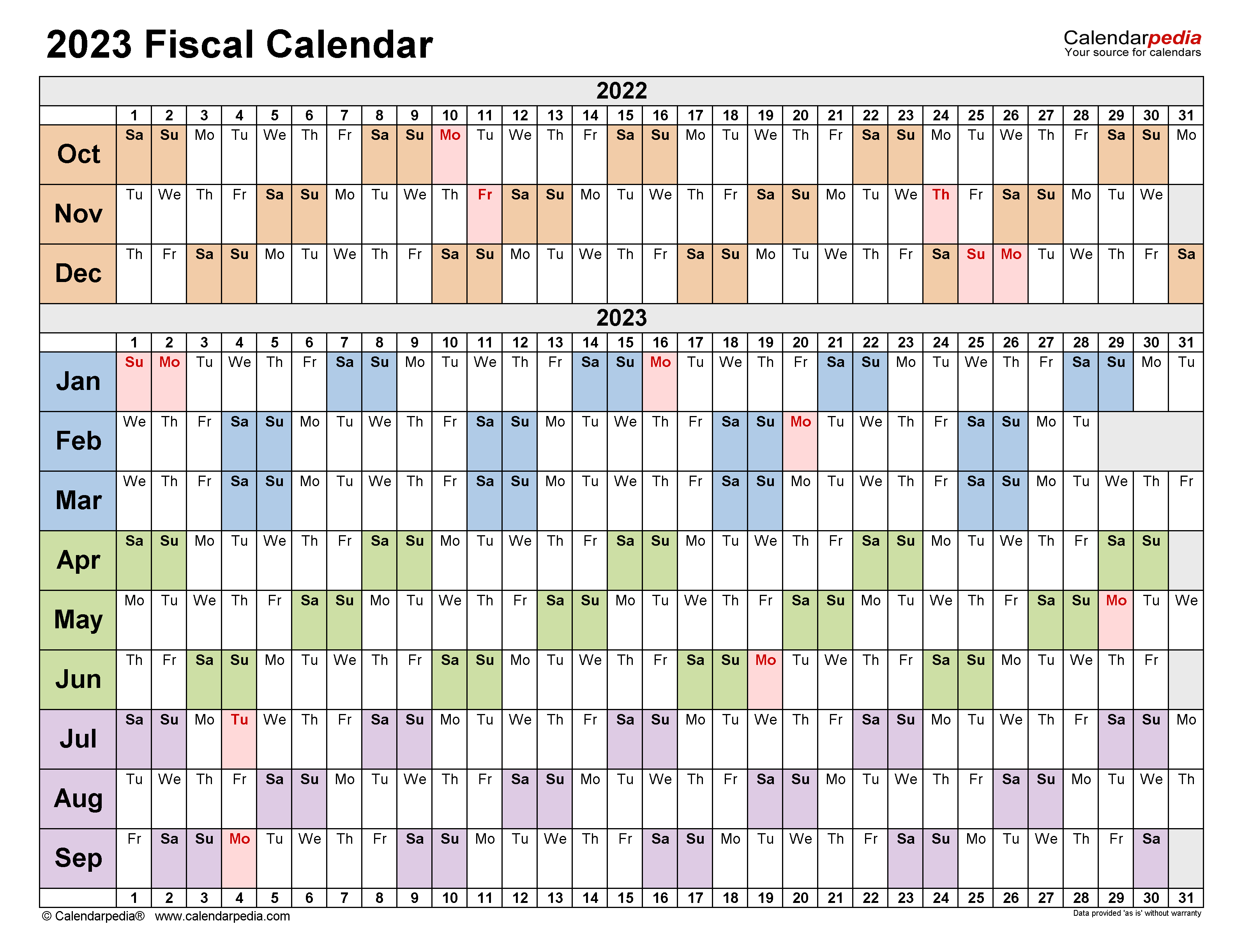

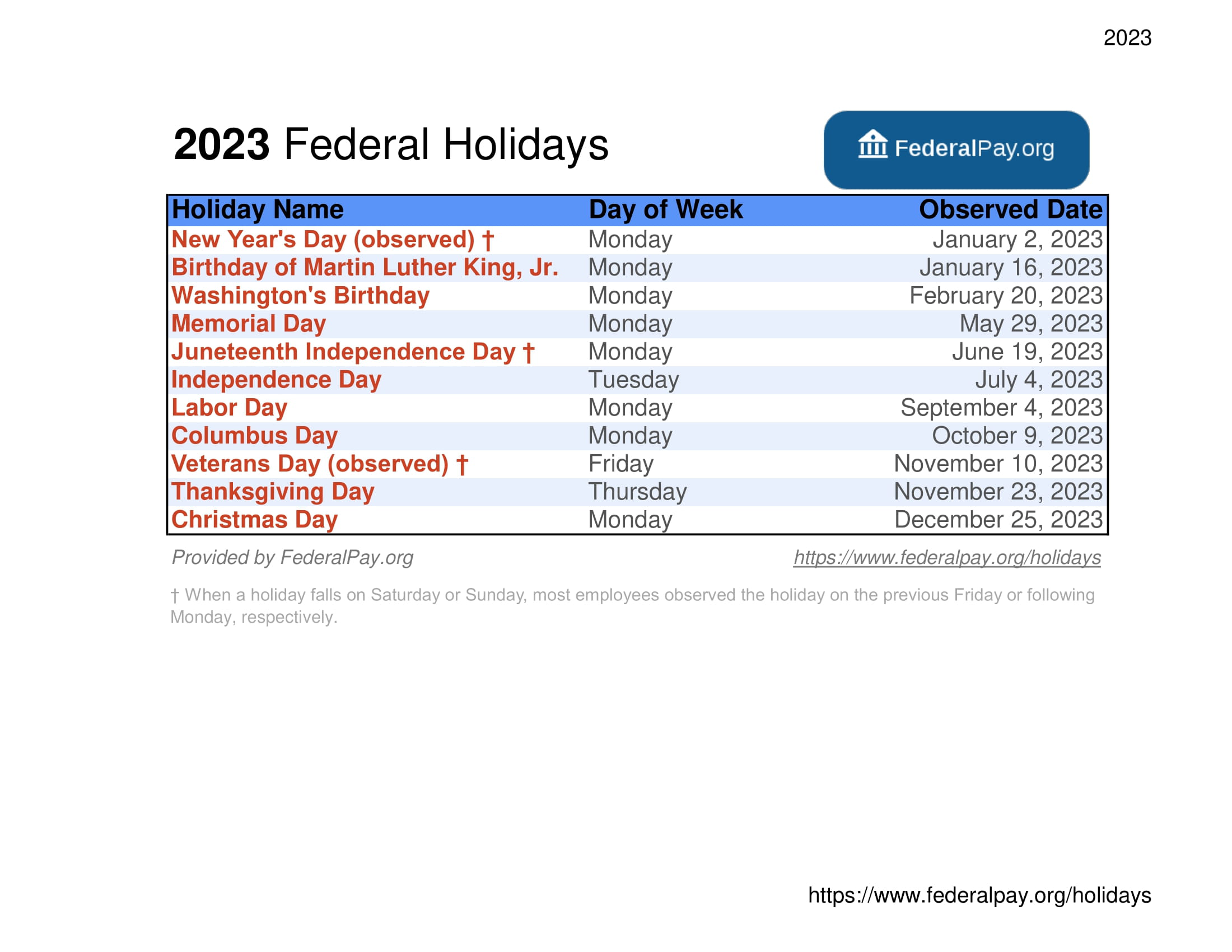

Fed payment dates 2023

Employment VerificationPSB NewslettersFrequently Asked QuestionsOPM's Employee ExpressTax Information

Benefits payment dates

New to Monash New to Monash.Specifically, in 2023-24, the federal fuel charge will continue to apply in Alberta, Saskatchewan, Manitoba, and Ontario, and will come into effect as of July 1, .08 per child under 6 and $491.Account payment dates: Accounts are payable by the following dates: Half (50%) of the account is payable by 30 April and the full account (100%) by 31 July even if a statement of account is not received by mail.

Canada FPT Payment Dates 2024

The 2,5% discount date is 30 April. Telangana Open School Society (TOSS) has Released Fee Payment due dates from 10th and Intermediate Examinations to be held for the Academic Year 2023-24.

Term start and end dates for the 2023/24 academic year; Winter 2024 Spring 2024 Summer 2024 Fall 2024; Jan.

Climate Action Incentive payment amounts for 2023-24

When fully available, instant payments will provide substantial benefits for consumers and businesses, such as when rapid access to funds is useful, or when just-in-time payments help manage cash flows in bank accounts. Your first semester.

What Is A Canada Fed Deposit

15, 2023 4th payment. Currently registering for Summer 2024 (May to August) Summer fees are due: May 21, 2024.93 percent update to the CY 2024 Physician Fee Schedule (PFS) Conversion Factor (CF) for dates of service March 9 through December 31, 2024.The undersigned certify that, as of June 13, 2023, the internet website of the California Department of Tax and Fee Administration is designed, developed, and maintained to be in compliance with California Government Code Sections 7405, 11135, and 11546.IR-2024-112, April 17, 2024.9 percent, effective .The FedNow Service went live on July 20, 2023. Note: If any of these dates fall on a holiday or weekend, the due date for fee payment will be the first working day following the holiday/weekend.91 monthly from ages 6-17.Updated on Nov 20, 2023.As your income goes up, the tax rate on the next layer of income is higher. So, spend it wisely. Term Tuition Fees Accommodation Fees; Autumn (Term 1) 13 November 2023 (50%) 13 November 2023 * Spring (Term 2) 22 January 2024 (50%) 22 January 2024 * Summer (Term 3) N/A: 13 May 2024 * Vacation (Term 4) N/A: 01 July . It is available to depository institutions in the United States and enables individuals and businesses to send instant payments through their depository institution accounts.comEverything You Need To Know About FedNow - Forbesforbes.

This does not include charities, garnishments, court orders, union or other organizational dues.

16, 2024 : July 2, 2024, to Aug. Registration for Summer 2024 begins: March 11, 2024.7 and the Web Content Accessibility Guidelines 2. View Pay Chart. Find your annual direct deposit, social security, and other federal pay posting dates right here, including military pay, OPM, RRB, VA and more.Last Update: July 20, 2023.Your next student finance payment date will be in April 2024 — this is usually the last instalment of your loan for the academic year. The due dates for the first three payment periods don't apply to you. Add the GSA Payroll Calendar to your personal Calendar. March 20, 2024. For residents of Newfoundland and Labrador, Nova Scotia, and Prince Edward Island, payments commenced in July 2023. Shortly after registration, the accounts will be available in the UP Portal.It’s Tax Day in the United States for most Americans, and there are still plenty racing to file their 2023 income tax returns up until the clock strikes midnight. AP Inter Supplementary Exam Fee dates 2024 will be announced by the Board of Intermediate Education Andhra Pradesh on its official website of BIE AP, https://bie. Federal Reserve has launched a long-awaited service which will aim to modernize the country's payment system by eventually allowing everyday . The General Schedule base payscale is adjusted for cost of living based on location.

AP Exam Fees

Wednesday through Friday check dates have a Friday cutoff. The payment schedule for these . 2023 tax rates for a single taxpayer For a single taxpayer, the rates are:orgRecommandé pour vous en fonction de ce qui est populaire • Avis

Payroll Calendars

With the many different government programs available for Canadians, it can be tricky to keep track of all the benefit payment dates. 31, 2024, and pay the entire balance due at that time, you won't have to make the final .

Important Dates

Use to start, change, or stop an allotment or our toll-free number to establish a checking or savings allotment. Yes.

Federal Reserve Board

The Goods and Services Tax/Harmonized Sales Tax credit is paid quarterly: January 5, 2024.The GST rebate is issued four times a year, the 2023 payment dates are Jan. 16, 2024: The dates listed below are based on a standard 15-week semester that begins on the term start date.Current fee payment deadline.If you're a calendar year taxpayer and at least two-thirds of your gross income for 2023 or 2024 is from farming or fishing, you have only one payment due date for your 2024 estimated tax, January 15, 2025.

Fed’s instant payment service ‘FedNow’ set to launch by July 2023

August 20, 2024.WASHINGTON — The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals, retirees, investors, businesses, . payment in accordance with the Accuracy of Deposits Rule. – Forbes Advisorforbes.Publish Date; 2025 Payroll Calendar [PDF - 163 KB] 11/01/2023: 2024 Payroll Calendar [PDF - 49 KB] 11/21/2022: 2023 Payroll Calendar [PDF - 162 KB] .

2023 Form 1040-ES

Don’t use Form 941-V to . February 20, 2024.Saturday through Tuesday check dates have a Tuesday cutoff.• The Board of Governors of the Federal Reserve System voted unanimously to raise the interest rate paid on reserve balances to 4. 15 for details. 8 to April 26, 2024: May 6, 2024, to Aug. Students who want to appear the supplementary examinations can check details and complete Payment of the Examination fee process for 1st and 2nd .

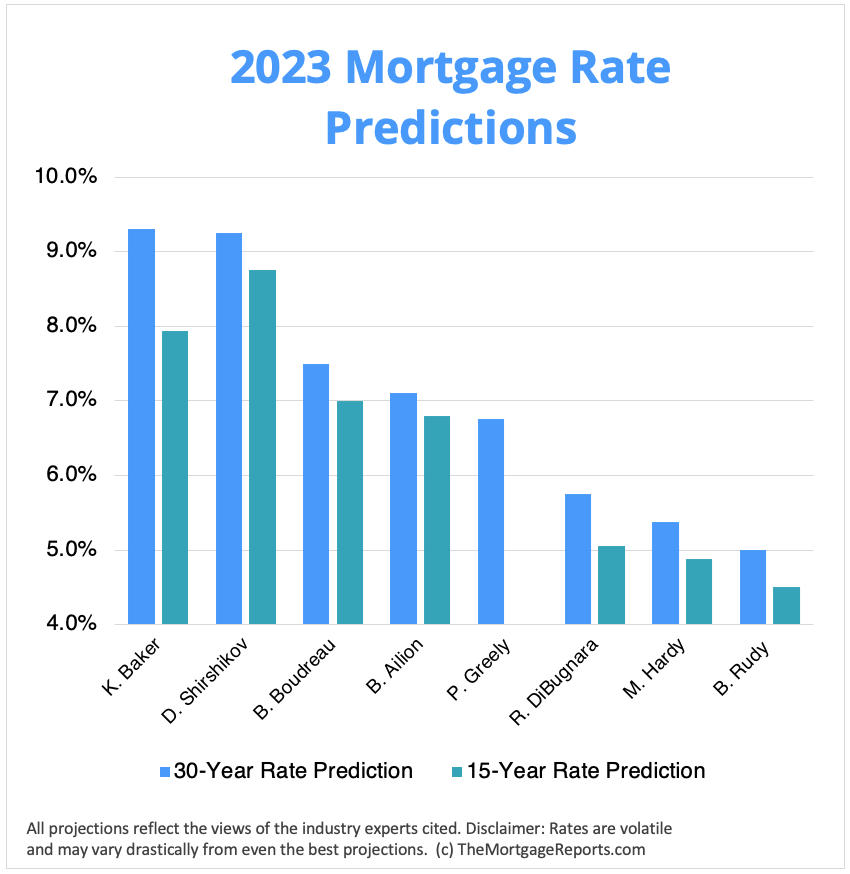

Estimated tax

comFedNow Service: 7 things you need to know - The Payments . Highest Locality Adjustment.The Federal Reserve is on track to launch an instant payment service called FedNow between May and July of 2023, allowing settlement of U. Fees paid by mail, fax or telephone must be received in the Registrar’s Office by the close of business day on the Fees Due Date. The payment dates vary depending on the program you are eligible for.If approved for the CCB, you will receive a maximum monthly payment of $583. This replaces the 1. Undergraduate, PGCE and Postgraduate Taught students - September 2023 start . Your first semester Your first semester. The 2022 Federal Reserve Payments Study (FRPS) collected data for the 2021 calendar year.These incentive payment amounts will be paid on January 15, April 15, July 15, and October 15th in 2024.

Federal Reserve Payments Study (FRPS)

The table below outlines the fees for 2023-24.

If you’re a Scottish student, you’ll get your student finances on .IR-2023-11, January 23, 2023.Yes, there are specific payment dates for Canada Fed deposits.AP Inter Supplementary Improvement Time Table 2023 Inter 1st & 2nd year Exam Dates, Fee Particulars, The AP Exam Fee Schedule or Due Dates for Payment of Examination Fee For 2nd Year Regular and Ex-Failed Students (General & Vocational) for IPE March 2023 have Been Announced by the Board of Intermediate Andhra Pradesh State. The service is a flexible, neutral platform that supports a broad variety of instant payments. October 4, 2024.Additionally, if you submit your 2023 federal income tax return by Jan. January 2024 Date Event; 1: The indexation rate for the year 2024 will be provided at a later date: 9: Last day for changes to banking information for the January .July 20 (Reuters) - The U.Payment due dates 2023/2024. The service is a flexible, neutral . Download the GSA Payroll Calendar ICS file. 27: Pension payment transferred in pensioner's account, via direct deposit. See all dates & deadlines How to pay your fees.All payment dates 1. Note 1: The PEI quarterly payments include the 10% rural supplement that all residents are eligible for.In addition, 16 service providers are ready to support payment processing for banks and credit unions.

1, Level AA success criteria, .The Federal Reserve Payments Study: 2022 Triennial Initial Data Release.

If you mail your payment and it is postmarked by the due date, the date .

Filing Dates for Sales & Use Tax Returns

Fees may apply to exams ordered after the November 15 final ordering deadline.

General Schedule (GS) Base Pay Scale for 2023

See section 11 of Pub.Form 941 for 2023: (Rev.

April Social Security Check: Where Is Your Money?

When Will the IRS Start Accepting 2023 Tax Returns and Issuing Refunds?

Canada Fed Deposit 2024: Eligibility and Payment Dates

January 19, 2024.The rule will also increase the total annual compensation requirement for highly compensated employees (who are not entitled to overtime pay under the FLSA if .

For more, here's the maximum amount of Social .An Update on the Federal Reserve’s Instant Payments . Banks and credit . You pay the higher rate only on the part that's in the new tax bracket.The Canada Fed deposit is a payment you receive from government benefit programs, such as the Canada child benefit, GST/HST tax credit, Canada workers benefit, or a related program. College Board fee reduction for eligible students. TABLE OF CONTENTS.

The Fed

For the July 2023 to June 2024 payment period, you receive up to $496 (single individual), $650 (couples), and $171 per child under the age of 19. 3, 2024, to Dec.In 2016, the Obama administration proposed doubling the overtime salary threshold to $47,476 from $23,660 but a federal judge in Texas struck down the .

Form 941 for 2023: Employer’s QUARTERLY Federal Tax Return

Make a payment or view 5 years of payment history and any pending or scheduled payments.

Benefit payment dates

2nd January 2024. Current students. See Farmers and Fishermen in The fee can be paid from 1st to 10th February 2024. These program payments could be delivered to your bank account in one lump sum under the label, Canada Fed. The allotment must be for a minimum of $50.Critiques : 153,4K25 percent update provided by the Consolidated Appropriations Act, 2023, .On March 9, 2024, President Biden signed the Consolidated Appropriations Act, 2024, which included a 2. WASHINGTON – The IRS encourages taxpayers to use the IRS Tax Withholding Estimator to ensure they’re withholding the correct amount of tax .

Climate Action Incentive Payment (CAIP) Payment Dates 2024

We'll help you find out if you should expect a check this week, as well as how your payment date is determined.Pay Period Calendar - 2022 Author: National Finance Center Created Date: 8/4/2021 6:19:40 AM .April 18, 2023 2nd payment. The Federal Reserve encourages . Late order fee. Dates are subject to .April 19, 2024.Written by Riley Adams, CPA • Reviewed by Miguel Burgos, CPA Updated for Tax Year 2023 • April 5, 2024 3:38 PM.

Publication 509 (2024), Tax Calendars

15 for deposit instructions. June 15, 2023 3rd payment. 16, 2024* * You don’t have to make the payment due January 16, 2024, if you file your 2023 tax return by January 31, 2024, and pay the entire balance due with your return. The Federal Reserve on Thursday announced that its new system for instant payments, the FedNow ® Service, is now live.Find your annual direct deposit, social security, and other federal pay posting dates right here, including military pay, OPM, RRB, VA and more.