File form 2555 online

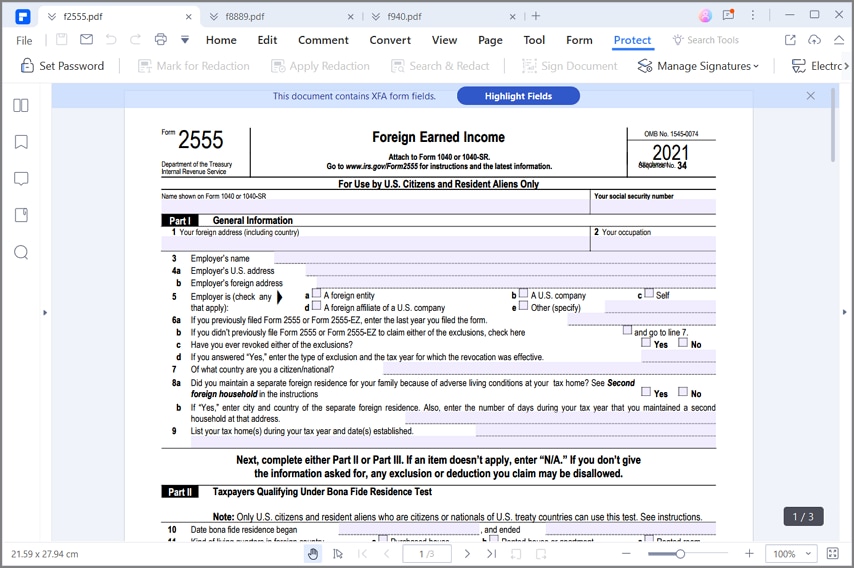

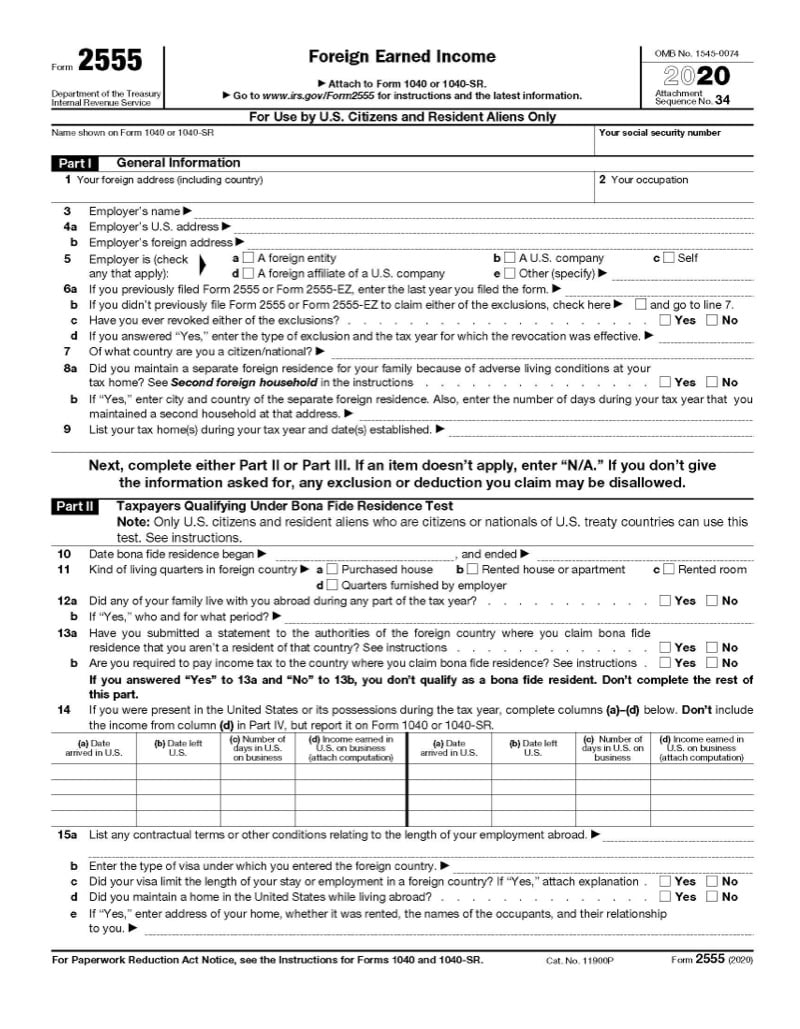

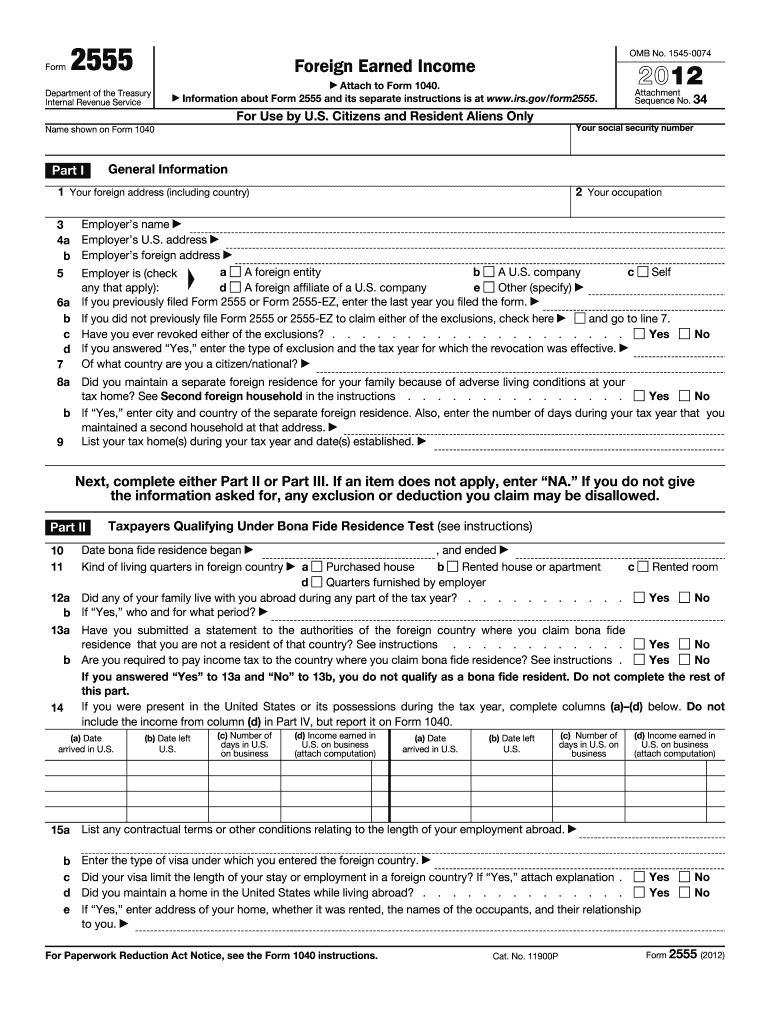

Think of it as the IRS saying, We still love you, even if you're 5,000 miles away. Select Jump to foreign income.IRS Form 2555, Foreign Earned Income, is the tax form that a U. citizens living in Canada, Australia, NZ, the UK, Ireland, and most of the EU countries.Form 2555 - Foreign Earned Income.File your own expat taxes online.Whether expats can use form 2555-EZ depends on their circumstances though.This guide will explore the nuances of claiming this exclusion through Form 2555, a topic of significant relevance for U. If you didn’t previously file Form 2555 or Form 2555-EZ to claim either of the exclusions, check here. Hartford, CT 06176-7008. Designed specifically for U. Special Considerations When Filing Form 2555. If you answered “Yes,” enter the type of exclusion and the tax . tax software for expats is uniquely designed to let you take control and file your taxes yourself with accuracy and confidence — and will help you find every credit and deduction you deserve. But TurboTax and form 1040-v instruction said I should mail it to following address instead since I also file form 2555: Internal Revenue Service. citizens or resident aliens living abroad.You can be a short-term or long-term/permanent expat to take advantage of this benefit. This form allows an exclusion of up to $107,600 of your foreign earned income if you are a U. These forms must be included with your return if you are a US Citizen or resident alien with income earned in another country, regardless of whether U.

Department of the Treasury Internal Revenue Service Austin, TX 73301-0215 .

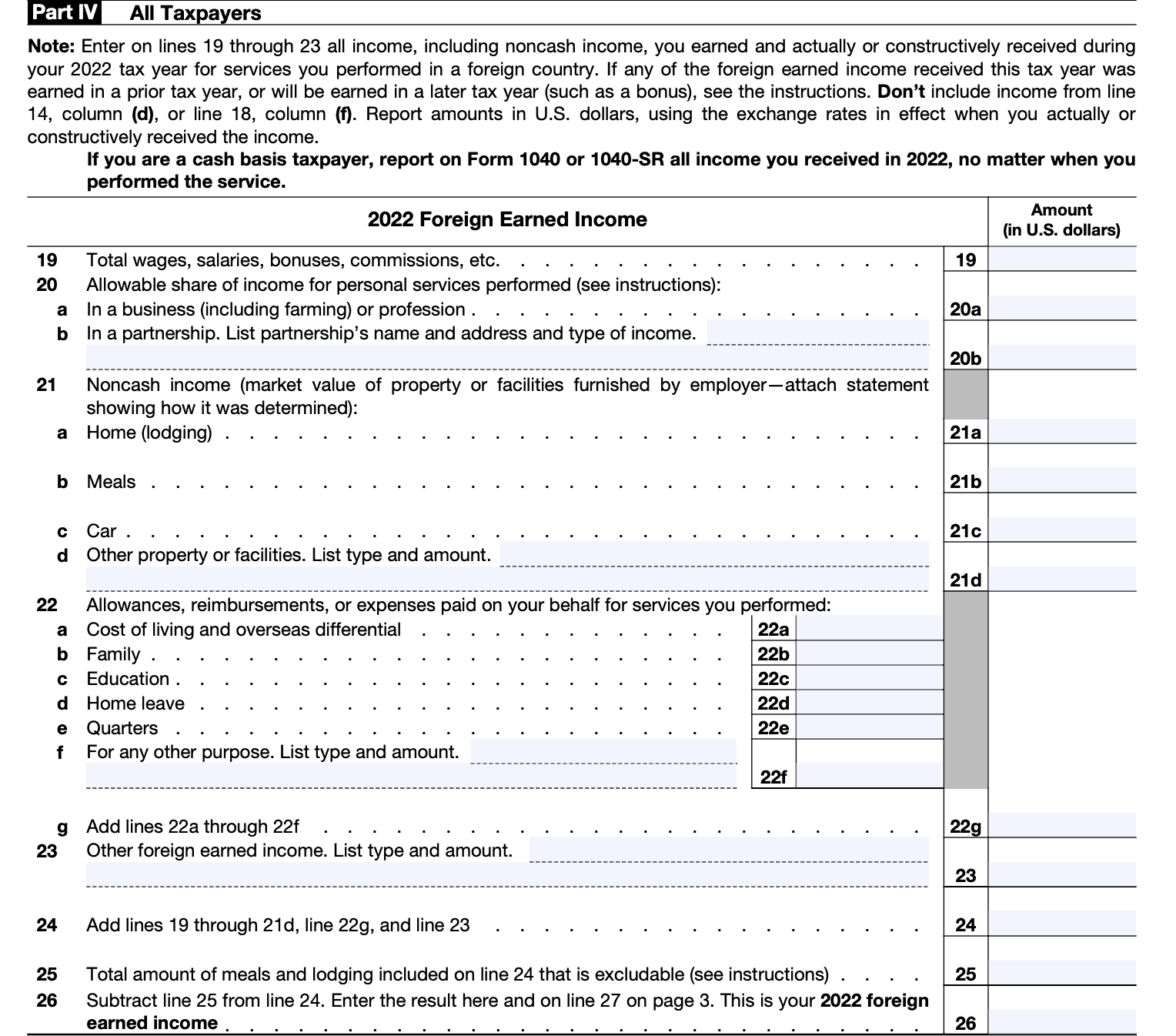

2022 Instructions for Form 2555

Form 2555 is the form you file to claim the Foreign Earned Income Exclusion, which allows you to exclude up to $120,000 of foreign earned income for the .

To claim the FEIE, you need to file IRS Form 2555 and attach this to your expat tax return.Recommandé pour vous en fonction de ce qui est populaire • Avis

IRS Form 2555

Eligible taxpayers will file this tax form with their income tax return.

UK Income Tax Guide for American Expats

Allows to carry out work on a .Form 2555, or as I like to call it, The Expat's Shield, is the IRS form used by U. They both work to prevent double-taxation on income earned abroad, but the FEIE deducts your foreign income from your yearly tax filing and the FTC lets you claim a dollar-for . If you qualify, you can use Form . Mail your Form 1040 or 1040-SR to one of the special addresses designated for those filing Form 2555. Then, attach it to your US Tax Return and send it in the mail.

Manquant :

onlinePrior declaration for a detached house and/or its annexes

for 2014 I turbotax online used this form for foreign earned income, but I just noticed it didn't use it last year or this year.A foreign country, U.The foreign Earned Income Exclusion (FEIE) is available to certain Taxpayers who qualify for either the Bona-Fide Residence Test (BFR) or Physical Presence Test (PPT).

Form 2555

this is not a good way to file US tax returns . Attach to Form 1040 or 1040-SR. Prior declaration for a detached house and/or its annexes - DPMI (Form 13703*11) Ministry of city planning-Cerfa n° 13703*11.

In order for a Form 2555 to be considered timely filed, it must be attached to your timely-filed income tax return. To skip the easy form filing via MyExpatTaxes, you can fill out the form manually through Form 2555. For married joint filers the threshold is $27,700, and for Head of household it is $20,800. resident alien living and working in a foreign country.Form 2555 is typically used by U. Your foreign address (including country) 5 Employer is (check a A foreign entity b A U. Form 2555 is typically used by U. In 2024, this magic number is up to $126,500. For example, if your foreign earned income is $118,000, you can only exclude foreign earned income up to $107,600 (2020amount) on the Form 2555 which will reduce your taxable . Department of the Treasury Internal Revenue Service. This is not tax or legal advice.6 (as of 10-01-2019).So, you would have to file a US tax return for any government support over $5.comAbout Form 2555, Foreign Earned Income | Internal .

govRecommandé pour vous en fonction de ce qui est populaire • Avis

About Form 2555, Foreign Earned Income

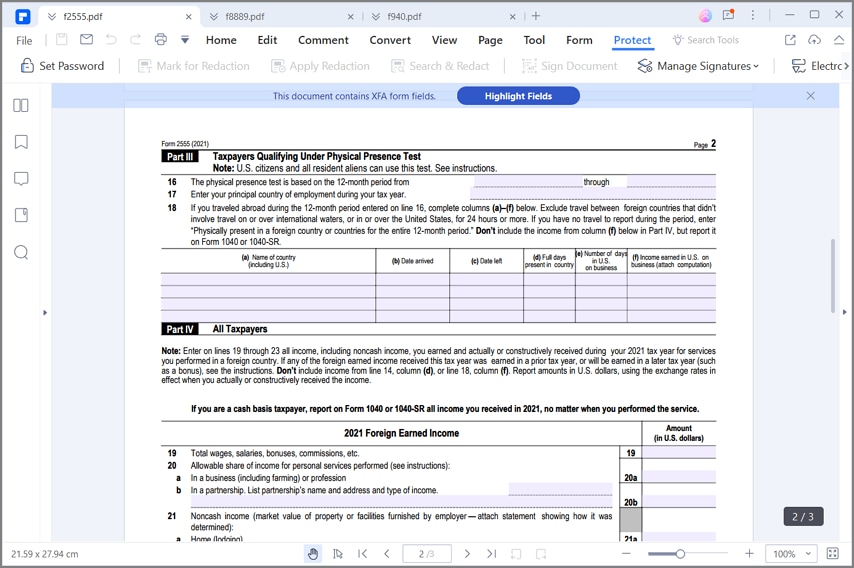

When a taxpayer meets the requirements to qualify for foreign income exclusion using Form 2555 — they are able to exclude upwards of $107,600 of their foreign earned income .Step 10: File the form. person, citizen or resident, may use to: Declare the amount of income earned while living outside the United States. If you are married to a US citizen or green card holder, and both you and your spouse are working and living abroad, then both of you must fill out a separate Form 2555 in order to claim the exclusion. citizens living overseas.Generally, Form 1040-X must be filed within 3 years after the date the original return was filed or within 2 years after the date the tax was paid, whichever is later. Form 2555-EZ is a simplified version of this form. company e Other (specify) 6 a If you previously filed Form 2555 or Form 2555-EZ, enter the last year you filed the form. The purpose of this form is to calculate the foreign earned income exclusion and/or the housing exclusion or deduction.Form 2555 Instructions: A Guide for Expats - Greenback . citizen living abroad is still required to file an annual Form 1040 tax return and pay taxes on their worldwide . 13K views 1 year ago International Tax Forms and Topics. However, if you live outside the U.What Is The Purpose Of Form 2555? Form 2555 is used to claim the Foreign Earned Income Exclusion (FEIE). If you are mailing a paper return, send it to the appropriate IRS address for your location. At the right upper corner, in the search box , type in foreign income and Enter.The most notable and important foreign income forms for a U. Those who cannot meet the minimum requirements can apply for . It’s frustrating for expats, but all US persons (both citizens and permanent residents) are required to file a federal tax . Despite receiving the same amount of income from the government, if you were single you would not have to file, but if you were married to a non-American, you would have to file.Enter the lesser of Line 40 or Line 41 on Line 42, and you will have your final Foreign Earned Income Exclusion for the year. To qualify, taxpayers must meet certain requirements, such as the tax home test and the physical presence test. Im going through the process of filing my 2023 USA federal taxes and I’m confused about my foreign earned income and form 2555.Do I file form 2555 or not? I’m a Japan/USA dual citizen, moved to Japan from the USA (no visa) for the first time back in July of 2023. Considerations and Drawbacks: Claiming the foreign earned income exclusion can affect eligibility for other tax benefits and comes with certain restrictions. citizens and residents working overseas.What is Form 2555 and When is it Required to be Filed?goldinglawyers.If you are working and/or living abroad and meet certain requirements, you may be eligible to use the Foreign Earned Income Exclusion.

Instructions for Form 2555 (2023)

Foreign Earned Income.Instructions for Form 2555 - Introductory Material.

IRS Form 2555

You may use Form 2555 and Form 1116 on the same return, but you cannot use the same earnings (and taxes paid relating to those earnings) on both forms. on April 15th, you are entitled to an automatic extension (without the . tax form for American citizens or resident aliens residing .teachmepersonalfinance.

Form 2555 is a tax form that can be filed by US citizens and Green Card Holders who have earned income from outside the United States and Puerto .

Manquant :

Start for free.Manquant :

onlineIf you previously filed Form 2555 or Form 2555-EZ, enter the last year you filed the form. Virgin Islands, or the Northern Mariana Islands, see Pub 570. income was also earned or not. File Form 2555 along with your tax return. If you meet the requirements, you can .Exclusion and Foreign Tax Credit (or Deduction)

greenbacktaxservices. Investor & self . citizens or resident aliens living abroad to exclude a portion of their foreign earned income from U. Form 2555-EZ is a . *If you live in American Samoa, Puerto Rico, Guam, the U. If eligible, you can also use Form 2555 to request the .Disclaimer: This video is for entertainment purposes only.Information about Form 2555, Foreign Earned Income, including recent updates, related forms, and instructions on how to file. citizens or resident aliens who work and earn income abroad and want to exclude some or all of their foreign earned income from U. To enter foreign earned income / exclusion in TurboTax Deluxe online program, here are the steps: 1. TaxAct, normally the more “affordable” tax software in America can provide less of a user-friendly guidance system to help US expats file taxes efficiently and all online. If you are e-filing your tax return, follow the instructions provided by your tax software.

company any that apply): d A foreign affiliate of a U.

2555-1116

: r/USExpatTaxes

Form 1116 vs Form 2555 Many expats ask us if they should file Form 1116 or if they should file Form 2555 to claim the Foreign Earned Income Exclusion instead. Enter the FEIE as a negative amount on Form 1040, Schedule 1, line 8d “Foreign . Form 2555, known as the Foreign Earned Income Exclusion form, is a critical U. possession or territory*, or use an APO or FPO address, or file Form 2555, or 4563, or are a dual-status alien. Here's how to add or remove a Form 2555 or 2555-EZ from your return: Sign in to TurboTax and open or continue your return.

International

Have you ever revoked either of the exclusions? . Citizens and Resident Aliens Only.US Expat users of TaxAct will need to use the Premier+ Version, which starts at $64.

DIY Expat Tax Filing Online

Form 2555: Foreign Earned Income

Once it’s completed, carry over the calculations to your Form 1040.Another common theme with these programs is to force users to take the Foreign Earned Income Exclusion (Form 2555) which can put the majority of US citizens living abroad at a major disadvantage.

If you are married to a US citizen or green card holder, and both you .