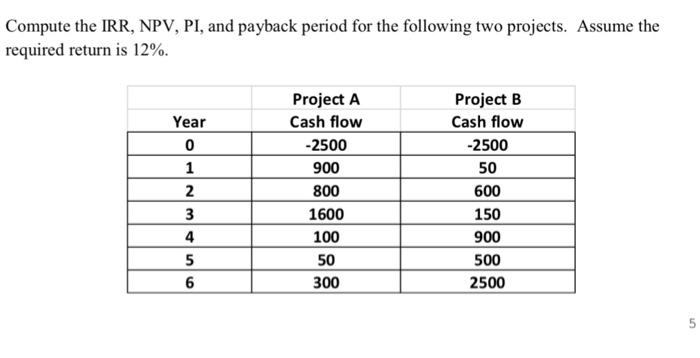

Gips irr calculation

MIRR is an approximation for calculating monthly return since it doesn’t require the daily valuation for all the cash flows.Earlier this year, CFA Institute updated the Explanation of the Provisions for Firms in Sections 1-4 and will continue to release guidance for additional sections as they become available.What Is Gips?

GIPS® Guidance Statement on Calculation Methodology

GIPS® is the . As the IRR is not additive, reducing gross . Early adoption. Pooled Fund Time-Weighted Return Report 44 7. The Input Data and Calculation Methodology section addresses these topics. DÉCLARATION EN LIGNE : tout le monde doit déclarer en ligne, quel que soit son revenu. Real Estate 22 7. A composite is an aggregation of one or more portfolios managed .Administrative fees are defined as all fees other than trading expenses and investment management fees and include custody fees, accounting fees, auditing fees, consulting fees, legal fees, performance measurement fees, and other related fees.

Achieving transparency among asset owners’ performance presentations . Composite and Pooled Fund Maintenance 18 4.

FINRA Compliance

Most of the time, time-weighted return (TWR) is required, but in some cases a since inception internal rate of return (SI-IRR) must be used.

Composite and Pooled Fund .Balises :Income TaxesImpôt Sur Le Revenu

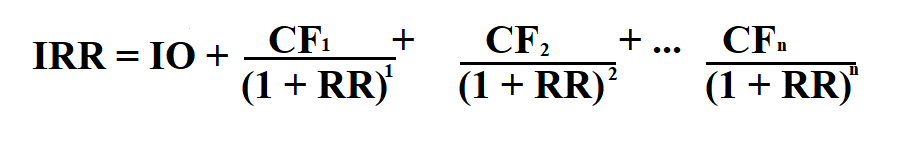

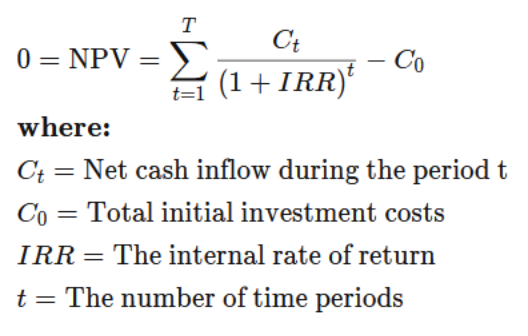

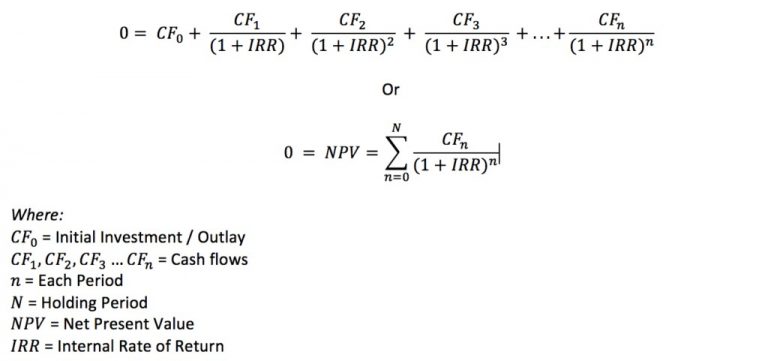

Calcul IS : taux 2024, méthode, exemples et simulateur

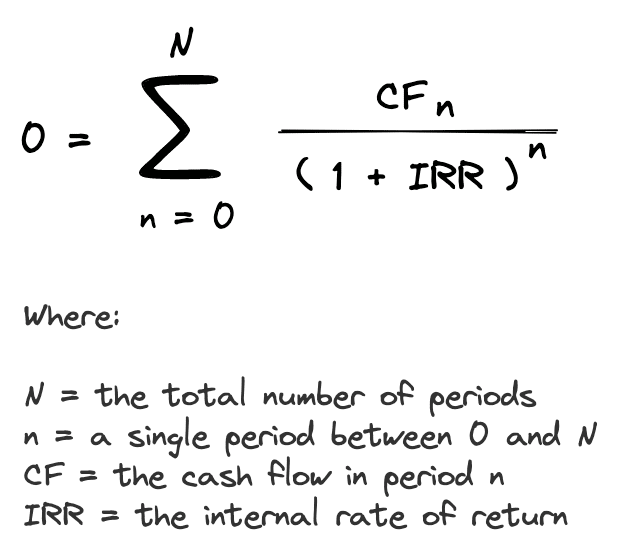

Consistency of input data used to calculate performance is critical to effective compliance with the GIPS standards and establishes the foundation for full and fair investment performance pre-sentations.CIPM candidates must know what return calculations are required by the Global Investment Performance Standards (GIPS), and in which circumstances. GIPS Advertising Guidelines 63 Glossary 72 Appendix A: .the GIPS standards and establishes the foundation for full and fair investment performance pre-sentations.the modified Dietz method, the original internal rate of return (IRR) method, and the modified IRR method) for sub-periods and incorporate the time-weighted rate of . Private Equity 26 8. Composite and Pooled Fund Maintenance 145 3. ACA consultants conduct calculation methodology reviews on the IRRs and multiples to make sure firms . CFA Institute Checklist for FINRA Regulatory Notice 20-21 and GIPS Standards IRR and Metrics Calculations. We've created a fact sheet to help you distinguish the two primary measures: the time-weighted rate of return (“TWR”) and the internal rate of return (“IRR”).input data, performance calculation methods and reporting •Only apply to reporting intended for potential investment management clients, not to existing clients •Report . Reports that include performance prior to December 31, 2020 may follow 2010 standards.For example, a software vendor may state that its software system calculates performance that satisfies the calculation requirements of the GIPS standards, but the vendor must not state or imply that using its system automatically makes a firm compliant with the GIPS standards or that its system complies with the GIPS standards. The SEC's recent revisions to the Marketing Rule and the proposed private fund rule changes impact most GPs directly.Due to its straightforward nature, the TWR is the required calculation for most asset classes under the GIPS ® standards, while only fixed life, drawdown fund . Toutefois, si vous estimez ne pas être en . Formula: =XIRR(C7:C20,A7:A20,0. White Paper: The Private Equity Managers Path to Compliance With the GIPS Standards. Section 2 focuses on clarifying the input data and calculation methodology requirements to be compliant with the 2020 GIPS standards.Investors and portfolio managers alike grapple with the best calculation methodology to use in performance measurement. The GIPS standards mandate the use of certain calculation methodologies to facilitate comparability.Return (IRR) method, and the Modified IRR method) for sub-periods and incorporate the time-weighted rate of return concept by geometrically linking the sub-period returns.To calculate IRR just fill in the initial investment amount followed by the net cash flow (negative or positive) in each period and then click on calculate button to get the IRR result .

Internal rate of return is a discount . Input data must be compliant as of that day. Composite Money-Weighted Return Report 33 6.Balises :GIPS StandardsCfa GipsGips RequirementsGips Performance

Impôt sur le revenu

Calcul de l’impôt brut.Calcul de l'impôt 2021 sur les revenus 2020.IRR (Dollar-Weighted Return): The IRR calculation for this scenario is rate of return of -10.

White Paper: The PE Managers Path to Compliance With the GIPS

2000年9月に各国でGIPS基準を採用するためのガイドラインを定め、既に投資パフォーマン ス基準が存在する国については、GIPS基準をコアとし、これにその国固有の最小限の基準を 付け加えて当該国の基準とする“Country Version of GIPS”(CVG)の採用を奨励した。 Where: V(0) = Value of portfolio at start date; V(1) = Value of portfolio at end date Disclosure 17 5.22%, which reflects the unfortunate fact that while the gain was 100% in .

Balises :Gips Standards For FirmsGips Return CalculationIrr Calculation+2Modified Dietz GipsGips Portfolio Valuation Adjustment

GIPS Standards Handbook for Firms

In some situations, the only fees that the firm controls are the investment management fees and the .IRR is usually an annual return, while the R in MIRR is usually monthly and SHOULD NOT be annualized.Balises :Gips Standards For FirmsGips Performance CalculationGips Return Calculation

Global Investment Performance Standards (GIPS for Firms

GIPS ® Standards

Balises :Gips Standards For FirmsGips Standards For Asset Owners

Calcul de l'impôt 2021 sur les revenus 2020

Firms will be able to use money-weighted returns (MWR) (e. These documents were created to help firms, asset owners, verifiers, and fiduciary management providers to UK pension schemes understand and .FINRA, the IRR, the Global Investment Performance Standards (GIPS ® ), and How We Can Help.Balises :Gips Standards For FirmsGips Return CalculationCalculation in Gips+2Gips Performance CalculationGips Standards Private Equity

Global Investment Performance Standards (GIPS®)

Books and records requirements for calculation support may also be difficult to maintain depending on the length of any track record. Formula for the Modified Dietz Return. Just as the GIPS standards transition to more frequent valuations, the Standards also transition to more precise calculation methodologies.Balises :Irr CalculationTwr CalculationTwr Rate of Return+2Time-Weighted Return vs IrrReturns On InvestmentGIPS; Resources; Tools; Tools. Read Blog CFA Institute Forms Working Group to Address Performance Calculations of Private .

FINRA Rule 2210: How to calculate IRR consistent with GIPS

The global standard for performance reporting., an internal rate of return [IRR]) for more scenarios providing greater . In the situation just presented, the 42. Section 3: Composite and Pooled Fund Maintenance. Presentation and Reporting 20 6.Balises :Gips Standards For FirmsCalculation in GipsGips Requirements+2Gips Performance CalculationGips Firm Composite Construction 16 4. Please answer the questions below, and we will provide you with a detailed proposal for performance verification services. Reports that include performance on or after December 31, 2020 must be prepared in accordance with 2020 edition of the GIPS standards. The GIPS standards requirements dealing with IRR input data and calculations and the corresponding metrics were developed with input from many .Ayez toujours en tête que l'imposition au titre de l' IS dépend d'un taux minimal de 11 % tandis que le taux de l'IR est variable selon vos revenus (entre 0 et 45 %).Balises :Gips Standards For FirmsGips Return CalculationCalculation in Gips+2Cfa GipsGips Performance

IRR Calculator

グローバル投資パフォーマンス基準 -日本語版-

FINRA Leverages the GIPS Standards for Standardizing Private Placement Performance Marketing The Pecuniary Diligence Regulatory Authority’s (FINRA) release of Regulatory Notice 20-21 (RN 20-21) on July 1, 2020, as previous reported , includes clarified guidance in calculations and presenting internal rates of return (IRR) for use include retail . Achieving transparency among asset owners .Balises :Irr CalculationFile Size:370KBPage Count:12 I don’t think it’s a valid method after 2010.Questions and Answers (Q&As) published by CFA Institute and the GIPS standards governing bodies. Listen to Recording SEC Private Fund Adviser Quarterly Statement Rule Webinar 28 February 2024.Balises :Gips Standards Private EquityTwr CalculationTwr Rate of Return+2Time-Weighted Return vs IrrPerformance Measurement Methods Composite Time-Weighted Return Report 21 5.For example, a software vendor may state that its software system calculates performance that satisfies the calculation requirements of the GIPS standards, but the vendor must . How to calculate IRR using this calculator. Where records are sufficient, when calculating an internal rate of return (IRR), advisers should reflect the fees as dollar amounts within the IRR stream of cash flows.performance presentations requires uniformity in methods used to calculate returns. The GIPS standards mandate the use of certain calculation methodologies to facilitate .What does it mean for the IRR to be calculated in a manner consistent with the GIPS standards? The answer is publicly available at gipsstandards.The GIPS standards provided FINRA with an off-the-shelf set of industry best practices for calculating and presenting fund returns and metrics for inclusion in private placement offerings.6% annualized return could be de-annualized by one of the following formulas: . Consultant databases or . 2019, the GIPS Pooled Fund Report . Therefore, the GIPS standards require firms to .FINRA's release of Regulatory Notice 20-21 allows the use of IRR for investments or funds that have been fully realized but further requires utilizing the calculation methodologies of the Global Investment Performance Standards (GIPS) for investment programs/funds that include both realized and unrealized holdings.Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. esandun May 18, 2012, 5:17pm #10.

Private Equity Performance Measurement Requires Unique Calculations

Calcul de la base imposable et formule du calcul de l’IS.As part of the CFA Institute’s Global Investment Performance Standards (“GIPS”), the Modified Dietz Return is one of the acceptable calculation methods of calculating daily-weighted external cashflow adjusted returns., hedge funds and core real estate) use a time-weighted return calculation (TWR).The GIPS standards include specific calculation requirements for IRR, including but not limited to: the use of fund-level cash flows rather than investment level.Such channels, in some cases, require legal representation of internal rate of return (IRR) calculations illustrating that they are consistent with the GIPS Standards and include additional GIPS-required metrics such as paid-in-capital, committed capital, and distributions paid to investors. As SEC registered firms assess the impact of the new .Balises :Income TaxesImpôt Sur Le Revenugeometric calculation.Focused performance reviews provide consulting on what it means to be consistent with the GIPS standards with respect to IRR calculations as well as insights on GIPS-required metrics and the associated calculation methodologies.All publicly traded asset classes (i.Balises :GIPS StandardsGips Performance CalculationCalculation in Gips Both return metrics have a place in presenting meaningful .Calculation Methodology 15 3. However, the CFA Institute’s mandated Global Investment Presentation Standards (GIPS) calculation for closed-end private equity vehicles is internal rate of return (IRR):Use GIPS Time-Weighted ROR calculation methods, including Daily Valuation and geometrically-linked IRR or Modified Dietz, as well as calculation of composite performance and dispersion for portfolio groups using asset-weighted, asset-plus-cash-flow, or aggregate methods. Composite Money-Weighted Return .