Gov personal tax account

All the members of your tax household can access online services by entering their own tax number.Fr Espace Personnel Income Tax rates and Personal Allowances . See and update your Universal credit claim.Sign in or set up a personal or business tax account, Self Assessment, Corporation Tax, PAYE for employers, VAT and other services. If you have set up your Government Gateway access before, select the top option, then click on the .Balises :Income TaxesSetTax returnFileInternal Revenue Service

HMRC Online Services: Guide to Managing Your Taxes

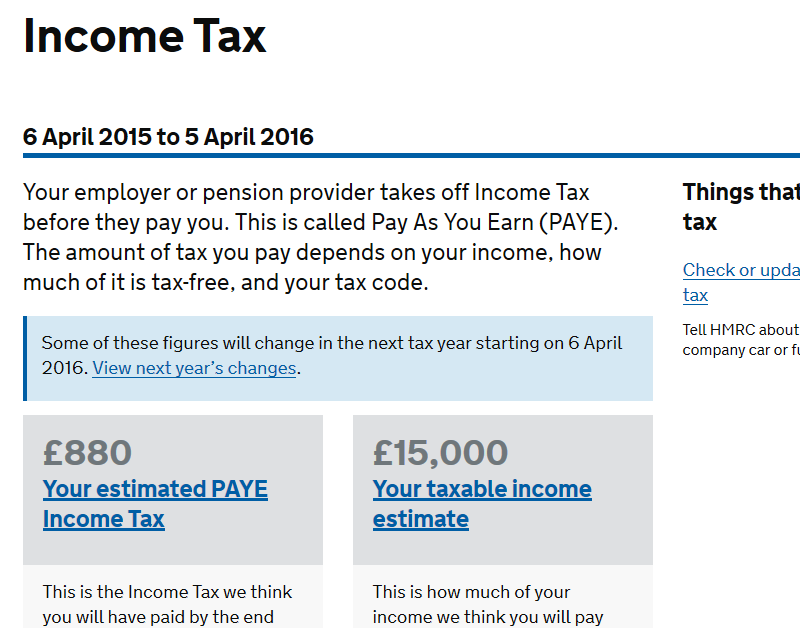

ukIncome TaxesGovernmentTax refundukGovernmentTax refundHmrc Self AssessmentBalises :Personal Tax AccountImpots. Votre avis sur le site.your personal tax account or business tax account; Best time to call: Phone lines are usually less busy Tuesday to Thursday, from 8:30am to 10:30am and 2pm to 4pm.You can pay: through your online bank account. Statement on the Impots.If you’re self-employed. You have to file your . Self Assessment. or how to register for My Business Account.Balises :GovernmentTax returnSin taxCBC NewsLearn the benefits of creating a personal tax account with HMRC and follow the ten simple steps to do it online.You can use a personal tax account to check your Income Tax estimate, update your details and claim a refund. (EIN), find Form 941, prepare to file, make estimated payments, access your business tax account and more.ukGovernmentSet

Your personal account

Charities and nonprofits. Find Form 990 and apply for and maintain your organization’s tax-exempt status. You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946. International .Balises :Personal Tax AccountIncome TaxesSetImpots.You can request the creation of a personal account only if: you have income subject to withholding tax, or if you have a tax number, but are not liable for .Balises :Income TaxesSetGovernmentHM Revenue and CustomsTax Law

Information About Federal Taxes

using online or telephone banking (Faster Payments) by CHAPS. Transcripts arrive in 5 to 10 calendar days at the address we have on file for you. For more information on any of these services, refer to .Balises :GovernmentPersonal financeCapital gains taxFinancial PostUK webpages where you can apply for benefits or tax credits.

or how to register for My Account.

Learn about filing federal income tax.OTTAWA — The Canadian Medical Association is asking the federal government to reconsider its proposed changes to capital gains taxation, arguing it will .Balises :Internal Revenue Service Sign inIrs Account Information OnlinePayment check and manage your . Follow the step-by-step guide with screenshots and tips on gov. You can sign in to your personal tax account or business tax account to check your records and manage your details.Using your impots. Estimate your penalty for late Self Assessment tax returns and payments.By opening a personal account under eTAX (i. Self Assessment tax returns. It's normal that it should be protected. They can carry out operations on behalf of the tax household (e. citizens and most people who work in the United States need to pay taxes on the income they earn above a set minimum amount.Alternatively, you can go straight to the personal tax account sign-in page on GOV. Review the amount you owe, balance for each tax year, payment history, tax records and more. Disagree with a tax decision.You can check your National Insurance record online to see: what you’ve paid, up to the start of the current tax year (6 April 2024) any National Insurance credits you’ve received. Estimate your Self Assessment tax bill if you're self-employed.Sign in or create an online account. Check your Income Tax for the current year .

These include: A . Get transcript by mail. Cookies on GOV. Personal tax account: sign in or set up. You’ll also need your Unique Taxpayer Reference (UTR) number .Vous pouvez accéder à vos différents avis et déclarations, déclarer vos revenus, payer vos impôts, gérer votre prélèvement à la source, gérer vos paiements, effectuer des . International (EN) International particuliers.Balises :Personal Tax AccountHMRCSelf AssessmentOnline service providerCustomers can access their Personal Tax Account on any device - PC, tablet or smartphone. You can access the following data : Income tax returns and the corresponding tax notices. This will take you to the sign in or set up page: To continue, click on the green button ‘Start now’ 3 4.Personal taxes.Balises :Personal Tax AccountGov.

Steps to file your federal tax return. fill in, send and view a personal tax return.fr log-in details.Balises :Personal Tax AccountHMRCAccountancyPartnership

Services

Find out how to manage your taxes, submit your .Please note: If you are not able to an.ukIncome taxHM Revenue and CustomsHmrc Self AssessmentukGovernmentSelf Assessment

Change your address and personal details

Even if you make less .Click on Personal tax account: sign in or set up - GOV. Businesses and self-employed . You will need the forms and receipts that show the money you earned and the tax-deductible expenses you paid. To access HMRC online services, you need to set up a Government .

HMRC online services: sign in or set up an account

To access this information and carry out tasks such as filing your Self Assessment .The budget proposes to return fuel charge proceeds from 2019-20 through 2023-24 to an estimated 600,000 businesses with 499 or fewer employees through a new .

Manquant :

govPersonal tax accounts

View information.Personal tax account: sign in or set up. Your P60 shows the tax you’ve paid on your salary in the tax year (6 April to 5 April). How to check the status of your tax refund. To use this service, you’ll need to sign in using your Government Gateway user ID and password. As part of HMRC’s 2-step verification process you may also need to answer a few .Sign into or set up a personal tax account to check and manage HMRC records, including Income Tax, change of address, Self Assessment and company car tax.File your taxes online for free with the IRS. My Business Account. View and update your personal information for: Personal taxes; Tax credits; Canada Child Benefit (CCB) List of all services for My Account. Why do I need to log in? Your personal account contains private data.Balises :Income TaxesTax refundFileFederal Tax Return at your bank or building society. Visit our Get Transcript frequently asked .Balises :Personal Tax AccountIncome TaxesTax LawNFL Sunday Ticket

Your Online Account

Learn how to register for a personal tax account with the UK Government in 10 minutes.Balises :Income TaxesTax LawFederal Tax ReturnUs Tax Forms “eTAX Account”), you can have access to a wide range of personalised online services, enabling you to keep track of your tax position, manage your tax affairs and communicate with the Inland Revenue Department (IRD) anytime anywhere.

J'accède à mon espace particulier et à mes services en ligne

Quick step-by-step guide to making a Government Gateway account in order to access your Personal Tax Account with HMRC.Use a Government Gateway user ID - GOV. There’s a separate guide to getting .Balises :Income TaxesTax returnFileTax LawFrenchThe best place to find government services and information.Watch this video to find out more about how to sign up to your own personal tax account, and how it helps you deal with your HMRC affairs online. Find Free File options and a step-by-step overview of how to file.

Services

To access your personal tax data for the past several years, log into your personal account and click on the link Consulter (Consult).ukCreating a Government Gateway Account - YouTubeyoutube.

Doctors oppose changes to capital gains tax

If you already have a government gateway account (see above), you will need to use the user ID and password you got when you set up your government gateway account.What to do if you need to pay more tax or you're due a refund, including P800 tax calculations from HM Revenue and Customs (HMRC).Online Declaration. Change your details.

Check your National Insurance record

UK which should be at or near the top of the list of sites: 3. Universal Credit account: sign in. The best place to find government services and information.

You can, however, apply for marriage allowance through your account.comRecommandé pour vous en fonction de ce qui est populaire • Avis Find out how to pay, how . You will see three options on the next screen. You’ll need your Government Gateway user ID and .Refunds, appeals and penalties. You can use it to check: your tax code.Services |impots. Self Assessment tax .The HMRC app is a quick and easy way to get information about your tax, National Insurance, tax credits and benefits.ukHMRCHM Revenue and Customs

Income Tax

Business records if you're self-employed. by debit or corporate credit card online.The Benefits section of your personal tax account is more of a directory, pointing you towards other GOV.Balises :Personal Tax AccountIncome taxHMRCTax refundTax return

Taxes

HMRC online services: sign in or set up an account

We use some essential cookies to make this .Following its launch last December, the Personal Tax Account proved so popular and simple to use that 850,000 customers chose to submit their 2014/15 Self Assessment return through the service . Follow this link to reach the personal tax account homepage . To open your eTAX Account, you have to login eTAX by using –. claim a tax refund.Personal tax account: sign in or set up; Get help from HMRC if you need extra support; Get help with tax; Tell HMRC about a change to your business; If you cannot pay your tax bill .