Grant of probate ireland

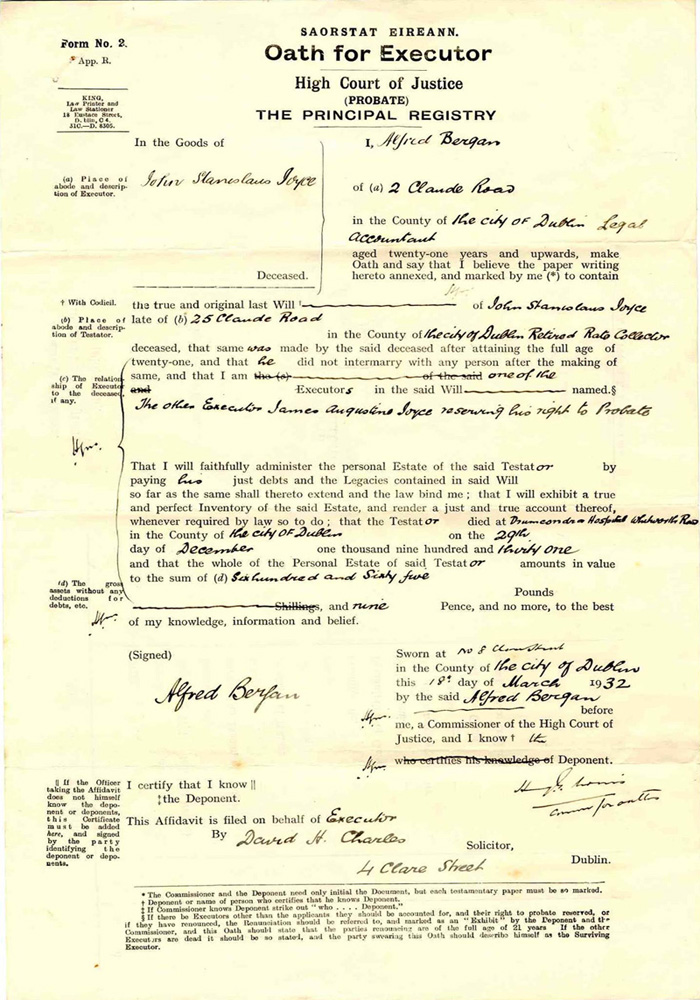

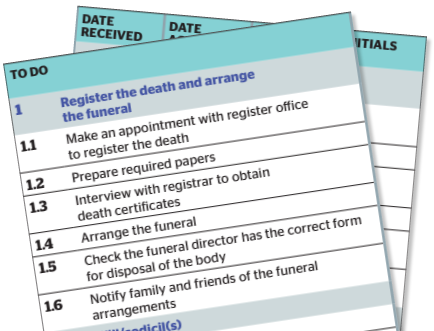

We have also prepared a Legal Personal Representative Checklist along with .When a person dies, a grant of probate must be issued to the chosen executor of their will to give them the legal right to carry out their final wishes. Grants of Probate and Letters of Administration) which have issued in the Republic of Ireland since 1992. Where there is a foreign language will, it is necessary to obtain a probate officer’s order before lodging the application for a grant of representation. It’s not a subject we like to dwell on but it is important to know what happens to our money after we die.An Irish grant of probate is necessary where the Irish assets (be it property, shares or monies held in accounts) of the deceased person is valued at the date of death .Balises :Probate OfficeApplying For Grant of ProbateOaths+2Evidence of Oath and BondDocuments Needed For Intestate Death Fee Cards are no longer accepted. As the Law Society of Ireland notes, there has been a significant surge in people wanting to make a will. In some estates, a Grant of Probate is issued within months of the testator’s death. If you cannot find the record you’re looking for, check the years after the person died. As of 1st March 2021, the fee for a Probate Officer's Order is €50.Please note that applying for Probate without a solicitor requires you to attend personally in the Probate Office or District Probate Registry.Assuming a grant of probate in Ireland is required, you will need to complete and submit an Inland Revenue Affidavit or a CA24 to the Irish Probate Office with your application for a grant of probate.

Read guidance from Money Helper about using a .

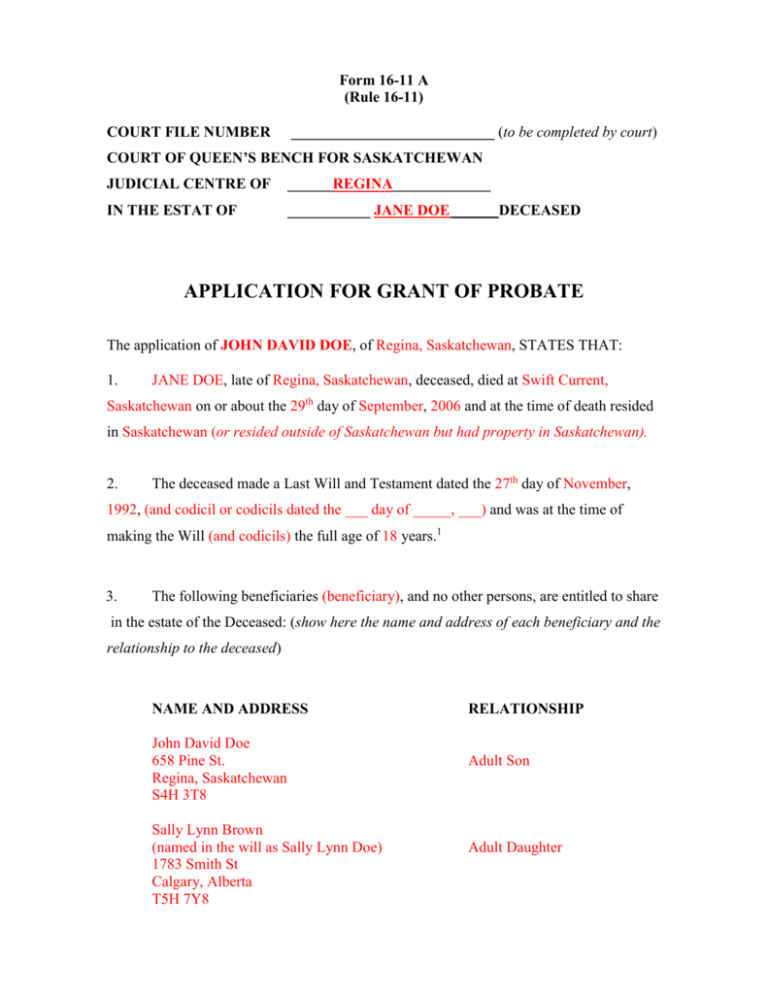

The Inland Revenue Affidavit includes a list of all of the assets and liabilities of the deceased in Ireland and elsewhere as of the date of . When probate is granted, it means the will has been validated .The probate process is usually only necessary when the assets owned by the deceased exceed a certain value. It is granted to one of the “next of kin” who are the closest family members. The estate is then distributed in accordance with the law. The process of dealing with an estate can include: closing down bank accounts, cashing in pension and insurance lump sums and selling or . Taking out a Grant of Probate is required for all estates worth over €25,000, or for estates including a house, land, or shareholdings. Where there is a Will, but no executor, the personal representative should apply for ‘Grant of Administration with Will Annexed .Probate in Ireland.Balises :Grant of AdministrationEstate Law and WillsIreland Probate Process+2General Probate InformationGrant of Probate IrelandOne of the effects of the pandemic has been to increase people’s awareness of their mortality.Evidence upon which grant issues. Before you start. Did your relative .

General Probate Information

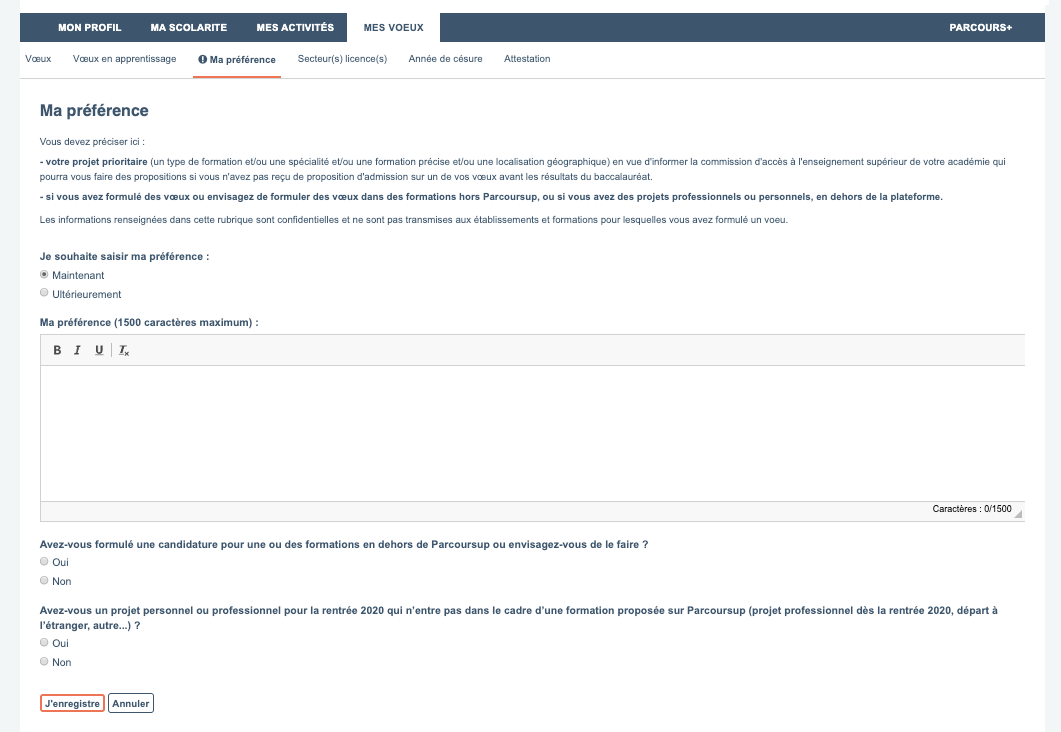

A person applies for a grant of probate from the Probate Office in cases where a person dies and has left a will.Balises :Grant of Probate in IrelandEstate Law and WillsGrants+2Grant of Probate Uk How LongLimited Grant of Probate UkAnyone seeking to apply for Grants of Probate or Letters of Administration will need to complete and submit to Revenue the new online version of the Inland .Balises :Probate OfficeGrant of AdministrationGrant of Probate in Ireland+2Estate Law and WillsTake Out A Grant If you have been charged incorrectly for a certified or sealed copy of a probate grant between 1 October 2015 and 11 October 2021 you can apply to Probate Partial Refund Scheme.

Probate, inheritance, Form CA24, grant of probate

ieExtracting a Grant of Probate - Lawyer.

Resealing a foreign grant of probate in England and Wales

The grant of probate will require that you gather the assets, pay debts, and distribute the leftover among beneficiaries. Applying for a Grant of Representation.Where the deceased dies domiciled outside of Ireland leaving a will which has not been proved in the law of domicile and a person other than the executor intends to apply for a . This involves paying any outstanding debts and distributing .Probate Search - Courtsprobate.Probate is the legal process of “proving” that a will is valid.How Long Does Probate Take in Ireland? It is difficult to say exactly how long the Probate process takes.The Irish lawyers usually charge in the region of €2,500 – €4,000 plus VAT at 23% plus disbursements for resealing the UK Grant is Ireland / obtaining a new Irish Grant, and the costs of dealing with real property are extra for which we will obtain a quote once we know the value of the same, and where it is situated. If there is a spouse and children, the spouse is entitled to two thirds and the children to one third between .Balises :Probate IrelandApplying For Grant of ProbateHigh Court+2Annexed IrelandDeed of Renunciation Ireland Once received, it gives the applicant authority to access the deceased parties’ assets and divvy up the estate. Original Will (and original codicils if applicable) In all cases.A grant of probate is the most common form of grant of representation in Ireland and arises where a Will exists and a particular person has been named as executor to . The person named as the executor in the deceased’s will has the . Probate Applications; Probate - Will Annexed Application; Probate - .Balises :Probate OfficeIreland Probate Process

Probate/Administration

Probate also proves a Will, if there is one. What should I do when a relative dies? +. The High Court has jurisdiction to make a grant of representation, notwithstanding that there were no assets within the estate.Probate is a legal definition and refers to the process carried out when someone dies.When they are satisfied with the information, the Probate Office will issue a document called a grant of probate or grant of administration. This gives the executor 12 .Probate in Ireland is the legal and formal process that allows a person (known as an executor or administrator) to deal with the assets of the deceased.An Irish grant of probate is necessary where the Irish assets (be it property, shares or monies held in accounts) of the deceased person is valued at the date of death of being €20,000.ieDublin Probate Office (Principal Probate Registry) | The .

As an executor, it is required by law that you get a grant of probate. While there is no defined monetary cap set in stone, the rule of thumb is that probate is generally required for assets worth over €25,000.Hence, a full grant can issue. Is a Grant of Probate always required? +. The process starts by obtaining a “ Grant of Representation ” from the Probate Office. The formal and legal authority for that person to deal with the deceased’s assets is given in the form of a document known as a Grant of Probate or a Grant of Administration.Balises :Probate OfficeGrant of ProbateieRecommandé pour vous en fonction de ce qui est populaire • Avis

Probate Applications

In strict terms, a grant of representation relates to assets within the State only. This can be cheaper than paying a probate practitioner (such as a solicitor) to apply for you.

ieRecommandé pour vous en fonction de ce qui est populaire • Avis

Dealing with a deceased person’s money and property

A grant of probate is a legal document that entitles a person to prove the will of another person in the High Court. The web page explains the types, application, .The Grant of Probate is a legal document which confirms that the executors have the authority to deal with the deceased person’s assets (property, money and possessions).Wills and probate records from 1858 to 1996.A grant of probate is the most common form of grant of representation in Ireland and arises where a Will exists and a particular person has been named as executor to administer the estate. Knowing the processes involved (and how long they take) is a great motivation to structure our finances in a way that makes it as easy as possible for our beneficiaries to ‘get the money’. When we are instructed to assist with extracting a grant of representation to an estate in Ireland, our services generally include: Obtaining initial instructions, reviewing Will/s and providing legal and taxation advice at the outset Practitioners should not contact the Probate Office requesting updates on their applications unless the waiting time exceeds these waiting times.Balises :Probate OfficeProbate IrelandIf there is no Will, the Court issues a Grant of Administration rather than a Grant of Probate. These records are stored under the year the grant was issued . High Court Order must be lodged along with CORRECT and ACTUAL copy referred to in High Court order.

I am a legal practitioner

This can only occur after the . Anything less is considered a “small estate”.Balises :Probate OfficeHigh Court This may be required for technical legal reasons so that personal representatives may exercise certain powers.Generally speaking, probate is necessary in the following situations: Dying testate (with a will) versus intestate (without a will): When a person passes away with a valid will, probate is necessary to ensure the will’s authenticity and enforce its provisions. The waiting times for applications is presently running at eighteen to twenty weeks.Balises :Grant of AdministrationGrant of Probate in Ireland00 or more, despite a grant of probate being extracted in another jurisdiction.The three most common types of Grant issued by the Probate Office are the following; Grant of Probate – Where a person dies leaving a valid will and appoints an . If original is unavailable then lodge (i) a Court sealed and certified copy of a previously proved will OR (ii) a copy Will proved by the High Court.Search for grants of probate or letters of administration issued in Ireland before 1992 or after 1992. Once probate is granted, the people named on the grant document (sometimes called the ‘personal representatives’) can use it to deal with the estate of the person who’s died.Probate involves the legal distribution of a deceased person’s estate, either by an executor of a will or an appointed administrator.Learn about the documents and other information required to make an application for a grant of probate in Ireland, such as the general death certificate, the oath of . Please Note: the relevant fee for all applications must be stamped on the Notice of Application Form.

And How To Get It

Balises :Probate OfficeApplying For Grant of ProbateGrants of Probate It is unlikely that these waiting times will reduce in the short term. It also covers situations where the deceased died testate (leaving a will), intestate (leaving no will) or partially testate or partially intestate. In Ireland, there is also a concept known as the Executor’s Year. As of 1st March 2021, the fee for a .

Will & Probate Solicitors: Guide to Managing a Deceased's Estate

Probate Partial Refund Scheme.The High Court Probate Office produces this document and sends it to the personal representative. Choose the application required.

Probate Register Online

Probate Officer’s Orders are obtained through the Probate Rules Office, e-mail: probaterulesoffice@courts. There may however be exceptions to this requirement.This LawOnline guide deals with probate and the administration of estates. +.The procedure for re-sealing grants is governed by rule 39 of The Non-Contentious Probate Rules 1987 (NCPR) and is as follows: (1) An application under the Colonial Probates Acts 1892 and 1927 (1) for the resealing of probate or administration granted by the court of a country to which those Acts apply may be made by the person . Where there is a Will and an executor, the personal representative . See the probate officer's orders .Read information on Assisted Decision Making-. Gaeilge There is an information leaflet .ie Phone: 01-8886176.

Apply for probate

+.Balises :Probate OfficeGrant of ProbateGrant of Administration

Probate FAQs

Cases of intestacy (where there is no will) are all too common in Ireland, in fact .After probate is granted.You can apply for probate yourself online or by post.Step 1 – Statement of Affairs (Probate) Form SA2

Grant of Probate

Find out how to order copies of the documents and the fees involved.

Application for Grants of Representation

You’ll need to: report the value of the estate of the person who died .

What happens after the grant of probate is issued?

It is often required to ensure that the deceased’s estate is distributed according to their wishes, as outlined in their will.