Form on ben 2020

For best results, download and open this form in Adobe Reader.

FORM DI-Q1 (05-31-2019) U.Critiques : 26

Populations légales 2020

Form ON-BEN Application for the 2020 Ontario Trillium Benefit.The 2020 OTB payments, calculated based on the information provided on your (and your spouse’s or common-law partner’s) 2019 return(s) and Form ON-BEN, will be issued monthly from July 2020 to June 2021. §,q!3¤ 11800018 FOR OFFICIAL USE ONLY • If no one lives and sleeps at this address most of the time, go .

pdf; For people with visual impairments, the following alternate formats are also available: E-text 5006-tg-22e.pdf; PDF fillable/saveable 5006-tg-fill-22e. 5- On this page, choose the section Involuntary separation, answer the question, Do you want to apply .ARCHIVED - 5006-TG ON-BEN Application for the 2020 Ontario Trillium Benefit and Ontario Senior Homeowners' Property Tax Grant.

Form 5006-TG (ON-BEN)

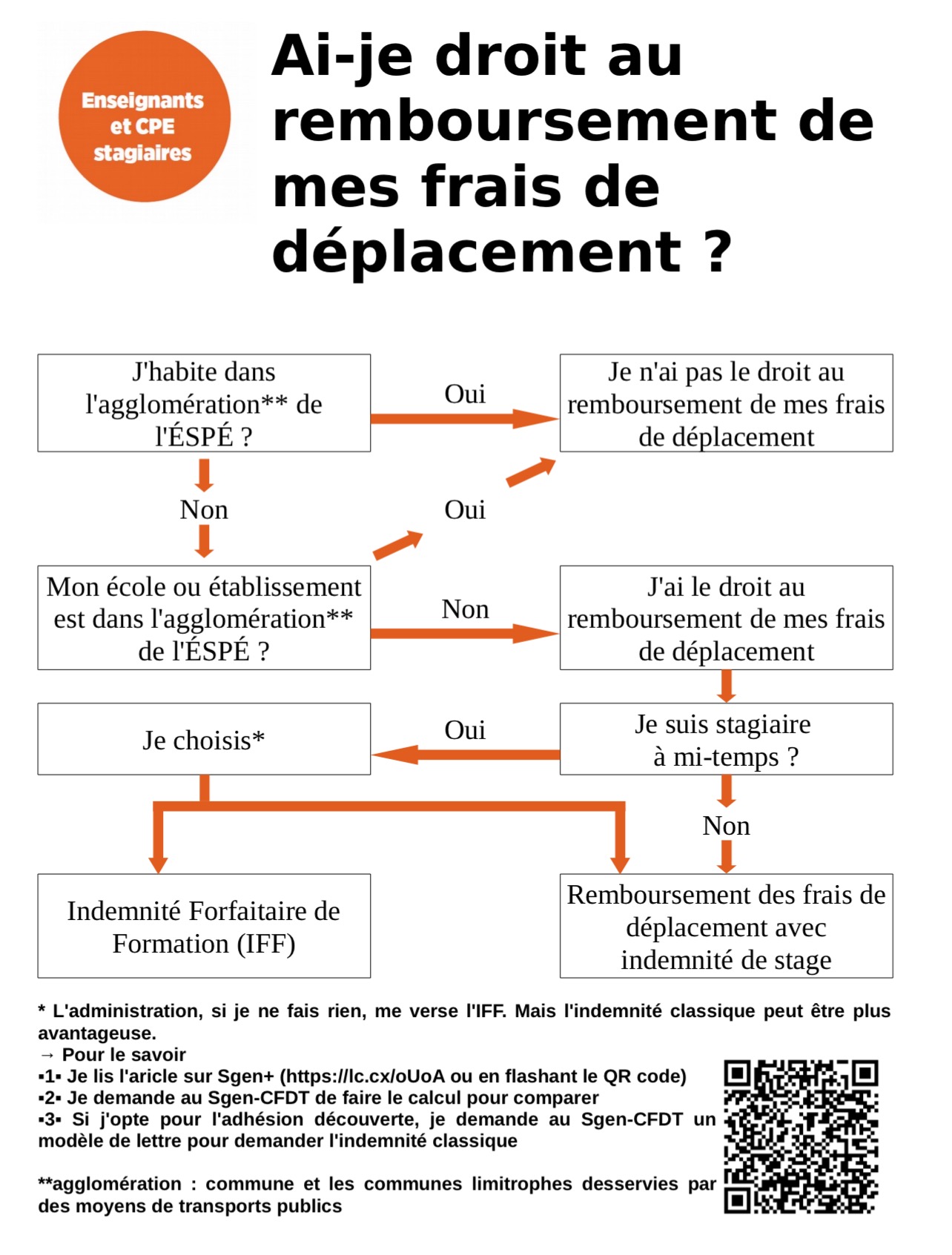

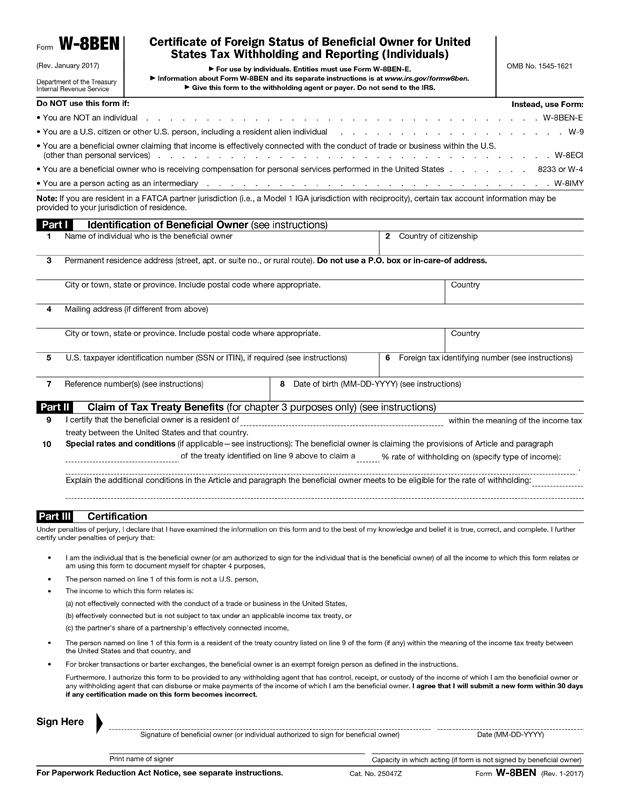

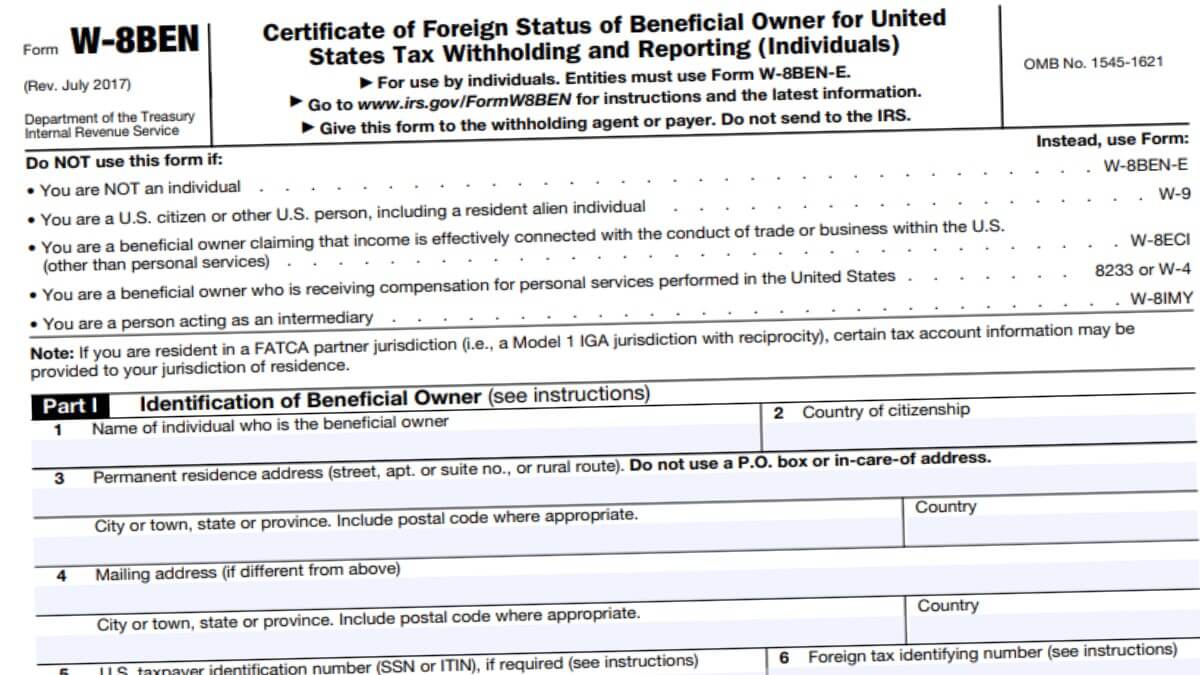

You can view this form in: PDF 5006-tg-21e. If you forget to include the ON-BEN with your tax return, you may file an adjustment to your return via CRA My Account or by mail. DEPARTMENT OF COMMERCE Economics and Statistics Administration This is the official questionnaire for this address. You have asked for clarification concerning the amount of home energy costs that should be entered in box 61210 on Form ON-BEN 2019, Application for the 2020 Ontario Trillium Benefit and Ontario Senior Homeowners’ .Le Bulletin officiel de l'éducation nationale, de la jeunesse et des sports publie des actes administratifs : décrets, arrêtés, notes de service, etc. 2022-03-09 21:14. 24 – The Vermont Hollywood – Los Angeles, CA.pdf; PDF fillable/saveable 5006-tg-fill-21e.Generally, a Form W-8BEN will remain in effect for purposes of establishing foreign status for a period starting on the date the form is signed and ending on the last day of the third succeeding calendar year, unless a change in circumstances makes any information on the form incorrect.

Date de modification : 2024-01-23.

myTaxExpress and T2Express FAQs

The information you provide on your 2020 . La déclaration via le service en ligne .Bandes-annonces et extraits du film Ben non (v.

ARCHIVED

le 22 mars 2022. Form W-9 is used to provide a correct TIN to payers (or brokers) required to file information returns with IRS.Ben&Ben have rescheduled their San Francisco and Los Angeles shows. Films Top 2024 films Dune - Deuxième partie Civil War Actualit é.Information about Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, including recent updates, related forms, and instructions on how to file. Du fait de la crise sanitaire de la Covid-19, l'enquête annuelle de recensement qui devait se tenir en 2021 a été reportée en 2022. With our divisions, Form-on formwork components and Form-on used formwork & scaffolding, we fulfill different demands and requirements in construction. When you arrive at the page for the ON-BEN form, answer the questions that apply to you and provide a few details about your principal residence in the designated fields of the tax software.txt; Large print 5006-tg-lp .Download Fillable Form 5006-tg (on-ben) In Pdf - The Latest Version Applicable For 2024. Information about Form 1040, U.A W-8 BEN form is a United States Internal Revenue Service (IRS) tax form used to determine the foreign status of non-resident aliens for the purposes of taxation. and Ontario Senior Homeowners' Property Tax Grant Protected B when completed. Both the OTB and . CENSUS BUREAU It is quick and easy to respond, and your answers are protected by law. Schedule ON428–A - Low-income Individuals and . View credit amounts for previous benefit years. Form 1040 is used by citizens or residents of the United States to file an annual income tax return.

5006-TG T1 General

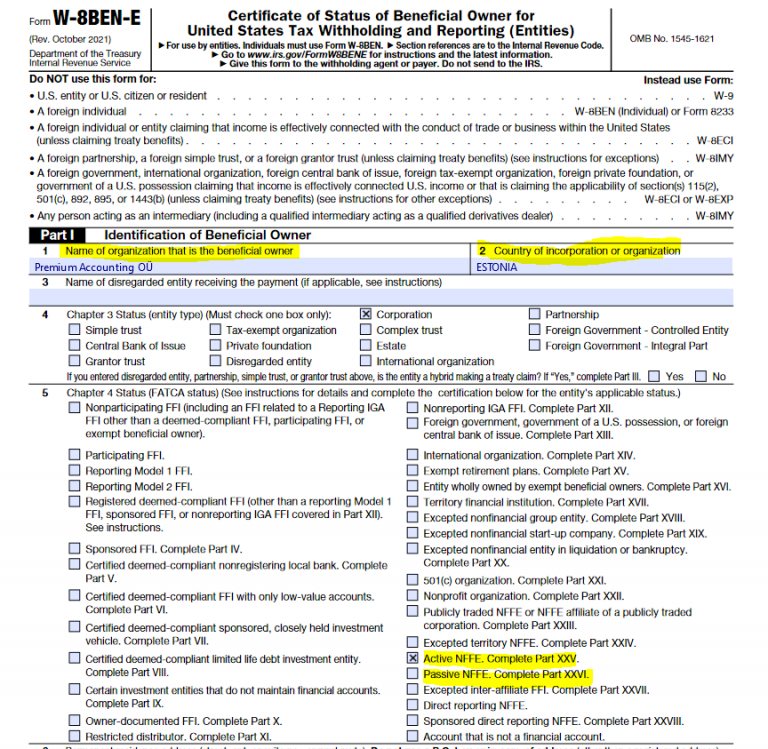

October 2021)-8BEN-E Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. For best results, download and open this . Elle est destinée à l'établissement de l'impôt sur les revenus. You can view this form in: PDF 5006-tg-22e.Give Form W-8BEN to the person requesting it before the payment is made to you, credited to your account, or allocated. Les versions des années passées sont aussi disponibles. NOTICE REVENUS 2020.Mise à jour : 2024-01-23.The Form ON-BEN (5006-TG) application for the 2020 Ontario Trillium Benefit and Ontario Senior Homeowners' Property Tax Grant (Large .Select the checkbox labelled Ontario trillium benefit and Ontario senior homeowners’ property tax grant (ON-BEN) then click Continue.

2020 Census Informational Questionnaire

Future Developments For the latest information about developments related to . La mise en place de mesures ministérielles et les opérations annuelles de gestion font l'objet de textes réglementaires publiés dans des BO spéciaux.Formulaire ON-BEN 2023. You can view this form in: PDF 5006-tg-16e. Fill Out The Application For The Ontario Trillium Benefit And Ontario Senior Homeowners' Property Tax Grant - Canada Online And Print It Out For Free.Easily fill out and download the Form ON-BEN (5006-TG) Application for the 2020 Ontario Trillium Benefit and Ontario Senior Homeowners' .Critiques : 15

ON-BEN

Complete Form ON-BEN (Application for the Ontario Trillium Benefit and the Ontario Senior Homeowners’ Property Tax Grant).

For the Ontario tax return, rent payment is entered on page 1 of form ON-BEN (Version 2019 and prior), or page 2 of ON-BEN (Version 2020 and later).Ben&Ben’s Live On Tour 2022 North American dates are: SEPTEMBER: 23 – Fox Theatre – San Francisco, CA. Utilisez ce formulaire pour demander, pour 2023, la . Enter the total amount of property tax paid on line 61120 in Part A and complete Part B of this form. La déclaration annexe n°2042 RICI permet de déclarer les réductions d'impôt et crédits d'impôt les plus fréquents.Download Printable Form On-ben (5006-tg) In Pdf - The Latest Version Applicable For 2024. When you file your tax return using TurboTax, this form will be completed as you .txt; Large print 5006-tg-lp-21e. The information you provide on your 2019 . Fill Out The Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners' Property Tax Grant (large Print) - Canada Online And Print It Out For Free.5006-TG ON-BEN Application for the 2024 Ontario Trillium Benefit and Ontario Senior Homeowners' Property Tax Grant - Canada. Ontario Sales Tax Credit This credit is a tax-free payment to help Ontarians with the sales tax they pay.ARCHIVED - 5006-TG T1 General 2010 - ON-BEN Application for the 2011 Ontario Senior Homeowners' Property Tax Grant, the 2011 Ontario Energy and Property Tax Credit, and the 2011 Northern Ontario Energy Credit You must be a resident of Ontario on .You owned and occupied a principal residence in Ontario that you, or someone on your behalf, paid property tax on for 2023. For example, a Form W-8BEN signed on September 30, 2015, remains . propriétaires pour l'impôt foncier de l'Ontario.

Both the OTB and OSHPTG are designed to help low- to moderate-income Ontario residents offset the cost of the energy sales tax, property tax, and more.

Bulletin officiel n°31 du 30 juillet 2020

You can view this form in: PDF 5006-tg-20e. See General information for details.4,6/5

Form ON-BEN (5006-TG)

Form ON-BEN – Application for the 2024 Ontario Trillium Benefit and Ontario Senior Homeowners' Property Tax Grant.Populations légales 2020.It’s Hero Time! Télécharger le pdf.We are writing in response to your correspondence dated January 13, 2020, regarding the Ontario Trillium Benefit (OTB). Cette notice n’a qu’une valeur indicative. Protégé B une fois rempli.:Nope) Bandes-annonces et extraits du film Ben non (v.In each file, Form ON-BEN will be generated by the program and Part C - Involuntary separation will be completed automatically.

BEN NON (2022)

You owned and occupied a principal residence in Ontario that you, or someone on your behalf, paid property tax on for 2022. Form On-ben (5006-tg) Is Often Used In Large Prints, Canadian Revenue .Page Last Reviewed or Updated: 23-Apr-2024. If you do not provide this form, the withholding agent may have to withhold at the 30% rate (under chapters 3 and 4), backup withholding rate, or the rate applicable under section 1446. L'Insee a adapté ses méthodes de calcul des populations légales pour pallier ce report et continuer à produire des populations légales de qualité chaque année. If you met these conditions and are applying for the 2023 OSHPTG, tick this box. However, you can choose to wait until June 2021 to get your 2020 OTB entitlement Séries Top 2024 séries Shōgun Le Problème à .

Ontario Trillium Benefit

~1 min.La déclaration de revenus (n° 2042) permet de déclarer les revenus perçus par les membres du foyer fiscal.Form 5006-TG (ON-BEN) Application for Ontario Trillium Benefit and Ontario Senior Homeowners' Property Tax Grant - Canada, 2023; Form . Individual Income Tax Return, including recent updates, related forms and instructions on how to file.The ON-BEN form is used to claim the Ontario Trillium Benefit (OTB) and Ontario Senior Homeowners’ Property Tax Grant (OSHPTG).Each year, you must apply for the Ontario Trillium Benefit by filing your personal Income Tax and Benefit Return and completing and enclosing the ON-BEN Application Form . For more information regarding the Ontario . Form 5006-tg (on-ben) Is Often Used In Canadian Revenue Agency, Canadian Federal . Pour savoir si vous êtes admissible à la prestation trillium de l'Ontario et à la . You must be a resident of Ontario on December 31, 2019 to .:Nope) Passer au menu Passer au .4- In this group, choose the option ON-BEN - Application for the 2020 Ontario Trillium Benefit (Ontario sales tax credit, Ontario energy and property tax credit, Northern Ontario energy credit) and the Ontario Senior Homeowners' Property Tax Grant.