Fiduciary responsibility for 401k plans

With the shift to defined contribution plans, the trust-based fiduciary regime took on an increasingly prominent role in regulating the provision of retirement benefits.comRecommandé pour vous en fonction de ce qui est populaire • Avis For example, a well-diversified 401(k) plan might include .benchmarkmyplan. To mitigate this risk, fiduciaries must understand the sources of liability.If you’re a small business owner considering the implementation of a 401(k) plan for your business, it’s important to understand your responsibilities as a plan fiduciary, including compliance with the Employee Retirement Income Security Act (ERISA).

“The fiduciary retains the responsibility of monitoring the service provider itself,” says Webb.Does your 401 (k) plan have a fiduciary? Yes. Over the past decade, several high-profile 401 (k) fee lawsuits and DOL efforts to implement a fiduciary standard for professional . Get the latest industry news, deadlines and tips you need to know to help tackle your fiduciary responsibility needs. Enter the date each task is completed in the field to the right of the task.

Fiduciary Education Campaign

Meeting Your 401(k) Fiduciary Responsibilities

This duty includes selecting and monitoring plan .

401(k) Plan Oversight

Some financial advisors did not get a lot of love from the White House bully pulpit on Tuesday when President Joe Biden rolled out the Department of Labor’s newly proposed .

What Is 401(k) Plan Fiduciary?

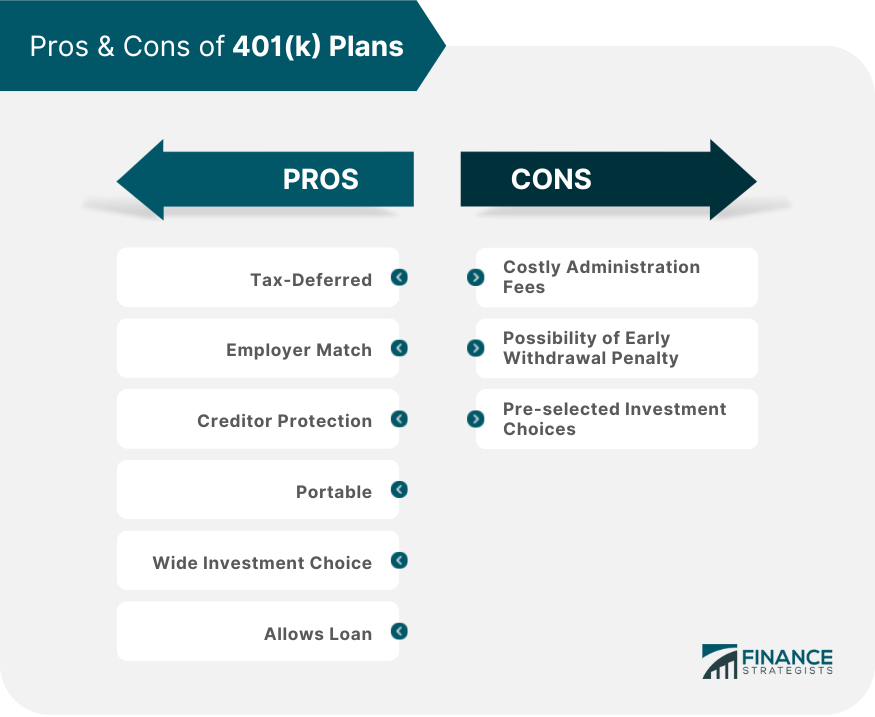

Department of Labor - DOLdol. Part 2, published in the Winter 2015 issue, looked at . 2020 | By Fred Reish Defined Contribution Insights. This is why a 3 (38) fiduciary must be a registered investment adviser (RIA) under federal or state law, a . In the context of 401 (k) plan administration, this includes acting honestly, prudently, and loyally when .November 1, 2023.401(k) plan sponsors are operating in an ever-changing regulatory environment defined by mandatory disclosure of information regarding plan investments and mandatory consideration of fees paid from plan assets (including revenue sharing and 12b‑1 fees) for plan services. Here are the main duties: Pick Prudent Investments.Understanding your role as a fiduciary. This means that they must invest the plan’s assets in a way that minimizes the risk of large losses, while also ensuring that the plan’s investments are well-diversified across different asset classes.

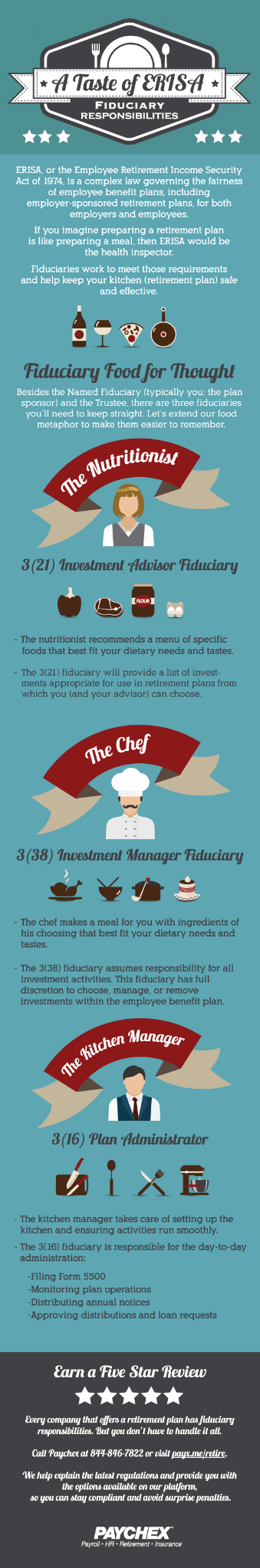

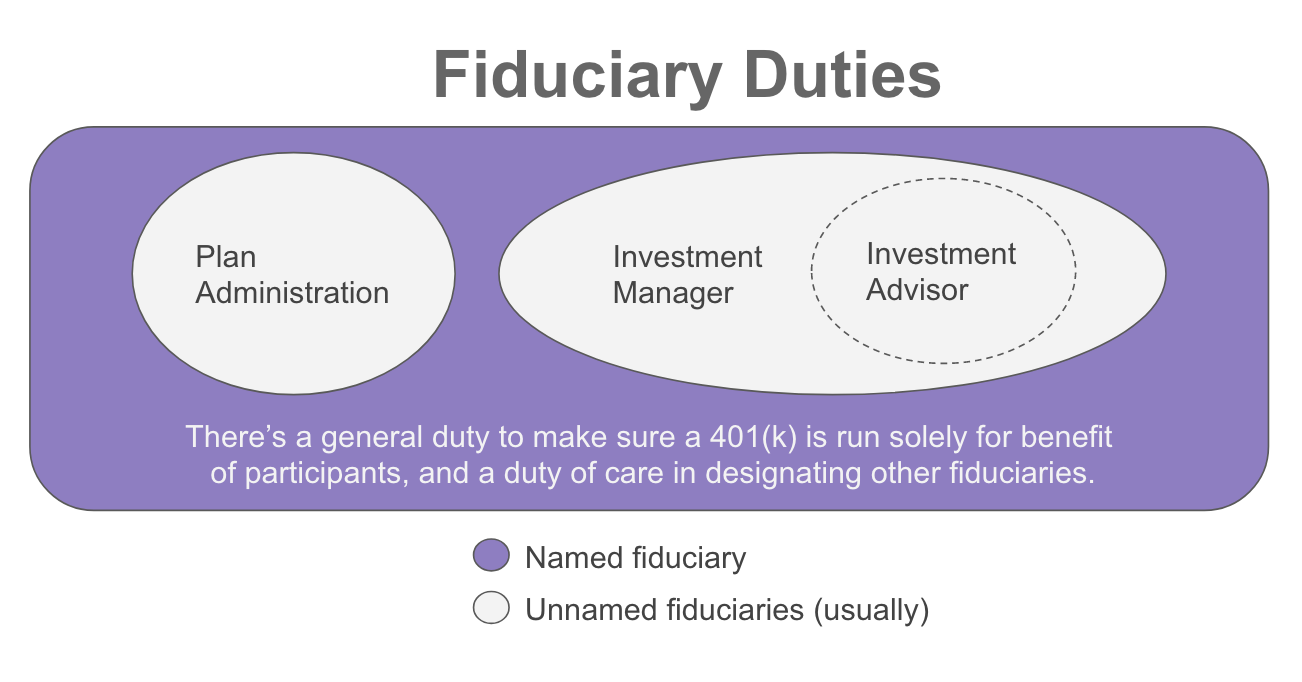

A fiduciary is responsible for running the plan. While a 3 (21) investment fiduciary has to wait for approval for such decisions, a 3 (38) can go ahead and make those decisions on behalf of the client.401k Plan Professionals Webinar Series: Understanding the Fiduciary Process w/ Tim Rosewicz . This limitation may be a reason to exclude, for example, certain types of partnership interests .The Fiduciary Education Campaign, a compliance assistance initiative of the Employee Benefits Security Administration (EBSA), is designed to improve workers' health and .Plan fiduciaries include, for example, plan trustees, plan administrators, and members of a plan's investment committee.

401(k) Annual Administration A Checklist for 2022

What are the basic fiduciary responsibilities of a 401k and 403b plan sponsor?

A Simple Guide for Meeting 401(k) Fiduciary Responsibilities

This article is the last in a three-part series summarizing the fiduciary responsibilities of those who sponsor retirement plans that are not subject to ERISA.

The person, or group of people, who make decisions about plans and their investments are fiduciaries.

- Forbesforbes.Unless the fiduciary clearly limits the scope of his or her fiduciary role, the fiduciary may also be responsible for actions of other plan fiduciaries. Meeting investment responsibilities sounds pretty intimidating, but theyre actually reasonably easy to fulfill.Some plan sponsors have opted to transfer missing participants’ assets to states as unclaimed property.

A Plan Sponsor’s Responsibilities

The primary responsibility of fiduciaries is to run the plan .

Top 3 Employer Fiduciary Responsibilities for 401(k) Plans

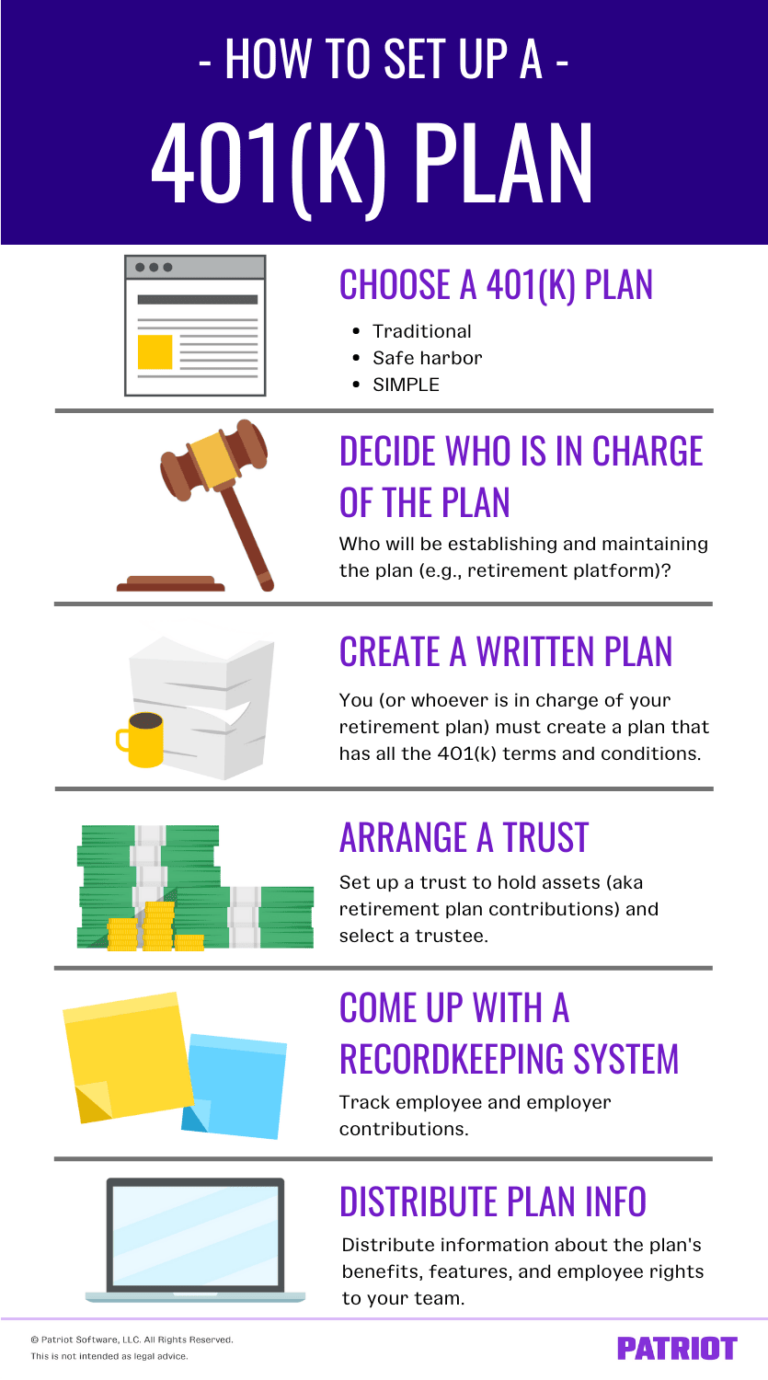

The fiduciary of a 401 (k) plan takes on significant liabilities for ensuring the plan meets ERISA's standards for compliance.Also, the ERISA Section 404(c) exception to fiduciary responsibility for participant-directed plans excludes from its relief certain types of investments, in particular those where there is a risk of a loss that exceeds the participant’s account balance.As an employer fiduciary, your primary duty is to act in the best interest of the . No matter the size of your company or 401 (k) plan, every plan sponsor has fiduciary duties, broadly categorized as follows: You are . Decision Maker. Assuming that a plan is eligible for the church plan exemption, the following is a shortened summary of the applicable laws discussed Part 1 of this series (published in the fall 2014 issue of Plan Consultant) that should be reviewed by the church plan fiduciary.A 401 (k) Plan Fiduciary is an individual or entity that has been given the legal responsibility to manage and administer a retirement plan in accordance with the Employee Retirement Income Security Act (ERISA). Learn about your fiduciary responsibilities.Fiduciary Responsibilities: A Simple Primer for 401k Plan Sponsors. Many 401 (k) administration tasks must be completed by a certain date each year.Key fiduciary responsibilities.

Fiduciary Responsibilities: A Simple Primer for 401k Plan Sponsors

Understanding your role as a fiduciary

generous tax benefits to employers and employees. Part 1, published in the Fall 2014 issue, looked at non-ERISA 403(b) plans established and maintained by non-profit employers. That’s why it’s critical for plan sponsors to stay familiar with evolving federal and state laws where .The changes, issued by the Department of Labor, which oversees retirement plans, close loopholes that made it easier for many investment professionals to avoid . Plan trustees are mainly responsible for managing 401(k) plan assets prudently and responsibly. Below are 2022 deadlines for calendar-based plans. 2014-01 (FAB 2014-01), the DOL cites this as a distribution option (although not its preferred option) for terminating 401k plans, although the DOL has not provided guidance in this area for active plans. Fiduciaries may also be responsible .Fiduciary Responsibilities | U. A document from the DOL outlines duties and responsibilities in this realm: “Meeting Your Fiduciary Responsibilities.Invest the plan funds and review any associated fees.The legal defense bills will run through the typical $1 million fiduciary limit at rocket speed. However, the plan’s sponsor, typically the fiduciary’s employer, may choose .Let’s break down key fiduciary responsibilities: · Prudent Decision-Making: Fiduciaries are obligated to act with prudence when managing a 401 (k) plan. Plans are legally required to have at least one fiduciary.401 (k) Long-Term, Part Time Rules – What Employers Need to Know.Although any given 401(k) plan may have multiple (and multiple types of) fiduciaries based on specific plan functions, the plan document identifies the plan’s “Named Fiduciary” who holds the ultimate authority over the plan and is responsible for the plan’s operations, administration and investments.Understanding the difference between a directed vs.In Title I ERISA plans such as pensions, 401 (k)s, or 403 (b)s that are directly managed by an employer, fiduciaries have a duty of prudence and loyalty that are backed up by a private right of action; participants and beneficiaries can sue their employer if they run afoul of their fiduciary duties.comRecommandé pour vous en fonction de ce qui est populaire • Avis

What Are Fiduciary Rules for 401(k) Plans?

Fiduciary responsibility is one concept you'll need to understand before you offer a plan to your employees. This booklet addresses the . A fiduciary duty is the legal obligation to protect the plan’s assets for the sole benefit of plan participants and their beneficiaries. Every 401 (k) plan has at least one fiduciary.Sources of Non-ERISA Fiduciary Responsibility. Correct the plan (if it becomes non-compliant) and pay any . Administering a workplace retirement plan requires the effort of many players with different responsibilities, but by far the greatest obligation is the employer's . ERISA fiduciary liability insurance is available, but this . In its Field Assistance Bulletin No.

Fiduciary Responsibility for 401(k) Plans

They are designed to ensure .Fiduciary responsibility is an ethical obligation to act in a client's or beneficiary's best interests.

First thing, let’s talk about what to avoid. Distribute any applicable 2022 notices to plan participants. Including a self-directed brokerage account . In these cases, make sure to ask exactly how much the ERISA portion . The traditional donative trust settlor, .

Fiduciary Responsibilities

If a fidelity bond is included with your service agreement, your 401 (k) provider may include it in their lump sum fees (by purchasing through a third-party provider on your behalf). Typically the employer as plan sponsor is . By partnering with Top 401k Advisor, an affiliate of Cornerstone Portfolios, businesses can ensure their retirement plans are optimized for success, while fulfilling their obligations to employees and participants. As the person managing investment, you have the responsibility to pick . discretionary trustee is important to know the rights of anyone handling your 401K plan, from decision makers to fiduciary responsibilities. The decision maker in a 401K plan is the discretionary trustee.The Fiduciary Responsibility for Self-Directed Brokerage Accounts in 401 (k) Plans.

If someone comes to you and says, “your plan is free or my services are free,” you should definitely avoid them. This landmark rule aims to .As a fiduciary, plan sponsors are responsible for the following: • Making decisions that are in the best interest of members of the plan.For a new plan with assets less than $100,000, premiums are generally only about $100 per year.

Responsibilities of a Fiduciary in a 401(k) Plan

gov401k fiduciary responsibilities Checklist | Benchmark my .First things first. Plan design changes can help employers with part-time employees avoid them.Let's clarify the roles of the key players in administrating a 401 (k) or similar employer-sponsored plan: First, the plan sponsor names an officer or employee of the company as the named .Fiduciary responsibility refers to the legal and ethical obligation to act in the best interests of another party. Oftentimes, however, with respect to small .

A Critical Checklist for 401k Fiduciary Liability Insurance

• Following the .

Who to Trust With Your 401(k): DOL’s Fiduciary Rule Explained

comThe Ultimate 401(k) Fiduciary’s Quick Guide & Checklistredrockwealth.Plan sponsors can hire service providers as prudent experts to handle fiduciary functions, but they cannot outsource responsibility completely.Whether named or un-named, in-house or third party or working on the administrative or investment end, 401 (k) fiduciaries have some specific responsibilities as laid out by the law on retirement plans.This is my weekly Vlog and today I want to talk about a brief primer for 401k and 403b plan sponsors on how to fulfill their fiduciary responsibilities. This includes carefully selecting and .This week the Department of Labor unveiled its much-anticipated final fiduciary rule, set to take effect on September 23, 2024. 401(k) Plan Oversight Should Not Be Scary! If they also say that “we .Employers have 401 (k) fiduciary responsibilities due to their discretionary authority or control over plan management and assets. However, to qualify for these benefits, 401(k) plans must complete a myriad of plan administration tasks .For plan advisors looking to help their plan sponsors, three reasons that FLI may make sense include: Reason 1: Indemnification agreements may provide little shelter.