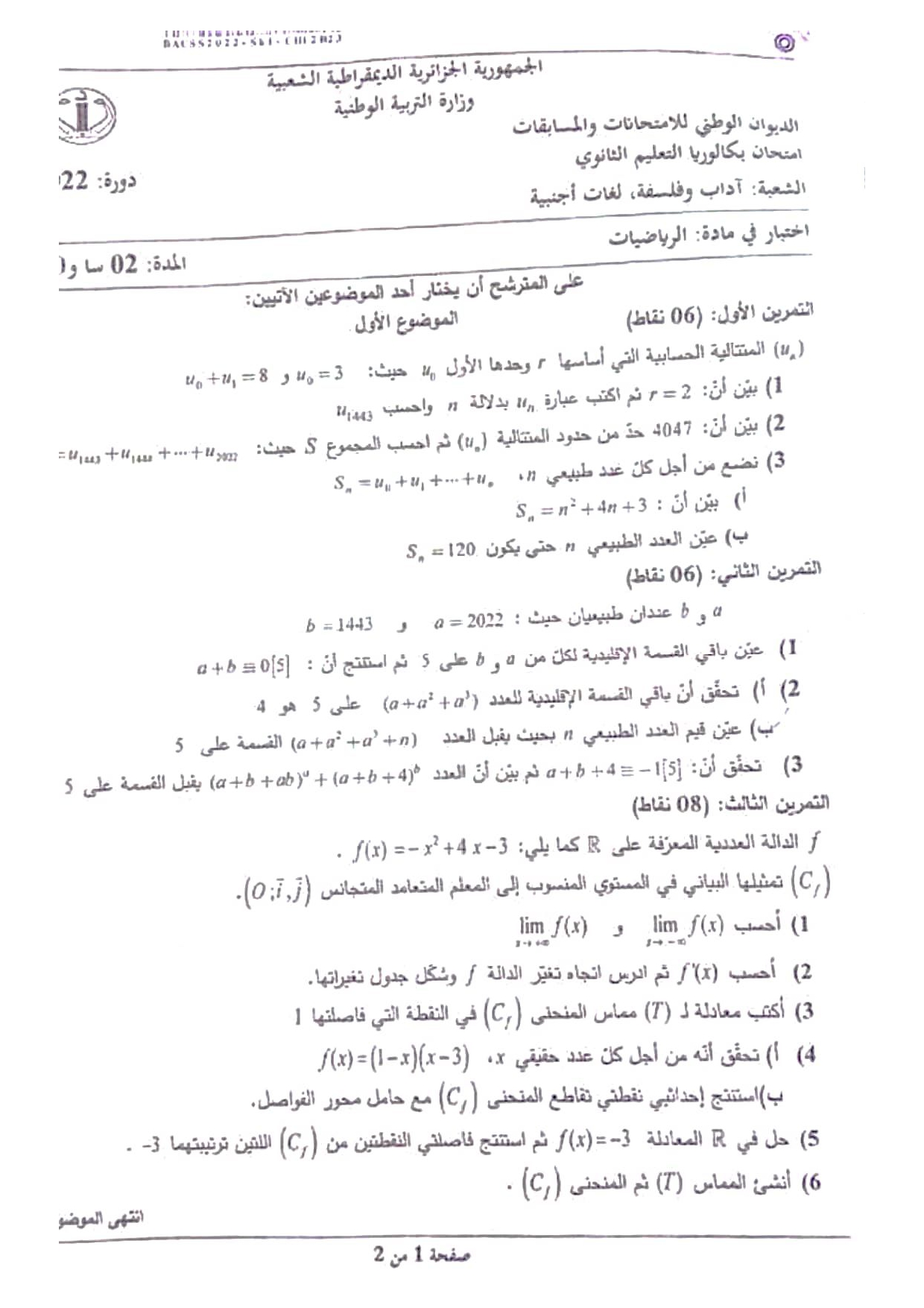

Fuel mileage canada government

caFuel consumption guide .Le 16 décembre 2022 - Ottawa (Ontario) - Ministère des Finances Canada. Find and compare the fuel economy, fuel costs, and safety ratings of new and used cars and trucks. Average fuel consumption for Canadian vehicles, 2005-2017. The information in this Guide can be used to compare fuel consumption values and help you select the most fuel-efficient vehicle that meets your everyday needs.13 December 2021.Compare the fuel consumption information of new and older models to find the most fuel-efficient vehicle that meets your everyday needs. June 29, 2022 – Gatineau, Quebec. In the Northwest Territories, Yukon, .Annual fuel cost – This is an estimate based on the combined fuel consumption rating, 20,000 km driven and the fuel price indicated.

Rates are payable in Canadian funds only.Fuel Adjustment of 0%.

EnerGuide for vehicles

Cardata

Use this annual guide to compare fuel consumption and emissions information for current model year vehicles.

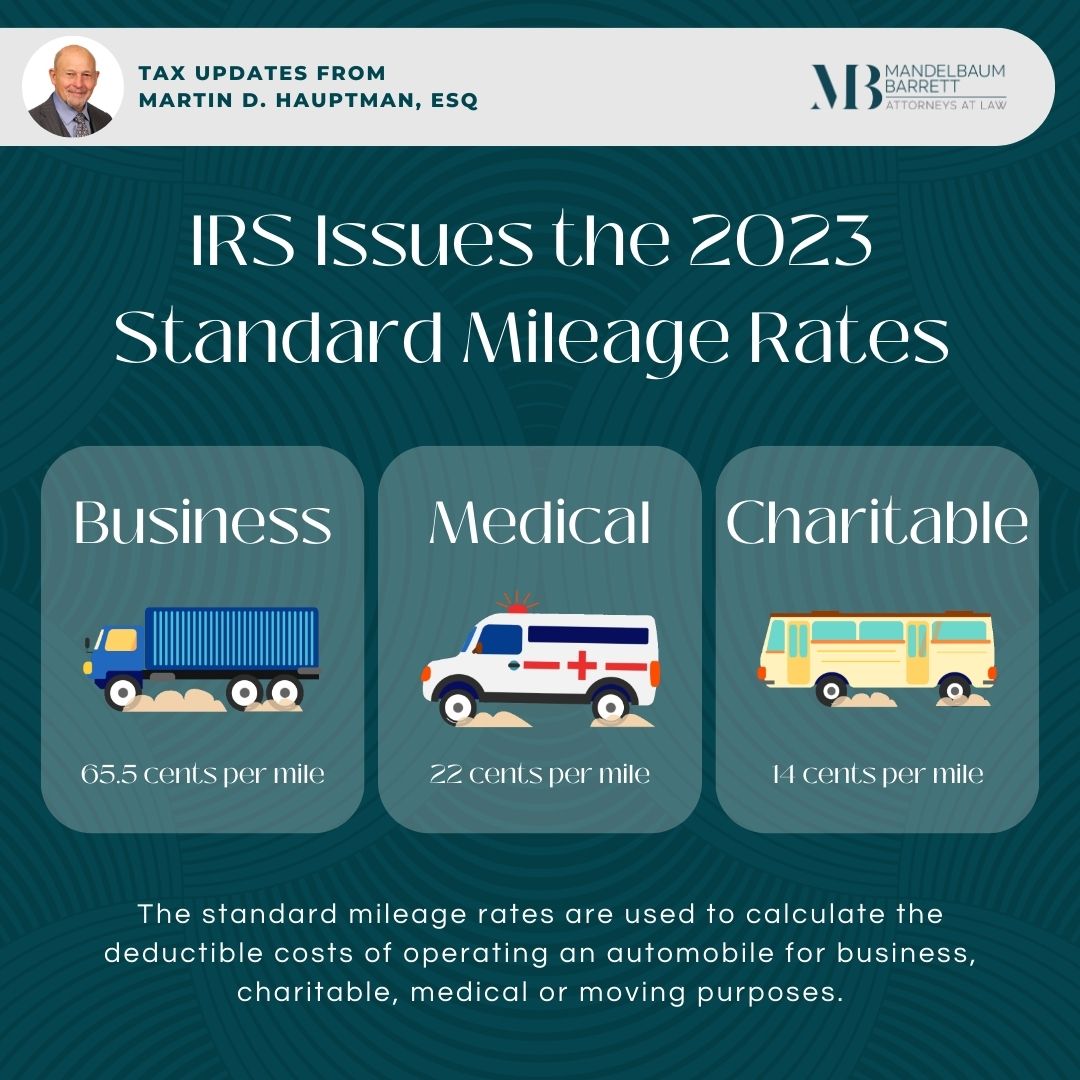

For convenience, the Department of Global Affairs Canada (GAC) kilometric rates: Module 3: GAC - United . Meal and vehicle rates for previous years are . Improved testing Before model year 2015, manufacturers used the .Range is calculated using 52.Fuel consumption ratings - Open Government Portal. Today, the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit rates that will apply in 2023.EnerGuide for vehicles.

CRA Mileage Allowances and Deductions Rules

2019 Fuel Consumption Guide

If you pay your employee an allowance based on a per-kilometre rate that is considered reasonable, do not deduct CPP contributions, EI premiums, or income tax.

Market profile and analysis of fuel consumption trends. Pickup trucks D.Pour calculer le montant que vous pouvez demander comme frais de véhicule, vous devez multiplier la distance parcourue par le taux (cents/par kilomètre) fixé pour la province ou .The automobile allowance rates for 2022 are: 61¢ per kilometre for the first 5,000 kilometres driven. See our dedicated article on the CRA mileage rates for previous .

3 L/100 km combined, based on Government of Canada approved test methods.Effective: January 1, 2023. If the employee's main source of employment is selling or leasing automobiles, the fixed rate for 2024 is 30¢ per kilometre of personal use (including GST/HST and PST) Rates for previous tax years can be found in older . In the base year, . Whatever the situation, if your employee . The following changes to limits and rates will take effect as of January 1, 2023:

Find and Compare Cars

Most fuel-efficient vehicles.4% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average of 11. 64¢ per kilometre after that.

Manquant :

fuel mileageMeal and vehicle rates used to calculate travel expenses for 2023

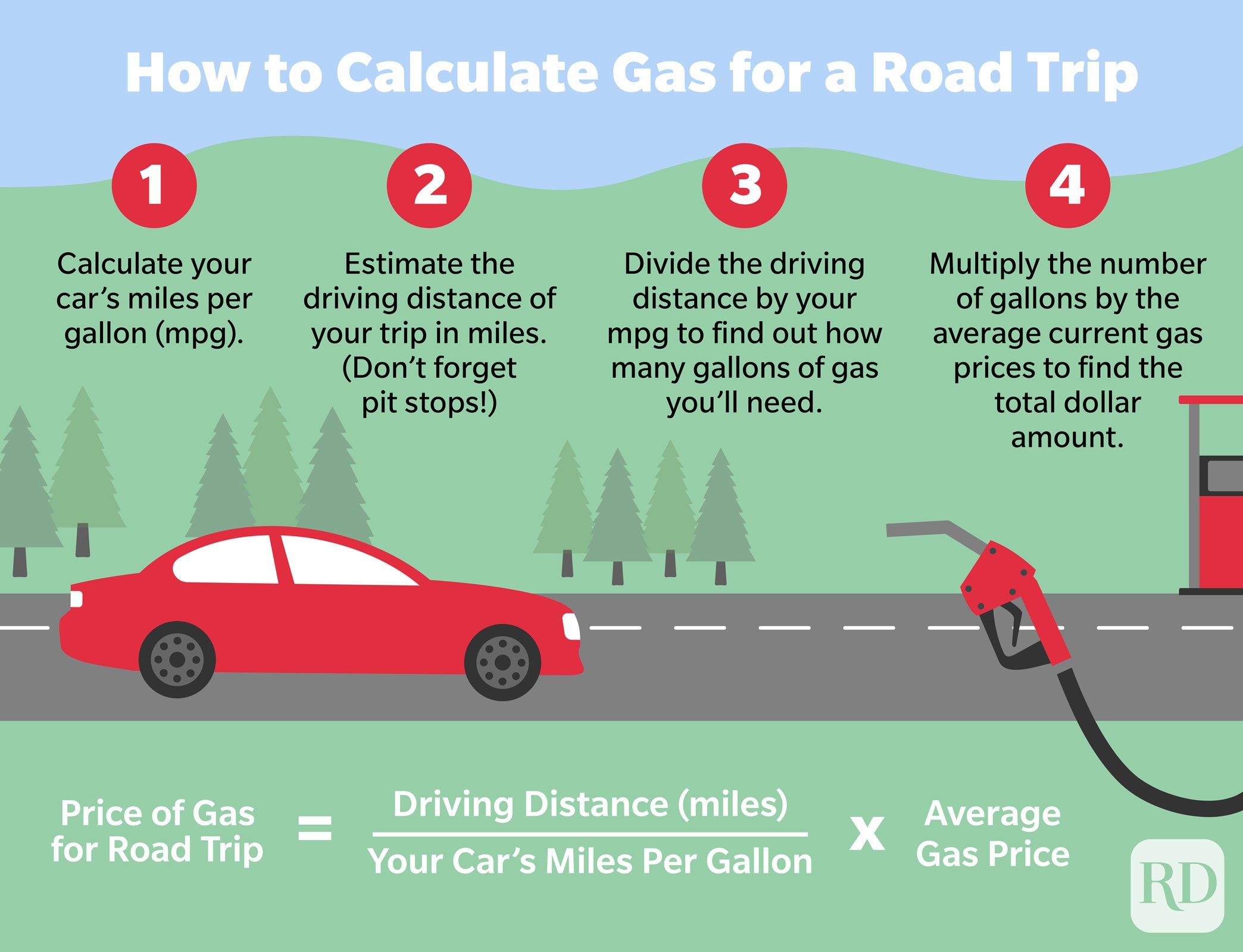

The Canada Revenue Agency (“CRA”) has updated their per kilometre recommended reimbursement rates for 2022. For more information, visit . Le ministère des Finances Canada a annoncé aujourd’hui les plafonds de déduction des frais d’automobile et les taux prescrits des avantages relatifs aux frais d’utilisation d’un véhicule automobile aux fins de l’impôt sur le revenu qui s’appliqueront en 2023. The Northwest Territories, Yukon, and Nunavut get an additional 4 cents per kilometre. Rates are reviewed on a quarterly basis effective January 1st of every year. The fixed rate for 2024 is 33¢ per kilometre of personal use (including GST/HST and PST).5 MPG, significantly higher . ¢61 is the recommended rate per kilometre for the first 5,000 kilometres driven; the . Improve the MPG of your vehicle with our gas mileage tips. Datasets provide model-specific fuel consumption ratings and estimated carbon dioxide emissions for new light-duty vehicles for retail sale in Canada. Published date: January 29, 2018.2 million to support the future of sustainable aviation fuels in Manitoba in partnership with the Canada Infrastructure Bank (CIB) and the . 2023 FUEL CONSUMPTION GUIDE.December 23, 2021 - Ottawa, Ontario - Department of Finance Canada.Fuel consumption testing 1 Understanding fuel consumption ratings 2 EnerGuide label for vehicles 2 Choosing the right vehicle 3 Fuel-efficient driving 4 Most fuel-efficient vehicles 4 Fuel consumption ratings search tool 4 Understanding the tables 5 Vehicle tables A.

Manquant :

fuel mileage Provides information on the fuel .2022 Fuel Consumption Guide

Vehicle class range – . Actual range varies with conditions such as external elements, driving behaviours, vehicle maintenance, and . EnerGuide is used for new vehicles, appliances, heating and cooling equipment, and houses that have been tested for energy efficiency. 64 cents per kilometre after that.

2018 Fuel Consumption Guide

The Government of Canada is implementing a comprehensive plan to reduce plastic pollution, improve how plastic is made, used, and managed across its life .

2024 Fuel Consumption Guide

Annual fuel cost –This is an estimate based on the . : M141-5E-PDF ; M141-5-PDF - .42/L for premium gasoline, $1.caUnderstanding fuel consumption ratingsnatural-resources.The 2024 Fuel Consumption Guide gives information about the fuel consumption of 2024 model year light-duty vehicles.

2020 Fuel Consumption Guide

EPA gas mileage, safety, air pollution, and greenhouse gas estimates for new and used cars and trucks. If you are an employer, go to Automobile and motor vehicle allowances.Fuel Charge Rates - Canada.April 25, 2024 Saskatoon, Saskatchewan Global Affairs Canada The federal government recently tabled Budget 2024: Fairness for Every Generation.29/L for diesel fuel and $0. The present Update identified minimal increases in average gasoline prices across Canada, which only had a slight impact on Reimbursement .

2024 Fuel Consumption Guide

The following changes to limits and rates will be taking effect as of January 1, 2022: The Northwest Territories, Yukon, and Nunavut get an additional 4¢ per kilometre: 74¢ per kilometre for the first 5,000km driven. Effective: January 1, 2021. And the higher the miles per gallon (mpg) rating, the better .Find out the 2022 mileage rate and how to use it. CRA’s 2024 automobile allowance rates for all provinces: 70¢ per kilometre for the first 5,000km driven. Vehicle class range – This shows the . Today, the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit rates that will apply in 2022. It is a plan to .Reasonable rate per-kilometre.3% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average of 12. To help you compare vehicles from different model years, the fuel consumption ratings for 1995 to 2014 vehicles have been adjusted to reflect 5-cycle testing.Estimated annual fuel cost.

Personal driving (personal use)

6 L/100 km City / 7.

2023 Fuel Consumption Guide

Plug-in Hybrid. : M141-5E-PDF ; M141-5-PDF - Government of Canada Publications - Canada.

2021 Fuel Consumption Guide

Sport utility vehicles (SUVs) E.

That adds up to an estimated fuel economy of 5.Fuel consumption guide .

Provides information on the fuel consumption of model year passenger cars, pickup trucks, vans, special purpose vehicles and alternative fuel vehicles. The Northwest Territories, Yukon, and Nunavut have an additional 4¢ per kilometre allowed for travel. In a subsequent year, a logbook was maintained for a three-month sample period during April, May and June, which showed the business use as 51%.Find out the fuel consumption ratings of 2022 vehicles in Canada and compare them with other models and years.3% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average . The 2022 CRA mileage rate is: 61 cents per kilometre for the first 5000 km driven.In Manitoba, the Honourable Jonathan Wilkinson, Minister of Energy and Natural Resources, joined the Honourable Wab Kinew, Premier of Manitoba, to announce a new combined federal investment of $6.The 2024 CRA mileage rate for business-related driving is 70 cents per km for the first 5,000 kilometres driven, then 64 cents for each additional kilometre. An employee may use one of your owned or leased vehicles for purposes other than business or, an employee may use their personal vehicle to carry out employment duties and get an allowance for the business use of that vehicle.2 cents per kilometre.In 2022, the new Canada Revenue Agency rate is set at ¢61. You can use this information to .This guide is produced by Natural Resources Canada (NRCan) in cooperation with vehicle manufacturers. See the most efficient new light-duty . NRCan thanks the Canadian Vehicle Manufacturers’ Association and Global Automakers of Canada for their assistance in the production of the 2018 guide.Treatment of the fuel with Max Mileage resumed on Jan. Special thanks are extended to Environment and Climate Change Canada (ECCC) for collecting . The per-kilometre rates that the CRA usually considers reasonable are the amounts prescribed in section 7306 of the Income Tax Regulations.

Chapter 3: Lowering Everyday Costs

CO 2 and smog ratings – Here are the vehicle’s tailpipe emissions of CO 2The federal government is investing $2,998,826 million in this project through the Green and Inclusive Community Buildings (GICB) program and the Heiltsuk Tribal . 24, 2019, again using winter fuel, and ended on Mar. Find the previous year's 2023 per-kilometre rate in Canada. Datasets provide model-specific fuel consumption ratings and estimated carbon dioxide emissions for new light-duty vehicles . 2024 Fuel Index Adjustment Month Fuel Adjustment Base Rate January Fuel Adjustment of 22% Base Rate of 22% February Fuel Adjustment of 24% Base Rate of 24% March Fuel Adjustment of 22% Base Rate of 22% April May June July August September October . Vehicle class range – This shows the best and worst combined fuel consumption ratings of vehicles in the same class. Plug-in hybrid electric .Remember, the lower the litres per 100 kilometres (L/100 km) rating, the better the fuel consumption. This year, the CRA automobile allowance rate is ¢61 per kilometre. Annual fuel cost – This is an . 55¢ per kilometre driven after that.

Automobile allowance rates

For the period December 2022 - February 2023 fuel expenses represent 22.For the period June - August 2021 fuel expenses represent 21.The kilometric rate payable when a Canadian registered vehicle is driven on government business travel in more than one province or in the USA shall be the rate applicable to the province or territory of registration of the vehicle.Effective: January 1, 2022.