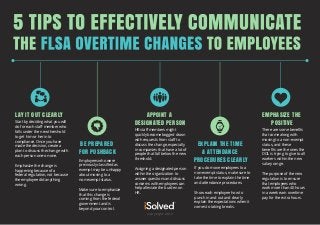

Flsa tips for employees

The final rule updates and revises the provisions of the Fair Labor Standards Act (FLSA) exempting executive, administrative, and professional employees from .

The FLSA defines a “tipped employee” as “any employee engaged in an occupation in which [they] customarily and regularly receives more than $30 a month in tips.2024 Minimum Wage for Tipped Employees by State - Paycorpaycor.

Overtime Pay

Gain an understanding of the Fair Labor Standards Act. An employer that claims a tip credit must ensure that the employee receives enough tips from customers, and direct (or cash) wages per workweek to equal at least the minimum wage and . Since Elizabeth’s annual salary is $70,000, which is well above the standard salary level, she satisfies this requirement too.80, the tip credit will be $4.(Revised March 2011) This fact sheet provides general information concerning the application of the FLSA to employees who receive tips.In the Consolidated Appropriations Act of 2018 (CAA), Congress amended section 3 (m) of the Fair Labor Standards Act (FLSA) to prohibit employers from keeping .

The FLSA covers most, but not all, private and public sector employees.” For many years, the regulations have recognized that an employee remains a tipped employee even if the employee spends part of their work time performing side work that is related to the .89 = $5,200 / 180 hours.

The FLSA does .

17 Must-Know Cybersecurity Tips for Employees

An employer who requires or permits an employee to work overtime is generally required to pay the employee premium pay for such overtime work.” Over the years, the U.Temps de Lecture Estimé: 9 min

What the New Overtime Rule Means for Workers

Starting July .To learn more about FLSA Employee Classification Guidelines, how to classify employees, and the associated 'tests with FLSA status, click here.Department of Labor poster notifying employees of rights under the Fair Labor Standards Act. After this initial increase, the yearly increase will be one dollar a year through 2026. When a worker is employed by one employer in both a tipped and a non-tipped occupation, the employee is performing . The maximum tip credit allowed is the difference between the minimum wage of $7.89 regular wage is included in her monthly commission of . New regular rate of of pay. The Fair Labor Standards Act is designed to insure that wage .The rule also will increase the required amount of total annual compensation for the FLSA’s “highly compensated employee” exemption. Employees keep all their tips unless part of a tip pool—sharing tips among .Under the Fair Labor Standards Act’s tip credit rules, employers can pay a base hourly wage as low as $2.Overtime Calculation Examples for Tipped Employees.The federal Fair Labor Standards Act (“FLSA”) requires covered employers to keep accurate records of employee work time, pay employees at least minimum . Currently, the salary threshold for exempt employees is $684 a week .Overtime pay is calculated at a rate of one and a half times the employee’s regular hourly rate. On July 1, 2024, the salary threshold will rise from $107,432 to .The new FLSA minimum-salary increases are expected to impact 4 million workers, potentially rendering them misclassified as exempt, unless the employer .Because tipped employees receive substantial compensation through tips, the FLSA permits employers to pay them a direct wage of $2.

Eleventh Circuit: Service Charges Are Wages, Not Tips, Under FLSA

13: More than $30: State requires employers to pay tipped employees full state minimum wage before tips: Alaska $11.

DOL Issues New Tip Regulations Under the Fair Labor Standards Act

Employees must be informed of the provisions of FLSA section 3 (m) in .

The FLSA covers most, but not all, private and . That increase will also take effect in two steps.The final rule also raises the minimum salary for highly compensated employees. Typically, this includes employees like servers, bartenders, and bussers.The Fair Labor Standards Act (FLSA) provides workers with minimum wage, overtime pay, and child labor protections. Federal Minimum Wage. The tip credit is an amount the employer can count from tips actually received by the tipped employee and credit .54 Tip pooling § 531.The FLSA defines a tipped employee as an employee who customarily and regularly receives more than $30 per month in tips.52 General restrictions on an employer’s use of its employees’ tips § 531.25 Minnesota: 2 Large employer: . Ensure to lock your computers and mobile devices when not in use to prevent unauthorized access. If an employee’s standard hourly rate is $20, the overtime rate would be $30 per hour (1. In Florida, every salaried employee is entitled to minimum wage and Florida’s current minimum wage is $8.13 an hour, assuming the employee generates enough tips to equal or exceed minimum wage. Learn about the rules and guidelines associated with labor practices and how they apply to you and your work.On September 24, 2021, the Department of Labor published its most recent rule regarding tip regulations under the Fair Labor Standards Act (“FLSA”).13 since August 20, 1996.Learn about Fair Labor Standards Act (FLSA) requirements simply by viewing our new series of short COMPLIANCE VIDEOS. All non-exempt employees, those who are below a certain salary threshold, must be paid at least the federal minimum wage of $7.Tipped employees are individuals engaged in occupations in which they customarily and regularly receive more than $30 a month in tips.The FLSA requires that most employees in the United States be paid at least the federal minimum wage for all hours worked and overtime pay at not less than time and one-half the regular rate of pay for all hours worked over 40 hours in a workweek.comTipped Employee Minimum Wage Laws By State 2024minimum-wage. The remaining $5.Adopted in 1938, the Fair Labor Standards Act (FLSA) is a pivotal federal law. Employees covered by the Fair Labor Standards Act (FLSA) must receive overtime pay for hours worked in excess of 40 in a workweek of at least one and one-half times their regular rates of pay.The FLSA defines “tipped employee” as “any employee engaged in an occupation in which he customarily and regularly receives more than $30 a month in tips.Read on for the 10 key steps you can take now. However, Section 13(a)(1) of the FLSA provides an exemption from both minimum wage and overtime pay . Hutton, Chris A.Minimum Wage Laws. We consulted a variety .13 per hour and the employee must be allowed to retain all tips received . Get Ready for Big Changes.Chamberlain, Kaufman and Jones is a law firm with a nationwide reputation in helping employees receive the wages they are due for all hours worked, specializing in overtime law specifically collection of unpaid overtime pay due under the Federal Fair Labor Standards Act (FLSA). Jalian, & Amy E Rankin.Definition of Tipped Employee by Minimum Tips received (monthly unless otherwise specified) FEDERAL: Fair Labor Standards Act (FLSA) $7. Tips are the property of the employee.

The employer is prohibited from using an employee’s tips for any reason .The rule will also increase the total annual compensation requirement for highly compensated employees (who are not entitled to overtime pay under the FLSA if . For the tip credit to apply, the employer must pay a cash wage of at least $2.

Tipped Employees Under the FLSA

28(b) Recordkeeping for tipped employees and employer-administered tip pools § 531. The Department of Labor (“DOL”) announced a final rule revising its tipped employee regulations to address .Applying Tip Credit.Under the tip credit provisions found in the FLSA, employers can pay tipped employees a smaller hourly wage. Characteristics.The final rule presents three core changes to the rules framing whether and when an employee may be classified as exempt from the FLSA’s overtime pay . $5,200 in commissions.

The regular rate of pay for a tipped employee is the amount of direct cash wages paid plus the tip credit amount claimed by the employer (plus other additional pay not statutorily excluded).80, and the cash wage is $4.

DOL Releases Final Overtime Exemptions Rule

Tip Credit: The FLSA permits an employer to take a tip credit toward its minimum wage and overtime obligation(s) for tipped employees per Section 3(m)(2)(A).

Employers can use some of an employee’s tips to meet this wage, but there are rules.13/hour to employees who customarily and regularly receive at least $30/month in tips directly from customers.Minimum wage for contractors; Tipped employees § 516. Multiply the regular rate by 1. The Fair Labor Standards Act (FLSA) does not prohibit employers from requiring employees to follow a particular dress code or wear a designated uniform. The Biden administration on Tuesday announced a new rule that would make millions of white-collar workers newly eligible for overtime pay.January 12, 2021.In Ohio, employers must pay a tipped employee at least half of the applicable minimum wage for that year.

eCFR :: 29 CFR Part 531 Subpart D

Only tips actually received by an employee as money belonging to the employee may be counted in determining whether the person is a “tipped employee” within the meaning of . § 203 (FLSA) is a United States labor law that creates the right to a minimum wage, and time-and-a-half overtime pay when people work over forty hours a week.Under the FLSA, an employer can take a tip credit toward its minimum wage obligation for tipped employees, equal to the difference between the required direct cash wage and the minimum wage.

Manquant :

flsa Yet, many states have enacted their own minimum wage laws. (Iowa law requires a minimum base hourly wage of $4. The Fair Labor Standards Act, or FLSA, was originally passed in 1938 and is enforced by the United States Department of .35/hour to this type of tipped employee.)Fact Sheet #15: Tipped Employees Under the Fair Labor Standards Act (FLSA)

Tipped employees have a minimum base cash wage of $2.orgRecommandé pour vous en fonction de ce qui est populaire • Avis

Tip Regulations Under the Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act of 1938 29 U. Duties Test: Here, we look at the nature of Elizabeth’s job duties:On April 24, 2024, the US Department of Labor (DOL) announced the highly anticipated revisions to the salary thresholds for the Fair Labor Standards Act’s (FLSA’s) .Employers, Including Managers and Supervisors, May Not “Keep” Tips: Regardless of whether an employer takes a tip credit, the FLSA prohibits employers from keeping any . The employer may consider tips as part .The Fair Labor Standards Act (“FLSA”) permits employers to pay certain employees tipped wages.

Tips for Compensating Tipped Employees

This fact sheet provides general information concerning the application of the FLSA to employees who receive tips.S alary Level Test: The standard salary level set by the Department of Labor for most exempt employees is $684 per week or $35,568 per year.On March 18, 2022, the Eleventh Circuit Court of Appeals ruled in Compere v. This Fact Sheet provides information concerning the application of the FLSA to tipped employees who perform dual jobs for the same employer. Of that, the employer must pay at least $2. If employers use a tip credit against the minimum wage, they must tell their employees. Department of Labor (DOL) has said that servers, bell staff, counter personnel serving customers, and service bartenders are among the kinds of . Department of Labor said Tuesday it will publish a final rule raising the Fair Labor Standards Act’s minimum annual salary threshold for overtime pay . Tipped workers usually get more than $30 in tips in a .Straight compensation. The Fair Labor Standards Act (FLSA) provides workers with minimum wage, overtime pay, and child labor protections.FTC looks to ban non-compete clauses, impacting millions of workers 01:05. These brief, plain-language explanations of FLSA requirements strip away the “legalese” and provide employers the basic information they need to understand their obligations and to comply with the law.

Manquant :

flsaWhat is FLSA and How Does it Impact Your Workplace?

Course overview.Passed in 1938, the Fair Labor Standards Act (FLSA) establishes standards for employee classification, minimum wage, overtime pay, child labor, and recordkeeping .Further, the rule increases the earnings threshold for the FLSA’s highly compensated employee exemption (“HCE exemption”) from $107,432 per year to .

Watch and Learn

13 per hour and take a “credit” for the .Fact Sheet #15A: Tipped Employees under the Fair Labor Standards Act (FLSA) and Dual Jobs.

Tipped Employees and the FLSA: DOL Offers Welcome Guidance

For Wisconsin employers, the required direct cash wage is at least $2. must regularly make $30 in tips each month.FLSA for Employees Learning objectives. So here is the entire process in a nutshell: Calculate the regular hourly rate. By subtracting $4. If the employee’s total tips do not amount . Overtime Hourly Pay.