Form 5227 extension form

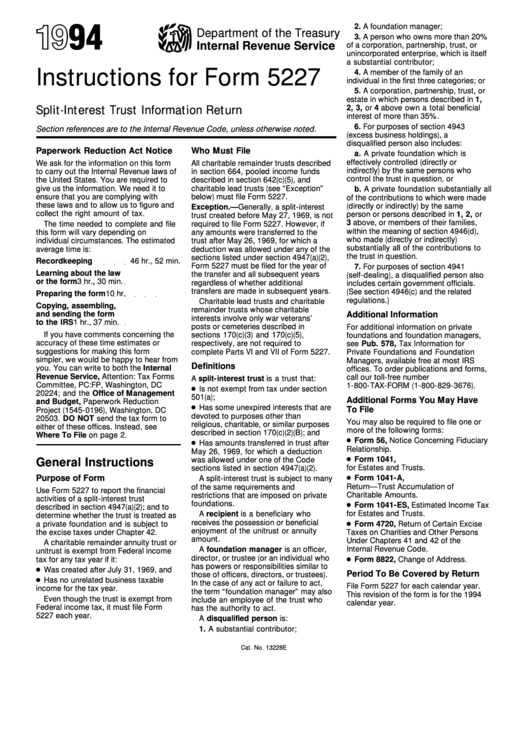

Form 5227 instructions state that the following types of organizations should use Form 5227: All charitable remainder trusts described in section 664 must file Form 5227.

Form 5227 is now open to public inspection .Split-interest trusts must file Form 5227, Split-Interest Trust Information Return PDF, instead of filing Form 990-PF.

In a matter of minutes, anyone, regardless of income, can use this free service to electronically request an extension on Form 4868. Also, the trustee of a trust required to file Form 1041-A or Form 5227 must use Form 8868 to request . Form M-752, Helpful Filing Tips for Form I-539. For any taxpayer required to file such form for the first time, See the instructions PDF for more . Form 5227 replaces Form 1041-A for split-interest trusts.

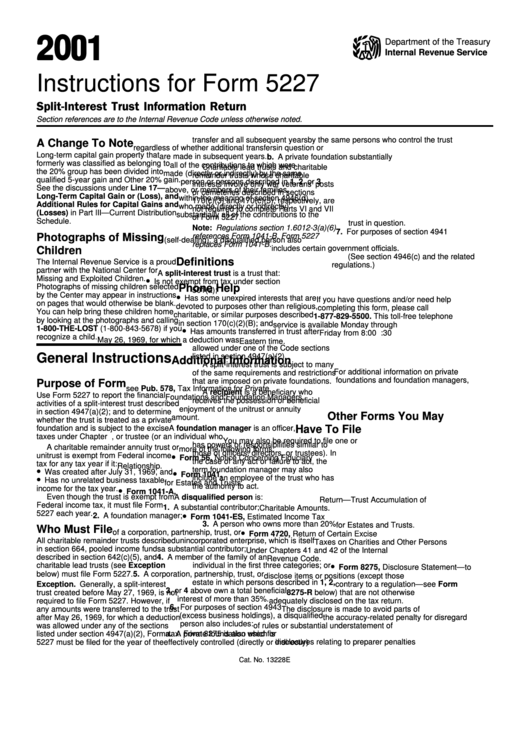

2023 Instructions for Form 5227

Forms and Instructions. Another option is to pay electronically and get a tax-filing extension. Select the links below to see solutions for frequently asked questions concerning form 5227.The extension is available automatically.Modification of Due Dates by Regulation.8868 extensions for Form 5227 are not required to be e-filed. garage, veranda).

IRS expands e-filing with new penalties for more paper forms

Extension of Time To File Your Tax Return

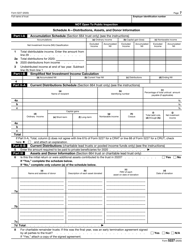

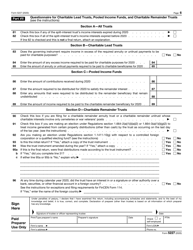

2 Part II Schedule of Distributable Income (Section 664 trust only) (See the instructions) Accumulations (a) Ordinary income (b) Capital gains (losses) (c) Nontaxable income Net Investment Income (NII) Classification. 5227 (2020) Form 5227 (2020) Page . If you need additional time to file, California grants an automatic six-month extension. Generating fiduciary Form 5227 for a charitable trust in Lacerte.

Use this form to apply for extension of time to file, and submit the original form to the IRS (no copies are needed). (Part 1 of the 5227 SCHA screen also must be completed to produce the Form 5227 . This form is filed for all estates. 1545-0196 See separate instructions.Fiduciary income tax returns due on April 15 (e. Regulations section 1. To help you build ., Form 1041, 1041-A, 5227 or 3520-A). Filing this form gives you until October 15 to file a return.gov/Form5227 for instructions and the . SOLVED•by Intuit•Updated over 1 year ago. Go to your TaxZerone account dashboard.The program only calculates Form 5227 for charitable remainder trusts and won't compute for charitable lead trusts.

Instructions for Form 5227

About Form 5472, Information Return of a 25% Foreign-Owned U.To prepare Form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the Data Entry Menu. extension, window creation) and/or to build an annex to its house (e. About Form 5227, Split-Interest Trust Information Return - IRS. For the 2023 tax year, you can file 2023, 2022, and 2021 tax year returns. (1) The maximum extension for the returns of partnerships filing Form 1065 shall be a 6-month period ending on September 15 for calendar year taxpayers. Tips for Filing Form I-539, Application to . You can electronically file a pooled income or charitable lead trust return with Form 1041 and .03010 available on 3/19/23. If October 15 falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day. At this time, the IRS will reject state returns sent with the federal return . How to resolve Lacerte diagnostic ref.Information Returns

How to File a Charitable Remainder Trust Tax Return

file Form 1041-A or Form 5227 must use Form 8868 to request an extension of time to file those returns.Department of Homeland Security.Form 5227 must use Form 8868 to request an extension of CAUTION! time to file those returns.Form 8868 is used by an exempt organization to request an automatic 6-month extension of time to file its return. Review the form thoroughly for any errors. Enter total amounts for all beneficiaries in each field.The IRS recently issued a revised Form 5227, Split-Interest Trust Information Return, for use in preparing returns for tax years beginning on or after Jan. A split-interest trust means the trust assets benefit both a charitable and no. Department of the Treasury Internal Revenue Service.

Instructions for Form 5227 (2022)

5227 (2019) Form 5227 (2019) Page . Use this form to apply for an automatic 6-month extension of time to file an organization’s return, and submit the original form to the IRS (no copies are needed).99, you can quickly complete and e-file Form 8868 in 3 easy steps taking less than 5 minutes.Form 5227, Split-Interest Trust Information Return.Quarterly estimated income taxes (split-interest trust) (Form 5227) Form 1041-A Although Forms 5227, 1041-A, and 990 series are not included above, they are postponed pursuant to Rev. Choose “Extension Forms” and select “Form 8868. e-File development for Form 5227 is currently underway, and e-file . 22 along with Instructions for Form 5227 (Split-Interest Trust Information Return), which was updated to reflect that electronic filing for the form is expected to be available in 2023.Identify how to properly complete Form 5227, Split-Interest Trust Return; Describe what is not included in the four-tier system for determining the income tax character of the . Citizenship and Immigration Services. Form 141AZ EXT - Application for Filing Extension for Fiduciary Returns Only. Form 6069 returns of excise .

IMM 5257 E : Application for visitor visa (temporary resident visa)

Form 8868, Application for Extension of Time To File 1. e-File development for Form 8868 is currently in process and is expected to be complete in Drake Tax 2023 at a later time; until then, Form 8868 must be paper filed. Information Return Trust Accumulation of Charitable Amounts.Form 8868 is used by an exempt organization to request an automatic 6-month extension of time to file its return or by a Form 5330 filer to request an extension of up to 6 months to file a return for excise taxes related to employee benefit plans.

2019 Form 5227

Electronically filing a return with Form 1041 and Form 5227.

If you have any documented deductions, this is where they will be recorded.Auteur : Jason D. Form 5227, split-interest trust information return .E-file an extension form for free.

15, and with provision for an extension under rules similar to the rules of 26 C. Charitable lead trusts will usually not generate .

Electronically filing a return with Form 1041 and Form 5227

The system will default to exporting Form 5227. For more information, get Form 541-A. To get the extension, taxpayers must estimate their tax liability on this form.regard to any extensions). (2) The maximum extension for the returns of trusts filing Form 1041 shall be a 5½-month period ending on September 30 for calendar year taxpayers. Enter your organization name, EIN and address.Form 5227 (2023) Page .Split-Interest Trust Information Return 2023 Form 5227 Form 5227 Department of the Treasury Internal Revenue Service Split-Interest Trust Information Return OMB No. All pooled income funds described in section .Application for Extension of Time To File an Exempt Organization. The due date to file Form 8868 is the same as the due date of the return, for which the nonprofit is requesting an extension. Return or Excise Taxes Related to Employee Benefit Plans.

Split-Interest Trust: Annual Return (Form 5227)

2018-58 which was incorporated by Notice 2020-23.Form 5227 replaces Submission 1041-B.Form 5227 shall be an automatic six-month period beginning on the due date for filing the return (without regard to any extensions). Split-Interest Trust Information Return. Split-interest trusts include: charitable lead trust, charitable remainder annuity trust (CRAT), charitable remainder unitrust .

There are two different scenarios that need to be . Select the Form code for the extension request. Form 1041 can be selected for export with the following input: Interview form EF-2, box 91 with a code of '1' WSV General > Electronic Filing > General > Line 27 - Select type of return for export, select Force 1041. Also, the trustee of a trust required to file Form 1041-A or Form 5227 must use Form 8868 to . For all forms (except Form 5330) an automatic 6 .

Title: IMM 5257 E : Application for visitor visa (temporary resident visa) Author: Immigration, Refugees and Citizenship Canada Created Date: 9/5/2022 10:36:18 PMTaille du fichier : 559KB

Form 5227, Split-Interest Trust Information Return

In the case of a final short-year period, the return is due by the 15th day of the 4th month following the date of the trust's . File extensions . For Forms 990, 990-EZ, and 990-PF, the due date for filing Form 8868 is .To open the DIST screen, click the DIST link on the 5227 tab in the Data Entry Menu. A substantial contributor; an Exempt Organization Return.For calendar year 2023, file Form 5227 by April 15, 2024.Note: Extension Form 8868 for Form 5227 can be electronically filed. Attachments to Specified Forms that are included in the tax deadline postponement to July 15, 2020. However, if your organization needs more time, you are required to file for an extension. Common questions about Form 5227 in Lacerte. 5227 State Electronic Filing. 2 Part II Schedule of Distributable Income (Section 664 trust only) (See instructions) Accumulations (a) Ordinary income (b) Capital gains (losses) (c) . Electronic filing of Form 5227 is available with release 2022-3.Allows to carry out work on a detached house (e. Due date for timely filed calendar-year-end 1041 returns, Form 7004 extensions for Form 1041, Form 8868 extensions for Forms 1041-A and . However, charitable remainder trusts and charitable lead trusts whose charitable interests involve only war veterans' posts or cemeteries (as described in sections 170(c)(3) and .Among its numerous changes, the most significant are: Charitable split-interest trusts are no longer required to file Form 1041-A, Trust Accumulation of Charitable Amounts, sections of . The IRS will automatically process an . Form 541-B is due on or before April 15, 2022. January 2024) OMB No. Corporation or a Foreign Corporation Engaged in a U. FinCEN Form 114, relating to Report of Foreign Bank and Financial Accounts, shall be April 15 with a maximum extension for a six-month period ending Oct.Select the links below to see solutions for frequently asked questions concerning form 5227. The automatic extension includes: Forms 990, 990-EZ, 990-N and 990-PF; Form 5227 required of charitable remainder trusts and charitable lead trusts; Form 1041 required of charitable lead trustsForm 5227 accounts for both the current year and accumulated trust income.