Forecasting future expenses and savings

personal finance test 1 Flashcards

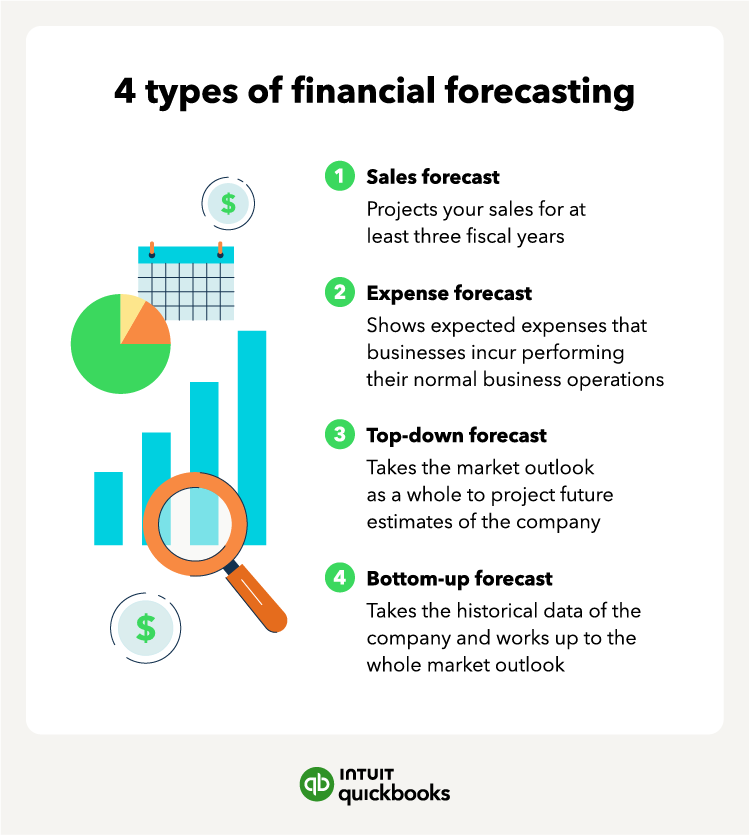

Profit and Loss Forecast: This projects the profit or loss by subtracting projected expenses from projected revenues.Expense Forecast: This predicts future costs, including both fixed and variable expenses.

Planning Budgeting Forecasting: How it is done

Here's how to do it effectively: Assess your current financial situation: Analyze your income, expenses, and savings to determine your financial capabilities .

Manquant :

AI Homework Help. By accurately predicting and preparing for future expenses, individuals and organizations can effectively allocate their resources, manage cash flow, and make informed financial decisions. So, activate a cell in a new column parallel to February (2nd month of our data): 2.In January 2023, the FTC issued a proposed rule which was subject to a 90-day public comment period.What Is Financial Forecasting and Why Is It Important?

Expense forecasting plays a crucial role in financial planning and decision-making for individuals and businesses alike.Budget planning is the process of forecasting future expenses and savings.

7 Financial Forecasting Methods to Predict Business Performance

They then received information on potential events identified as high-risk, low-risk or no . Planning for your organization's financial future is vital for those . The FTC received more than 26,000 comments on the . These spreadsheets work with Microsoft Excel with macros enabled.Expense forecasting is not limited to businesses; it also has significant implications for personal finance planning. budget planning.Financial forecasting is the process of estimating or predicting how a business will perform in the future. Savings appear to be a major concern for households. Forecasting is typically used to . an opportunity cost .Forecasting is a technique that uses historical data as inputs to make informed estimates that are predictive in determining the direction of future trends. We investigated whether they adjusted their predictions in response to various risk scenarios or not and how such potential adjustments were affected by the information .

Do Risky Scenarios Affect Forecasts of Savings and Expenses?

The Dave Ramsey budget template is for anyone who wants to be the boss of their money and kick debt to the curb. They then received information on potential events identified as high-risk, low-risk or no-risk. Your percentages may need to be adjusted based on your personal circumstances. Dave Ramsey Budget Template. Balance Sheet Projection: This . We are making a two-months moving average so the first average would be calculated at the end of month 2. The Foundation for Accurate Predictions. The template comes with editable cells to customize the expense and income headers.

3 Keys To Building Out A Successful Budget And Forecasting Expenses

By understanding the different methods used to forecast these expenses and following best practices for creating an effective forecast, businesses can plan and budget effectively, identify areas . Total headcount. Spend forecasting tracks the following metrics that have to do with a company’s total expenses: Expenses by department. the value of what you own minus the value of what you . They then re‐ ceived information on potential events identified as high‐risk, low‐risk or no‐risk.Planning, budgeting and forecasting is typically a three-step process for determining and mapping out an organization’s short- and long-term financial goals.Expense forecasting using the revenue forecast simply involves establishing a percentage relationship between the revenue and the expense.

A financial forecast is a proactive financial planning strategy that involves predicting and preparing for future expenses and financial goals. However, if your forecast is concerned with a business’s future, such as a pending . Expense and cash flow forecasting: Your forecast should attempt to evaluate expected expenses based on current company objectives, adjusted for consequences like inflation and increased goods and services .

Financial forecasting is predicting a company’s financial future by examining historical performance data, such as revenue, cash flow, expenses, or sales.By forecasting expenses, individuals and companies can better allocate their resources, make informed financial decisions, and ensure that they have enough funds to cover their obligations.Browse Google Sheets 50/30/20 Budget Templates.

PearBudget Budget .is the process of forecasting future expenses and savings A Budgeting B Planning from FIN c07 at Ashworth College. What you own can also be referred to as your _____.Introduction to Income Statement ForecastingIncome statement forecasting is a financial analysis technique used to predict a company's future financial performance based on historical data and certain assumptions. The 50/30/20 rule of thumb is a guideline for allocating your budget accordingly: 50% to “needs,” 30% to “wants,” and 20% to your financial goals. It's Your Money offers an assortment of free or low-cost personal money management spreadsheets. Budget calculator is an easy-to-use tool to manage your expenses and income monthly in Excel desktop app, Excel online, and offline format. The income statement, also known as the profit and loss statement or statement of operations, provides a summary of a company's .Critiques : 27 Cash-Flow Projection: This assesses the inflows and outflows of cash, indicating liquidity over time. In this Excel tutorial, we will cover the step-by-step . In this section, we will discuss the benefits of future dating in expense forecasting. And while the process doesn’t eliminate uncertainty, it helps businesses plan and prepare for the future.This is where future dating comes in handy. Participants were asked to forecast future expenses and future savings.The future of inflation (forecast) targeting.

Is the process of forecasting future expenses and

Total views 100+ Ashworth College. In a financial planning and analysis (FP&A . It involves evaluating your current financial position by assessing your income, your . Forecasting refers to the practice of predicting what will happen in the future by taking into consideration events in the past and present. By analyzing income, expenses, and savings patterns, individuals can forecast future expenses, set realistic financial goals, and make informed decisions about investments, debt management, and retirement planning.

In conclusion, accurately forecasting overhead expenses is essential for any business looking to succeed in today's competitive marketplace.

Financial Forecasting Guide

Forecasting: Forecasting predicts future events and trends primarily based on historical data, market trends, and other factors.A forecast budget, often referred to as a financial forecast, is a tool that evaluates current financial performance and economic conditions to estimate and .; Forecasting is the dynamic, flexible process for assessing current performance and predicting future potential.

Manquant :

savingsEach financial forecast plays a major role in determining how much attention is given to individual expense items.

Decisions regarding how much money to retain in a liquid form and how to allocate the funds among short . Keynote speech by Isabel Schnabel, Member of the Executive Board of the ECB, at the thirteenth conference .Financial forecasting refers to the process of estimating or predicting how a business will perform in the future based on historical data, trends, and other business intelligence. While related, . Identified Q&As 25.The process of forecasting future expenses and savings is _____.

Key Highlights.Participants were asked to forecast future expenses and future savings.

Forecasting: What It Is, How It’s Used in Business and Investing

Identify All Revenue Sources And Expenses. It provides anticipated financial outcomes, such as revenue, expenses, and profitability, to assist in decision making, budgeting, and strategic planning. Identifying Patterns in Expense Data.; Budget forecasting is a specific type of forecasting that takes its inputs from the budget for the upcoming fiscal . Financial forecasting helps stakeholders like investors, financiers, management, and others make informed decisions and manage financial risks. Savings rates are historically low and are .These projections should attempt to predict future revenue goals, new business opportunities, and other positive impacts.

How to Use the Excel FORECAST Function Step-by-Step (2024)

Study Resources. Manually using the AVERAGE function. It allows businesses to record expenses that will be incurred in the future, making it easier to forecast expenses accurately.Budget forecasting refers to the process of estimating and projecting future financial outcomes based on historical data, market trends, and strategic . Excel’s financial tools provide a convenient and efficient way to track and analyze expenses , allowing users to create detailed budgets , monitor spending . We investigated whether they adjusted their predictions in response to various risk scenarios or not and how such potential adjustments were affected by the information given.

They then received information on potential events identified as high-risk, low-risk or no-risk. The rule was popularized in a book by Elizabeth Warren and her daughter, Amelia Warren Tyagi. The representation of what you give up as a result of a spending decision is called _____. The most common type of financial forecast is an income .

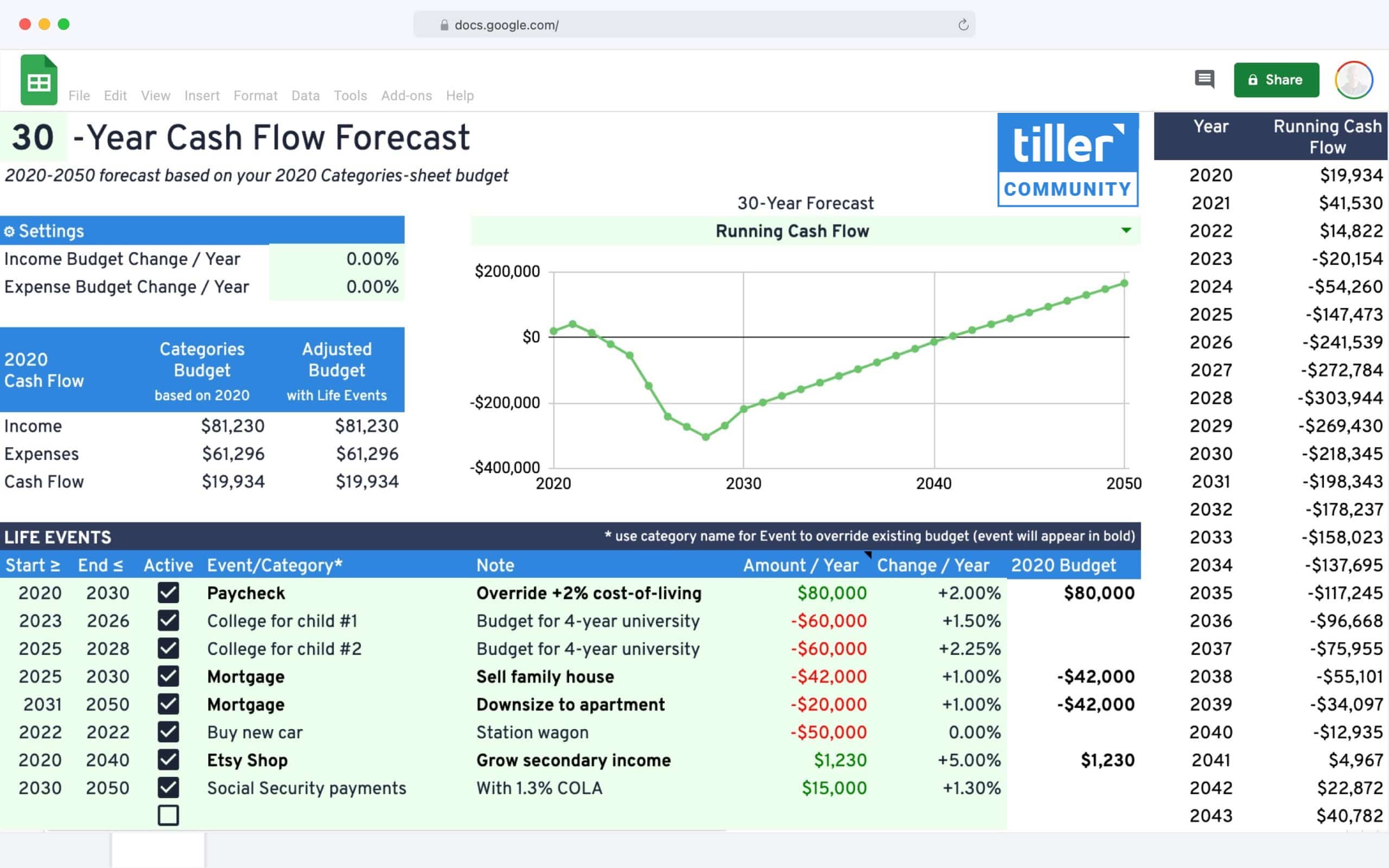

Cash Flow Forecast Basics

Exploring External Influences. Indeed Editorial Team. Budgeting is a detailed, static financial plan and expectations laid out in advance.There are three ways how you can apply the moving average method to forecast numbers. Future dating is the process of scheduling a transaction to occur on a future date.Budget Calculator. Updated June 24, 2022. Designed by Sheryl Killoran.

Forecasting Income Statement

For example, if you forecast high-level trends for general planning purposes, you can rely more on broad assumptions than specific details.