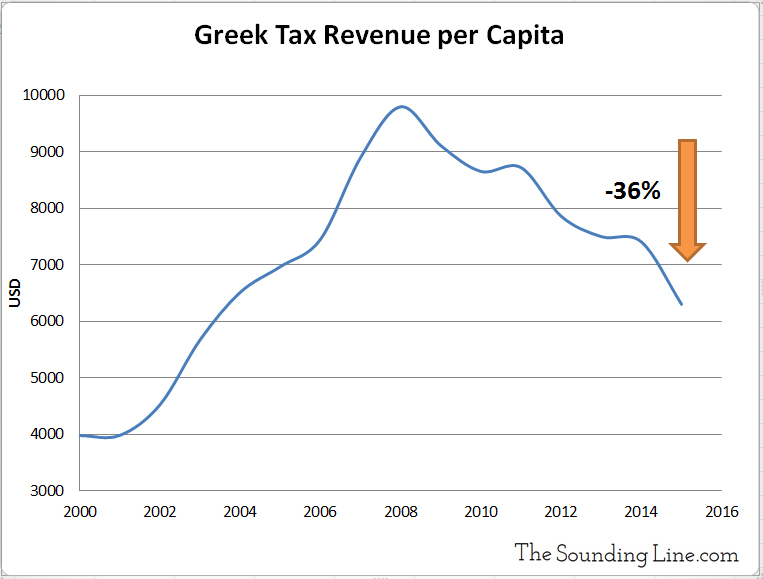

Greek tax payment system

Overall, the Greek tax authorities are moving towards a digitalized and more efficient tax compliance system, encouraging transparency and reducing the administrative burden on taxpayers. It exist three basic genres of taxation:4 Visit the Airport Offices of the Tax Refund Company You Work With. 22% tax is applicable on anything you earn between 10k and 20k euro.com301 Moved Permanentlymydata. The purpose of this reform, similarly to other countries, is to close the .grHow can I pay my taxes in Greece when I am abroad?taxblock.With the payment of this fixed tax, you’ll bear no further tax obligation for income earned abroad and you’ll be exempted from inheritance or gift tax on properties located abroad. AthexCSD has been authorised as CSD under CSDR and has introduced a new account type, an omnibus account, into its system. The world’s 3,000 billionaires should pay a minimum 2% tax on their fast-growing wealth to raise £250bn a year for the global fight .If you are in a country outside the SEPA (Single Euro Payment Area) geographical area, you can pay taxes and duties via S.

Inheritance Tax

Find out more about the procedures and relevant information of being an EU citizen in Greece at gov. 36% tax is applicable on anything you .

The above mentioned Decision A.VAT rates in Greece.1016/2024 indicates the Greek tax authorities (departments of AADE) that are competent for: carrying out compliance controls and imposing respective penalties. In particular, article 65 of the law provides that, with effect as from 1 July 2021, the special reduced VAT rates of 17%, 9%, and 4% (i .For any income above €40,000, the tax rate is 44%. Unlike in some other countries, taxation begins with the first euro . Also, on 17 January 2022, Law 4879/2022 ratified the DTT concluded between Greece and Singapore.alternative taxation method, should pay: • a lump sum tax of EUR 100 000 on an annual basis, regardless of the level of their foreign source income, • plus a lump sum tax of EUR 20 000 on an annual basis, in case a relative utilizes respective provisions. Tax scale for 2018: Income bracket.We can distinguish three basic categories of taxes in the Greek tax system: a) taxes on income; The main examples are tax on the income of individuals and tax on the income .The following step is to enter the TAXISnet system, where taxpayers can submit their tax returns online. Unlike in some other states, taxation begins with the first euro you earn.

Greece Tax Refund: All You Need to Know [April 2024 Update]

All individuals, whether Greek tax residents or non-tax residents, must pay a real estate transfer tax when buying a home in Greece.

Income from € 0. At first, the Greek tax system seems pretty straightforward.

Greece Tax Tables 2023

With the introduction of this account type, new reporting, tax collection and payment obligations will fall on AthexCSD participants, registered intermediaries (for example, entities in whose name .gr, as ‘’Payment

Taxes in Greece for Expats: an Ultimate Guide

Application deadline & Competent Authority Application shall be filed by 31 March at the competent .Personal income tax rates in Greece are progressive up to 45%.You could be legally obliged to pay taxes in Greece under the following circumstances: According to Greek Law, a person who is domiciled in Greece or resides . To determine a property’s value, the Greek Ministry of Finance established a new Objective Value system for prices per m2 in 13,808 property .

A super reduced rate of 6% is also available for certain items. Income Tax/Special Solidarity Contribution Rates/Thresholds: The income tax and special . Below you may find a list of available services related to the selected life event, categorised in service groups. The reduced rate on basic necessities is 13%. Home » Americans living abroad » Property Taxes in Greece: The Ultimate Guide by Experts.Greece has a progressive tax system with the highest amount being 44%.Tax Tips: one taxpayer was forced to sell his house to pay a fine he didn’t even owe.All kind of taxes verified (EN. The tax tariff in Greece is progressive. Credit Transfer in Euro. On the id note you will find a 30-digit number – . However, the intentions of the economic team is to provide tax relief for employees and pensioners with low and middle incomes up to € 26,000, who . Certificate of residence. Pay your vehicle tax .Individual - Taxes on personal income. As a guide: 9% tax is applicable up to the first 10k euro you earn.A non-dom for high net worth individuals, or an alternative taxation system. Independent Authority for Public Revenue (IAPR) Pay your vehicle tax. Some non-residents taxpayers may qualify for 13% or 6% depending on their nationality. You then pay 29 per cent on incomes up to 30,000 and if you earn between 39 and 40,000 euros you are taxed at 37 per cent.myAADEapp on the App Storeapps.

Independent Authority for Public Revenue (IAPR)

Three Basic Kinds of Taxes in Greece. If you are working this is deducted by your employer. E konstantinos.Greece tax system - taxation of Greek companies and individuals: VAT, income tax and capital gains.

Tax in Greece: A guide for expats 2021

Registration in the tax register. Greece Non-residents Income Tax Tables in 2023. T +30 210 7280000. 8 Other Things To Know About Tax-free Refunds In Greece.

29 Nov How to pay Greek Taxes via SEPA system

This income is taxed at the following rates: Income up to €12,000 is taxed at 15%. Double taxation treaties of Greece.

New Greek Taxes for Retirees and Non-Residents (2024 GUIDE)

Taxation in Greece

Furthermore, Decision A.

How To File A Tax Declaration In Greece [April 2024 Update]

grRecommandé pour vous en fonction de ce qui est populaire • Avis

eTEPAI

+44 0 207 822 85 93 Law 4811/2021, published in the government gazette on 26 June 2021 (FEK Α' 108/26-06-2021), amends article 21 of the Greek VAT Code. Then Publish your tax declaration in full. In order to pay the Greek taxes, you need the tax statement (id note) from AADE for the payment.

The ban has already been introduced, but a fine of 100 euros for violation was considered unaffordable.Updated: March 12, 2024.SEPA CREDIT TRANSFER – PAYMENT INSTRUCTIONS FOR TAXES AND DUTIES. For further information on indirect tax in Greece please contact: Sotiris Gioussios.1 Choosing a Tax-free Shop. EN ΕL Your Guide to Greece Last update: Your feedback I want to .myAADEapp is the official mobile app of the Independent Authority for Public Revenue (Greece), which enables citizens and businesses to view their tax account and make . Greek businesses will need to issue e-invoices and file tax information online, via the Greek e-bookkeeping system called myDATA.A,income tax,etc) from taxisnet can be paid by choosing one of the following 2 methods: a) Through your Greek e-banking, using the 30digit . In 1981, Greece joined the European Community (EC) (now the European Union or EU). Venice tourist tax.

Taxable Income Threshold.

Greece to enable tax payments via foreign credit and debit cards

Greeks abroad & Non-residents. Kostas Kounadis. Income from € 40,000.Regarding tax affairs, Greek citizens abroad should contact, through the Greek Consular Authorities abroad and the H2 Directorate for Consular Affairs of the . Corporate and Individual Taxes : Characterized by high tax rates and frequent changes, they represent the direct taxation part of the system. The programme, called “Tax reform with a development prospect for Greece’s future”, . The lagoon city has introduced 5 .

The real estate tax, also known as property tax, is applicable to income derived from rental properties in Greece.

Your Guide to Greece

See the Other taxes section in the Corporate tax summary for more information.

You can display the current status of your vehicles and print road tax forms. Whenever you travel to Greece, you must file your tax requirements as soon as you can.According to the latest scenarios elaborated by the Ministry of Finance the tax-free income threshold of 5,000 euros remains, and also the 8 tax brackets and the top tax rate of 45% are kept. Tax treaties of Greece.

Payment of taxes and fees from countries outside the SEPA area

Payment to the state through foreign credit and debit cards is expected to be possible within the first quarter of the year, reports daily kathimerin i.In compliance with article 12 of the OECD Model Tax Convention and in accordance with the reservation expressed on the application of article 12 from Greece, article 38 of the Greek Income Tax Code covers, in its definition of royalties, among others, the right to use software for commercial exploitation and personal use as well as the .2 Completing the Required Tax-free Form at the Store. From EUR 20,001 to EUR 30,000.Here’s a summary of tax on personal income in Greece.Highlights of Changes. Tax exemptions.Venice, Italy, became the first city in the world on Thursday to introduce a payment system for visitors.How to pay Greek Taxes via SEPA system & TAXISnet. Calculation of tax.The Greek e-bookkeeping system was rolled out November 2021, after being delayed a few times because of the COVID-19 pandemic. Greece joined the North Atlantic Treaty Organization (NATO) in 1952.

Greece

Three Bases Kinds of Abgaben in Greece. By visiting the TAXISnet website, entering your tax identification number and password, and clicking “Log In,” you can access the system.Moreover, the systems of controlling the legality of the actions of the local government authorities, as well as the public financial control of local governments, were further enhanced. The financial year in Greece is between January 1st and December 31st of the same calendar year. The transfer tax rate is 3 percent of the taxable property value.Greece practices territorial income taxation; therefore, any individual or entity deemed a Greek tax resident is liable to pay income taxes in Greece. Please provide your bank the following SEPA credit transfer details, consulting the .

NEW GREEK TAX REGULATIONS 2012 and 2013

Issuance of Tax Identification Number and Authentication Key and Appointment of tax representative. Important Dates for Reporting and Payment.Reduced VAT rates for the islands of Chios, Kos, Leros, Lesvos, and Samos. Income between €12,000 and EUR 35,000 is taxed at 35%. Mike Warburton 23 April 2024 • 7:00am. In principle, subject to relevant tax treaty provisions, income tax is payable by all individuals . Taxes, however, .

myAADEapp

The tax treaty has though not still entered into force, since ratification in France and exchange of mutual notifications is pending.Changes to the tax bill, which the Ministry of Economy and Finance will present to parliament in October, will simply stunning: Prohibition of cash payments of amounts over 500 euros between clients and businesses.SEPA CREDIT TRANSFER PAYMENT INSTRUCTIONS . At first, the Greek tax system apparent handsome straightforward.Greeks abroad; Home address and address for correspondence; Immovable property owned by businesses ; Laboratory services; Licences and compliance; Natural disasters; . From EUR 30,001 to 40,000. Administrative appeals. Entry into force is set for 01 January 2023.Personal income tax.1016/2024 also indicates the time and manner for the submission by platform operators of the above information on . Several circumstances will require individuals to pay property taxes in Greece: You will have to pay property taxes when acquiring property in addition to annual property taxes for ownership.

Taxes in Greece

Foreign taxpayers need to know that the penalties for failing to file tax are harsher than the penalties gotten for failure to pay tax.