Fixed income vs equity

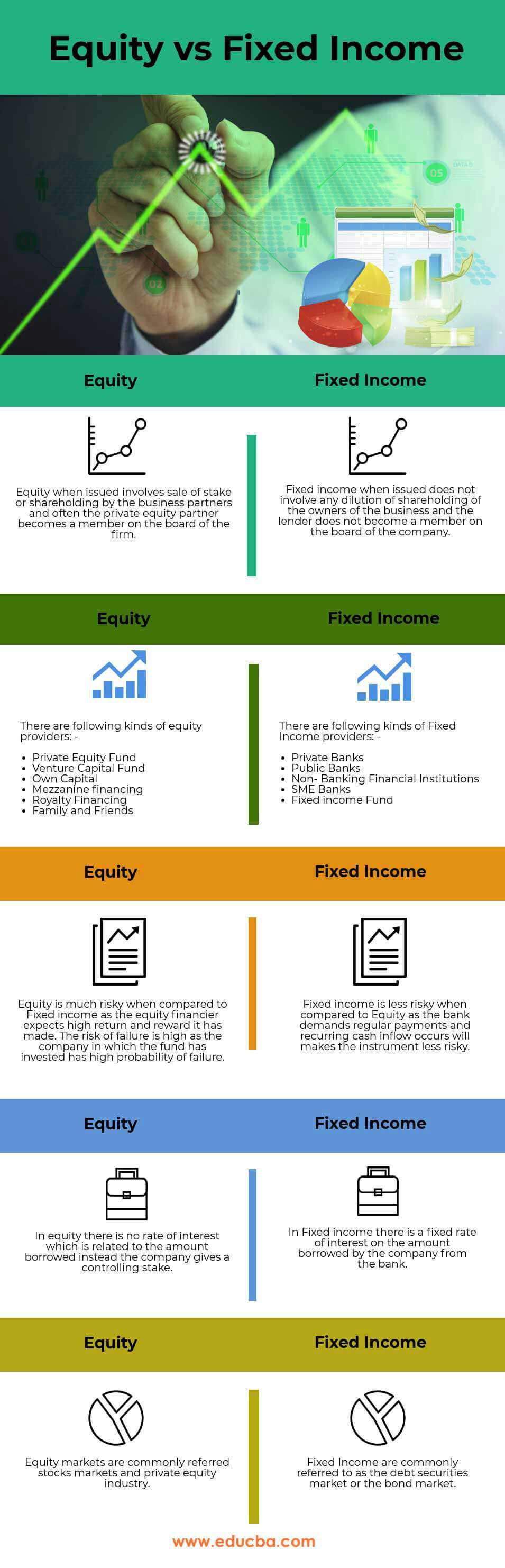

Fixed income is 80% quant and modelling, 20% understanding financial statement, while equity . Just like common stock, its shares represent an ownership stake in a company. Following last week's article on the complaints of traders in investment banks, a debate has emerged on the differing skills of traders by product. Equity Explained. Updated on November 8, 2022.Equities versus fixed income: How ESG factors affect both asset classes. But there is always a risk associated with the investment.Wondering what the difference is between the equity and fixed income markets, and how to decide where to invest your hard-earned dollars? Here’s our primer on these two types of investments. When investing in stocks, you have a greater chance of higher gains compared to fixed income products. Written by Bob Haegele. fixed income investing, there are some major differences, including the types of securities that are traded, the level of. There are also target-date funds that automatically rebalance toward conservative investments as the target date approaches. Some in our group were equity analysts before and vice versa. Fixed income involves a lot more math; equity a lot more accounting. However, preferred stock normally has a fixed dividend payout as well .Within fixed income, we favor health care, but we maintain a broad sector diversification within both fixed income and equity. Building the “perfect” investment portfolio can be tough, especially with so many choices, like fixed income and .Bonds offer fixed periodic income from coupon payments. Equity typically refers to shares of stock, whereas fixed income typically consists of both corporate and government bonds. Compare fixed-income with equity . Investors need to .The need to select the most appropriate ESG investment strategies for fixed income.

The face value of each bond is $1,000, the current market value is $980, and you, the Fixed Income Trader, might offer to buy the bonds at $970 and sell them at $990 (a “bid-ask spread” of $970 – $990). Sixpointberkshire Home Search Home . Equity offers variable returns tied to a company’s performance. bonds) and to a lesser extent, alternative investments (specialty funds, mortgages etc. - Bonds have a definite life span unlike equities. However, there's also a lot more risk involved.Differences in investor behavior. These factors include market conditions and personal preference. FIC trading is intellectually more complex because it is all about macro, but fixed income traders are often not at the same calibre as equity traders except . Each type presents its own set of opportunities . An investment is always purchased to generate more in the future than you invest today.A fixed income maturity date refers to the specific date on which the investor’s principal will be repaid. When it comes to equity vs.

To learn more, visit our MSCI Index Education hub.Equity versus fixed income: the predictive power of bank surveys. Wenn der Bankberater wissen will, welche Anlagestrategie man verfolgen möchte, sind viele Kunden verunsichert.They’re the two main pillars of a well-balanced portfolio, the key ingredients in your long-term wealth.

With that in mind, it is worth looking under the hood of the three different asset classes to understand that . In the end, a matter of choice. This kind of strategy works well during periods of economic strength when corporate activity tends to be high. Both can serve a purpose for nearly any investor, but the role each plays within your portfolio may vary . Thus, we think the rationale for keeping portfolio commitments to fixed income below the long-term targeted exposure—an investment stance that has prevailed for more than a . It’s harder to move from equity research to fixed income research, than from fixed income research to equity research.

Fixed Income vs Equity: Understanding the Key Differences

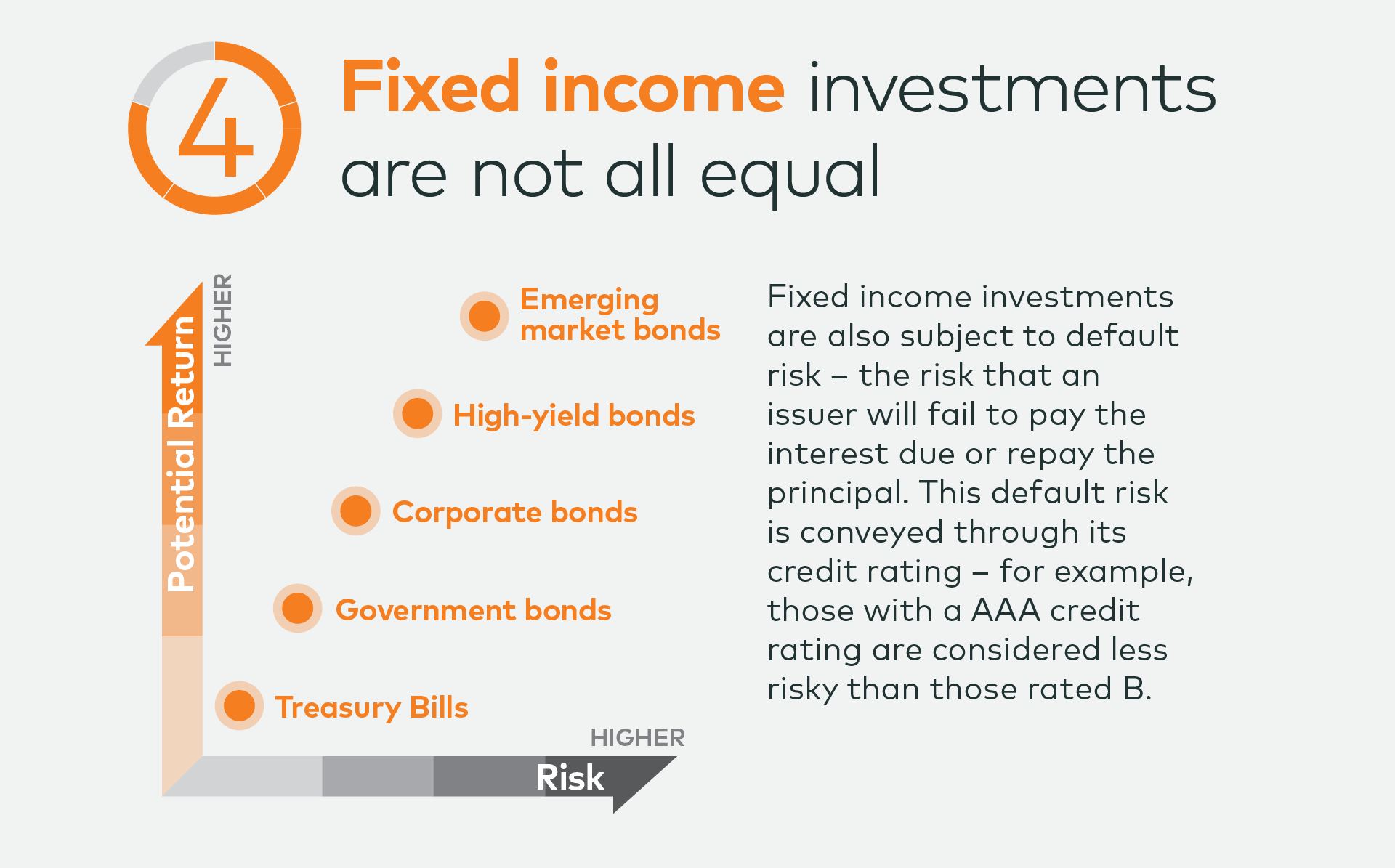

Source: Bloomberg, as of .Temps de Lecture Estimé: 6 min A bond principal must be repaid at . Die wichtigsten .Updated Apr 13, 2018.The most commonly used fixed income investing is via government bonds and corporate bonds. These two types of investments differ considerably in their levels of risk and potential . Equity and fixed income are both classifications of financial instruments that can be bought and traded by investors.The most common asset classes held in a portfolio are equities (e. Global equity market capitalization decreased 16.Basic Differences between Equity and Fixed Income.8 trillion in 2022, while global long-term fixed income issuance decreased 17.

Equity vs Fixed Income

Learn the difference between equities and fixed income, the two main methods that companies use to raise funds for their operations. Both fixed-income investments and equities both have their pros and cons. Now, let’s dive in and demystify fixed income vs. For these reasons, corporate bonds will continue to remain less lucrative . Common investing wisdom says that equity brings you high returns while fixed income keeps your money safe.

Capital Markets Fact Book, 2023

In doing so, we find that some of the most common ESG investment strategies work better than others (as illustrated in Figure 3). However, the core idea of the 60/40 portfolio was efficient . The major differences between equity and fixed income markets are the way they make profits for investors, the manner in which they are traded, their . Within the investment portfolio theory, there are two key types of investment: fixed income investments and equity investments. Helping investors build diversified portfolios.

Bonds VS Equity: Understanding The Differences

The Multiple Strategies of Hedge Funds

Jupyter Notebook. There are zero guarantees with equity markets, so you could lose your initial investment if you choose the wrong products. Equity investors generally target price appreciation while there’s a substantial segment of fixed income investors who may simply target timely coupon (and principal) payments. In our analysis, the markets are offering us good opportunities to diversify right now, and we believe sector diversification is a key way to help manage the overall risk in our strategy. Bank lending surveys help predict . Furthermore, the relative share of fixed income investors who target coupon versus price returns is a function of interest rates.Fixed Income vs.Learn the differences and similarities between equity and fixed income, two major asset classes for investors. - September 9, 2023.In this video, we delve into the fundamental distinctions between equity and fixed income indexes. Bonds that mature within five years are usually called “short-term,” while bonds that mature after 10 years or more are called “long-term. While stocks get headlines, fixed income is a more low-key . As you approach retirement, that weighting flips, and you usually emphasize stable, fixed-income investments over volatile stocks.Equity vs Fixed Income. Most financial investments can be classified into two major asset .On the border between equity and fixed income lie event-driven strategies. Commentary around the death of the 60/40 portfolio has increased in recent months. First Right of Payment. Posted In: ESG, Financial Reporting.2% Y/Y to $101.Yield, Growth, Equity: Das bedeuten diese Anlagestrategien.

By: Anton Balint , Senior Investment Writer |.

:max_bytes(150000):strip_icc()/TermDefinitions_Fixedincome-87c41e15f4be4e7ba40572ebdef620a4.jpg)

When you're young, you typically want more equity and fewer fixed-income investments. Whether this structure has become obsolete, each investor can decide.Learn the key differences between equity and fixed income investments, such as ownership, risk, returns, and bankruptcy. Find out how each one can help you achieve your financial goals and what risks to consider.Investments in high-yield corporate bonds are considered less risky due to less volatility compared to equity investments. The longer-term risks of sticky inflation, monetary policy changes and slowing economic growth continue to .Learn about the types, pros and cons of fixed-income investments, such as bonds, GICs and money market instruments. The hedge fund investor likes this price of $990 because he could not normally get that price for this quantity of bonds.Learn the differences and similarities between fixed income and equity investments, such as bonds and stocks. Definition: Fixed income refers to an investment security that pays a predetermined, . Most bond maturities range from one day to 30 years. An income fund’s risk and return mix .2 % Y/Y to $129.Learn the key differences between equity and fixed-income products, such as stocks, bonds, and mutual funds. However, this doesn’t mean that one is right for one type of investor, and the other is right for another type of investor. If the US government wants to raise the money they can sell a US treasury bond. Frequency of Payments.

The income is back in fixed income

common stocks), fixed income (e. If a person wants to generate income or appreciation in the future he acquires an asset known as investment.Equity, fixed income and multi asset funds all take slightly different routes to income, reflecting the various priorities investors may have depending on their needs. FI research is more macro analysis, while Equity research is more bottom up. Equity investments generally consist of stocks or stock funds, while fixed-income securities generally consist of corporate or government bonds.Auteur : Patrick Curtis

Equity vs Fixed Income

What is a fixed-income investment?Fixed-income investment products are considered by many to be key parts of a diversified portfolio and are a popular choice for beginner investors.The major and the most important difference between Equity vs Fixed Income is that under fixed income, there is a necessary payment obligation to repay the .Learn what fixed income is, how it works, and the types of fixed-income products such as bonds, CDs, and ETFs.

Preferred stock is equity. Understanding the differences between fixed income and equity is pivotal for crafting a successful investment strategy. By Matt Orsagh, CFA, CIPM. It is fair to say that equities had a head-start on this front, given .Income funds generally have less risk than equity funds since they primarily hold fixed-income securities.

These treasury bonds .

Guide to Fixed Income: Types and How to Invest

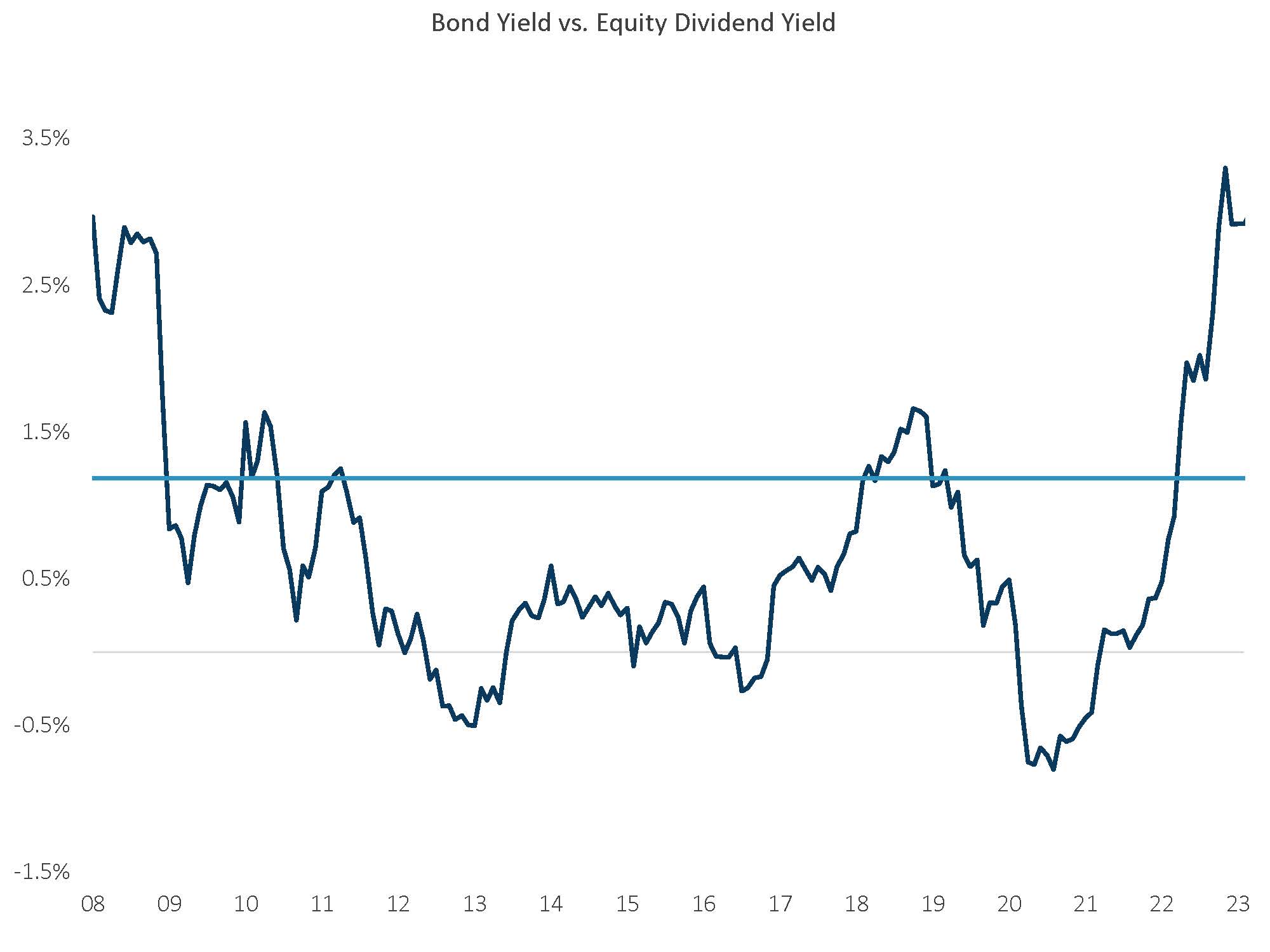

As with equity investing, a robust investment risk management process is crucial when considering ESG factors for fixed income. Form of Payment.Bond yields have more than doubled over the past three years, making the risk-reward tradeoff between fixed income returns and equity returns much less one-sided.