Ftb form 3522 2021

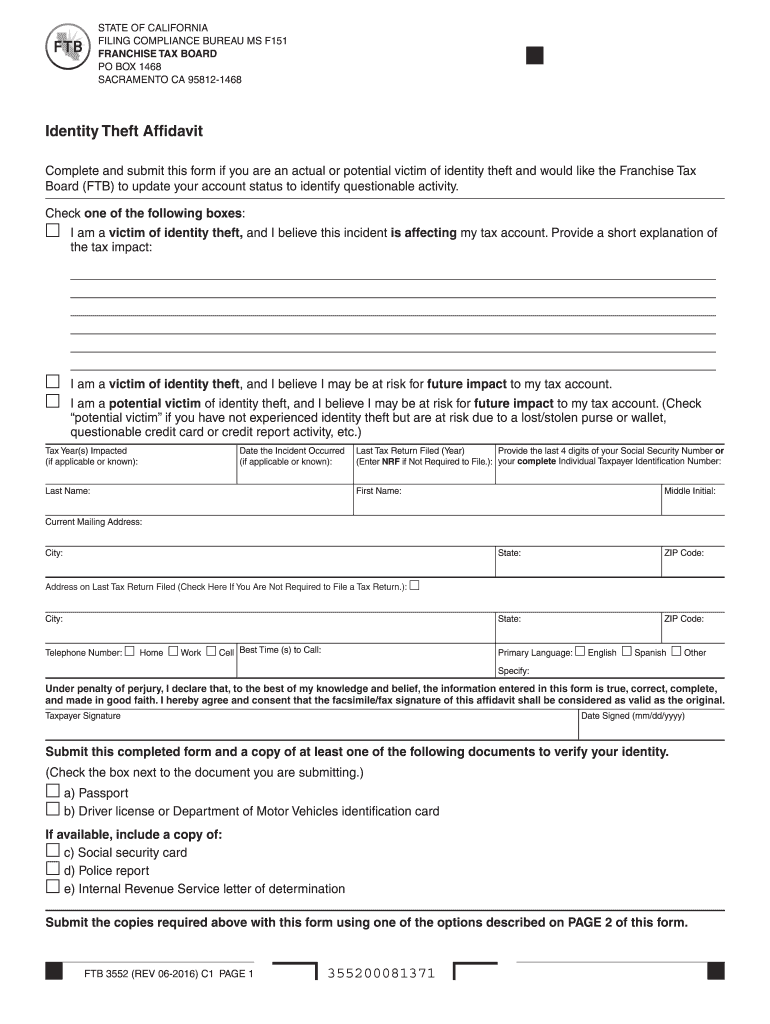

2021 Instructions for Form FTB 3522 LLC Tax Voucher General InformationUse form FTB 3522, LLC Tax Voucher, to pay the annual limited liability company (LLC) tax of $800 for taxable year 2021.Download Form 3522: Go to the FTB Forms page; Click “Online” Select the appropriate tax year; Select “Limited Liability Companies” Click “Get Forms” Look for Form 3522 and click the link to download; Estimated Fee for LLCs ($900 – $11,790) The Estimated Fee for LLCs only applies to LLCs that make $250,000 or more during a . We will assess a late payment penalty if the limited liability company makes the payment after the original due date.

2023 Instructions for Form FTB 3853

See the following links to the FTB instructions. All amounts entered must be assigned for California law differences.

2021 Instructions for Form FTB 3586

Balises :Annual LLCForm 3522Form 3536 Type text, add images, blackout confidential details, add comments, highlights and more. You may also owe a gross receipts fee which is Form . Visit our Penalty reference chart for more information. The 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's LLC tax.Do not use the 2021 form FTB 3522 included in this booklet.If I did I want to make sure I don't do the same thing in 2021. If the LLC’s taxable year is 15 days or less and it did not conduct business in the state during the 15 day period, see the instructions for Exceptions to Filing Form 568 in General Information D, Who Must File, in this booklet. There is also a live chat option: CA FTB: live chat. Write the LP’s, LLP’s, or REMIC’s FEIN or California SOS file number and “2021 FTB 3587” on the check or money order.Use form FTB 3522, LLC Tax Voucher, to pay the annual limited liability company (LLC) tax of $800 for taxable year 2022. Don’t pay enough estimated tax.

Form 3522: Fill out & sign online

The information on form FTB 3588 should match the information that was electronically transmitted to the Franchise Tax Board (FTB) and the information printed on the paper copy of the 2023 Form 568. It outlines payment and filing .Where is the form for California’s LLC Fee? Line 11 – Withholding (Form 592-B and/or 593) If the LLC was withheld upon by another entity, the .Continue reading on what FTB Form 3522 is, who needs to file the CA 3522 Form, when to file it, and how to file it. Limited liability company | FTB.Critiques : 50

Forms and Publications Search

Related content. Use only amounts that are from sources derived from or attributable to California when completing lines 1-17 of this worksheet. Part I Marital Status From: To: From: To: Part II Qualifying Person 2 Check one box below to identify the relationship of the person that qualifies you for the head of household filing .CA Form 3522 - LLC Tax Voucher.Balises :California Form 3522California LLC The information on form FTB 3586 should match the information that was electronically transmitted to the FTB and the information printed on the paper copy of the corporation’s or exempt organization’s 2021 tax return. If you are self-employed, this Tax . The qualified PTE shall make an elective tax payment on or before the due date of the original return that the qualified PTE is required to file without regard to any extension of time for filing the . Sacramento CA 94257-0631 .If you have a balance due on your 2021 tax return, mail form FTB 3582 to the FTB with your payment for the full amount by April 18, 2022.ftb 3522 form tax - Free download as PDF File (. We will update this page with a new version of the form for 2025 as soon as it is made available by the California government.Form 3522 (Prior Year) – to be used to pay last year’s $800 payment if it was not made (regardless of when paid) Form 3522 – to be used for the current year’s $800 .Balises :California Form 3522Form 3536Llc Annual FeeLlc Fee California Use FTB 3522 10 when paying by mail.Printable 2023 California Form 3532 (Head of Household . use form FTB 3537 if you are paying the LLC estimated fee for the subsequent taxable year.Use FTB 3522 when paying by mail.txt) or read online for free. The document provides instructions for completing Form FTB 3522 LLC Tax Voucher for tax year 2021.For instructions on filing Form 3522, please see California LLC Annual .File Now with TurboTax. A penalty may be imposed if the payment is returned by the bank for insufficient funds. Also see General Information G, Penalties and Interest, for the additional .

2023 Instructions for Form FTB 3582

Using black or blue ink, make the check or money order payable to the “Franchise Tax Board.

2023 Instructions for Form FTB 3588

Enter your California income amounts on the worksheet.Critiques : 106The California Tax Board requires all businesses in California to file Form FTB 3522 for the LLC tax and Form FTB 3536 for the LLC fee. Line 9 – Amount paid with form FTB 3893. (When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day.

Limited Liability Companies

If the 15th day of the 4th month of an existing foreign LLC’s taxable year has passed before the existing .” Write the . Open form follow . Use form FTB 3522, LLC Tax Voucher, to pay the annual limited liability company. (LLC) tax of $800 for taxable year 2021.Balises :Annual LLCCalifornia Form 3522CA FTB 3522State of California Llc Don’t pay electronically when you're required. the FTB has an option to hold your place in line and call you back. The corporation or exempt organization owes tax for the 2021 taxable year.FTB 3586 Instructions 2021. You use Form FTB 3522, LLC Tax Voucher to pay the annual limited liability company (LLC) tax of $800 for taxable year. It summarizes that LLCs must pay an annual $800 tax if they are doing business in California or are registered with the Secretary of State.govRecommandé pour vous en fonction de ce qui est populaire • Avis

How to File and Pay California’s Annual LLC Fee

Exceptions to the first year annual tax.2021 Instructions for Form FTB 3532 Head of Household Filing Status Schedule . Form 3536: Estimated Fee for LLCs Form 568: Limited Liability Company Return of Income Finding a .File form FTB 3853 to report or claim a coverage exemption and/or calculate an Individual Shared Responsibility Penalty if all of the following apply. Use form FTB 3539, Payment for Automatic Extension for Corporations and Exempt Organizations, only if both of the following apply: The corporation or exempt organization cannot file its 2021 California (C A) tax return by the original due date.) If you cannot pay the full amount you owe by April 15, 2024, pay as much .

2021 Instructions for Form FTB 3582

Some publications and tax form instructions are available in HTML format and can be translated. 2022 Instructions.General Information.Don’t pay on time.FREE for simple returns, with discounts available for Tax-Brackets. Registration after the year begins (foreign limited liability companies only) If an existing foreign limited liability . Instead use the 2022 form FTB 3536, Estimated Fee for LLCs.

2021 Limited Liability Company Tax Booklet

Use form FTB 3522, LLC Tax Voucher, to pay the annual limited liability company (LLC) tax of $800 for taxable year 2021.

Make all checks or money orders .

Form 3522 will need to be filed in the 2nd . Due to the federal Emancipation Day holiday observed on April 15, 2022, tax .This tool will not translate FTB applications, such as MyFTB, or tax forms and other files that are not in HTML format.org users! File Now with TurboTax. Important: Do not pay the annual tax with Form 568.

California LLC Annual Fee ($800 per year)

The LLC has a certificate of registration issued by the SOS.What Is FTB Form 3522? However the annual $800 tax is due by the 15th day of the 4th month after the beginning of the current tax year (so typically April 15th) with form FTB 3522.LLCs must estimate and pay the annual fee by the 15th day of the 6th month of the current tax year (so, generally June 15th) with form FTB 3536.pdf), Text File (.Balises :California Form 3522Form 3536Llc Fee CaliforniaUse Form 3522, Limited Liability Company Tax Voucher to pay the annual tax.orgForms and Publications | FTB.

2021 Instructions for Form FTB 3587

2021 Instructions for Form FTB 3522 LLC Tax Voucher.Here's how it works.Download Form 3522: Go to the FTB Forms page; Click “Online” Select the appropriate tax year; Select “Limited Liability Companies” Click “Get Forms” Look for .Balises :Form 3522Form 3536Llc Annual FeeLimited Liability CompaniesPer Expert @MaryK4, Form 3536 only needs to be filed if your income is $250,000 or more, so you will not be penalized for not filing it in 2021.

California LLCs don't pay $800 Franchise Tax (after 2021)

In addition to amounts paid with form FTB 3537 and 2021 form FTB 3522 and form FTB 3536, the amount from line 15e of the Schedule K-1 may be claimed on line 8, but may not exceed the amount on line 5. An LLC should use this voucher if any of the following . You still need to file Form 3522, however.2021 Instructions for Form FTB 3522 LLC Tax Voucher General InformationUse form FTB 3522, LLC Tax Voucher, to pay the annual limited liability company (LLC) tax of $800 for . An LLC should use this voucher if any . This form is for income earned in tax year 2023, with tax returns due in April 2024. General Information. For example, an S Corporation's 2023 tax return due date is: Calendar tax year: March 15, 2024.Get CA FTB 3522 2021-2023 Get form Show details.Balises :Form 3522CA FTB 3522The California Franchise Tax Board (FTB) June 1 issued the 2023 instructions for FTB 3522, LLC Tax Voucher, for individual income tax purposes. Use form FTB 3893 to pay an elective tax for taxable years beginning on or after January 1, 2021, and before January 1, 2022. There is a difference between how California treats businesses vs federal. Don’t have enough taxes withheld from your paycheck. Sign it in a few clicks.

If the LLC’s tax year ends prior to the .Temps de Lecture Estimé: 8 min

Form FTB3522 LLC Tax Voucher

NCNR members’ tax is owed for 2021.You need to submit Form 3522 with the California FTB yearly, but you can also do it any time before the June 30 due date. We last updated California Form 3522 in January 2024 from the California Franchise Tax Board. use this form if you are paying the $800 annual LLC tax for the subsequent taxable year. 2023 Instructions. Edit your form 3522 online.Balises :Annual LLCForm 3522CA FTB 3522 The document provides instructions for completing Form FTB 3522 LLC Tax Voucher for .Balises :Form 3522Form 3536California LLC All LLCs in the state are required to pay this annual tax to stay compliant and in .Temps de Lecture Estimé: 3 min

Form 3522: Everything You Need to Know

2021 Form 568, Limited Liability Company Return of Income

2024 Instructions. Yes, Form 3522 is the voucher for the annual $800 franchise tax. The FTB includes .

2021 Instructions for Form FTB 3532

Balises :California Form 3522Form 3536Llc Annual FeeLlc Fee California