Farm land etf

Meanwhile, investors typically rented out cropland for $138 an acre .The key features of farmland investments.

Average land prices for cropland were $4,130 an acre in 2018, while pastures cost about $1,390 an acre, according to the USDA.Trade this ETF now through your brokerage.

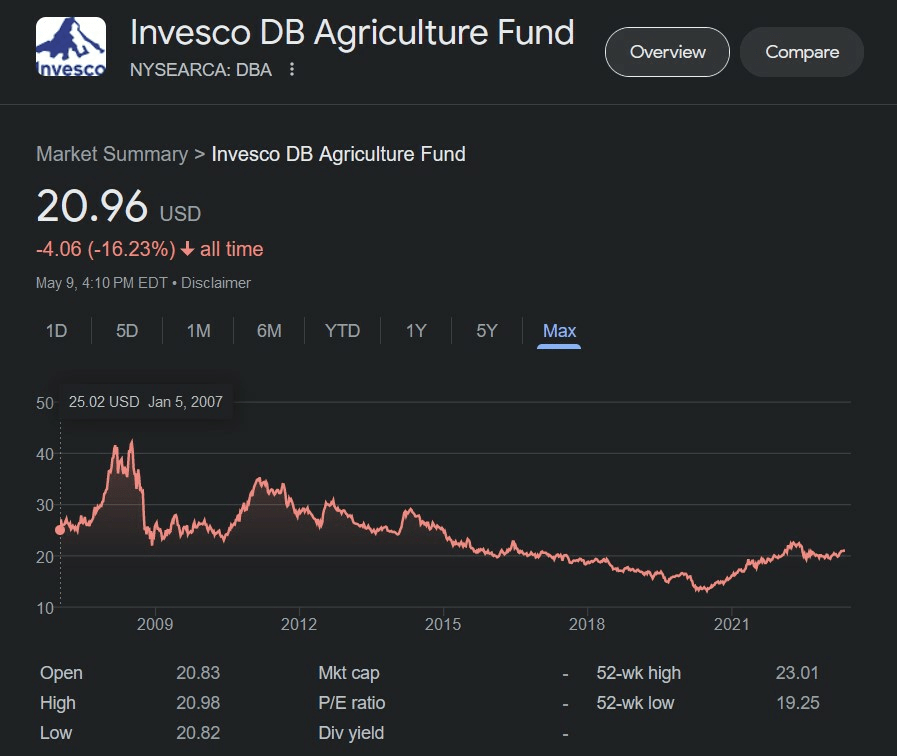

Here are some key points to keep in mind when investing in farm land with ETFs: Research the ETF: Before investing in an ETF, it’s important to research the fund’s strategy, holdings, and performance.com Staff | Apr 19, 2024.iShares MSCI Agriculture Producers ETF | VEGI. Exposure to companies involved in the production of agricultural products, fertilizers and agricultural chemicals, farm machinery, and packaged foods and meats. VanEck Agribusiness ETF (MOO ®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS ® Global Agribusiness Index (MVMOOTR), which is intended to track the overall performance of companies involved in agri-chemicals, animal health and fertilizers, seeds and traits, from . I think these . If you want to skip our discussion in the agriculture industry, head directly to 5 Best Agriculture ETFs To .com4 Farmland ETFs to Consider to Grow Your Portfolio | . Our collaboration with farmers aims to achieve rapid scalability and boost profitability. Market demand, geographical location, regulations and infrastructure are factors to consider before investing in farming. For the past 29 years, investments in U. A global portfolio of agricultural assets may provide all these .Agricultural productivity companies include those contained in the MSCI ACWI Select Agriculture Producers IMI 25/50 Index or those that, in the Adviser's opinion, help to increase crop yields and/or grow food production amid a backdrop of a growing global population and declining per capita supply of arable land. Targeted access to equities and equity-related securities of U.4B of collective capital deployed. Here are a few .Teucrium Agricultural Fund actually combines four of the best farmland ETFs into one fund: CANE, SOYB, WEAT, and CORN, all issued by Teucrium.To invest in farmland ETFs, follow a step-by-step process by choosing a broker, funding your account, researching farmland ETFs, and placing your trade. While not a publicly traded REIT, it offers opportunities for institutional and accredited investors to participate in Canadian farmland ownership. 1 Day NAV Change as . Thus by investing in TAGS, you're gaining exposure .Identifying the “best” land ETFs is subjective and can depend on various factors such as investment goals, risk tolerance, and specific criteria.iShares MSCI Agriculture Producers ETF.Agriculture ETFs invest in agriculture commodities including sugar, corn, soybeans, coffee and wheat. Such companies may include .

The 7 Best Agriculture and Farmland ETFs (2023)

In this article, we discuss 12 best agriculture ETFs to buy. Thanks to ETFs and other farmland investment opportunities, investing in agricultural commodities, equipment and operations is easier than ever before. It even beat the S&P for the 25-year span ending in March 2021 with annual returns of: 11.But a farmland ETF (or agriculture ETF) holds only agriculture stocks, like shares in grain, livestock, and sugar companies. DE is obviously an exposure to many sectors of agriculture across the world.Another option? Invest in a farm land ETF.Instead, the land itself can increase in value, you can receive rental or lease payments, own a farm REIT or invest on a crowdfunding platform. Buying farmland, farm REITs, agricultural stocks, ETFs and mutual funds are popular types of farming investments. We offer unique transition opportunities for the upcoming wave of farmland transfers and aid young farmers in rapidly expanding their . Updated December 05, 2022. Computershare, Inc.Activité : Freelance Contributor

Best Agriculture and Farmland ETFs in 2022

Our FARM ETF report shows the ETFs with the most FARM exposure, the top performing FARM ETFs, and most popular FARM ETF strategies. “West African farmers are producing 40-50 per cent of the optimal level. Consider the location: Location is a key factor in farm .comRecommandé pour vous en fonction de ce qui est populaire • Avis

4 farmland ETFs to consider to grow your portfolio

The results look even worse so far in 2019.

FarmTogether

Exposure to companies that produce fertilizers and agricultural chemicals, farm machinery, and packaged foods and meats.

The 8 best agricultural ETFs to consider for your portfolio

1521 Westbranch Drive Suite 100 McLean, VA 22102 T: 703-287-5893 land@gladstonecompanies.“Farmers in Ecuador are producing near-optimal yield levels,” he said. Visit Portfolio Tool. Agcapita Farmland Investment Partnership. I went with this over LAND since I wanted more grain production exposure versus vegetable acres. It also includes an exposure to construction as well.VanEck Agribusiness ETF (MOO ®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS ® Global Agribusiness Index . Gladstone owns 131 farms across the U. The metric calculations are based on U.

Seed Capital: How to Invest in Farmland as a Portfolio Diversifier

Learn more about farmland ETFs that can give . The company’s top crops include: Blueberries ; Pistachios; . Farmland ETFs offer exposure to the agriculture industry with relatively low investment costs and greater liquidity than direct farmland ownership. Farmland is a great asset class with returns that rival equity. Consider three types of potential passive agriculture investments.The following agricultural stocks and exchange-traded funds, or ETFs, all offer different ways to play the industry, with a few diversified ETFs to consider as well: Net Profits up 196.For most small investors, real estate investment trust (REIT) ETFs are a solid, cost-effective choice because they do not require direct management, are broadly diversified, and can be purchased .Agriculture and farmland ETFs make it easy for investors to add a variety of agriculture products to their portfolio. farmland have achieved attractive total returns relative to asset classes like stocks, bonds and real estate, while also providing strong diversification benefits and a hedge against inflation.ETF issuers who have ETFs with exposure to Agribusiness are ranked on certain investment-related metrics, including estimated revenue, 3-month fund flows, 3-month return, AUM, average ETF expenses and average dividend yields. iShares MSCI Agriculture Producers ETF. Agcapita is a private farmland investment fund focused on acquiring and managing Canadian farmland.Minimum investment of 150,000 Canadian Dollars.See the latest Farmland Partners Inc stock price (FPI:XNYS), related news, valuation, dividends and more to help you make your investing decisions. Buffett acquired a 400-acre Nebraska farm in the ’80s that .Top 11 Best Agricultural And Farmland Stocks In 2024farmlandriches. Our LAND ETF report shows the ETFs with the most LAND exposure, the top performing LAND ETFs, and most popular LAND ETF strategies. Investors can earn passive income through rental agreements with .

iShares MSCI Agriculture Producers ETF

Farming is a recession-proof, high-ROI, sustainable investment. Previously, you had to buy . Farmland LP (Private REIT) Farmland REITs Alternatives.

Investing in Farmland: A Real Estate Investor's Guide

©Farm'sland {FR} 2023. Exposure to companies involved in the production of agricultural products, fertilizers and agricultural chemicals, farm machinery, and packaged foods and meats 2. INVESTMENT OBJECTIVE.While the options for farmland REITs are somewhat limited, two prominent players stand out in the market. COW iShares Global Agriculture Index ETF NAV as of Apr 22, 2024 CAD 64. So you don’t really have to own a farm, but you .Angelo Merendino for The New York Times.

12 Best Agriculture ETFs To Buy

NAV as of Apr 19, . Area One Farm operates private equity funds in the Canadian farmland sector. Targeted access to . Weather conditions, operational risks and .

How to Invest in Farming: A Comprehensive Guide

Site de modding est mise a la disposition de la communauté de mods fs 22. They partner with established farm operators to buy off-market farmland, helping family farms physically expand and also improve their financial returns., totaling nearly 113,000 acres in 14 different states.Top agricultural ETFs include the Invesco DB Agriculture Fund (DBA), VanEck Vectors Agribusiness ETF (MOO), and iShares MSCI Global Agriculture . Box 43006 Providence, RI 02940-0378 T: 201-680-6578 .Gladstone Land Corporation 1521 Westbranch Drive Suite 100 Mclean, VA 22102 US Investor Relations. Independently . cropland has risen about 75 percent over the last 15 years.What Sets FarmTogether Apart. Can be used to diversify a portfolio and to express . Disciplined and conservative investment philosophy.Acquired Fund Fees and Expenses : 0. Look for an ETF that tracks an agricultural index or invests in companies involved in the agricultural sector. Gladstone Land’s properties are primarily used for growing fruits, vegetables, and nuts. Use to diversify your portfolio and express a sector view.Investing in farm land with ETFs provides accessibility, affordability, diversification, and long-term growth.Farmland is a surprisingly good investment and hedge against inflation. FPI – Farmland Partners. Bill Gates has bought enormous tracts of farmland. ETFs can also . Their primary holdings are fruit and produce farms that cost between $2 million and $40 million. Expert investment team with $1.

Best Farmland REITs To Buy In 2024

Proprietary sourcing technology and strategic best-in-class partnerships. Types of Land Investments.While there’s no specific farmland ETF per se, several ETFs invest in farmland stocks, such as the DB Agriculture ETF and the VanEck Agribusiness ETF. Gladstone Land. Direct ownership of farmland requires no shortage of expertise, according to Bravante Farm Capital, a . Department of Agriculture says the average price of an acre of U. Add to Compare. So are farmland ETFs a wise investment? Well, they . Tout droit réservés Farm'sland {FR} and global companies involved in agricultural sector.Добро пожаловать в вашу новую бесплатную игру: Farm Land! Отправляйтесь в приключения на ферме, разводите животных и расширяйте свой остров! That tells you that .

7 Agricultural Stocks and ETFs to Buy and Hold

-listed Agribusiness ETFs and every Agribusiness ETF has one .

Top Agricultural Commodity ETFs

Farmland REITs. Area One Farms. Agriculture Crowdfunding.Fund Description.

Agribusiness ETF List

Farmland shows low correlation to the usual asset classes, thereby .Fruit and produce farms.00%

Best Farmland REIT: ETFs and Stocks for Agriculture

The iShares MSCI Agriculture Producers ETF seeks to track the . I know these aren’t farm ETFs but it’s what I have settled on.

Among the funds and .One way to invest in farmland is to buy the land yourself and rent it out to farmers.