Ev ebitda meaning

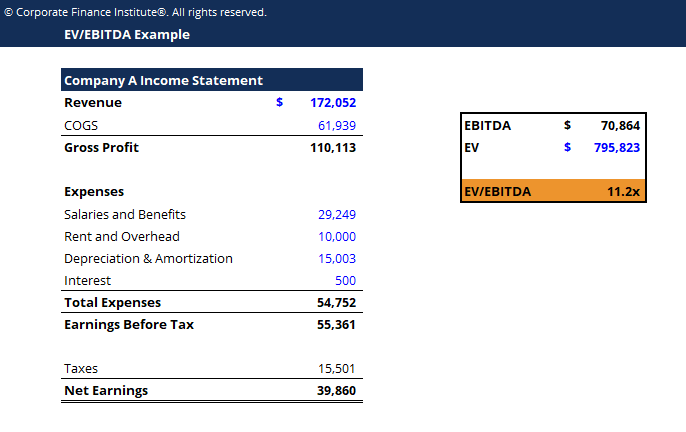

Avskrivninger på driftsmidler.EBITDA Used in Valuation (EV/EBITDA Multiple) When comparing two companies, the Enterprise Value/EBITDA ratio can be used to give investors a general idea of whether a company is overvalued (high ratio) or undervalued (low ratio). It is used to evaluate a company's . The EV formula is : EV=Market Capitalisation+Total Debt−Cash and Cash Equivalents. Multipeln är nära besläktad med P/E.

Manquant :

meaningEV/Ebitda

Par ailleurs, l' EV représente la valorisation globale de l'entreprise, incluant à la fois sa .Il est souvent considéré comme la déclinaison étatsunienne de l’EBE, traditionnellement utilisé en France. EBITDA is earnings before interest, tax . For eksempel på fast eiendom. Where: Market capitalisation: Calculated as the company's current share price multiplied by the total number of outstanding shares.

Enterprise value/EBITDA ratio (EV/E) Definition

EBITDA, on the other hand, is a measure of a .Balises :Enterprise Value To EbitdaEbitda Ratio It is a measure that takes into account more than just the value of equity.Balises :Enterprise Value MultipleEnterprise Value To EbitdaDepreciationEBIT og EBITDA er sammenhengende med et selskaps resultat, med andre ord kan vi finne disse i årsregnskapet.- EV/EBITDA est un multiple de valorisation populaire car il prend en compte la dette, la capitalisation boursière et le bénéfice d'exploitation d'une .

EV/EBIT Ratio

This measure offers a holistic perspective regarding the company’s overall worth. Com essas informações, é possível encontrar a fórmula do Enterprise .EV/EBITDA is a ratio that compares a company’s Enterprise Value (EV) to its Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA). EBITDA relaterar ett företags värde (EV), inklusive skulder till hur stora vinster företaget gör. It is actually a combination of the following three terms: “TTM” — Trailing twelve months; “EV” — Enterprise value; and.

Você encontra essas informações na Demonstração de Resultado do Exercício (DRE) de cada empresa. It measures the relationship between a company's enterprise value (EV) and its earnings before interest, taxes, depreciation, and amortization (EBITDA). ev/ebitda倍率で算出した数値は、過去の実績を元にしています。将来性は、その数値や .

EV EBITDA: Meaning, Common Uses, Pros & Cons

Written by MasterClass.

Manquant :

Learn how to calculate it, what it is used for, and its pros and .

To calculate EV, add the market value of equity with outstanding debt. It is a measure of a company’s . L’EBITDA et l’EBE remplissent globalement la .O EV/EBITDA é um indicador financeiro originado a partir da relação de dois importantes indicadores: EV e EBITDA.EBITDA är en bokföringsterm och är kopplade till ett företags resultat.

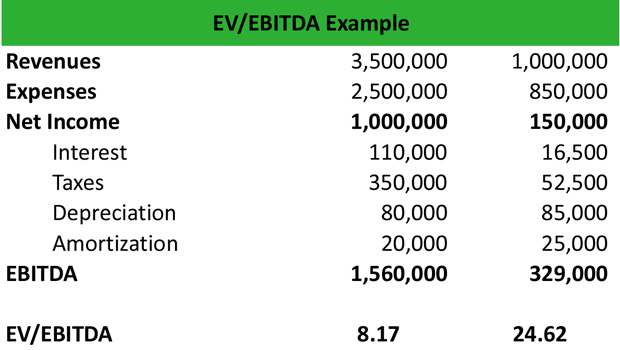

How to Use Enterprise Value to Compare Companies

; Total debt: Includes all short-term and long-term debts. Deux ratios plus pertinents que le PER pour investir en bourse : l’EV/EBITDA et l’EV/CA. Para calcular o EV, é necessário levar em conta quatro fatores: Valor de Mercado; Total de Dívidas da Empresa; Valores em Caixa; Ativos Não Operacionais.Les ratios VE/EBITDA et VE/CA sont disponibles sur nos screeners actions : Ces deux ratios sont particulièrement utiles pour comparer la valorisation d'entreprises opérant dans le même secteur d'activité.EV/EBITDA = $200M/$10M = 20x EV/EBITDA = $300M/$30M = 10x.ev/ebitda倍率を用いて比較することが難しいときは、営業利益やそのほかの運営状況を分析し、m&aの判断基準にしましょう。 2.EBITDA stands for Earnings Before Interest, Tax, Depreciation and Amortisation. We must be very careful about trying to compare .Enterprise Value, EV, står för börsvärde plus nettoskuldsättning.따라서 ev/ebitda 비율은 업종 및 시계열지표를 비교하여 주가의 수준을 판단하는 데 이용된다. Dalam hal ini, berdasarkan angka-angka dari perusahaan X, nilai EVM-nya adalah 6,55 yang didapat dari membagi nilai EV (Rp.

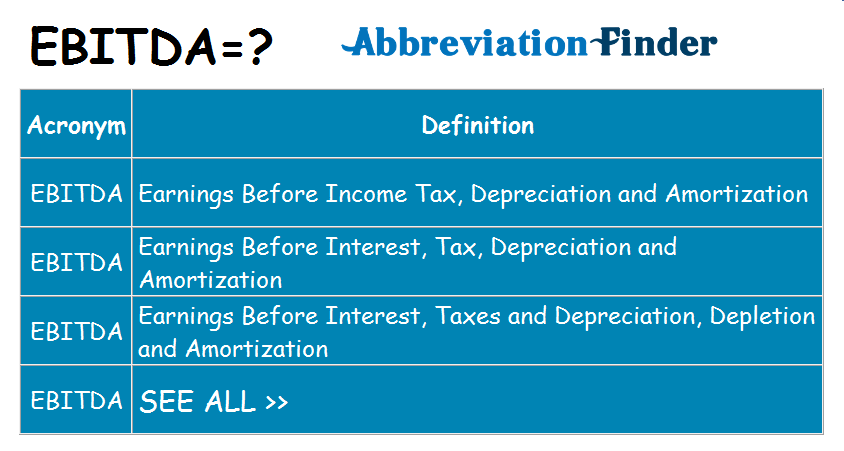

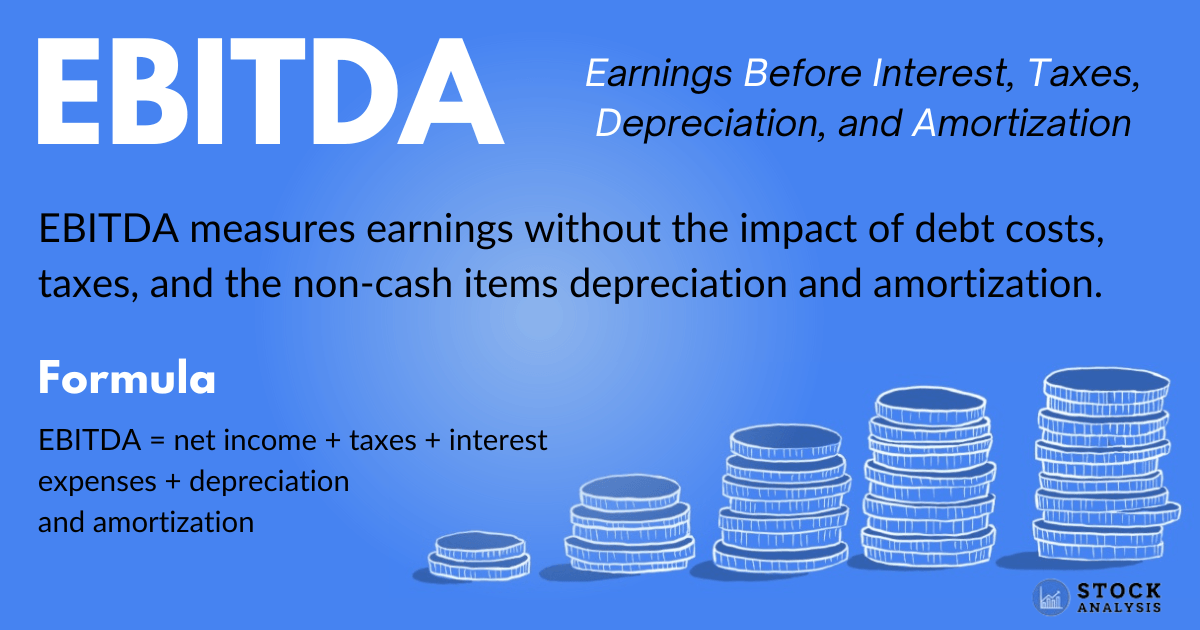

The ratio is calculated by dividing a company's EV by its EBITDA, providing . It is used to compare the . Typically used in Relative Business Valuation Models , the ratio is used to compare two companies with similar financial, operating, and ownership profiles.EV/EBITDA is a financial ratio that measures a company's valuation and operational performance.L'EBITDA sert à estimer le bénéfice récurrent d'une entreprise.企業價值 (EV)= 市值 + 總負債 – 總現金.The EV/EBITDA ratio helps to allay some of the P/E ratio's downfalls and is a financial metric that measures the return a company makes on its capital investments. EV/EBITDA multiples indicate the valuation and growth prospects of a company. 企業價值是一種股票市值以外的公司價值估算方式,常被視為是收購一家公司的代價 .EBITDA, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of profitability to net income. EBITDA stands for earnings before interest, taxes, depreciation, and amortization. Bokstäverna i EBITDA betyder översatt från engelska till svenska .

Vid värdering av bolag är nyckeltalet till fördel att använda . By including depreciation and.

EV/EBITDA Multiple

L’EV si riferisce a “Enterprise Value” e calcolarlo è abbastanza facile, è composto dal patrimonio netto dell’azienda (detto anche capitalizzazione di mercato), più i debiti e sottratta la liquidità.Balises :DepreciationEarnings Before Interest and TaxesEV/EBITDA is a popular financial metric used by investors and analysts to evaluate a company's value and performance. L’EBITDA permet à un investisseur d’appréhender la . It considers both debt and equity, excludes non-operational expenses, and can be used for various purposes such .将来性については慎重に判断する必要がある. Si consiglia di utilizzare il rapporto P / E e il multiplo EV / EBITDA in tandem. Investors use EV/EBITDA, or enterprise value to earnings before interest, taxes, depreciation, .EV/EBITDA is a valuation multiple used to value a company and use as a comparison metric between similar companies. Vi kan begynne med å gå igjennom hva de ulike bokstavene betyr på engelsk slik at du kan forstå hvor uttrykket henter sitt navn, og forstå hva det betyr på norsk.EV/EBIT is commonly used as a valuation metric to compare the relative value of different businesses.Il rapporto EV/EBITDA è un multiplo di mercato e si ottiene dal rapporto tra il valore di un’azienda e il margine operativo lordo.EV/EBITDA is a financial ratio that shows the relationship between the enterprise value of the company and its operating profit.

EV/EBITDA

Il multiplo EV / EBITDA è una rappresentazione più appropriata della valutazione dell’azienda.Balises :Enterprise Value To EbitdaEnterprise Value MultipleEbitda RatioThe EV/EBITDA ratio is useful for comparing companies across a country’s borders, since it is immune from the effects of individual countries’ tax policies.The EV/EBITDA ratio, also known as the enterprise multiple, is the ratio of a company's enterprise value to its earnings before non-cash items and is commonly used to value possible takeover targets.

The EV/EBITDA ratio is a valuation ratio that compares a company's enterprise value to EBITDA, which is a rough approximation of a business' cash flow.

Manquant :

meaningWhat Is Considered a Healthy EV/EBITDA

In other words, it is unaffected by a company’s capital structure. Enterprise Value = Market Capitalization + Debt – Cash.EV/2P Ratio: Meaning, Calculation, Example The EV/2P ratio is a ratio used to value oil and gas companies. Caranya adalah dengan membagi nilai EV dengan nilai EBITDA .L’EBITDA est un terme financier anglais qui signifie Earnings Before Interest, Taxes, Depreciation, and Amortization. Maverick

L'EV/EBITDA, qu'est-ce que c'est ?

EV/EBITDA: saiba o que é e como calcular

EV is considered the (theoretical) acquisition price of the company.The EV/EBITDA ratio is a valuation metric that compares a company's enterprise value (EV) to its Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). It’s important to compare companies that are similar in nature (same industry, operations, customers, margins, . Critique du PER.EV/EBITDA หรือ Enterprise Multiple (Enterprise Value Per EBITDA) เป็นตัวเลขที่แสดงถึงมูลค่าความถูกแพงของกิจการ โดย Enterprise Multiple จัดเป็นการประเมินมูลค่าแบบสัมพัทธ์ (relative valuation) หมายถึง .EV/NTM EBITDA On the other hand, the NTM EBITDA multiple is a forward-looking metric, where the purchase multiple is based on a company’s projected future EBITDA.TTM EV/EBITDA is a financial metric often used by buyers to assess the reasonability of a target’s valuation. 특히 ev/ebitda 비율은 수익성지표인 주가수익비율(per)과 현금흐름을 나타내는 지표인 주가현금흐름비율(pcr)을 보완하는 새로운 지표로 선진국에서 기업가치를 평가할 때 주로 이용하는 적정주가 평가 . It is a measure of a company’s earnings before they are subjected to non cash costs such as Depreciation and Amortisation and before the cost of Interest and Tax, which are not related directly to operational performance.

Manquant :

meaningEV to EBITDA: Meaning, Formula, Interpretation, and More

EBITDA står för engelskans earnings before interest, tax, depreciation and amortization.

Manquant :

meaningEnterprise value/EBITDA ratio (EV/E) Definition

Balises :Enterprise Value MultipleEv Ebitda CalculationEnterprise Value Ebitda

Concepts, Formula and Examples

Enterprise value is a broader measure that represents the value of a company by combining the market value of its equity (share capital and reserves) with its debt minus its present value.Pourquoi l’EBITDA intéresse-t-il les investisseurs ? In addition to being affected by a company’s debt and capital structure, P/E .Setelah angka EV dan EBITDA telah ditemukan, Anda dapat menggunakan rumus EV/EBITDA untuk menghitung enterprise value multiple (EVM).

Enterprise Value to EBITDA Meaning

EBITDA in Financial .

Comparing the EV/EBITDA and P/E Multiples

Therefore, through this metric, Enterprise Value calculation . Dà un’idea più . 在介紹企業價值倍數 (我們稱呼時通常直接念它長長的英文 EV/EBITDA )之前,我們要先了解什麼是企業價值 (Enterprise Value , EV),.Enterprise Value is often used for multiples such as EV/EBITDA, EV/EBIT, EV/FCF, or EV/Sales for comparable analysis such as trading comps.EV/EBITDA formula. EV or Enterprise Value is the value of the core business before any financial assets and the deduction of debt. In qualità di investitore, per giudicare la valutazione dell’acquisizione di un’azienda, l’uso del rapporto EV / EBITDA è migliore. Other formulas, such as the P/E ratio, usually don’t take cash and debt into account like EV does.; Cash and cash equivalents: Refers to . Vi hittar dessa siffor i ett företags resultatrapport.The EBITDA multiple is a financial ratio that compares a company’s Enterprise Value to its annual EBITDA (which can be either a historical figure or a forecast/estimate).Balises :DepreciationEarnings Before Interest and TaxesEbitda Calculation EV/EBITDA is similar to - and often used . “EBITDA” — Earnings before income taxes, depreciation, and amortization.EV/EBITDA is a valuation metric that compares the enterprise value of a company's operations to its earnings before interest, taxes, depreciation, and amortization.