Generation skipping tax exemption 2012

The 40 percent flat GSTT is imposed on three triggering events: (1) a direct skip with no remaining GST .4,6/5

Generation skipping transfer tax (GSTT) explained

First let’s start with a cautionary tale.

Through coordinated use of your federal gift exclusion and GST tax exemption, you may create trusts with an aggregate value of up to $13,610,000 ($27,220,000 per married couple) with no gift or GST tax. By using a bypass or QTIP trust (these are very different strategies, see below), the deceased spouse’s GST exemption can be applied, potentially allowing .not counted as part of the lifetime exemption.92 million in 2023 or $13. In practical terms, this means that 1/3 of the trust’s assets is NOT EXEMPT and will be subject to GST Tax.

Estate Tax Planning: Portability, Bypass and QTIP Trusts Explained

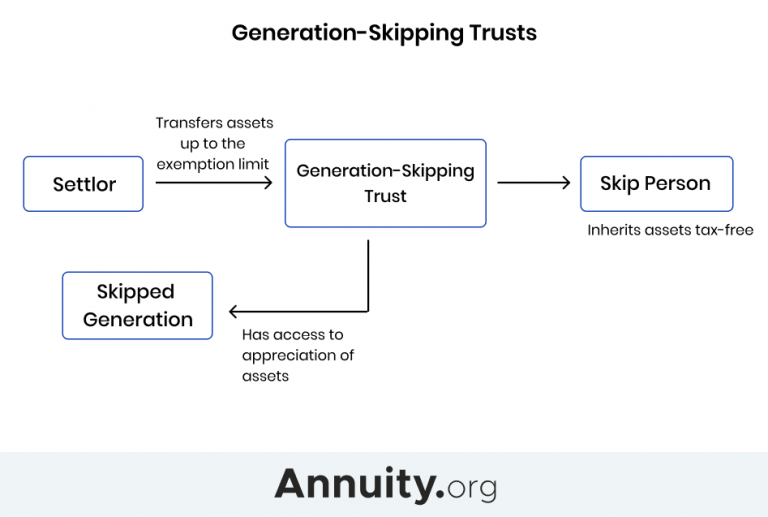

The generation-skipping transfer tax (GSTT) is a federal tax that results when there is a transfer of property by gift or inheritance to a beneficiary (other than a.Dynasty (Generation-Skipping) Trusts.

Unpacking the Generation-Skipping Transfer Tax

Wealth Transfer in Florida and Generation Skipping Trusts

The basic exclusion amount is the total amount that an individual may pass by gifts made during his or her lifetime .Effective January 1, 2023, the estate and gift tax basic exclusion amount and the generation‑skipping transfer (“GST”) tax exemption are scheduled to increase from . As of January 1, 2022, the GSTT exemption was set at $12.November 2, 2022.Intended to ensure that people transferring modest sums of wealth to younger generations don't have to bear the brunt of the tax burden, these exemptions .GENERATION-SKIPPING TRANSFER TAX: THE BASICS AND BEYOND Carol Harrington and Ellen Harrison November 7, 2019. The inclusion ratio of a trust, calculated under IRC § 2642(a), determines the portion of the trust assets that is subject to GSTT. You may want to consider taking advantage of the lifetime exemption from the GST tax, which may be applied to any combination of transfers during your life or made at the time of death. Also, on January 2, 2013, the American Taxpayer Relief Act (ATRA for short) .

Now, generation-skipping transfers above the applicable exclusion amount are taxed at the highest rate that apply to other transfers.

Generation-Skipping Planning: Portability does not extend to the generation-skipping tax (GST) exemption, meaning it’s lost if assets are passed directly to a surviving spouse.

Generation Skipping Trusts: What They Are, How a GST Works

The American Taxpayer Relief Act of 2012 established a permanent $5 million tax exemption on generation-skipping transfers, meaning there’s only a federal .com THE GST TAX EXEMPTION •The GST tax exemption equals the “basic exclusion amount” under 2010(c)(3). In the case of decedents dying and gifts made after . To benefit from use of the GST tax exemption, a transferor can use the exemption when making transfers to skip persons, like grandchildren.

The Hawaii estate tax rate starts at 10% for a net taxable estate of $1,000,000 or less, and increases for larger estates.The federal generation-skipping transfer tax (“GST”) exemption is also increased to $5 million per taxpayer in 2011 and 2012. In addition, the GST exemption is . (2) Certain transfers treated as if made after October 22, 1986.12 million for married couples.The allocation of a transferor’s generation-skipping tax (GST) exemption protects transfers from the GSTT.4 Other Exemptions and .92 million per individual, but they can be utilized at different rates. Indeed, the GST tax exemption amount matches the lifetime estate and gift tax exemption amount (and is likewise scheduled to roughly . Federal law application.The below reference chart was prepared in collaboration with Julie Miraglia Kwon based on her lecture “Generation-Skipping Transfer Tax: Exploring the Nooks and Crannies” given to the American Bar Association Real Property, Trust and Estate Law Section on April 18, 2023.In other words, the GSTT is an additional tax on the transfer of property and assets that skips a generation.Aside from increasing the estate tax, gift tax, and generation-skipping transfer tax exemptions to $5,000,000 for 2011 and $5,120,000 for 2012, this law introduced the concept of “portability” of the federal estate tax exemption between married couples.

Generation-Skipping Transfer Tax Basics

The current federal estate tax, gift tax and GSTT exemption . Gift Tax Beginning January 1, 2011, the gift tax lifetime exemption is $5.GSTT fact: As of 2023, each individual gets a substantial $12. It also applies to asset transfers made to people who are more than 37.

The Federal GST Tax Exemption and Rate Table

7% on the excess of a net taxable estate over $5,000,000.

By effectively “skipping” a generation and transferring assets to grandchildren or more remote descendants, these trusts take advantage of tax .this date are exempt from GSTT and are deemed to have an inclusion ratio of zero.0 million and the tax rate on amounts over .06 million for individuals, and $24.5 years younger than the transferor, with some exceptions.Starting on Jan. The estate tax is effectively a flat . (1) A will or trust of a decedent who dies after December 31, 2009, and before January 1, 2011, is deemed to refer to the federal estate and generation-skipping transfer tax laws as they applied with respect to estates of decedents dying on December 31, 2009, if the will or trust .

How To Complete Form 709

Generation-skipping transfer tax: How it can affect your estate plan

Some states collect generation-skipping transfer taxes. Each spouse must claim his or her full GST exemption during life or at death, and any unused portion of a spouse’s GST exemption will be lost.Generation-skipping transfer tax rates have risen and fallen over the years, with a recent high of 55% in 2001 and a low of 0% in 2010—due to an exemption awarded by the 2010 Tax Relief Act. When filing a gift tax return, it is essential to consider the generation-skipping tax implications, as the exemptions and rules differ slightly from the gift tax rules. In 2022, a 40% generation-skipping transfer tax applies to amounts above $12,060,000 gifted to individuals 37 ½ years younger than the creator of the trust. Assets subject to the generation . Under New York’s new law, the exemption is . (3) Certain trust events treated as if . She explained that two important concepts should be . The GST also has an exemption linked to the estate and gift tax exemption.

The basic credit amount for 2012 is $1,772,800. You anticipate that your child will exhaust the trust, leaving nothing for your grandchildren. Both the gift tax exemption and GST tax exemption start at $12. It goes up to $600,000 plus 15. You create a trust for the benefit of your descendants. Generally, the generation skipping transfer tax applies when a .(a) Transfers subject to the generation-skipping transfer tax.92 million exemption from the generation-skipping tax, as well as a $17,000 per-year per-person exemption.Generation-skipping trusts are an estate planning strategy tailored to those looking to create a lasting financial legacy, minimize estate taxes, and protect family wealth for multiple generations.92 million lifetime maximum exemption for generation-skipping transfers before triggering any . (1) In general.The Generation Skipping Transfer Tax (GSTT), also known simply as the Generation Skipping Tax (GST) impacts high-net-worth individuals who are planning to use their .

Recent Changes in the Estate and Gift Tax Provisions

For example, if a person transfers $1,500,000 into a trust for her grandchildren only and allocates $1,000,000 of GST Exemption, the inclusion ratio of that trust would be: $500,000 / $1,500,000 = 1/3. This exemption functions similarly to the lifetime estate and gift tax exemption.What is the generation-skipping transfer tax (GSTT) and what is generation-skipping tax (GST) exemption? The GSTT is separate from, and in addition .While gifting, it’s important to consider the Generation Skipping Transfer (GST) tax exemption, especially when giving to grandchildren.The top rate for gifts and generation-skipping transfers remains 35%. The Hawaii law also includes a generation skipping transfer tax. The annual gift tax exemption is indexed for inflation in $1,000 increments and will rise to $15,000 in 2018 and remain at that level in 2021. A generation-skipping tax is also imposed, to address estate tax avoidance through gifts and bequests to a later generation.

Like the gift tax, everyone currently receives a $12.This lifetime GST tax exemption amount will grow annually through 2025 based on inflation rates.TRA 2010 also unified the estate tax, the gift tax, and the generation-skipping transfer tax exemptions, and it indexed these exemptions for inflation beginning . Generation-skipping trusts, in turn, use the GST exemption to reduce . The givers gets a lifetime.61 million in 2024 [0] IRS.

Generation-skipping transfer tax

The regulations under section 2601 provide guidance for determining if a trust .comRecommandé pour vous en fonction de ce qui est populaire • Avis

What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?

The GSTT exemption and applicable exclusion are determined every year and are indexed for inflation.5 years younger than the donor.The IRS uses the generation-skipping transfer tax to collect its share of any wealth that moves across families when assets aren’t passed directly from parent to child.Taking the time to understand the tax and make use of your available generation-skipping tax (GST) exemption can significantly impact your planning.

generation-skipping transfer tax

Therefore, careful planning is essential to avoid the imposition of both .Auteur : Troy Segal

What is the Generation-Skipping Transfer Tax?

Intended to ensure that people transferring modest sums of wealth to younger generations don’t have to bear the brunt of the tax burden, these exemptions .The generation-skipping transfer (GST) tax is separate from the estate tax; it applies when you transfer assets to recipients two or more generations below you.

Generation-skipping trust for estate planning

General Planning .

Electing Portability

Source: Saiber Estate Planning Alert.The tax is currently calculated at a flat rate of 40% (the same as the estate and gift tax rate) on transfers above the lifetime generation-skipping trust tax .