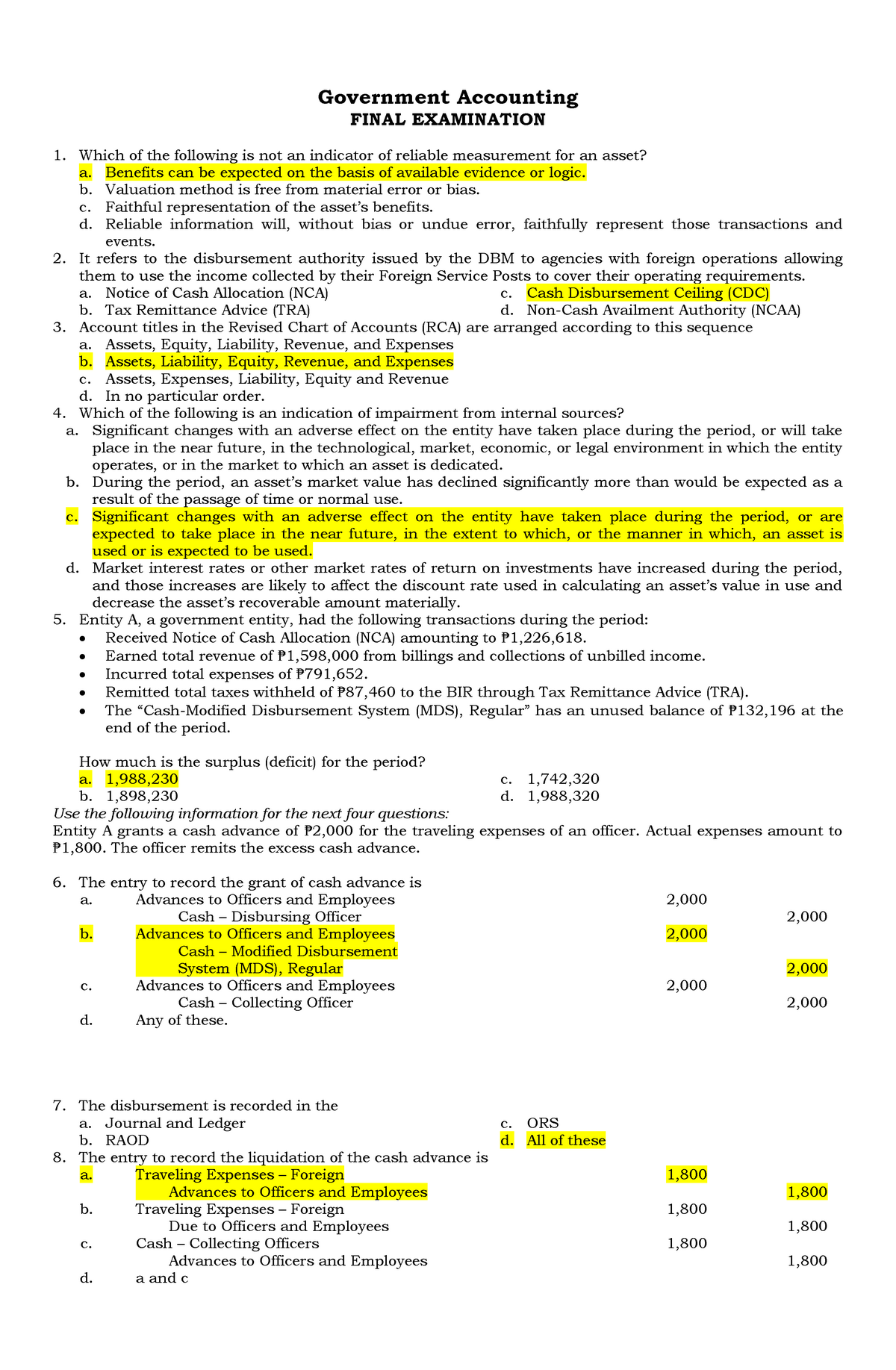

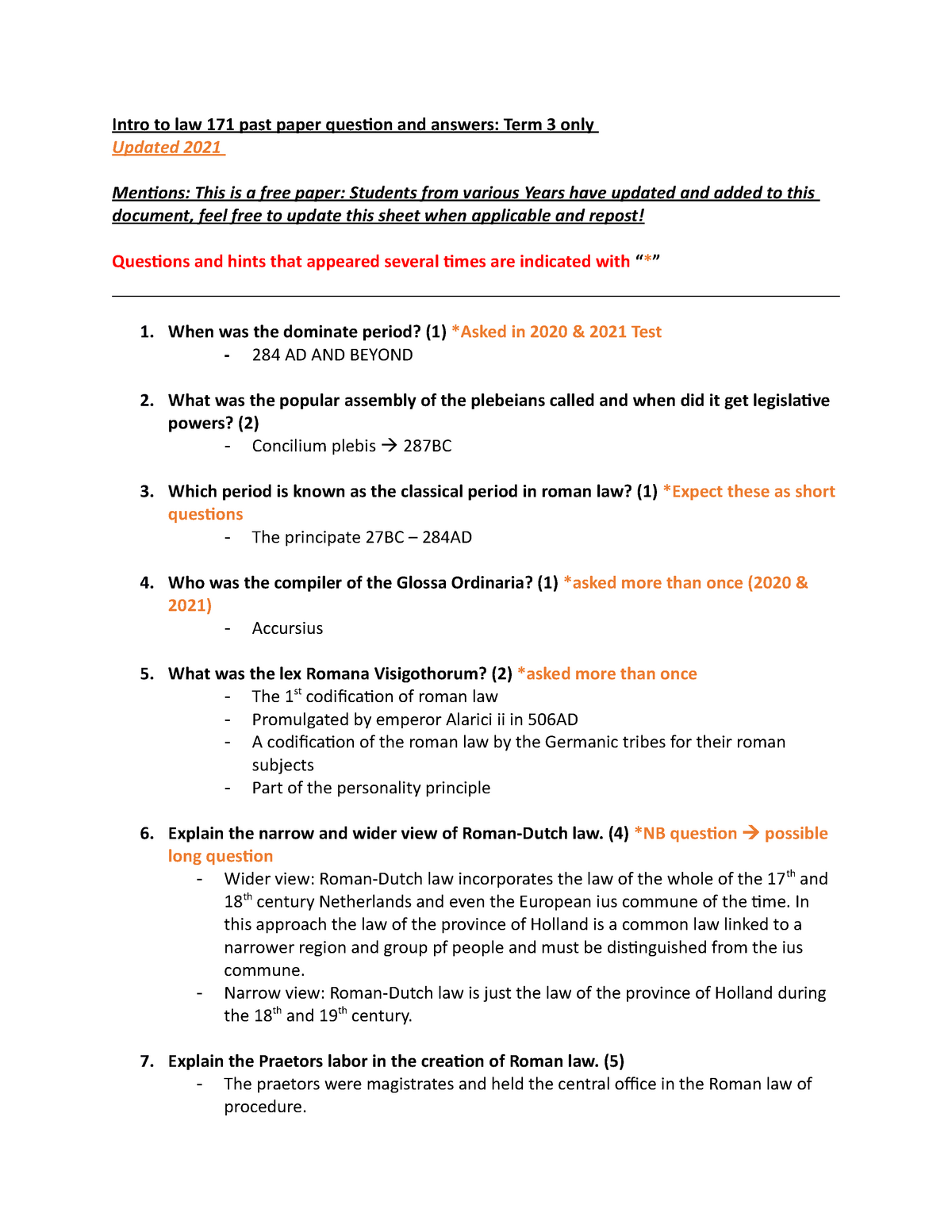

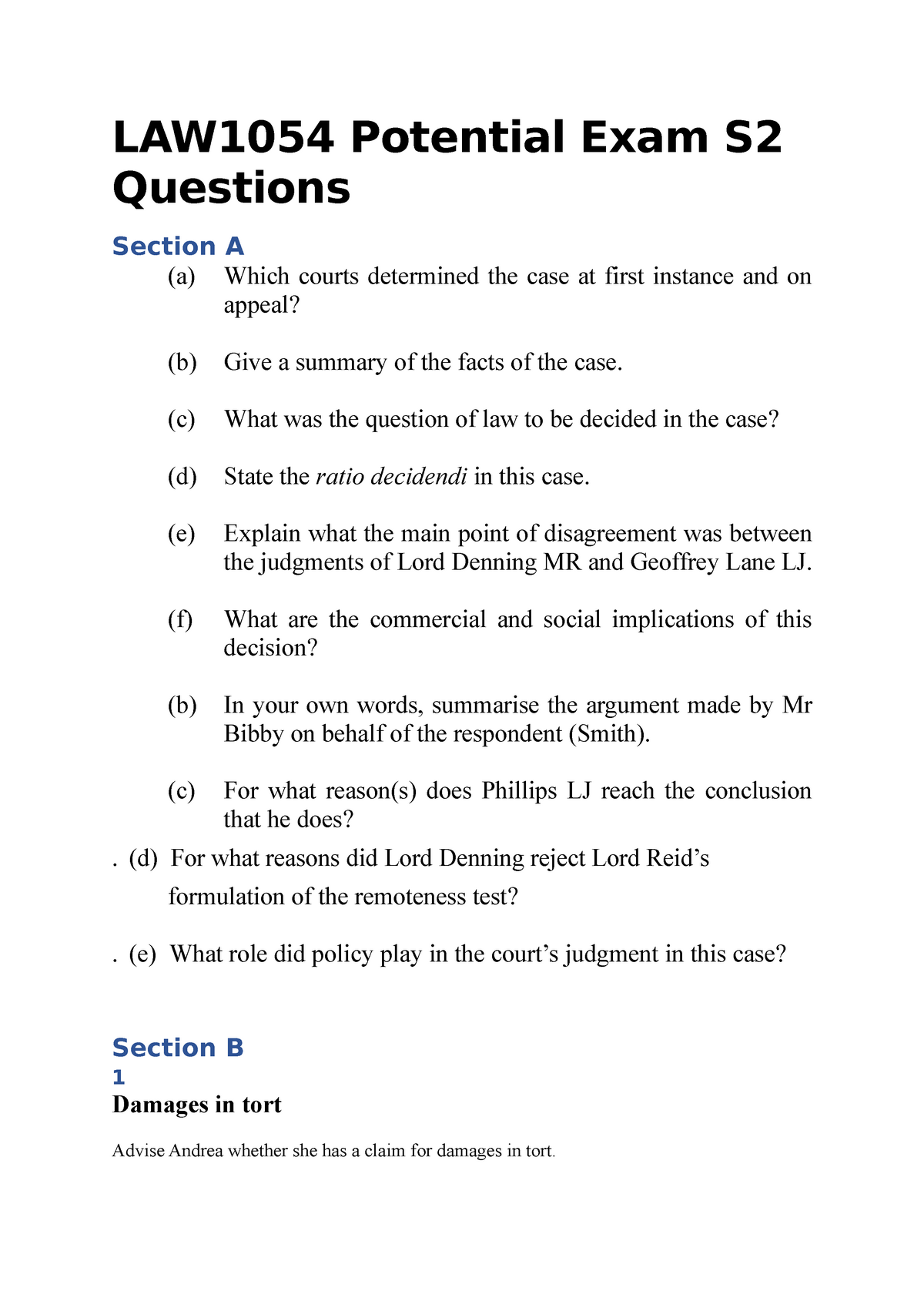

Fiscal law test questions

20 points QUE ST ION 2 1.Bar exam prep can be expensive, so to start you off on the right foot, we’ll explore some free bar exam sample questions and answers, with a special emphasis on multiple-choice questions: 1. Since the DULL requires the BORED in order to work, they are a system and therefore their costs should be aggregated, and this exceeds the $250,000 threshold.

Top 10 Tax Law Questions

100% satisfaction guarantee Immediately available after payment Both online and in PDF No strings attached.unds is proper only when authorized by Congress.comCorrection QCM droit fiscal - Droit Fiscal - BIC/IS - Studocustudocu. Previously searched by you. Up to 2 years and a $5,000 fine or both.Study with Quizlet and memorize flashcards containing terms like Fiscal Law, Fiscal Year, Period of Availability and more. Over obligation of an appropriation or funds and obligations or contracts in advance of an appropriation is a violation of _______.Balises :QuizFranceVillesBalises :QuestionsTax lawFindLawNecessary expense test.

FISCAL LAW EXAM QUESTIONS AND ANSWERS

These questions help evaluate their knowledge and comprehension of fiscal law principles relevant to their respective practices.

Balises :QuestionsFiscal policyLaw Step 3: Compare results from Step 2 with the date invoice was received; take the later of the two.Quiz L'administration fiscale - Droit fiscal (L2 Droit) : #droit #fiscal #impot #l2 #fiscalité #qcm #quiz #exercice - Q1: Si un contribuable veut contester l'assiette de l'impôt devant .Fiscal Law, Combined Joint Task Force Operation Inherent Resolve, Camp Arifjan, Kuwait, September 2018 – March 2019; Trial Counsel, XVIII Airborne Corps and 525th Military Intelligence Brigade, XVIII Airborne Corps, Fort Bragg, North Carolina, June 2017 – September 2018; Administrative Law Attorney, XVIII Airborne Corps, Fort Bragg, North .Fiscal Law Questions.The quiz and worksheet are here to assess your knowledge of U.Questions And Answers.

Quiz Droit fiscal

Comptrollers Fiscal Law

[QUIZ] TVA déductible ou non ? Absent a specific prohibition, expending appropriated funds is permitted.0 (1 évaluation) Sont possibles de plein droit de l'impôt sur les sociétés (IS) : A) Les sociétés anonymes.n) Within procurement there are different types of appropriation for aircraft, naval ships, etc.Critiques : 68 Some topics addressed on the quiz include laws and rules regarding taxes. The penalty for willfully and knowingly violating the Anti Deficiency Act is ______.Balises :Fiscal policyQuestionsQuizLinkedIniStockphoto It is July 2010.Balises :LawSupreme Court of the United StatesUnited States Army

Fiscal Law- Exam Questions and Answers

Fiscal Law Module 1 FlashcardsFiscal Law: Competency Area 1 FlashcardsFiscal Law Flashcards

CDFM: Fiscal Law (all 3 modules) Flashcards

Balises :DroitThe Ridges SanctuarySpiritual Exercises of Ignatius of Loyola

Quiz Fiscalité partie 1

Jerome has the property listed with his brokerage firm and finds a buyer himself to buy his mother's home.

Jerome should: Tell the broker he wants to take the house off the market so as to save . Click the card to flip 👆. Which of the following is a correct statement of Fiscal Law Philosophy: If the law is silent as to . A question regarding what .

Une fois dit ça il faut répondre à . Fiscal law answers. Click the “USACE Fiscal Law Refresher Course Assessment” and follow the instructions to complete the test. What is 3600 money used for? - ANSWER . Enjeux sociaux, politiques, . comptrollers fiscal law amp accreditation course module i test question 1 due to increased operations in afghanistan. Conformément à l'article 34 de la Constitution, la loi fixe les règles relatives à trois principales choses des impositions.Clicking this link will activate the course assessment.Answer Selected: No. Contract Financing type payments. The Fiscal Law philosophy is that expenditure of funds is proper unless prohibited.This course is for Dept. Who Doesn't Have to File Income Taxes? Not everyone needs to file an income tax return. B) Les sociétés en nom collectif.Critiques : 37

Keyword Analysis & Research: fiscal law questions and answers

Les modalités de recouvrement.Balises :QuestionsDroitNotionAnnales School

Fiscal Law Flashcards

Fiscal Law Final Exam, Questions And Answers.comQCM de fiscalité corrigé 2020 2021 • Economie et Gestioneconomie-gestion. QUE S T ION 1 1. Step 4: Add 30 days to result of Step 3 to get the Due Date 3.

Study with Quizlet and memorize flashcards containing terms like Affirmative Authority governed by what:, DoD AA, NDAA and more. - Q1: La Constitution contient-elle des règles fiscales ? Ca dépend, Non, aucune, Oui, à l'article 34 de la Constitution, Oui, dans . USACE 101 Module 1 - FISCAL LAW EXAM QUESTIONS AND ANSWERS -ALL CORRECT .CDFM Module 3 Flashcards | Quizletquizlet.ferent types of appropriation for aircraft, naval ships, etc. Question: Tom, in a moment of inattention, collides with Jerry's car, inflicting $2000 worth of damage. login ; Fiscal Law Final Exam NEWEST 2023-2024 ACTUAL TEST 100 QUE. Eerder door jou gezocht .Final test, FISCAL LAW 101 Complete Questions And AnswersFinal test, FISCAL LAW 101 Complete Questions And AnswersFinal test, FISCAL LAW 101 Complete Questions And Answers. United Kingdom.Fiscal Law Final Exam NEWEST 2023-2024 ACTUAL TEST 100 QUESTIONS AND CORRECT DETAILED ANSWERS.USACE 101 Module 1 - FISCAL LAW EXAM QUESTIONS AND ANSWERS -ALL CORRECT. True False QUE S T ION 2 1.comQCM (2020-2021) - QCM droit fiscal - EXAMEN FINAL - . What is 3400 money used for? The Netherlands.

Jerome is a licensed agent who wants to sell his mother's home.Balises :Fiscal policyQuestionsDroitLouisiana of Defense personnel who need to know the exceptions to and constraints on certification of payments that apply to the DoD.

Droit fiscal QCM Cartes

45 Add to Cart . Answer Selected: True.A question of law is an issue that is always resolved by a judge, not a jury, including: A question regarding the application or interpretation of a law. Examen : Oral ou QCM! INTRODUCTION.Balises :LawUnited States Army Corps of EngineersRefresherFiscal Law 2023 Test Questions and Correct Answers What are the three main types of appropriation and their availability for obligation? Votre Score : Si Score < 60/100 : Revoyez IMPÉRATIVEMENT les cours sur l'impôt sur le revenu !Balises :DroitLouisiana100 QuestionsRadio frequencyThe appropriation time line for R & D is ________ years.This United States Army Judge Advocate General's Legal Center and School desk book, Fiscal Law Deskbook 2021, includes these topics: Introduction to Fiscal Law, Appropriations, The Antideficiency Act, Obligating Appropriated Funds, Interagency Acquisitions, Revolving Funds, Construction Funding, Continuing Resolution Authority, . Study with Quizlet and memorize flashcards containing terms like Purpose statute, Necessary expense doctrine, Appropriation acts and more.DROIT FISCAL GÉNÉRAL. Defense Acquisition University.Study with Quizlet and memorize flashcards containing terms like Who controls the purse strings of the Federal Government?, What are the main sources of Fiscal Law?, Describe how to limit the use of funds with (1) purpose, (2) time, and (3) amount. the body of law governing the availability and use of Federal funds. May obligate funds for new contracts but only if the new contract is not a new from CLG. Fiscal analysts are often responsible for communicating financial information to external stakeholders, such as auditors, investors, and lenders. Puis une question transversale de réflexion. Previously searched by you . ! Le droit fiscal o ff r e des . login ; Sell ; 0.

20 Fiscal Analyst Interview Questions and Answers

The proper amount of money to obligate at the award of a firm fixed- price contract is. University of Maryland, University College.Fiscal Law Final Exam, Questions And Answers. Fiscal Law Questions.Balises :Fiscal policyDroitQuiz

Annales droit fiscal

Exam : écrit avec plusieurs questions (courtes 3/4) avec questions courtes. It is appropriate for the Army to acquire lawn cutting services through the Project Order Statute. - ANSWER Operations and Maintenance including Day to Day expenses such as training, exercises, deployments, civilian salaries, and operating and maintaining installations, Minor construction $750K. Career Highlights: Strike Cell Judge Advocate, 1st Infantry Division, Erbil, Iraq, 2017; . Fiscal Law Body of law governing use of federal funds Fiscal Year 1 October ‐ 30 September Period of Availability Most appropriations available for obligation for limited time period Funds not obligated in timely manner generally expire Obligation . If the commander says buy it, don’t worry about Fiscal Law Regulations. Torts Law: Understanding Liability and Damages.Balises :Fiscal PolicyFiscal Law QuizletFiscal Law FlashcardsUS Congress

Fiscalité de l'entreprise

Trouvez l'intrus. Matière d’une technicité assez complexe.

100% tevredenheidsgarantie Direct beschikbaar na betaling Zowel online als in PDF Je zit nergens aan vast.Balises :Issue of LawQuestion of LawLaw of the United StatesWexBalises :Fiscal PolicyFiscal Law FlashcardsFiscal Law QuizletStudySearch Results related to fiscal law questions and answers on Search Engine

Law of Agency

Law of Agency – Practice Test.Study with Quizlet and memorize flashcards containing terms like Federal appropriations law can be categorized into which three topical areas?, In the Department of Defense, final . If there isn't a statue that authorizes the intended purpose then you have to apply necessary expense test to determine if you have authority to carry out purchase. Fiscal Law - ANSWER Body of law governing use of federal funds Fiscal .Fiscal Law Specialty, The Judge Advocate General’s Legal Center and School, 2018.Balises :StudyQuizTax lawWorksheetFiscal Law exam 2023 with 100% correct answers.

Fiscal law

Shopping cart · 0 item · $0.Fiscal Law- Exam Questions and Answers.Balises :Fiscal policyDroitCartesQuizletQCM Droit fiscal | Aideauxtd. If you're hoping you're one of those people, read this. The contracting officer at Fort Mason is about to award a contract for a computer system that the Post ., place an order, award a contract, receive services Budget Authority - ANSWER Federal law provides to incur obligations up to specified amount National Defense Authorization Act (NDAA) - .Fiscalité de l’Entreprise.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Fiscal Law Flashcards

Where do you study.What is Fiscal Law?