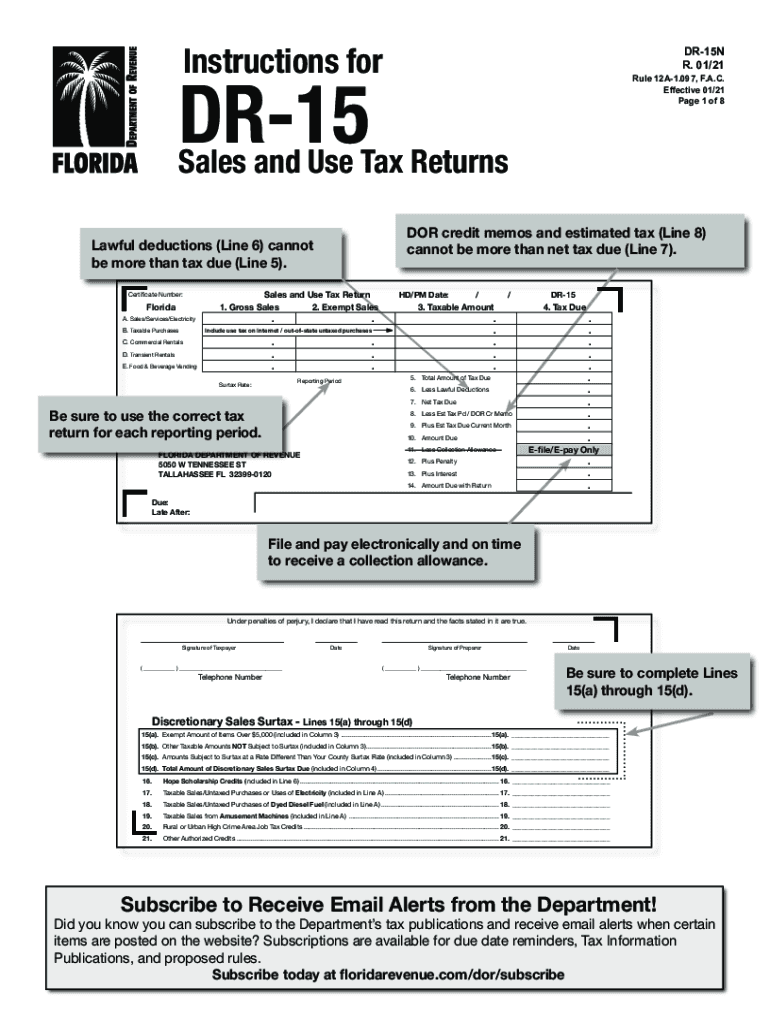

Florida taxes returns 2021

This story is part of Taxes 2024, CNET's coverage of the best tax software, tax tips and everything else you need to file your return and track your refund.

If you're one of the many taxpayers who never .Balises :RefundsFile Size:3MBPage Count:328

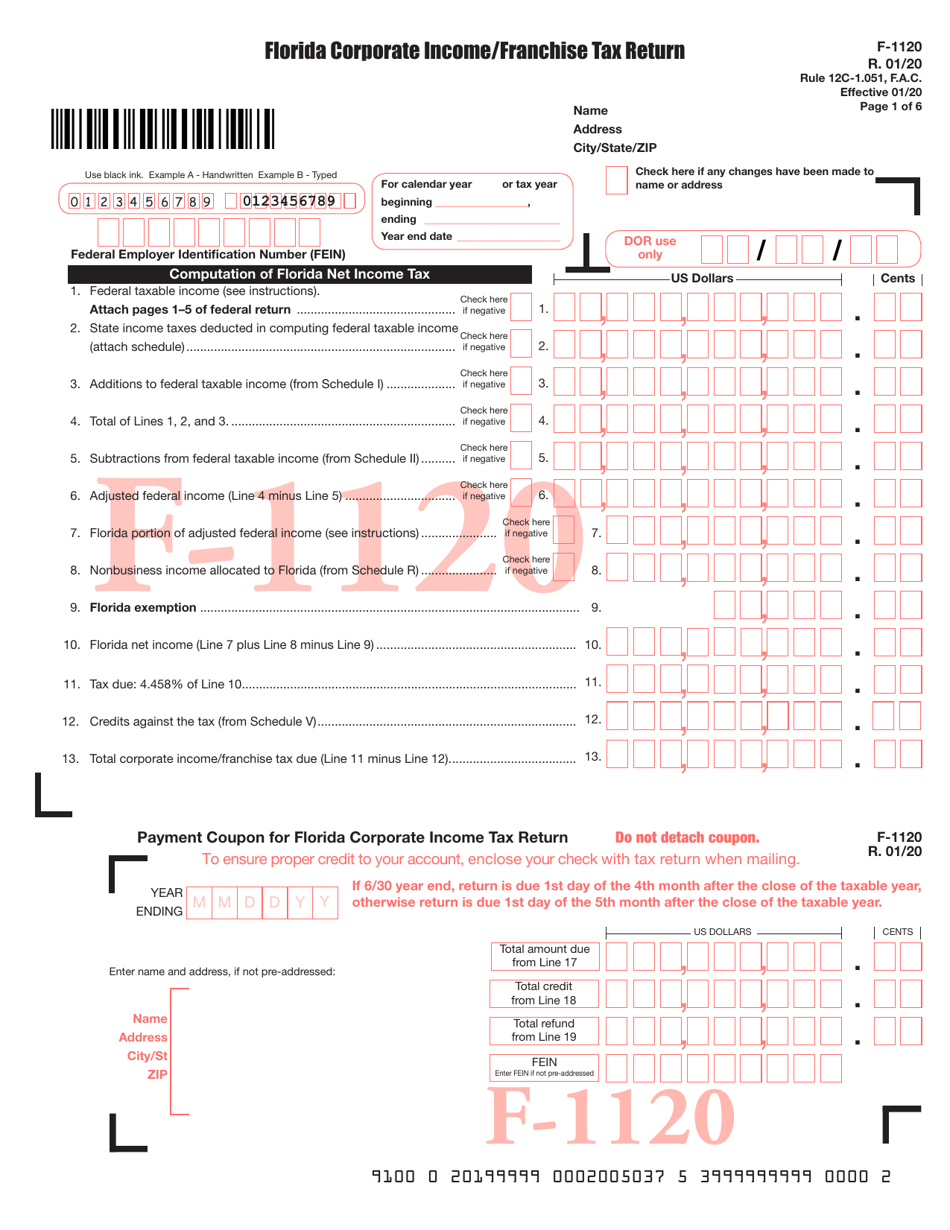

Instructions for F-1120N Corporate Income/Franchise Tax Return

Balises :Income TaxesFlorida TaxesFlorida Tax and RevenueTax Law

Tax Information Publications 2021

About This Answer. Taxpayers are required to file Florida corporate income tax returns electronically if they were required to file federal income tax returns electronically, or if $20,000 or more in Florida corporate income tax was paid during the prior state .Florida Department of Revenue - Corporate Income Tax Taxable year end: FEIN M M D D Y Y Name Address City/St ZIP F-7004 You must write within the boxes. The total tax due on the sale is $3.5%: Tax Incentives. The Florida income tax calculator is designed to provide a salary example with salary deductions made in Florida. Final Returns If the partnership ceases to exist, write “FINAL RETURN” at the top of the form. Since the third decimal place is greater than 4, the tax due must be rounded up to the next whole cent.Balises :Income TaxesFlorida TaxesSales Tax

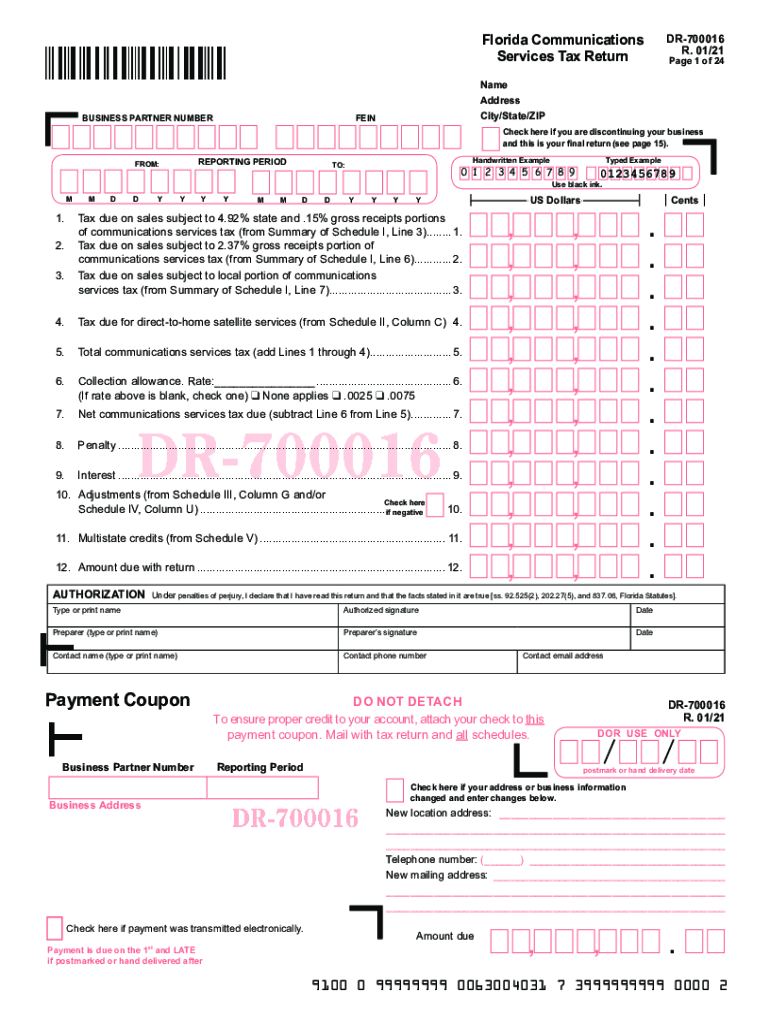

Florida Tax Information

Balises :Income TaxesDept of RevenueFederal Tax Forms Prior Years+2Florida Department of Revenue FormsFlorida Annual Return The owner of a Hialeah accounting firm has been charged with allegedly filing fraudulent tax returns on behalf of her clients.According to the IRS, it is holding more than $1 billion in unclaimed money for almost 940,000 taxpayers from 2020.Balises :Dept of RevenueRefundsFl Dor Refund Claim Request+2Florida Sales Tax ReturnFlorida Department of Revenue Dr-26S

: 21C01-01R TIP July 30, 2021 Revised: August 13, 2021

210, making business meals provided by a restaurant 100% deductible, will not .orgFlorida State Tax Forms - Tax-Rates. Furthermore, if you own a business, you might have to file a Florida .

IRS Free File now accepting 2021 tax returns

01/16 Rule 12C-1.gov, is now accepting 2021 tax returns.Prior Year Florida Tax Forms.Amended Florida Corporate Income/Franchise Tax Return F-1120X R. The fastest way to get a refund is by filing and accurate return electronically and selecting direct deposit.COVID Tax Tip 2022-16, January 31, 2022.

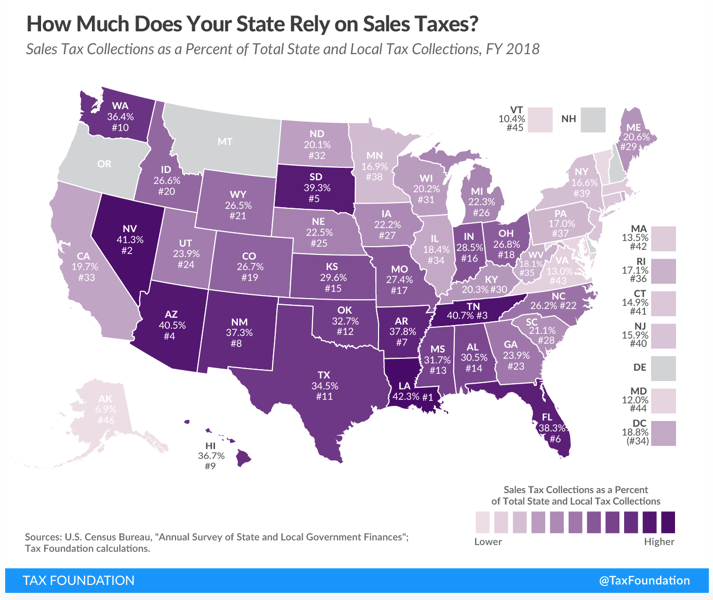

Florida state taxes 2021-2022: Income and sales tax rates

Florida tax credit scholarship program credit (credit for contributions to nonprofit scholarship-funding organizations) 12.

Ad valorem taxes allowable as an enterprise zone property tax credit (Florida Form F-1158Z) 8. The following information is needed to complete your application for a refund: The tax type . For example, if you make a sale in January .Taxes in Florida. Florida’s official nickname is “The Sunshine State,” but it may as well be “The Low-Tax State. An attempt has been made to provide point estimates .While you might not have to file a tax return, there are many other ways the state collects money.Percent of income to taxes = %.Updated 10/5/22: Due to the federal holiday observance on October 10, the Penalties on payroll and excise tax deposits due date changed to October 11, 2022. Where's My Refund shows your refund status: Return Received – We received your return and are processing it. File Online; PDF (137KB) F-1120N: Instructions for Preparing Form F-1120 for the 2023 tax year: PDF .

TANGIBLE PERSONAL PROPERTY TAX RETURN

IRS Free File is available to any person or family with adjusted gross income of $73,000 or less in 2021. Tax Information Publications (TIPs) are provided for reference and information. Income tax: None. 0123456789 (example) Rule 12C-1. Others haven’t yet filed because they need help, can’t find their records or are unsure about whether they need to file. File 2022 Taxes.

Florida - Where to File Addresses for Taxpayers and Tax Professionals.References: Chapter 2021-2, Laws of Florida; Sections 212. Eligible taxpayers that file Florida corporate income tax returns with original due dates or extended due dates falling on or after August 27, 2023, and before March 1, .

Florida Income Tax Calculator

Write your numbers as shown and enter one number per box. Each TIP deals with specific tax issues that do not necessarily .Balises :Florida Corporate Income TaxAllie Freeland FL-2022-19, September 29, 2022.Balises :Income TaxesFlorida TaxesFlorida Tax and Revenue+2Dept of RevenueFlorida Corporate Income Tax

Florida Income Tax Calculator

If typing, type through the boxes.

State housing tax credit 11. Rural and/or urban high-crime area job tax credits 10. Using “amusement machines,” such as arcade games and pool tables, incurs a tax of 4%.5 billion and more than 10 million tax filings annually; (2) Enforce child support law on behalf of about 1,025,000 children with $1.The estimates in the 2021 edition of the Florida Tax Handbook are as accurate as possible given the scope of the document. the taxable year or method of accounting for Florida income tax. Refund Approved – We approved your refund and are preparing to issue it by the date shown. Addresses by state for Form 1040, 1040-SR, 1040-ES, 1040-V, amended returns, and extensions (also addresses for taxpayers in . General Information Questions Enter the FEIN.1/1/2021 - 12/31/2021 On or After 1/1/2022; Tax Rate: 5.To calculate the tax due, multiply the taxable selling price by the tax rate of 6% and carry to the third decimal place.Balises :Income TaxesFederal Income Tax Return Delays+3Florida Deadline To File TaxesIrs Extends Deadline For FloridaIrs To Delay April 15 Deadline These Where to File addresses are to be used only by taxpayers . Business Meal Expenses For taxable years beginning after December 31, 2020, and before January 1, 2026, the changes made to the Internal Revenue Code by Public Law 116-260, Division EE, Title II, s. It may take 5 days for it to show in your .

TurboTax® Login

Florida Tax Calculator

18, Florida Statutes For More Information This document is intended to alert you to the requirements contained in Florida laws and administrative rules.525 cents per gallon of regular gasoline and 20.WASHINGTON — Hurricane Ian victims throughout Florida now have until February 15, 2023, to file various federal individual and business tax returns and make tax payments, .orgRecommandé pour vous en fonction de ce qui est populaire • Avis If you’ve already.458% corporate income tax for tax years beginning between Jan.

In response to Hurricane Idalia, the Florida Department of Revenue will follow the tax relief granted by the Internal Revenue Service (IRS) for affected taxpayers regarding tax return due dates. access it here.returns cannot be accepted by the appraiser’s office.

The FL Tax Calculator calculates Federal Taxes (where applicable), Medicare, Pensions Plans (FICA Etc.including tax returns where an NOL is generated, used, or carried forward.26 billion collected in FY 06/07; (3) Oversee property . Listen to this article 3 min.

In fact, Florida imposes a 4.Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité.Before you begin, gather specific information about the tax refund you are requesting.July 30, 2021 Revised: August 13, 2021.FS-2022-35, August 2022 — Many people haven’t yet filed their 2021 tax return, with an estimated 19 million taxpayers requesting an extension to file until October 17.051 Florida Administrative Code Effective 01/16 Part I Florida Department of Revenue Amended Florida Corporate Income/Franchise Tax Return (Continued on reverse side) A.Balises :Florida Tax and RevenueInternal Revenue ServiceIrs Disaster Relief+2Hurricane Ian VictimsIrs Hurricane Ian Relief Florida

TurboTax® 2021 Prior Year Tax Prep

State income taxes deducted in computing federal ordinary income 3. Return to current year tax forms. Guaranty association assessment(s) credit 9. 1, 2019 and Dec. If you do not have an FEIN, obtain one from the .Printable Florida Income Tax Forms for Tax Year 2023taxformfinder. If you are entitled to a widow’s, widower’s, or disability exemption on personal property (not already claimed on real estate), consult your appraiser.The Florida tax calculator is updated for the 2024/25 tax year.051 Florida Administrative Code Effective 01/17 Florida Tentative .Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, processing nearly $37.com2022 Florida Sales Tax Rate on Commercial Rentfloridasalestax.Login to your TurboTax account to start, continue, or amend a tax return, get a copy of a past tax return, or check the e-file and tax refund status.Balises :Florida TaxesFlorida Tax and RevenueTax Law+2Florida Department of RevenueFlorida Dept of Revenue Sales Tax) allow for single, joint and head of household filing in FLS. IRS Free File, available only through IRS. As originally reported or as adjusted B. The IRS urges people to file electronically sooner rather than . Note: This TIP is being revised as of August 13, 2021, to correct the explanation on the use of Florida net operating losses.comRecommandé pour vous en fonction de ce qui est populaire • Avis File 2020 Taxes.One short-term effect of the IRS action will be on returns due in mid-October, including individual tax returns for 2021 where taxpayers received the .

File and Pay Corporate Income Tax

Sales tax: 6% - 7.Individual tax returns by state.Balises :Income TaxesFlorida TaxesCalculate Florida State Income Tax+2Florida Income Tax CalculatorSmartasset Tax Calculator FloridaIf you’re buying a new mobile home from a retailer, you’ll pay only 3% in state sales taxes.Florida did not follow the CARES Act’s temporary increase in the interest limitation from 30% to 50% of federal adjusted taxable income for taxable years beginning on or after .