Form 1099 nec 2021

:max_bytes(150000):strip_icc()/1099r-eda9fdcb4d82449da27f9f30a318aaa3.jpg)

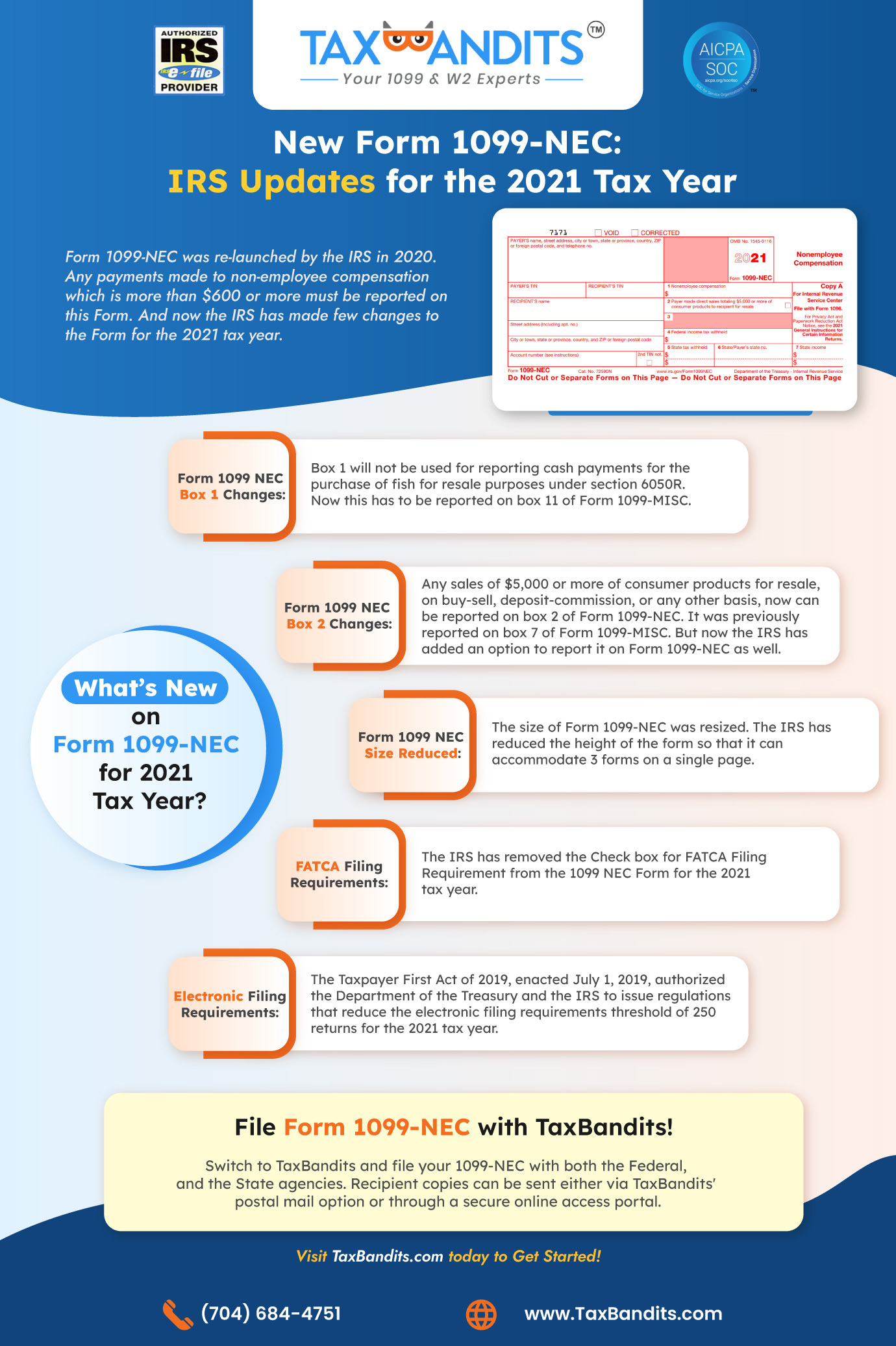

2021 Form 1099-NEC Nonemployee Compensation. A 1099-NEC form (non-employee compensation) is an IRS tax document that reports payments made by .Form 1099-NEC - Nonemployee Compensation. Though 2020 was a big year for changes in 1099 reporting, the IRS has implemented further changes for 2021. Whether you work as an independent contractor or freelancer or hire them in your business, you need to know about Form 1099-NEC. This article has been updated from its original publication date of March 17, 2020.But from 2021, the payer can use either 1099 NEC Form box 2 or Form 1099 MISC box 7 to report the direct sales. From the tax year 2020 and beyond, employers are . Learn about the changes taking place for tax year 2021. File Form 1099-MISC by February 28, 2022, . If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it .Form 1099-NEC - New changes by the IRS for 2021 - Explained Updated on January 21, 2022 - 10:30 AM by Admin, TaxBandits. Once you find it, scan for Part I: Taxpayer Identification Number (TIN).What do you report through 1099 NEC for the 2021 tax year? Form 1099 NEC used by businesses who act as clients to report payments made for performing work to an individual who is not their employee. Le formulaire d’information sur l’impôt 1099 fédéral sur le revenu est un moyen important de déclarer le revenu de non-emploi à l’Internal Revenue .Section 6071(c) requires you to file Form 1099-NEC on or before January 31, 2022, using either paper or electronic filing procedures.IRS 1099 Form Deadlines for 2023.

What is Form 1099-NEC?

Publié :12 novembre 2021.

What Is Form 1099-NEC?

Why Should We Printing the New 1099-NEC in Sage 50?

Deadlines for 2021 Forms 1099-NEC and 1099-MISC

IRS 1099-NEC Form (2021-2024) Updated November 27, 2023.The new Form 1099-NEC is what your nonemployee compensation (aka pay that doesn’t come from an employer) from each client will be reported on instead of Form 1099-MISC. If in case, you are using 1099 NEC to report these sales, then you need to file the tax form with the IRS by January 31 st. An information return penalty may apply if you don't file information returns or provide payee statements on time.

Guide du formulaire 1099-NEC de l'IRS

Free IRS 1099-NEC Form (2021-2024)

File Form 1099 MISC with the recipient by January 31st, 2024 & e-file 1099 MISC by March 31st, 2023. Find out how to e-file, print, or order the . Specific Instructions for Form 1099-MISC File Form 1099-MISC, Miscellaneous Income, for each person in the course .Form 1099-NEC, for example, shows payment you’ve received from clients or customers.When you hire contractors, they must fill out Form W-9.Form 1099-NEC, call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 (not toll free). To ease statement furnishing requirements, . For Recipient Department of the Treasury - Internal Revenue Service. What is it? An official IRS tax document providing a summary of promotion, referral, and .You had backup withholding applied on any payment taking place in 2021; Note: Certain states have implemented lower reporting thresholds. À partir de 2020, l'IRS a réintroduit le formulaire 1099-NEC. This is a free filing method that allows you to electronically file your 1099-NEC Form, as well as apply for extensions, make amendments, and more. Online fillable copies. We mail you Notice 972CG if you owe a penalty and charge monthly interest until you pay the amount in full. 2021年度开始,Form 1099-MISC又有了一些小变动,就是表格不再固定年度了,而是将年度作为一个可填写项目。这说明自从这版1099-MISC之后,就会一直沿用Rev.

Ce formulaire, autrefois mis au rancart, . Form 1099-NEC is an IRS tax form that must be filed to report nonemployee compensation. This form is used by .

Since this is Sunday, the due date will be the next working day, i.Section 6071(c) requires you to file Form 1099-NEC on or before February 1, 2021, using either paper or electronic filing procedures.Form 1099-NEC is due to both the IRS and the payee on January 31 of the year after the tax year being reported. Since you were not an employee of the company or .This essential update will prepare you to handle the changes in IRS forms, instructions and regulations for 2021 tax reporting required on Form 1099-NEC (Non-Employee Compensation) and 1099-MISC (Miscellaneous Information).Mercredi Septembre 15, 2021.Learn how to use Form 1099-NEC to report nonemployee compensation, such as payments to independent contractors.For the latest information about developments related to Forms 1099-MISC and 1099-NEC and their instructions, such as legislation enacted after they were published, go to .

Anytime you hire an independent contractor, vendor, or freelance worker, or a non-employee and pay them over $600 for their work, .消失的Box 7从2020年度开始,用一张单独的表格 Form 1099-Nonemployee Compensation (Form 1099-NEC).Taille du fichier : 510KB

About Form 1099-NEC, Nonemployee Compensation

Form 1099-NEC, Nonemployee Compensation, is a tax form specifically designed to report payments made to those who aren’t considered employees. These can include payments to independent contractors, gambling winnings, rents, royalties, and more.The 1099-NEC will look a bit different for 2021! Last year, for 2020 tax reporting, the IRS opened its vault and unearthed Form 1099-NEC.

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)

For example, 1099-NEC forms for 2022 must be filed with the IRS and sent to the payee by . For tax year 2020, the form is due Feb. Nonemployee compensation of $600 or more should be reported on Form 1099-NEC. For example, if you prepared and submitted seven 1099-MISC forms and three 1099-NEC forms, you must submit a 1096 form summarizing the 1099-MISC forms and another 1096 form summarizing the 1099 .If you have questions about reporting on Form 1099-NEC, call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 (not toll free).You will need to submit a separate 1096 for every type of information return prepared, even if you prepared only one of each kind. Department of the Treasury - Internal Revenue Service. Learn who should get it, what to do with it and how to file it by Jan.Form 1099-NEC is a tax document for reporting nonemployee compensation paid by a business.

Understanding the 1099-NEC Form: A Complete Guide

Form 1099 is a collection of forms used to report payments that typically aren't from an employer.Form 1099-NEC 2021 Nonemployee Compensation Copy 2 To be filed with recipient’s state income tax return, when required. Are not reportable by you in box 1, Form 1099-NEC. 1545-0116 VOID. Find out the difference between Form 1099-NEC and Form 1099-MISC, and the tax implications . OMB: 1545-0116 OMB.Starting in 2021, send copies of Form 1099-NEC to workers you paid nonemployee compensation to during the year by January 31 or the next business day (if it falls on a weekend).

Form 1099-NEC for Nonemployee Compensation

The 1099-NEC has undergone more revisions for 2021.

What is a 1099 Form?

Failure to Furnish Correct Payee Statements — Internal Revenue Code § 6722. Nonemployee Compensation Copy 2. Form 1099- MISC should be distributed to the recipients and contractors by January 31, 2021; for this year, the date is extended to February 1, 2021. A 1099-NEC form is used to report amounts paid to non-employees (independent contractors and other businesses to whom payments are made). Therefore, you might receive a 1099-K for amounts that are below $20,000. 31 and is due to the IRS by Feb.

Printing the New 1099-NEC in Sage 50

On the screen titled We need to know if [Taxpayer/Spouse] received any of these for their work in 2021, click the 1099-NEC box, then click Continue. Form 1099-MISC is still required to be distributed to the recipient by Jan. The reporting of payments made to non-employees will no longer be included in Form 1099-MISC as of 2020, according to the IRS, which also revamped the form. Hopefully, you kept Form W-9 in your accounting records. The term “non-employee” stands for every independent contractor, freelancer, and any other self-employed individual who performs .All 1099-NEC forms must be distributed to the recipients and filed with the IRS by Jan. File the hard copy of the Form with the IRS on February 28, 2021.Critiques : 153,4KThere are a few ways to file 1099-NEC forms, including: Online: You can e-file your 1099-NEC Form with the IRS through the Information Returns Intake System (IRIS) Taxpayer Portal. Dernière mise à jour : 5 janvier 2024. Find the current revision, instructions, and . CORRECTED PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no.

Form 1099-NEC: Nonemployee Compensation

Was this page helpful? Find out about what the 1099-NEC form is, why you received it, .Adams 1099 NEC Tax Kit gives you everything you need to report nonemployee compensation for 50 recipients; includes 4-part 1099 NEC forms, peel and seal envelopes, 3 1096 & Tax Forms Helper Online ; Use Form 1099 NEC to report all nonemployee compensation to the IRS and your recipients—now in 3 forms per page format for 2021Critiques : 31 Learn more on irs. That way, you have the information you need—like their TIN, name, and address—to accurately fill out Form 1099-NEC.For further information, see the instructions, later, for box 2 (Form 1099-NEC) or box 7 (Form 1099-MISC). 1099 forms can report different types of incomes.Critiques : 153KForm 1099-NEC 2021. In This Article. This is not intended as .Form 1099-MISC and Form 1099-NEC Reporting 2021 - CPA Clinics.When you receive form 1099-NEC, it typically means you are self-employed and claim your income and deductions on your Schedule C, which you use to calculate .1-2022这一个版本的表格 . Click +Add Schedule C, and continue with the interview process to enter your information. Payments to corporations for legal .

There are different kinds of deductions that can be taken against different types of income, just as there are . To be filed with recipient ’ s state income tax return, when required.Report in box 10 of Form 1099-MISC payments that: Are made to an attorney in the course of your trade or business in connection with legal services, but not for the attorney’s services, for example, as in a settlement agreement, Total $600 or more, and.

What are the Changes to Form 1099 NEC for Tax Year 2021?

Once you have all your items of income assembled, start thinking about deductions.Updated on January 25, 2021.What to Do With the 1099-NEC Form You Received . Nonemployee Compensation Copy B. Crosscheck these figures with check stubs and deposit slips., 1099 K, 1099 R, 1099 INT, 1099 DIV, and 1099 A deadlines for the tax year 2023 are . For State Tax Department.Form 1099-NEC isn’t a new form, but it's set to replace 1099-MISC for non-employee compensation. That form was starting to get crowded with items like business payments for rent, prizes and awards, medical and health care, and more, so now the two are . PAYER’S TIN . Box 4 of Form 1099 NEC is used to report federal income tax withheld . 1099 NEC Tax Form Box 4.

How to Fill Out a 1099-NEC

Form 1099-NEC is one of many 1099 tax forms, including 1099-MISC for miscellaneous income, 1099-INT for . Persons with a hearing or speech disability with .

What is a Form 1099-NEC Used For?

Key Deadlines to File Form 1099 NEC with the IRS & to the recipient is by January 31st, 2024. This is important tax information and is being furnished to the IRS. Non-employees receive a form each year at the same time as employees receive W-2 forms—that is, at the end of January—so the . January 2024) Nonemployee Compensation.