Ex dividend date mean

The ex-date and the record date for all . Date of Record. In other words, if you purchase a stock on or after the ex-dividend date, you won’t receive the dividend associated with it. Télécharger le .An ex-dividend date is the cutoff period that determines whether a shareholder will receive a dividend payment for stock they own. Dividends can be issued as cash payments, as . To receive the dividend, .At its core, the ex-dividend date is a significant event for dividend-paying stocks.Calendrier des dates ex-dividende et calendrier des dividendes. The ex-dividend date is the deadline or cut-off day for shareholders to qualify for the next dividend payment. A 2% stock dividend paid on shares trading at $200 only drops the price to $196. It is the date on which a stock starts trading without the right to receive the upcoming dividend payment.Dividend | Examples & Meaning | InvestingAnswers26 avr.Eine einfache Erklärung. Réinitialiser.

Ex-dividend date

2020Record Date Definition & Example | InvestingAnswers30 sept.Typically, the ex-dividend date is one business day before the record date. The first day of trading when the buyer of a stock is no longer entitled to the most recently announced dividend payment ( i. The ex-dividend date is used as the sole basis to determine who will receive payment of an upcoming dividend . Think of it as a marker in your calendar; if you buy the stock on or after . If you own the stock .

Think of it as a marker in your calendar; if you . XYZ also announces that shareholders of record on the company's books on or before August 12, .The record date was set for Nov. The ex-dividend date is normally set one business day before the . Ex-Dividend Date.

How Are Dividends Taxed?

It’s usually one business day before the record date. Record date: The dividend record .

Manquant :

mean 2020Dividend Payable Date Definition & Example | InvestingAnswers28 sept.Dividends: Definition in Stocks and How Payments Work

What Ex-Dividend Means and Why It Matters

Dividend: A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, paid to a class of its shareholders. If purchased on or after this date, the dividend goes to the seller. Date de clôture des registres : Vous devez posséder officiellement les actions à la date de clôture . To receive the dividend, investors must buy shares in the . Wenn eine Aktie also “ex Dividende” gehandelt wird, bedeutet dies .Ex-Dividend Date.

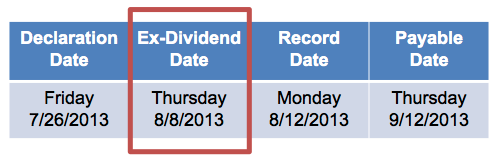

Friday, 7/26/2013.Ex-Dividend refers to a stock trading status which signifies that a declared dividend belongs to the seller rather than the buyer.

What is an ex-dividend date?

The ex-dividend date is the day on which all shares bought and sold no longer come attached with the right to be paid the most recently declared dividend.

Ex-Dividend Dates: Meaning and Significance

If you buy before the ex-date, you get the next dividend payout.) until the ex-date or the record date.

Everything Investors Need to Know About Ex-Dividend Dates

Ex-Dividend Date (or Ex-Date) In order to receive the next . Friday, 8/9/2013.The ex-date and the record date for all the corporate actions are on the same day since all the instruments are moved to the T+1 settlement cycle.

Ex-Dividend Date

This is required because when you buy or sell a stock, the trade often takes two business days to fully settle.

What does record date and ex-date mean?

: Que signifie « ex-dividende »? R.

Que signifie « ex-dividende

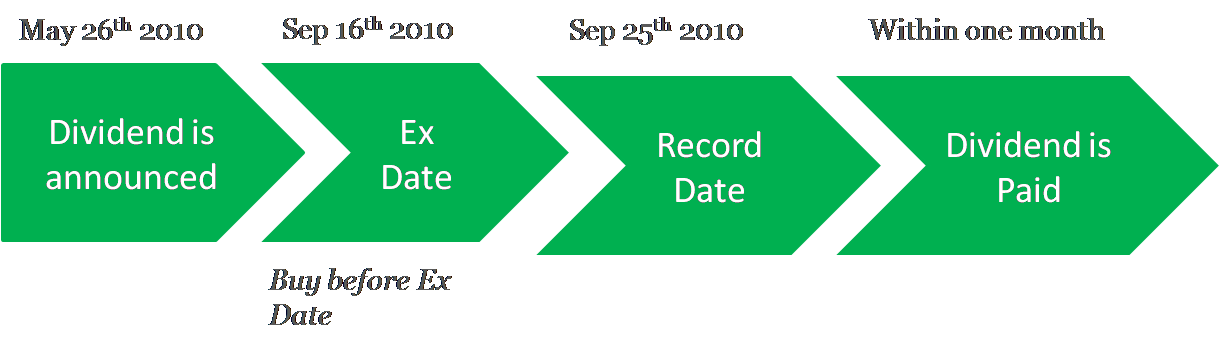

The ex-dividend date is commonly set two days before the record date.After the record date has been determined, the stock exchange assigns the ex-dividend date. October 31, 2023 Advanced. If you purchase and hold a security before its ex-dividend date, you will receive the next dividend. Below you will find a calendar of stocks going ex-dividend during the week of 4/22/2024. Record Date: This is the date on which shareholders must be on the company’s books to receive the declared dividend.Ex-Dividend Dates: Understanding Dividend Risk. The most important among these key dates is the ex-dividend date.Here, we explain the finer points of dividend payments.When investing for dividends, a vital sequence to understand is the ex dividend date vs record date. As you’ll see, the date a company pays out a dividend to shareholders is just one of the key dates you need to be aware of as an investor.Ex-Dividend Calendar. 2019Afficher plus de résultats

Ex-Dividend Date: What It Is & How It Works

Not all companies pay dividends. Monday, 8/12/2013.

This is the date that a company announces it is paying a dividend. The ex-dividend date is the critical date that determines who qualifies to receive the dividend. On July 26, 2013, Company XYZ declares a dividend payable on September 10, 2013 to its shareholders. It marks a cutoff date The cutoff date is the specific date on which shares bought and sold no longer come with the right to be paid the most recently declared dividend.To get stock dividends, you must buy the stock or already own it at least two days before the date of record or one day before the ex-dividend date. Instead, the dividend is paid to the . Ex-dividend Date. To receive the dividend, investors must purchase the stock no later than the .

How to set dividend alerts

the trade will settle the day after the record .

La date ex-dividende, qu’est-ce que c’est?

It marks a cutoff date .

Ex-Dividend Dates: Understanding Dividend Risk

This is known as T+2 settlement. Der Begriff “X” steht hierbei für “ohne”. People who trade options do so for several reasons: to target downside protection, to potentially .The ex-dividend date is set the first business day after the stock dividend is paid (and is also after the record date).Ex-dividend date: This is the day after which dividend payments will no longer be paid to investors who purchase a stock.The Ex-Dividend Date.

Incidentally, cum .This means that if you are the owner of the stock when the market closes the day before the ex-dividend date, you will be locked in to receive the dividend on the previously specified payable date. 7, which means the ex-dividend date would be on Nov. There is a very important exception to this rule.An ex-dividend date is the day on which a stock trades without the benefit of the next scheduled dividend payment. Before trading opens on the ex-dividend date, the exchange marks down the share price by the amount of the declared dividend. If you sell your stock before the ex-dividend . after which the stock is sold without the right .

As with cash dividends, smaller stock dividends can easily go unnoticed.

30 per share, its stock price will generally fall by that amount. Record date ; è il giorno in cui l’azienda controlla chi tra i propri azionisti ha diritto al dividendo.The ex-dividend date is the deadline or cut-off day for shareholders to qualify for the next dividend payment. Rendement du dividende. A stock will trade with the benefits of the corporate action or cum-benefit (i.Ex-dividend date. The ex-date is one business day. When a stock goes ex-dividend, it means the stock is trading without its next scheduled dividend.On day 3 (2 past your purchase date and equal to the ex-dividend date) you are the recorded owner and own any dividends due then or thereafter.

Since you purchased the shares more than 60 days prior to the ex-dividend date (May 9, 2022), the $163 in dividends your shares earned you are qualified.When a company announces a dividend, it will normally give investors 3 dates: an ex-dividend date, a record date, and a payment date. 2021Cash Dividend Definition & Example | InvestingAnswers6 oct.The ex-date or ex-dividend date is the trading date on (and after) which the dividend is not owed to a new buyer of the stock. Die X-Dividende, auch bekannt als Ex-Dividende, ist ein Begriff aus der Finanzwelt, der sich auf den Zeitpunkt bezieht, ab dem eine Aktie ohne Anspruch auf die nächste Dividende gehandelt wird. Buy on or after the ex-date, and the next dividend payout stays with the seller.Here we cover some common terms around dividends and what they mean: Declaration Date. This is crucial for . Date of Declaration. Example Scenario Anyone who purchases shares of a company prior to the., cum-rights, cum-dividend, etc.