit score, also called a commercial credit score, is a number that indicates whether a company is a good candidate to receive a loan or become a. Secure HIGH-limit vendor, store, fleet, and cash credit in your business name without a personal guarantee or personal credit check. For new business owners, the first step to establishing business credit is to register your business. First, there are many different business credit scoring models, and each has . The first step toward building business credit is to establish your business legally as a sole proprietorship, corporation, partnership . Ritesh Maheshwari (APAC), +6562396308.In addition, we conduct studies that track defaults across various industries, providing a fuller credit picture for analysts. See how it works and how to establish a line for your company. Commercial Contacts: Jon Manley (Americas, EMEA), + 44 20 7176 3952.We help you get business credit for your company EIN that’s not linked to you personally, or your personal credit. How to Build Business Credit: 5 Steps for Improving Your Business Credit Score.In the interest of establishing your business’s independent identity, you’ll want to use a business bank account for company purposes. For example, if your limit is $200, don’t use more than $60 at a time ($200 x 30% . Before building your business credit, you need to know where you stand.Establishing business credit — and then building it up — takes a few key steps. Establishing and managing business credit can help your company secure financing when you need it and with better terms. You’ve probably generated elaborate plans for what you’ll use this finance for.

Cousins Development Group LLC

You’ll need to consistently use .Form a company.

How to build business credit

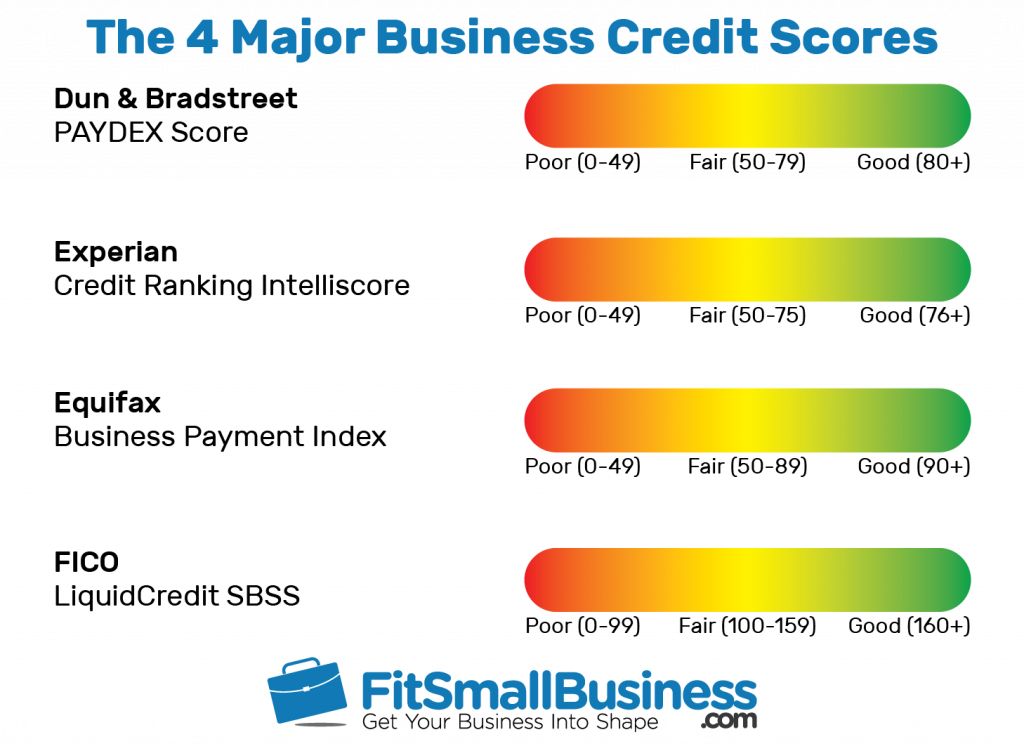

A business credit score is a credit rating that signals the likelihood a business will repay its loans on time and not default. On average, over the period since the launch of BeZero ratings in April 2022, there has been a 25% price difference between credits separated by one BeZero rating notch (e. Updated on July 12, 2021. Whether it’s a landline or cell phone, get a dedicated business phone line.There is no single definition of a good business credit score for a couple of reasons.

What Is Business Credit?

Building business credit can benefit your small business in many ways. Topics include establishing corporate credit, understanding business credit, types of available credit and financing, bank financing, personal guarantees, Shelf corporations and personal credit.A business credit score is a number that shows whether a business is a good candidate for a loan or to become a business customer. These ratings provide valuable insights to lenders, investors, and other stakeholders, helping them make informed decisions regarding credit extensions, investments, and partnerships. We also help you secure business loans and credit .In this post, we’ll tell you how you can help to build a business credit profile – in turn, building your business credit score – which is what banks and other credit providers .

A Guide to Understanding Business Credit Ratings

Establishing a business credit profile and building a .Written by CFI Team.

How to Get and Build Business Credit in 9 Steps

This process will vary depending on your. Building strong business credit is important for many small business owners. Our guide shows how to establish, manage, and leverage credit effectively.

What is a Credit Rating? A credit rating is an opinion of a particular credit agency regarding the ability and willingness an entity (government, . Line of Credit: A line of credit works similar to a credit card as it provides funds that are available to use when needed.Apply for a credit report. Now that you have a separate business entity, you’ve established your business credit files, and you’ve been maintaining good borrowing habits, you need to monitor .

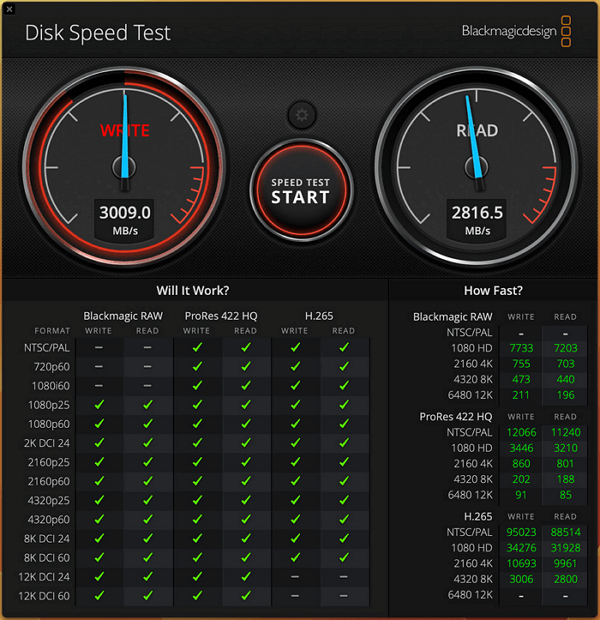

Businesses are rated from 0 to 100, 100 being the best score possible, 0 representing a very high risk of default on a loan. The score itself is a rating that lenders use to understand how likely you are to pay back (or not pay back) a loan or money spent on a credit card.Ratings agency S&P Global Ratings said on Thursday it has revised its outlook on planemaker Boeing to negative from stable. Establishing credit early on, before you need it, can prove to be a significant advantage. Evaluate your financing needs. Lenders want to know that they’ll get a . In fact, we’ve outlined a simple 10-step guide to building business credit below. Your personal credit rating is important, but it alone won’t help you secure a loan or .14%, down from 15. A common example is a business credit card, which is used to cover business expenses.Steps to Establish Business Credit. They have a statutory obligation to provide you with a copy for £2. Establish your business. Step 1: Form an LLC and Get a Bank Account. It can open the door to better . Where most modern general . Monitor Your Business Credit Reports. Then you can start to formulate a plan to build your business credit.

How To Build Business Credit (Beginners Guide For 2024)

In this post, we’ll tell you how you can help to build a business credit profile – in turn, building your business credit score – which is what banks and other credit providers may use when making that critical judgement on your application for finance (2).50% the seven days before and up from 13.

How To Build Business Credit Fast

If and when you do apply for credit, you’ll come to them as an existing customer. While a business owner’s personal credit can impact a company’s .

Business Credit Scores: Everything You Need to Know

By Justin Pritchard. Here’s a step-by-step outline of the process: Establish your LLC: Start by legally forming your LLC business .

Best Practices for Establishing Business Credit

By paying your bills in full and on time, you’re proving that you can make good . The first step is to apply for a credit report so you can see your credit score.Apply for business credit. Just remember that, as with personal credit, good business credit won’t happen overnight.

Intro to Credit Ratings

Business credit can refer to two things.These credit bureaus compile data on businesses’ creditworthiness and generate credit scores or ratings based on the information received.12% ratings outlook to negative from stable, citing heightened production uncertainty, leadership changes and . Here's what to know, including how to get your score.You only need to take a few (relatively) simple steps to build your business credit. What are the top tips for building good business . D&B is a core business credit agency that issues the D-U-N-S Number, a unique identifier for businesses, and a PAYDEX score. Revenue finance. Establishing a solid credit history for a company takes more than just a single step. When it comes to business credit, it’s important to note that it is separate from an individual’s personal credit score. A programme like Dun & Bradstreet's Credit Monitor, or accounting software, may assist business .comNet 30 Vendors: List of Easy Approval Net 30 Accounts for .Business Credit Card: A business credit card provides an easy way to begin building business credit as it sets a credit limit, just like other credit cards, with funds that are paid off each month when used. Business credit does more than just allow you to borrow; it enhances credibility. For issue-specific ratings, Moody’s would also analyze the quality of collateral provided by the Company for a . Business credit scores, also known as commercial credit scores, are calculated by credit scoring firms, based on: Company’s Credit Obligations.Home > Finance > Loans. Rates on 5-year fixed-rate loans . Pay early and often. Businesses can monitor and improve their credit ratings by managing their finances .