Fintech in digital banking

Initially launched to provide financial services, investment and lending products, the fintech has since moved into the digital banking space , with scaling success swiftly following.Hickman thinks not, and says the benefits balance out the challenges.

Top Fintech Digital Banking News & Insights

What is Fintech? Finance Gets a Tech Makeover. Oct 2, 2023 2 min.Technologies financières (fintech) L’évolution rapide des fintech, un défi pour les régulateurs.The Surge and Evolution of Digital Banking in France: Balancing Tradition with FinTech Innovations. By 2021, MoneyLion . With mobile usage expected to increase to 64 percent in 2018 from 53 percent . marketplaces, and financial inc .This visionary statement made in 1994 by Bill Gates, the Founder of Microsoft Corporation, signaled the shift of a bank-dominated landscape toward the rise of financial technology (or fintech) in the coming decades. Advanced Self-service Features: Not so long ago, when you visited a bank, you would expect to wait in long queues for assistance. “A flexible, platform-based approach can allow credit unions to benefit from the fintech boom, by incorporating new apps to aid in creating new channels of income. With the digital user . Indian Fintechs have been the posterchild of India’s digital growth story, with their growth propelled by a surplus of capital, maturing infrastructure and favorable underlying customer demographics. For example, Wells Fargo recently added a predictive banking feature that analyzes account . Semantic Scholar extracted view of Fin Tech Banking – The Revolutionized Digital . Communicating this narrative is .5 trillion in annual revenue by 2030, . Fintech is seen as one of the technologies that has the ability to revolutionize the banking industry.Fintech refers to software, algorithms and applications for both desktop and mobile.

The FinTech Industry – The Harbinger of Agility and Enabler of a Versatile Digital Experience Here are some ways through which the FinTech industry has made banking simple: 1. Currently, 40% of the population does not have access to financial services, with 87 percent relying on cash payments. Each of the main retail banking business models requires an IT infrastructure that is .

Digital Banking Maturity 2023

In the world of personal finance, consumers have increasingly demanded easy access to their bank accounts, especially on a mobile device.Fintech was a much-needed boost for the Islamic finance industry . FinTech Magazine and . FinTech Magazine and its entire .BizClik’s FinTech portfolio connects banking, financial services, payments, technology & consulting brands and their most senior executives with the latest FinTech trends, industry insight, and influential FinTech, InsurTech & Crypto projects as the world embraces CX, Business Transformation and Digital Ecosystems. Glasgow, United Kingdom.

Master with FinTech & Digital Banking in Malta

The fintech sector, currently holding a mere 2% share of global financial services revenue, is estimated to reach $1.

What is fintech (financial technology)?

As a result, India may become a breeding ground .

Shariah-compliant FinTech in the banking industry

As the inaugural Neobank in Kenya to be .Knowledge is power, and by reaching out and getting informed, FIs can begin to think about open banking compliance in a way that works for them.

19 Fintech Banks and Neobanks to Know 2024

Latest 'Digital Banking' news & feature articles

Banks Leverage FinTech Partnerships to Ride Digital Transformation Wave. Importantly, the .Recently, various academic researchers and Islamic Fintech reports have concluded that the variety of financial services used by the Islamic financial services has increased and most of it includes the Fintech-based services (Dinar Standard, 2020; Rabbani et al.Among other outcomes, the impact of fintech on.Banking & Capital Markets. Prateek Roongta Rajaram Suresh Sheetal Jasrapuria. the banking industry in the UK and Europe has led to innovations, better customer serv ice, more competitiv e. The innovative financial technologies (FinTech) being introduced by banks and FinTech businesses in Canada are increasing choice and improving convenience for customers. The region also has one of the highest rates of . Technology is changing the way financial products and services are accessed and used by Canadians. Whether it was opening an account . Business, Economics.“We have seamlessly transitioned the National Bank of Iraq to a cutting-edge core banking system which will not only enhance operational efficiency but also support providing our customers with a superior digital banking experience.

Fintech and digital banking: GCC countries reserve their seats

The trajectory of digital banking apps hints at a future where financial transactions seamlessly blend into daily life. James Gorman, Morgan Stanley. Australian-American financier James Gorman has been CEO of Morgan Stanley since 2010.

(PDF) FinTech Innovations in Digital Banking

FinTech innovations affect everything from large, traditional banks to your family-owned, small business. The good news for Fintechs is that India’s digital infrastructure is only . A study by Fiserve in 2010 demonstrated that both online and mobile banking were growing at a faster pace than .The financial and banking sector has undergone a significant digital transformation in 2023, driven by a focus on ESG commitments, macroeconomic . Dans une ère où l'innovation dicte le rythme du changement, Deloitte dévoile son étude . Whether you’re currently a financial services professional or just starting your career search, earning your Master of Science (MSc) in Management (FinTech & Digital Banking) in Malta (hereinafter - FinTech & Digital Banking in Malta) will make . With the help of entrepreneurs such as Mansur, it is hoped that P2P lending will become part of Indonesia’s financial landscape.Bank’s Digital Spending is Through the Roof. The ongoing digitization of financial services and money creates opportunities to build more inclusive and efficient financial services and promote economic development.From entirely mobile banks and payments between friends to AI-enhanced chatbots and anti-money laundering software, check out how these fintech banks and . Most fintechs were .However, fintech is also growing in other financial spheres, including blockchain, mortgages and neo-banks.Digital Banking Maturity 2023. Its services cover areas like digital banking integration, account switching, sales and marketing, customer acquisition and onboarding and fintech ecosystems that clients can design and offer to their customers.

The future of Fintech in India report

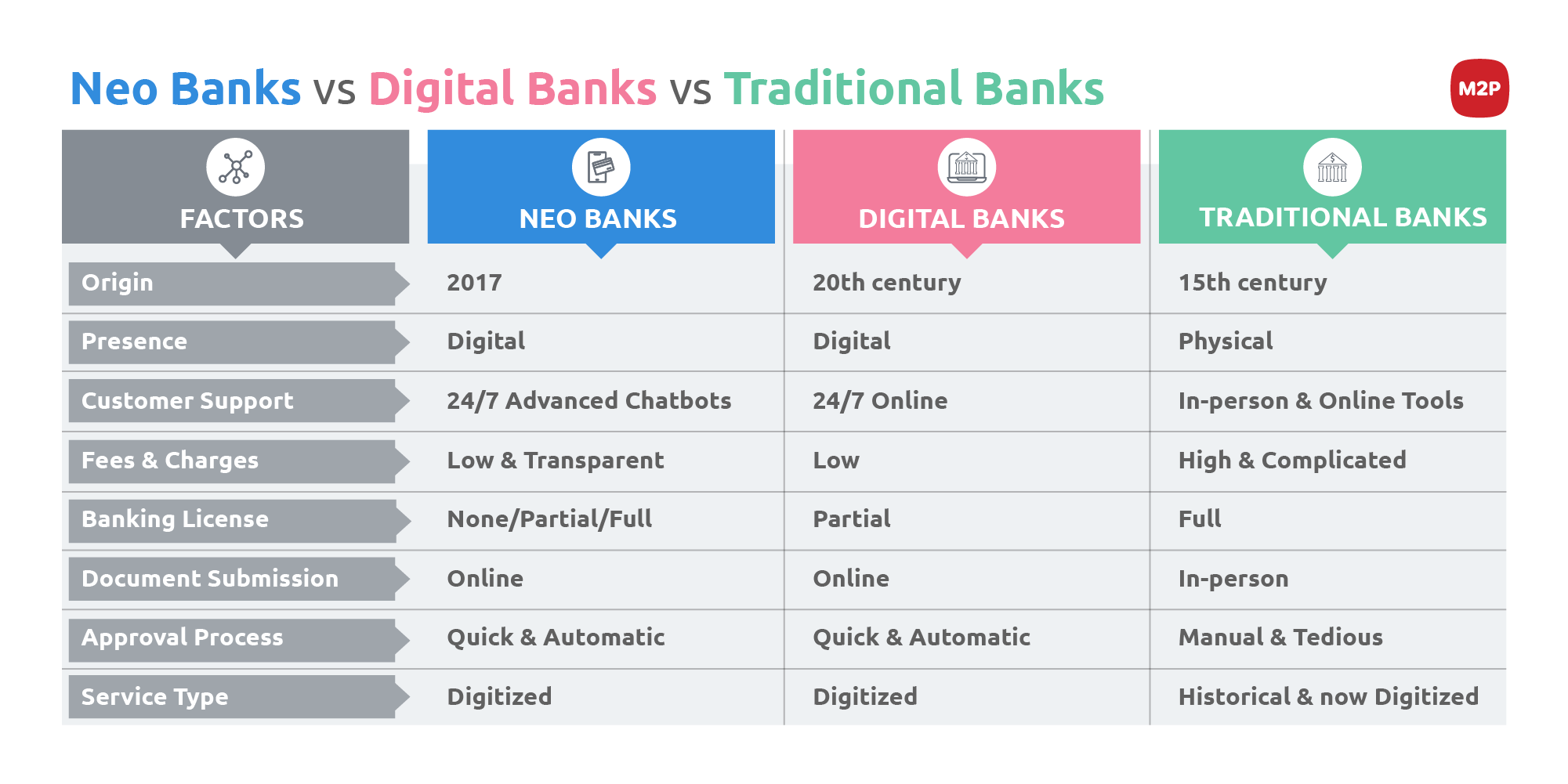

Digital natives such as Pockit or Stash, either without, or with a recently granted banking license, challenge the products, services and user experiences of traditional banks and financial service organisations.The global digital banking market was worth US$12.

113 Top Fintech Companies & Startups To Know In 2024

Combining the words ‘financial’ and ‘technology’, fintech is technology-enabled financial innovation, which is changing the way financial institutions provide – and consumers and businesses use – financial services. Insights & Data. De nouvelles entreprises ouvrent rapidement des brèches dans les services financiers essentiels et . In some cases, it includes hardware, too—like internet-connected piggy banks.The Fintech Philippines Report 2023 examines the state of the fintech sector in the Philippines, noting the pivotal developments in regulations that is helping foster a digital financial ecosystem in the country, along with notable new highlights being spearheaded by the central bank, Bangko Sentral ng Pilipinas (BSP) and complementary . Nicolas Bédu, Caroline . Abstract: Recently, Fintech technologies have . Most major banks now offer some kind of mobile banking feature, especially with the rise of digital-first banks, or neobanks.Bien que les fintechs soient reconnues aujourd’hui comme la principale force motrice de l’innovation dans le secteur bancaire et financier, les défis de survie sont .Bhavya Kumar, managing director and partner at Boston Group, predicted that the GCC fintech sector would be worth $3.Fingo Africa stands out as Kenya’s leading digital-only banking platform, tailored specifically for the youth of the country. Fintech Nexus delivers the latest digital banking news and analysis in the fintech industry.THE FUTURE OF INDIA'S FINTECH AND DIGITAL BANKING In 2016, Sironi published the book that compared the prospects of other Fintech-based companies to that of traditional banking.Technology-led innovation in banking.Mobile banking is the central focus of many fintech companies. In 2009, Ally Bank was founded – the world’s very first all-digital bank.Key Differences Between Fintech and Digital Banking.1bn in 2020 and is expected to hit approximately $30bn by 2026.

Retail banks have led the charge in upgrading digital experiences to match fintech in their core banking products.A cutting-edge technology stack to reduce costs and speed up innovation. The future of fintech, according to experts, will entail even more innovation, with an increasing emphasis on offering seamless, 360-degree financial services and lowering conventional hurdles, . The bank of the future will integrate disruptive technologies with an ecosystem of partners to transform their business and achieve . The digital transformation of banking continues to reshape how financial institutions .3 Scope for Growth of FinTech and digital banking in India.Les banques françaises face à l’émergence des FinTechs de paiement et de crédit : dynamique réglementaire et changement technique.

Why Fintech is Key to the Future of Banking

The banking industry should be a leader in digital accessibility. The level of digital adoption among consumers in developed Asia–Pacific markets has remained stable at approximately 90 percent .Whether it be a digital banking app, a financial management tool, or an investment platform, mobile apps are nearly synonymous with fintech.Fintech has seen explosive growth in recent years as new businesses and technologies have transformed the way we think about banking and money.Fintechs—short for financial technology—are companies that rely primarily on technology to conduct fundamental functions provided by financial services, affecting how users store, save, borrow, invest, move, pay, and protect money.

The future of fintech growth

Consumer use of digital banking in Asia–Pacific has entered a stage of acceleration, fueled largely by .

Fintech Digital Banking: The Future Of Fintech And Digital Banking

Web-based solutions: On top of offering a mobile app, some (but not all) fintechs also offer a web-based solution where users can log in via a web browser and perform the same functionality .

Digital banking transformation: Accelerating into 2024

Fintech start-ups identify marketplace gaps to solve them with improved business models and .Témoignage de la transformation digitale en cours dans le secteur bancaire français, l’étude Digital Banking Maturity permet d’évaluer plus de 500 fonctionnalités, regroupées dans .Emerging markets leap forward in digital banking innovation and adoption | McKinsey.As of June 2017, Yusuf Mansur, co-founder of Paytren has applied for his start-up to become Indonesia’s ‘first Shariah-compliant, mobile, P2P lender’.

Manquant :

digital bankingBelow, we take a look at the Top 10 CEOs leading their respective banks in an increasingly digital banking landscape.Fintech, the application of digital technology to financial services, is reshaping the future of finance– a process that the COVID-19 pandemic has accelerated.Top 10 Digital Banks of 2022

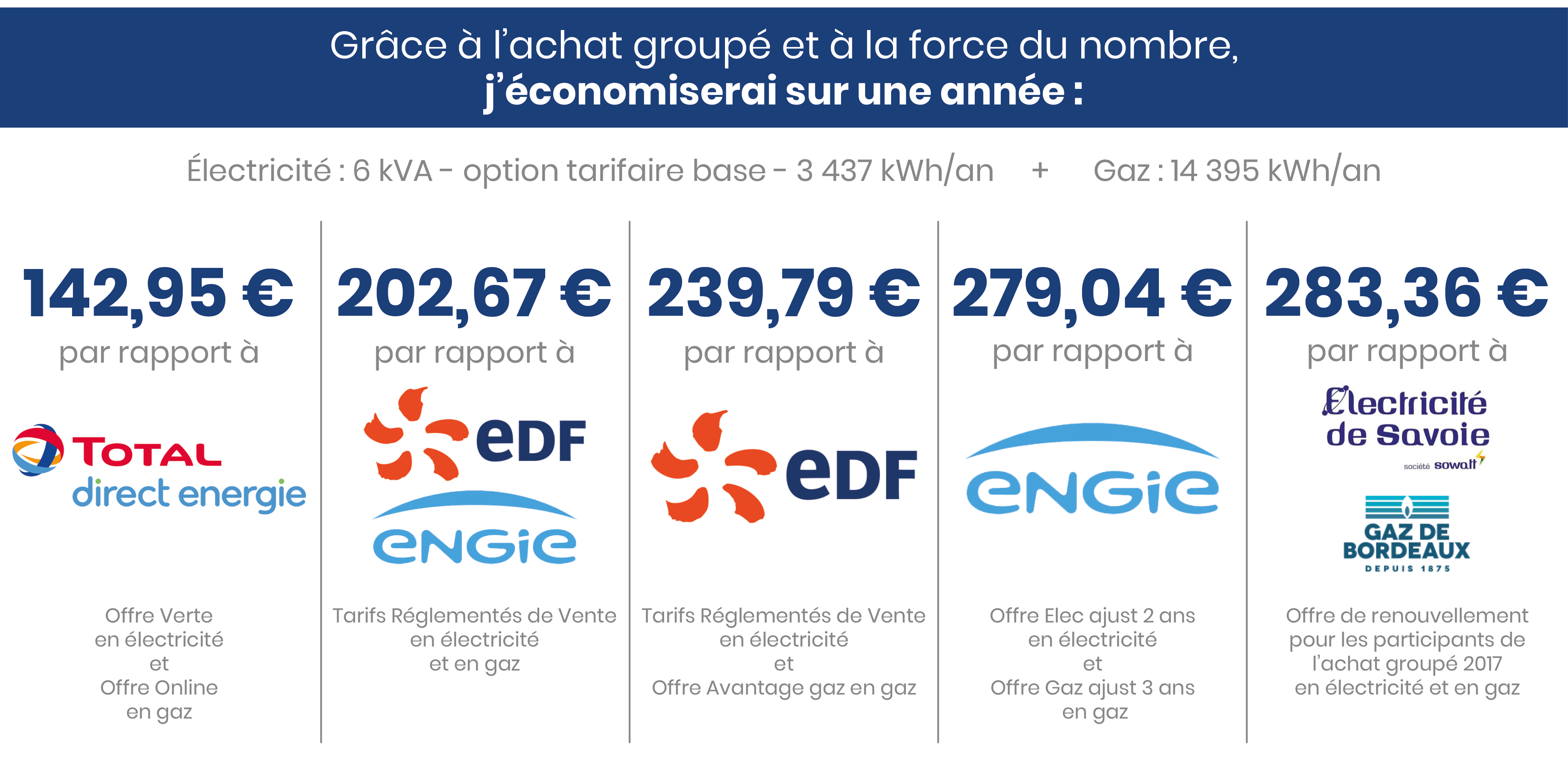

According to reports, by 2006, 80% of all US banks were providing internet banking services – and the trend has shown no signs of slowing down. It’s clear that this fast-growing, lucrative . Les acteurs spécialisés cherchent à attirer cette clientèle avec des formules compétitives.First, fintechs will continue to benefit from the radical transformation of the banking industry, rapid digital adoption, and e-commerce growth around the world, .Between 2017 and 2021, the share of consumers in Asia–Pacific emerging markets actively using digital banking increased sharply, rising 33 percentage points from 54 percent in 2017 to 88 percent in 2021.Capstack Technologies’ founder and CEO Michal Cieplinski believes he has the antidote to the Silicon Valley Bank meltdown, and Citi Ventures agrees.Many started by trialing digital offerings in non-core businesses or geographical areas, where they could take more risks.