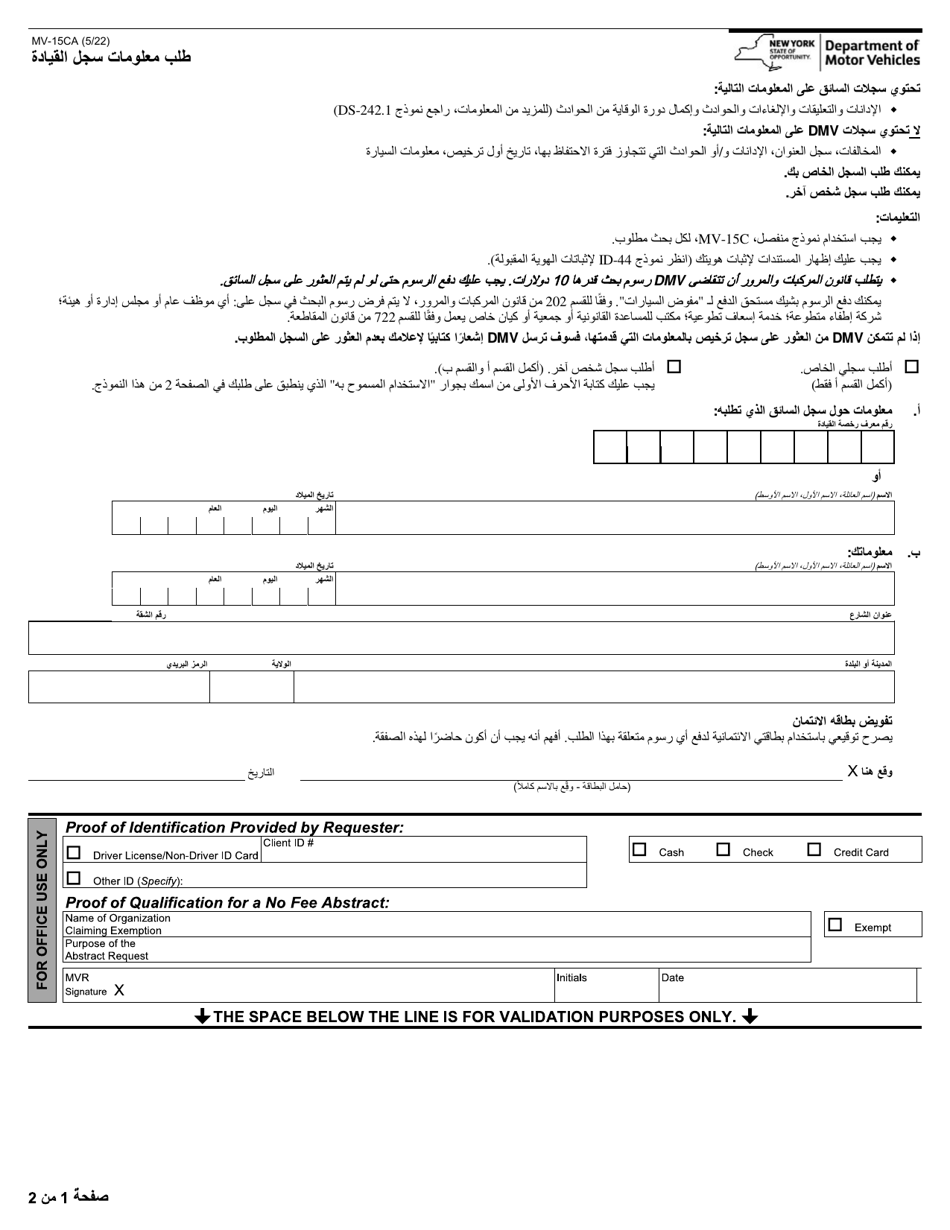

Fillable form 15ca

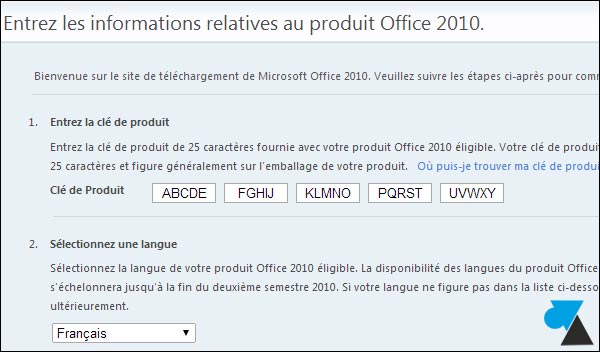

15CA form is the remitter’s declaration for taxable payments made to non-resident recipients.p65 Author: testing Created Date: 11/25/2019 11:49:54 AM This document contains a form for reporting information related to remittances made to non-residents in accordance with Section 195 of the Indian Income Tax Act of 1961. Launch Adobe Reader. 2021 540 booklet. Under the “Attach the ITR XML file”, attach the XML file.The process of filing Form 15CA and 15CB online involves several steps. I mailed a copy of the document identified above as follows: Electronic service.

Income Tax Form 15CA filing-Excel revised Form 15CB-Rule 37BB

2DCA-15

This tool will not translate FTB applications, such as MyFTB, or tax forms and other files that are not in HTML format.Previous years: Accessible Fillable PDFs.Form 15CA is a declaration by any person intending to make remittance: To non-resident or to a foreign company (irrespective of whether remittance is subject to . Some publications and tax form instructions are available in HTML format and can be translated.Critiques : 57Checking your browser before accessing incometaxindia. The revised rules and forms shall be effective from 1st April, 2016. On confirmation, a filled up Form 15CA with an . I personally delivered a copy of the document identified above as follows: Date mailed, electronically served or . Part B of form 15CA b.Find Your Court Forms.Form 15CA & 15CB FAQs: Filing, Compliance & Remittance Details.Access to Canada Revenue Agency (CRA) forms, tax packages, guides, publications, reports, and technical notices.You can order alternate formats such as digital audio, electronic text, braille, and large print.Form 15CA is a declaration made by remitters of payments to non-residents and used as a tool for collecting information about the payments that are chargeable in . Step 3: Fill out the form with accurate details like name, address, and PAN.pdf) 2013 – Fillable PDF (t1235-fill-13e. Important Dates. (Name of Court) at. If a user is already registered on the web, he must log in with the correct credentials, which are normally the PAN number and the password. 15CA (See rule 37BB) Information to be furnished under sub-section (6) of Section 195 of the Income-tax Act, 1961 relating to remittance of payments to a non . The process includes parts A to D depending on remittance amount and .Critiques : 37 Visit our Forms and Publications search tool for a list of tax forms, instructions, and publications, and their available formats.

Income and Expense Declaration

The following FATCA forms and instructions are available: Individuals.as indicated below (complete either a, b or c): Mail. , dated the agreement for support between the parties, dated. Form A2 (on page . Earned Income Tax Credit.

2021 Personal Income Tax Booklet

A confirmation screen with all the data filled by the user will be displayed. Form 15CA is then required to be uploaded by the remitter electronically at the site of the Income-tax Department. The same can be either confirmed or edited.pdf) 2005 – Fillable PDF (t1235-fill-05e.Part A of form 15CA b.

How To File E-Form 15CA And 15CB

Not sure what form you need or how to proceed? There are a number of free resources available to help with your legal problem.What is a T4A slip. To be able to fill in and save a PDF form, download and then open the form using the free Adobe Reader: Save the PDF fillable/savable form in a folder that you will easily find on your computer.Income and Expense Declaration (FL-150) Give your financial information to the court and to your spouse or domestic partner. Complete a blank sample electronically to save yourself time and money.Do whatever you want with a Form 15CA and Form 15CB when remittance is not taxable - TaxGuru: fill, sign, print and send online instantly.Form 15ca is a statement of remitter that is used to gather information on payments that are taxable in the hands of a non-resident receiver. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. It also helps the Income tax department to Form 15CA operates based on Tax .Step 1: Go to the income tax department website.

The Form should be . Date modified: 2023-06-30.pdf) 2015 – Fillable PDF (t1235-fill-15e.Critiques : 30

incometaxindiaefiling.Form 15CA: declaratory form for tax payment on non-resident transactions.

Fillable Online Form 15CA FAQsIncome Tax Department Fax

Saving, opening and using the forms.% Income-Tax Department FORM NO. This is a payment accumulating form for the Income Tax .pdf) 2009 – Fillable PDF (t1235-fill-09e. Submitted by Prabu on Wed, 03/11/2020 - 13:47. Fulltext search.

Form15CA UM

Choose the appropriate options; if you select that you want to sign the form digitally then you .Sign and date the form to certify the information provided is true and correct.

Fillable Online Form 15CA and Form 15CB when remittance is

Downloadable PDF of Form 15CB in all successful cases will be made available in view filed forms. Go to the “e-file” menu that is located on the upper left side of the page, click on “Upload Form 15CA (Bulk)”. A signed printout of both Form . 2021 Instructions for Form 540 Personal Income Tax Booklet Revised: 07/2022.Filling and saving PDF forms. If the remittances or payment are not liable to Non-Resident Indians, Form . The details required to file Form 15CA-Part –D are very basic such as name, address, PAN of remitter and receiver, the sum in Indian and Foreign Currency to be remitted and bank details of remitter. Civil Harassment. Obtain a certificate in Form 15CB from a chartered accountant certifying details of the payment, TDS rate, and compliance with the Income Tax Act.The Form 15F and related materials must be in the English language as required by Regulation.Overview

Instructions and Utility for Fillable Forms

Form 15CA FAQs

If you are not familiar with how our forms work, you may want to read our user guide.

How to Fill Form 15CA.Critiques : 55Form 15CA is a mandatory form to be filed for foreign remittance to a non-resident. Step 2: The General Instructions is provided in the Utility.Fill out Form 15CA with details such as name, address, PAN, country of remittance, amount of remittance, taxability under the Income Tax Act, etc. Step 2 – Login to e-Filing, Go to e-File -> Upload Form, Enter PAN/TAN of assesse, PAN of CA, Select Form Name as 15CB, Select Filing Type as Original.Form 15CA FAQs. Step 1 – Download FORM 15CB utility from Downloads page and prepare the XML File. Sample of Form 15CA is enclosed.3 Download Pre-Filled Form (Form 15CA - Part C) Step 1: Under the Forms in Utility tab, click the Form 15CA option. Please refer to these instructions for saving and opening the forms. If he is not already enrolled, he must click on the “Register” button on the website and then fill in all of the necessary information and fields to complete his registration on the web. Securely download your document with other editable templates, any time, with PDFfiller. S-T Rule 306 (17 CFR 232. Complete a blank sample electronically to save yourself time andCritiques : 45 This form is also available for the years listed below: 2019 – Fillable PDF (t1235-fill-19e. Select the ‘e-File’ option and click on .

Form 15CA and 15CB: Complete Details With Examples

in This process is automatic.Department of Defense Forms Program (external link) General Services Administration, Standard and Optional Forms Management Program (external link) Internal Revenue . Enhancing Transparency: Form 15CA mandates remitters to provide comprehensive details of the remittance, including its purpose and nature, this ensures . Amount of transfer request or aggregate of such transfers during the current financial year exceeds ` 5,00,000/-& An order/certificate u/s 195(2)/195(3)/197 of IT act has been obtained from Assessing a. The court uses the information to .txt) or read online for free.Filling Guidelines of Form 15CA.

On any device & OS. T3SCH15 Beneficial Ownership Information of a Trust. Step 3 – Upload the XML generated from the downloaded utility. 15CA (See rule 37BB) Income-Tax Department Information to be furnished for payments, chargeable to tax, to a non-resident not being a company, or to a foreign .Form 15 CA and 15 CB - Free download as PDF File (. Applicant(s) Full legal name & address for service — street & number, municipality, postal code, telephone & fax numbers and e-mail address (if any). The person making the payment, after obtaining the Certificate in Form 15CB from a Chartered Accountant shall furnish information in Form No.

Forms and Publications

Step 4: Provide information about the remitter and remittee. Your browser will redirect to requested content shortly.Login to the portal – https://www. Learn how to upload Form 15CA. Child Custody and Visitation.pdf), Text File (. CBDT vide its notification no. Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain . A person responsible for making such remittance (payment) has to submit . As per revised rules, form 15CA has been divided into three sections and the person responsible for payment shall .Filing process of Form 15CB.pdf) 2018 – Fillable PDF (t1235-fill-18e.Provisions applicable with effect from 01-04-2016. A T4A slip identifies amounts paid during the calendar year for certain types of income from many different sources including self-employed commissions and RESP educational assistance payments. Form 15CB: certificate for tax deductions compliance.Fill Form 15ca And 15cb Download, Edit online. , filed with the court on. No software installation. Step 5: Enter details of the nature of remittance and the purpose of remittance. What is Form 15CA? Here’s a brief overview of the procedure: Visit the official website of the Income Tax Department and select the ‘e-File’ option. Both Form 15CA- CB are filed electronically using digital signature.

Form 15CA FAQs

If you continue to .

T4A slip

The Form 15CA should be appropriately filled, signed, and submitted to the Reserve Bank of India or an authorized dealer before making the Remittance. You can get a Form T4A in a PDF or PDF fillable/saveable format to file on paper. This FAQs on filing of Form 15CA / 15CB on new Income tax portal for NRI is a humble attempt to put to rest those fears and ensure a smooth process of submission and compliance. Form 15: Motion to Change the order of Justice.What is Form 15CA? As per Section 195, every person making a payment to Non-Residents (not being a Company), or to a Foreign Company shall deduct TDS if such . Court office address. Taxpayers are also provided an export option to download the ARN number, .pdf) Print and fill out by hand. You must provide the signature required for .

T3SCH15 Beneficial Ownership Information of a Trust

Form 15 CA and 15 CB

Step 2: Download Form 15CA from the forms section.