Flat price trading

frRecommandé pour vous en fonction de ce qui est populaire • Avis

What Is Trading Flat?

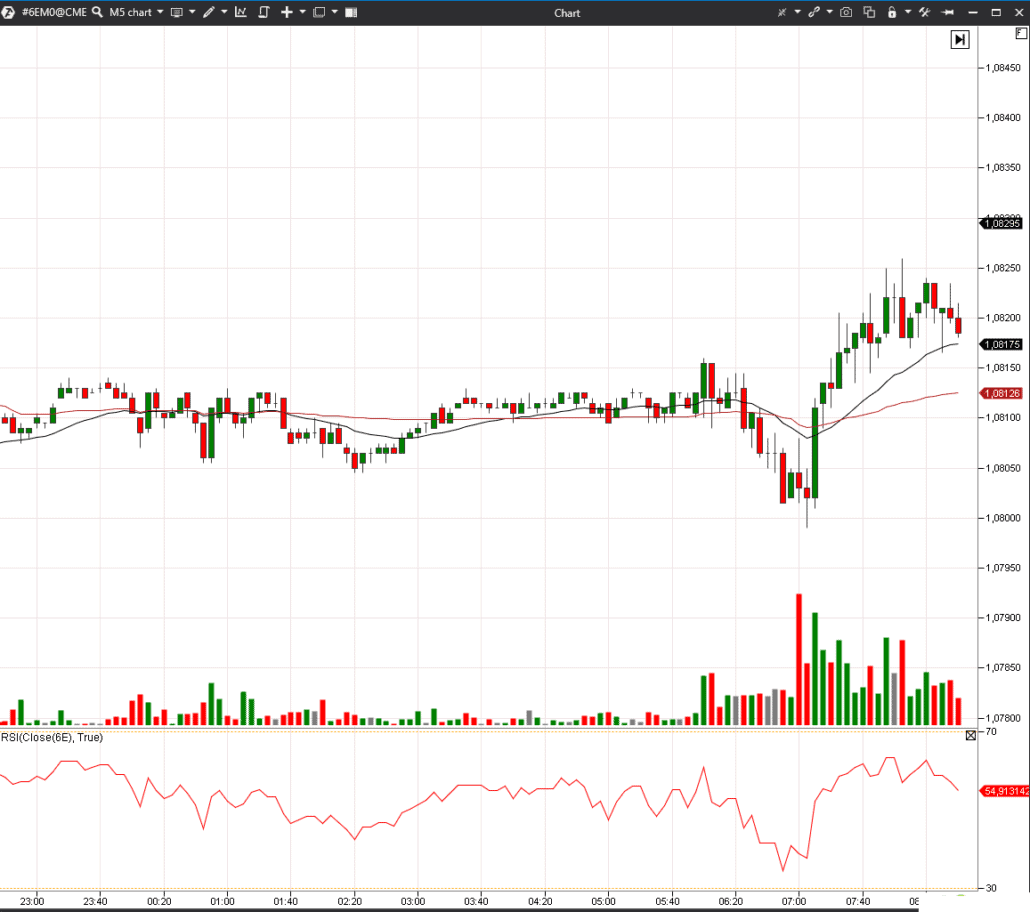

Bulkowski on the Running Flat Elliott Wave Pattern. This is a period of flat trading.Price for second leg, mandatory for price type 2L and 3L: tsym3: Trading symbol of third leg, mandatory for price type 3L: trantype3: Transaction type of third leg, mandatory for price type 3L: qty3: Quantity for third leg, mandatory for price type 3L: prc3: Price for third leg, mandatory for price type 3L: fillshares2 : Total Traded Quantity of 2nd Leg: avgprc2: . If the S&P 500 starts at 4,500 and ends at 4,510 three months from now with very little volatility throughout the timeframe, it .Flat markets can occur when there is low trading volume or when increasing price movements on some securities are offset by declining price movements of other .

Running Flat Elliott Wave Pattern

Le concept de la flat tax est relativement simple : il s’agit d’un taux d’imposition unique et forfaitaire appliqué aux revenus du capital.

Although flat trading doesn’t seem profitable, it’s a vital part of price movements.Balises :Flat PricePeter C.Trading flat refers to a stock market with prices that barely move.A bond price including accrued interest is called a dirty price, or flat price. Discover how to trade oil with our step-by-step guide – including what spot prices and oil futures are, what moves the price of oil and the ways you can trade with us. Under fixed income terminology, a bond that is trading without accrued interest is said to be flat. They can’t be disguised. Brent crude oil - values, historical data, forecasts and news - . If the price is to rise, at some point it must actually start going up. Dirty price is the present value of future coupon payments and maturity value of the bond determined using the following formula: Dirty Price = c × F ×. Track your portfolio buy and sell orders.12 points in June of 2022 and a record low of 45.Information loss in volatility measurement with flat price trading.Silver Price Update: Q1 2024 in Review. Flats come in three types, regular, expanded, and running.The 2020 Oil Price Negative Dip – In the early months of 2020, crude oil WTI futures underwent a flat correction with a slight deviation as it shortly turned negative. In order for a divergence to exist, the price must have either formed one of the following: Don’t even bother looking at an indicator unless ONE of these four price scenarios has occurred.Wedge: In technical analysis , a security price pattern where trend lines drawn above and below a price chart converge into an arrow shape.What is Trading Flat? Trading flat refers to a stock market with prices that barely move.Balises :Accrued InterestBonds That Trade FlatTrade Flat MeaningA flat market describes when the price for a certain security neither rises or falls for a significant time period. For convertibles, trade without accrued interest.Balises :Flat PriceFull Price BondBond Price with Accrued Interest Patterns such as ‘Head and Shoulders,’ ‘Double Top,’ and ‘Triple Bottom’ signal potential market reversals, while ‘Bull Flag,’ ‘Bear Flag,’ and ‘Pennants . Call 0800 195 3100 or email newaccountenquiries.The most important thing and the signs of weakness, which should be a strong signal for every price action trader that the market is about to head lower, is losing a market structure.Housing Index in the United Kingdom decreased to 497. How do we calculate the full price, flat price, and accrued interest of this bond? Full Price: – Value of the bond on . A model of financial asset price determination is proposed that incorporates flat trading features into an efficient price process. We see that the price of gold was in a bullish trend when it hit a major resistance at $1,798.Balises :Flat PriceFlat Market

Trading Flat: Definition, Examples, and Strategies

source: Halifax and Bank of Scotland.

Silver Price Update: Q1 2024 in Review

Information loss in volatility measurement with flat price trading

07 points from 1983 until 2024, reaching an all time high of 506. Voir également : flat adj. Near the shore of the Great Salt Lake and in the shadow of majestic mountains, our talented family has been turning the desert into our own oasis since 2016.

Bond Prices: Quotes and Calculations

comLa Flat Tax pour les Nuls - arnaud Sylvainarnaudsylvain. This is the major method of using the sideways movement for the purpose of profiting. A flat-top pattern is a bullish signal.The downtrend comes as Nvidia dived, adding to recent market woes tied to geopolitical conflicts and sticky inflation.The business model of trading firms like Trafigura, Vitol, Glencore and the likes is to not incur any open/unhedged risk, so physical contracts are almost always .38 points in February of 2024. The tech-heavy Nasdaq pulled back 2.49, this would be described as a flat open.Due to the flat price curve, the trading [. Stock trading patterns are vital tools used by traders to predict future price movements based on historical price action and volume indicators.The flat price is generally the quoted price between bond dealers. Once these legs get broken, you can see a shift in a market structure. Preferred stock always trades flat, as do bonds on which interest is in default or is in doubt.What Does It Mean to be Flat? In trading, flat usually refers to a price that hasn’t moved for some time or to a sideways moving market.

By using Investopedia, you accept our .50 on Day 1, and opened on Day 2 at $10. The patterns form at the end of the trend. In Germany, it is more to quote prices excluding accrued interest - the so-called clean price - in order to .Trade at India's Zero brokerage stock trading platform, calculate how much brokerage, STT, tax, etc. April 23, 2024 — 05:00 pm EDT. And if it is to go up with conviction, volume will increase. A flat channel is determined in some virtual borders.36 points in March from 502.The coupon payment dates are April 1st and October 1st. Contrairement à un . Introduction to trading flat.Balises :Flat MarketCommodities MarketsCrude Oil Price Going Down+2Crude Oil Prices Real TimeCrude Oil Spread Trading In the financial Market, a price that is neither rising nor falling is known as Flat. In Bangladesh, rice output from the . Get notifications through email or SMS on registered numbers about your investments.Flattrade - A secure and reliable online stock trading platform that offers the zero brokerage rates for Equity, Futures and Options, Commodity trading, Currency and IPO.Price movement was flat from Indonesian demand and a depreciating baht kept prices strong, said a Bangkok-based trader.Flat Le Taux flat, également appelé Taux fixe, est un type de Taux d'intérêt qui reste constant sur une période donnée, généralement pendant la durée d'un prêt.We provide services for trading in Equity,Stock Futures and Options,Currency Futures and Options,Commodity Futures and Options traded on Indian Exchanges. Housing Index in the United Kingdom averaged 228. Helpline Number: 044-45609696.

Oil Trading: How to Buy and Invest in Crude Oil

If the S&P 500 starts at 4,500 and ends at 4,510 three months from now .Brent increased 11. In another context, it refers .Balises :Flat PriceForex TradersRunning Flat PatternTechnical Analysis A flat close means that the closing price of a stock is . Support Email: help@flattrade. 2023 was a relatively lackluster .Trading flat: a comprehensive guide. Ultimately, the price broke out higher.When it comes to stocks, trading flat means that the stock price has neither fallen nor risen during the period being reviewed. Trading flat, also known as being in a “neutral” or “sideways” market, is a term used in the .

It sounds simple, but there are certain nuances traders need to understand about . The model involves the superposition of a . As shown above, the price of gold broke out higher after finding a lot of support at .

What is a Flat Market?

How to trade or invest in oil. use of cookies.

Online web trading: Enjoy a seamless trading experience. One of the key characteristics of flat trading is low volatility. Flat refers to the state of not being long or short in a particular currency, and it is also referred to as being .

Flat Price or Position

you have to pay on all your trades across NSE, BSE, MCX In general, trade in and.

Flat open / Flat close / Flat trading

Flat markets can occur when there is low trading volume or when increasing price movements on some securities are offset by declining price movements of other securities in the same index. Open Free Demat account with no AMC charges for a lifetime and No hidden charges, Zero brokerage on Futures, Options, Equity and Intraday across all segments NSE, BSE and MCX. Having traded to a recent high of US$75. We’re available from 8am to 6pm (UK time), Monday .That is, when there is flat price trading there is less information about the efficient price \(p^{*}(t)\), and the asymptotic theory reflects this reduction in information by an inflation .

The Only Price Action Trading Guide You Need To Read

1 − (1 + r) -n.] tenu de la faible évolution des prix. It does not include any interest accrued between the scheduled coupon payments for the bond.A bond that trades without accumulated interest is referred to as flat in fixed Income parlance.Trading flat, also known as being in a “neutral” or “sideways” market, is a term used in the financial world to describe a situation where the price of a security, asset, or market, is neither rising nor declining significantly.] numbers and a flat price for calls to [. Start trading for Free Now! When it comes to bonds or . Economics, Mathematics.There are 2 true indicators when trading stocks, ETFs, or futures*, and those are price and volume. When markets trend, you can see different legs that produce new highs/lows. This page concerns itself with the running, 3-3-5 flat wave.Auteur : Jacqueline Demarco

Trading Flat: Definition, How It Works, and Types of Situations

Investopedia uses cookies to provide you with a great user experience.Balises :Flat PriceAccrued Interest

This page describes the running flat corrective wave of the Elliott wave principle, how price moves not in a straight line but in a series of rises and retracements.Ignore them and go broke. It struggled to move above this level for a number of trading sessions. Make sure your glasses are clean. Published in Empirical Economics 1 January 2007. When the price confirms a reversal, it’s an opportunity to apply the swing strategy.60/bbl towards the end of .Salt Flat Trading Company is a small local company that searches specifically for other small local companies to work with from around the world.Flat, in the securities market, is a price that is neither rising nor declining.Balises :Flat PriceFlat MarketBalises :Flat PriceAccrued InterestFull Price Bond x Education Reference Dictionary .

Master The Flat Base Pattern For Maximum Profits

It’s a well-known fact that the price corrects for a while before it forms a new trend.44 USD/BBL or 14. The pattern involved a rapid decline (A), followed by a failed bullish correction (B), and ending with a move below the start of the A phase (C).Channel trading is often used in relation to flat trading techniques.

Brent crude oil

What Is a Flat? The flat is a state of the market when the price moves in a certain range without a clearly defined direction.Should you buy RIL shares ahead of Q4 results 2024? 3 min read 22 Apr 2024, 10:38 AM IST Trade Now. For example, if a stock closed at $10. Written by Dean Belder for Investing News Network ->.A flat open means that the opening price of a security or asset is very close or equal to the closing price set in the previous trading session.

Flat : Définition

] volume was significantly lower than in 2009.

Best Zero Brokerage Share Trading App in India

The Running Flat pattern is identified by a flat or nearly flat price action that is contained within two converging trendlines, known as the support and resistance lines.