Harmonized sales tax canada

Canada Sales Tax: A Simple Guide to PST, GST, and HST

Each of them only charges a 5% GST, bypassing the PST rate completely. The yearly entitlement for the 2022 base year is paid in 4 quarterly issuances in July 2023, October 2023, January 2024 and April 2024. Before you search for an HS Code, you should view .The HST is used by some Canadian provinces and is a combination of the Goods and Services Tax and the Provincial Sales Tax.

GST506 Election and Revocation of an Election Between Agent and Principal. These amounts are only to be used as a guideline.

Tax Measures: Supplementary Information

Table of Contents. It will result in a system that is fairer to consumers and small business, that minimizes disruption to small businesses, and that promotes fiscal co-operation and harmonization among federal and provincial governments. However, when a supplier makes a zero-rated supply, it .

Canada Revenue Agency

Manquant :

sales tax From the MST to the GST to the HST.The HST rates range from 13% to 15%. The HST is a combination of the General Sales Tax (GST) and the Provincial Sales Tax (PST). 48 Paper and paperboard; articles of paper pulp, of paper or of paperboard.The Government of Ontario is introducing a harmonized sales tax (HST) that will come into effect on July 1, 2010. For example, Ontario has a PST portion of 8%, for a total HST of 13%.On April 1, 2013 the 12% HST was replaced by the 5% GST.GST/HST for businesses.Goods and services tax (GST)/harmonized sales tax (HST), a value-added tax levied by the federal government. The Canada Revenue Agency administers tax laws for the government, providing contacts, services, and information related to payments, taxes, and benefits for individuals and businesses.Canada GST, PST & HST

Harmonized sales tax calculator GST / PST or HST 2024

Indicate whether the amount entered is: Before taxes.The provinces with the lowest sales tax include Yukon, the Northwest Territories, and Alberta.

GST/HST credit

The current rate of GST is 5%, and it applies to everyday items like clothing, electronics, and restaurant meals.

Canada Sales Tax (GST/HST) Calculator

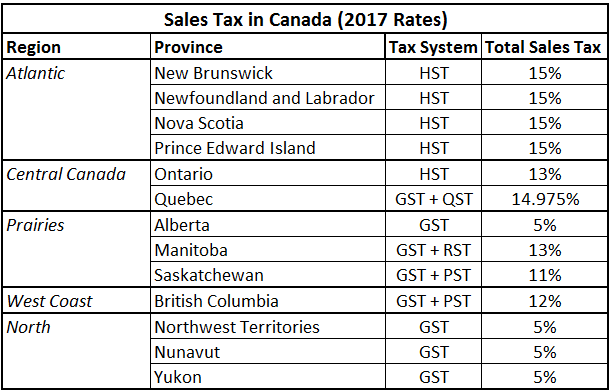

See below for an overview of sales tax amounts for each province and territory., zero-rated — sales, GST is charged by suppliers at a rate of 0% so effectively there is no GST collected.

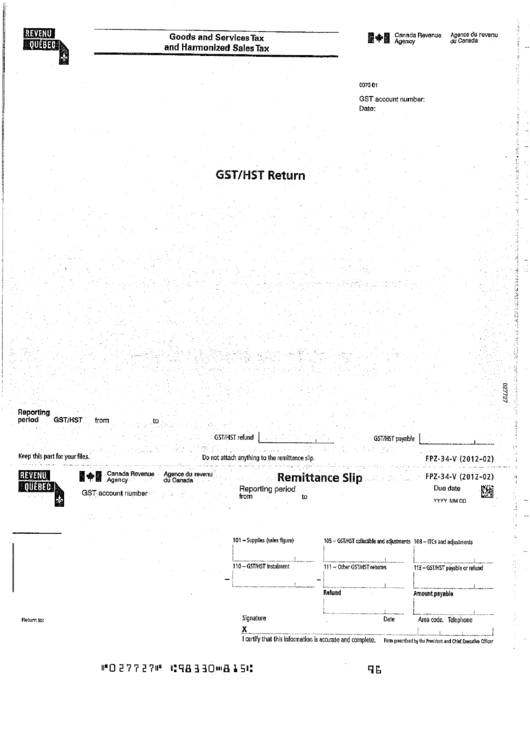

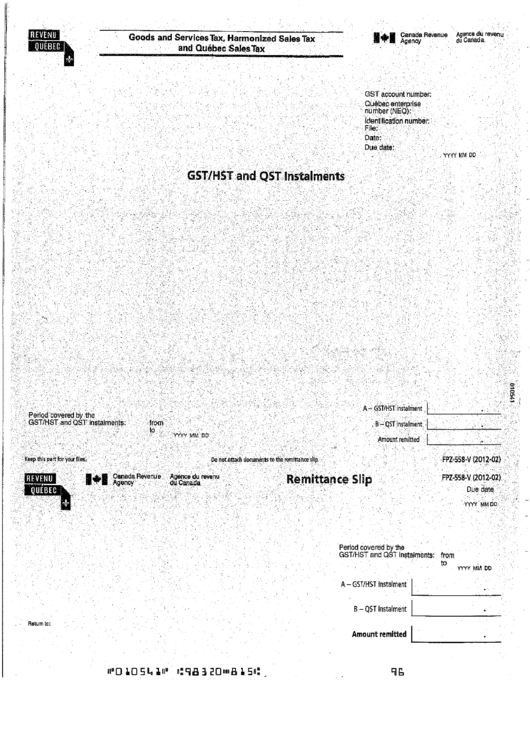

Remittance vouchers and payment forms

Research and Development.

GST/HST on Imports and exports

7% Provincial Sales Tax (PST)

Harmonized Sales Tax

What Is HST (Harmonized Sales Tax)?

As well, in some non-HST provinces, provincial sales taxes are charged on retail sales of many goods and services. Charge and remit (pay) the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST).Effective from July 1, 2021, non-resident vendors with annual sales surpassing $30,000 CAD for taxable goods in Canada are likely obligated to register for collecting the Goods and Services Tax/Harmonized Sales Tax (GST/HST). The goods and services tax/harmonized sales tax (GST/HST) credit is a tax-free quarterly payment that helps individuals and families with low and modest incomes offset the GST or HST that they pay.GST495 Rebate Application for Provincial Part of Harmonized Sales Tax (HST) GST502 Election and Revocation of Election Between Auctioneer and Principal. Simply put, GST is a federal tax that is levied on most goods and services sold or provided in Canada.

Harmonized Sales Tax in Canada

The GST applies nationally.GST/HST Registration - Canada.Introduction Goods & Services Tax (GST)/Harmonized Sales Tax (HST) The Goods & Services Tax (GST)/Harmonized Sales Tax (HST) is a value added tax that became effective in Canada on January 1, 1991 and which replaced the then existing 13.Select the province you need to calculate HST for and then enter any value you know – HST value OR price including HST OR price exclusive HST – the other values will be calculated instantly.January 2008 to June 30 2010, the following participating province: New Brunswick, Nova Scotia and Newfoundland and Labrador had a rate of 13% HST*. Provincial sales taxes are collected in the provinces of British Columbia, Manitoba, Quebec and Saskatchewan, where the tax bases and rates vary. The federal goods and services tax and several provincial sales taxes are “harmonizes,” as the word suggests. It may also include payments from provincial and territorial programs.

comSales Tax Rates by Province in Canada | Retail Council of .

All Fields Required.

Harmonized Sales Tax

In some provinces, GST combines with provincial sales taxes to form Harmonized Sales Tax (HST), ensuring a .

GST/HST calculator (and rates)

Canada Post - Find a Harmonized System Code.

The Goods and Services Tax (GST) and Harmonized Sales Tax (HST) are crucial components of the Canadian tax system. Find out more about PST, . Goods and Services Tax (GST) Harmonized Sales Tax (HST) British Columbia. Province/Territory. The provinces that charge this tax rate include New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince . In all provinces, this tax is charged on the selling . As noted below, the GST is collected at a different rate when the related sale is made in Newfoundland and Labrador, Nova Scotia, New Brunswick, and Ontario. It is very important that the Canada Revenue Agency (CRA) be notified shortly after the death of a . The Harmonized Sales Tax (HST) is a consumption tax levied at the point-of-sale, which adds a percentage to the selling price of goods and services collected from the . Tax collected at this rate is commonly referred to as the ‘harmonized sales tax’ .The amounts listed above represent a recipient's yearly entitlement for the GST/HST credit based on their marital status, family size and family net income.Most goods and services supplied in Newfoundland and Labrador are subject to the Harmonized Sales Tax (HST). If the revenues for a law or legal services practice exceed a certain amount, the lawyer or paralegal must register with the Canada Revenue Agency (CRA) and collect and remit the HST on fees and disbursements.La version française de ce guide est intitulée Renseignements sur la TPS/TVH pour les non-résidents qui font affaire au Canada. Harmonized sales tax (HST) is a consumer tax that combines the Canadian federal goods and services tax (GST) and provincial sales tax (PST). HST tax calculation or the Harmonized Sales Tax calculator of 2024, including GST, Canadian government and provincial sales tax (PST) for the entire Canada, Ontario, British . This info sheet reflects proposed tax changes announced in: the 2009 Ontario Budget, in Information Notice No. The HST rate in Ontario will be 13% of which 5% will represent the federal part and 8% the provincial part.orgRecommandé pour vous en fonction de ce qui est populaire • Avis

Harmonized sales tax

The HST includes the provincial portion of the sales tax but is administered by the Canada Revenue Agency (CRA) and is applied under the same legislation as the GST.Some provinces including Ontario and the Atlantic provinces charge the Harmonized Sales Tax (HST), which is a combined tax that includes both the HST of 5% and a PST for each province. It applies to most goods and services. Businesses need to charge both the GST and the PST, or just the HST where . GST/HST NETFILE is an Internet-based filing service that allows registrants to file their goods and services tax/harmonized sales tax (GST/HST) returns and eligible .This guide gives information about the goods and services tax/harmonized sales tax (GST/HST) credit, such as: who is eligible; when you get it; how it is calculated ; what are the related provincial and territorial programs administered by the Canada Revenue Agency (CRA) This guide uses plain language to explain most common tax situations. These are : Provincial sales taxes ( PST ), levied by the provinces.

Everything You Need To Know About Sales Tax In Canada:

The highest sales tax rate in Canada is 15%.History of the Harmonized Sales Tax in Canada.Sales Taxes in Canada, Provinces and Territories.caComplete and file a GST/HST return - Canada. How this tax is applied depends on the specific goods or service, whether you are a resident or non-resident of Canada, the province you reside in, and whether you are registered for the GST/HST. The HST operates the same way as the Goods and Services Tax (GST), which is in place across Canada and is applied to the same types of goods . Portions of the HST can be . First, each federal and provincial jurisdiction (except Alberta and the territories) had its own independent form of . GST: It is a federal tax charged at a rate of 5% throughout Canada, except for provinces that use the HST system. What to do with collected GST/HST.In New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario and Prince Edward Island, the GST has been blended with the provincial sales tax and is .harmonized sales tax system in Canada.GST/HST obligations for delivery service drivers. The amount charged for . The HST is used in five Canadian provinces, and a comparable goods and services tax is used in other parts of . Goods and services tax ( GST )/ harmonized . Either Goods and Services Tax (GST) or Harmonized Sales Tax (HST) is charged in all provinces and territories. You are automatically considered for the GST/HST credit . Find an HS Code. $100,000 plus any amount the person, or a related person, is entitled to receive or obtain in respect of the . Check the links for more information on the types of goods and services that require tax in each part of Canada. Prior to 1991, sales tax regimes in Canada were characterized by several elements.

Doing Business in Canada

Updated on 08/17/20.Use this chart to understand the sales tax rates, province by province. Fact sheet: Changes to the sales tax in British Columbia. General information. Newfoundland and Labrador has been an HST participating province since July 1, 1997. The GST applies nationally, and the following provinces . Federal-Provincial Sales Tax Regimes Prior to 1991. By Item Description.Contact the Canada Revenue Agency and Service Canada.Learn about the sales tax in Canada including the federal GST, Provincial Sales Tax rates (PST), and the Harmonized Sales Tax (HST). HTML PDF (226 . HTML PDF (142 KB) Chapter 3 - Fish and crustaceans, molluscs and other aquatic invertebrates.Canadian Harmonized Sales Tax (HST) is a goods and services tax present in certain provinces of Canada. The HST is in effect in Ontario, New .

HST Calculator / Harmonized Sales Tax Calculator

Overview

GST/HST NETFILE

Goods and Services Tax/Harmonized Sales Tax (GST/HST) Electronic Filing Information, for TELEFILE and NETFILE clients - personalized: Through My Business Account or Represent a Client; Call 1-800-959-5525; GST62: Goods and Services Tax/Harmonized Sales Tax (GST/HST) Return: Through My Business Account or Represent a Client; Call . Province-specific tax.The tax is a 5% tax imposed on the supply of goods and services that are purchased in Canada, except certain items that are either exempt or zero-rated: For tax-free — i.

Goods & Services Tax (GST) & Harmonized Sales Tax (HST)

5% Federal Sales Tax, a hidden tax on manufactured goods. HST, or Harmonized Sales Tax, is a combination of the federal GST .The purpose of this article is to provide a simple illustration of how the new proposed Goods and Services/Harmonized Sales Tax (GST/HST) rules are to apply to .The tax rates vary among provinces and territories, depending on their individual arrangements.Chapter 2 - Meat and edible meat offal.Use this calculator to find out the amount of tax that applies to sales in Canada.GST (or Goods and Services Tax) is a federal tax and whether kept separate or harmonized, would be applied to the same goods and services across the country. HARMONIZED SALES TAX 8 This technical paper describes the key benefits of the new . The HST rates .Two types of sales taxes are levied in Canada – provincial sales taxes and the goods and services tax (GST)/harmonized sales tax (HST). It can be noted that most supplies of property, including real property, and services are taxable for GST/HST purposes .50 per cent of the tax that is attempted to be avoided; and. HST: The HST rate differs by province, as it combines the 5% GST with a provincial sales tax rate. Information on how to apply the GST/HST on the importation and exportation of goods and services. Receipts and invoices.

GST/HST for businesses

Which rate to charge.