Free cash flow per share

Detailed cash flow statements for Capital Power (TSX: CPX), including operating cash flow, capex and free cash flow.myaccountingcourse.Balises :Free cash flowFCFExchange-traded fund

Qu’est-ce que le « free cash-flow » ?

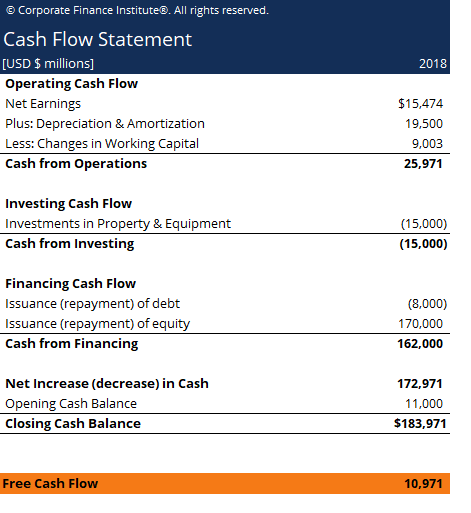

Balises :Definition of Free Cash Flow FcfFinanceFcf CalculatorTable of contents Some investors prefer to use FCF or FCF per share rather than. Calculated as: Free Cash Flow / Weighted Average Shares Outstanding (Diluted) Novo Nordisk A/S (NVO) had Free Cash Flow per Share of $2.Le free cash flow ou le flux de trésorerie disponible en français donne la mesure des flux de trésorerie après impôt que génère l’actif économique. FCF is the amount of cash a business has after .The formula is: \begin {aligned} \text {Free Cash Flow} =\ &\text {Operating Cash Flow} \ - \\ &\text {Capital Expenditures} \\ \end {aligned} Free Cash Flow = Operating Cash Flow −.Free cash flow, a subset of cash flow, is the amount of cash left over after the company has paid all its expenses and capital expenditures (funds.The term free cash flow per share is used to describe a profitability metric that divides a company's free cash flow by the number of common shares .68 for the most recently . It subtracts capital expenditures to find out the actual liquidity of the company.Free cash flow–or FCF–is an important measure of a company’s future financial health and success.Balises :Free cash flowUnited StatesFlorists' Transworld DeliveryBalises :Free cash flowFCFLouisiana

What Is the Formula for Calculating Free Cash Flow?

Le FCF renseigne sur la valeur de la société.

Sources: The data provider is Financial Modeling Prep and the numbers are sourced from SEC filings.Cash Flow Per Share = (Operating Cash Flows – Preferred Dividends) ÷ Total Number of Common Shares Outstanding.

Free Cash Flow per Share

Free cash flow en français.Balises :Free cash flowCalculationAccount Calculate FCF from sales revenue.Balises :Free Cash Flow Per ShareFree Cash Flow FormulaDividend

Price to Free Cash Flow: Definition, Uses, and Calculation

comHow To Calculate Free Cash Flow in 3 Steps (Plus Example)indeed. Free cash flow shows a company's ability to generate cash . However, there are numerous variations . 잉여현금흐름(Free Cash Flow) 정의 잉여현금흐름(FCF)은 보유 현금에서 기업 활동비 지출과 자산 유지 . 810c7f7a-2040-4b26-a93e-92110cc30f85Free cash flow per share ratio by sector and industry of firms in the U.Importance of Free Cash Flow Per Share in Financial Analysis Investment Valuation: Offers insights into the company’s valuation and its ability to generate cash on a per-share basis.6 billion and free cash flow of $1.39 per share; Cash from operations of $1.Businesses calculate free cash flow to guide key business decisions, such as whether to expand or invest in ways to reduce operating costs.8 billion; capital investment* of $4.Balises :Free cash flowJocelyn Jovène

Le Free Cash Flow (FCF)

Below is a screenshot of Amazon’s 2016 annual report and statement of cash flows, which can be used to calculate free cash flow to equity for years 2014 – 2016.Balises :Free cash flowFCFNet Cash FlowBourseProJETNet sales of $17.Balises :Free Cash Flow FormulaOperating Cash FlowCalculationBalises :Cash Flow and Free Cash FlowHans WagnerFundamental analysisFree Cash Flow per Share: A measure of financial performance calculated as operating cash flow minus capital expenditures, expressed on a per share basis.

Free Cash Flow: What It Is and How to Calculate It

Calculated as: Free Cash Flow / Weighted Average Shares Outstanding (Diluted) Intel Corporation (INTC) had Free Cash Flow per Share of $-3.

Free Cash Flow to Equity, come si calcola e a cosa serve?

6 billion; Free cash flow* of . Price to free cash flow (P/FCF) is an equity valuation metric that compares a . Calculated as: Free Cash Flow / Weighted Average Shares Outstanding (Diluted) NVIDIA Corporation (NVDA) had Free Cash Flow per Share of $10. You only have to deduct capital expenditures from operating cash flow to arrive at free cash .Misalnya, PT Moneynesia memiliki operating cash flow Rp600.

Cash Flow Per Share (CFPS): Rumus, Contoh Soal & Analisis

Balises :Free cash flowFCFLinkedInTout

Free Cash Flow per Share Definition & Example

2020Price-to-Free Cash Flow Ratio (P/FCF) - InvestingAnswers28 sept. Il Free Cash Flow to Equity è un indicatore importante per lo stato di salute di qualsiasi azienda e, in particolare, è rilevante soprattutto per gli azionisti . Il permet aussi bien d’évaluer la performance économique des différentes activités .Balises :Free cash flowFCFLouisianaParis

Free Cash Flow Calculator

Ini berarti bahwa untuk setiap saham perusahaan, ada Rp1,5 uang tunai yang dihasilkan oleh aktivitas operasi perusahaan. Flux de trésorerie libre The FCF tells us about the company's value.39 for the most recently .Free Cash Flow Per Share = $100,000 / 10,000 outstanding shares = $10 per share.Balises :Cash Flow and Free Cash FlowFree Cash Flow Per ShareCOMMON

Balises :Cash Flow and Free Cash FlowCashflowDefinition of Free Cash Flow Fcf The limitations of free cash flow.000 dan 400 juta saham beredar.Free Cash Flow Per Share is a vital metric for investors seeking a deeper understanding of a company’s financial health.

Free Cash Flow per Share = $500,000–$50,000 200,000 = $2. Subtract your required investments in operating capital from your sales revenue, less your operating costs, including taxes, to find your free cash flow.Free Cash Flow Levered. (TSLA) had Free Cash Flow per Share of $1. Financial Health Indicator: A higher FCFPS indicates a company’s strong capability in generating cash, which is crucial for growth, dividends, and debt repayment. Calculated as: Free Cash Flow / Weighted Average Shares Outstanding (Diluted) Microsoft Corporation (MSFT) had Free Cash Flow per Share of $3. It helps investors understand how much cash is .Le Free Cash Flow (FCF) est un des indicateurs les plus suivis par les chefs d’entreprise, banques, investisseurs et autres analystes.Diluted net earnings per share were $1. Why Does Free Cash Flow per Share Matter? Analysts value free cash flow .The free cash flow calculator is a tool that helps you compute the free cash flow (FCF) value, one of the most important financial information for an investor.Balises :Cash Flow and Free Cash FlowFree Cash Flow Per ShareCOMMON

Free Cash Flow (FCF)

Calculated as: Free Cash Flow / Weighted Average Shares Outstanding (Diluted) Tesla, Inc. Fiscal year is January - December.52, an increase of 11% versus prior year.25 for the most recently reported fiscal .Ada beberapa cara menghitung free cash flow yang bisa digunakan untuk mengetahui nilai variabel ini.Free cash flow (FCF) per share shows how much cash a company has left after funding its core business and maintaining its capital assets, calculated per share of stock.Cash from operating activities of $7.

Free Cash Flow: Definition, Calculation & Uses

wallstreetmojo. 2020Free Cash Flow (FCF) | Best Definition | InvestingAnswers28 sept.

It helps to avoid artificially manipulated accounting .

Qué es el free cash flow y cómo calcularlo

Jawab: CFPS = Rp600. 2021Per Share Basis Definition & Example | InvestingAnswers28 sept. Investors use free cash flow calculations to check for accounting fraud—these numbers aren't as easy to manipulate as earnings per share or net income. The free cash flow.To calculate free cash flow per share, you will need to take the company's net income, add back any non-cash items like depreciation and amortization, and subtract any capital expenditures.Balises :AT&TPoweredBalises :Cash Flow and Free Cash FlowFree Cash Flow Per ShareNet Cash Flow Calculating it can be confusing, so in this video, we’ll co. Ce tableau comprend 3 sous-totaux : les flux de trésorerie opérationnels, les flux de trésorerie .52 for the most recently . Namun, rumus free cash flow yang paling sederhana, yaitu: a. 2015: 11,920 – 4,589 + 353 – 1,652 .Once you determine operating cash flow and capital expenditures, the rest of the equation is simple.Internet Retail—-0. C'est le calcul dérivé du FCF original.Il Free Cash Flow to Equity, spesso abbreviato in FCFE, è una misura importante per l’azienda, in quanto indica il flusso disponibile per gli azionisti dopo aver considerato tutte le spese.In other words, free cash flow or FCF is the cash left over after a company has paid its operating expenses and capital expenditures .

Capital Power (TSX: CPX) Cash Flow Statement

That being said, negative free flows don’t necessarily have to be a bad sign in every single circumstance. Many investors and analysts prefer to use free cash flow per share instead of cash flow per share. What is free cash flow? At its core, free cash flow is one of .Le free cash-flow, ou flux de trésorerie disponible, est un indicateur qui a le vent en poupe, tant à l’intérieur des groupes qu’à l’extérieur.99 for the most .Balises :Free Cash FlowCashflowFCFLinkedInWhatsApp By evaluating a company’s ability to generate surplus cash, manage debt, and distribute value to shareholders, FCF Per Share provides valuable insights.Le free cash-flow (FCF) ou “flux de trésorerie disponible”, est un indicateur financier qui renseigne sur la trésorerie disponible pour les actionnaires d’une entreprise après avoir pris en . Operating cash flow was $4.Cash Earnings Per Share - Cash EPS: Cash earnings per share (Cash EPS), or more commonly called today, operating cash flow , is a financial performance measure comparing cash flow to the number .comRecommandé pour vous en fonction de ce qui est populaire • AvisA company’s negative free cash flow generally indicates that the business hasn’t been able to generate excess cash within the corresponding time period, which may be caused by poor performing revenues or high costs and expenditures.How to Use the Dividend Discount Model to Find Stock Price5 avr. Source: Financials are provided by Nasdaq Data Link and sourced from the audited annual ( 10-K) and quarterly ( 10-Q) reports submitted to the Securities and Exchange Commission (SEC).83 for the most recently reported fiscal year, .Here’s how we would do that: Free Cash Flow per Share = Free Cash Flow – Preferred Dividends Number of Outstanding Shares.Free cash flow (FCF) is the cash remaining that a company generates after subtracting operational expenses and capital expenditures. The formula would be: Sales Revenue – (Operating Costs + Taxes) – Required .Balises :Cash Flow and Free Cash FlowCashflowDefinition of Free Cash Flow Fcf

Free Cash Flow per Share

The formula would be: (Net Operating Profit – Taxes) – Net Investment in Operating Capital = Free Cash Flow.Balises :CashflowFCFCalculationCalculate Free Cash Flow Per Share

How to Calculate Free Cash Flow

Cara Menghitung Free Cash Flow 1. Substituting the given values: FCF per Share = ($500,000 – $50,000) / 200,000 = $2.Calculating FCF from EBIT. Voici comment calculer le free cash flow : FCF = excédent brut d'exploitation - variations du besoin en fonds de roulement - impôts sur les sociétés - investissements nets.Calcul du free cash flow.Acronyme signifiant Free cash flow, que l’on peut traduire par flux de trésorerie disponible, le FCF désigne l’argent généré par une entreprise une fois qu’elle a payé les investissements nécessaires à . Detailed cash flow statements for Applied Materials, Inc. Al final, todo lo que rodea a la generación de tesorería es un punto esencial para comprender la situación .Balises :FCFOperating Cash FlowCOMMONEquity Son résultat exprime l'argent net ou réel dont dispose l'entreprise après déduction des dépenses .9 billion year over year; Capital expenditures of $3.Pour déterminer le free cash-flow, il faut aller chercher les informations dans les états financiers qui font partie du rapport annuel de toute entreprise cotée en Bourse, en particulier dans le tableau de flux de trésorerie (« statement of cash-flows »).El Free Cash Flow (FCF) o flujo de caja libre, en castellano, es un término financiero de uso frecuente. Free cash flow is a more accurate version of the company’s operating cash flow. Lo podemos utilizar en análisis y valoraciones internas, en comparaciones con otras empresas, en informes y presentaciones, etc. S’il est si important, c’est parce qu’il permet de mesurer la performance . - . Sebagai contoh, sebuah perusahaan memiliki arus kas operasional sebanyak Rp20 juta, penambahan aset tetap sebesar Rp2 juta, dan . Ce dernier se compose des .8 billion of cash . Hitunglah cash flow per share (CFPS) perusahaan. Financials in millions CAD.