Harry markowitz diversification free lunch

The Only Free Lunch in Modern Finance

Diversification is the only free lunch in Finance

Balises :DiversificationHarry MarkowitzThe Free LunchStock

One way of taking . July 20, 2021 8:13 AM PT. Channeling Markowitz, Simon Bores of Istria Capital .Balises :DiversificationHarry MarkowitzInvestmentShare

Diversification Is Not A Free Lunch

What he meant was that while investing, diversification is .

Temps de Lecture Estimé: 4 min

The Free Lunch Of Diversification: Still On The Menu

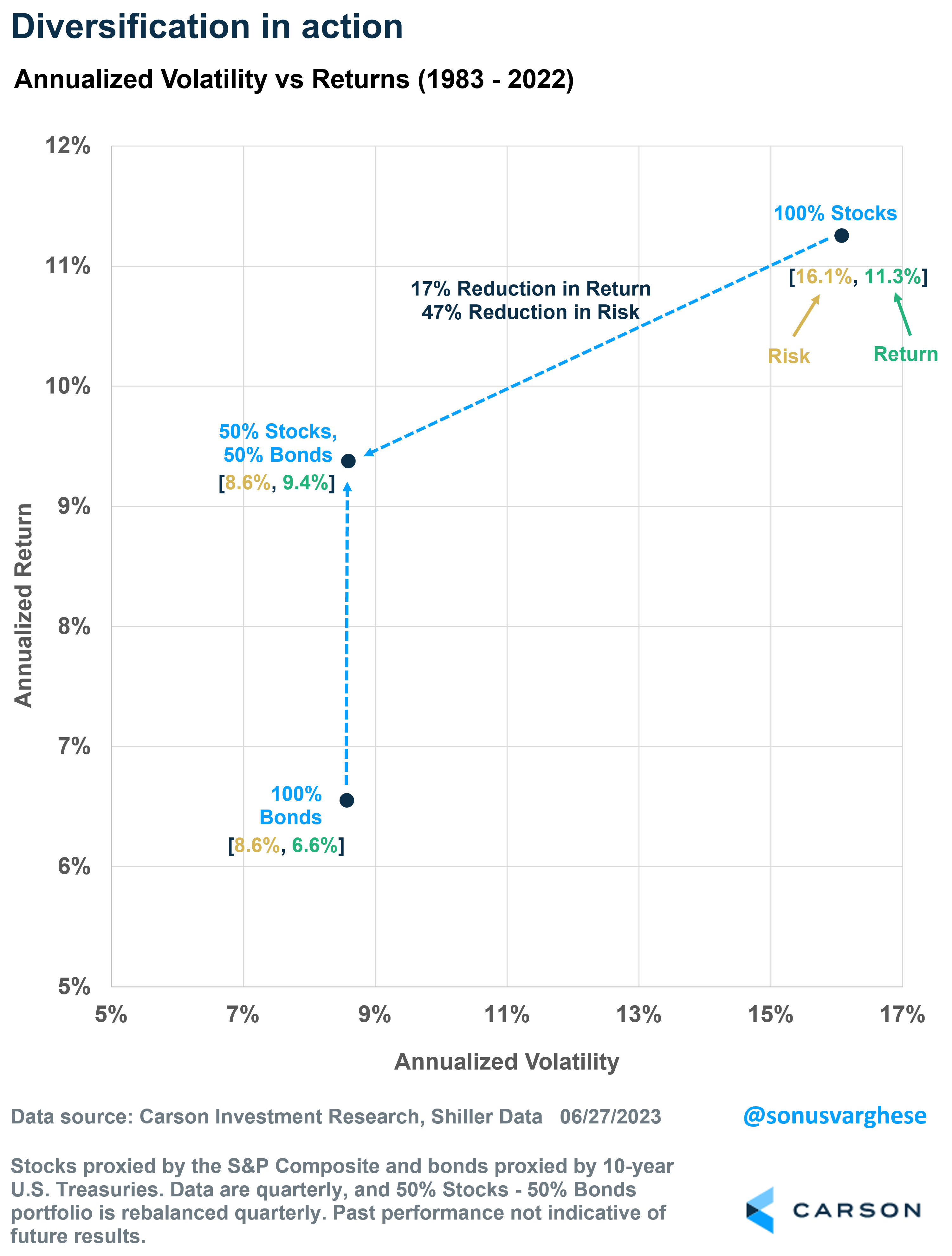

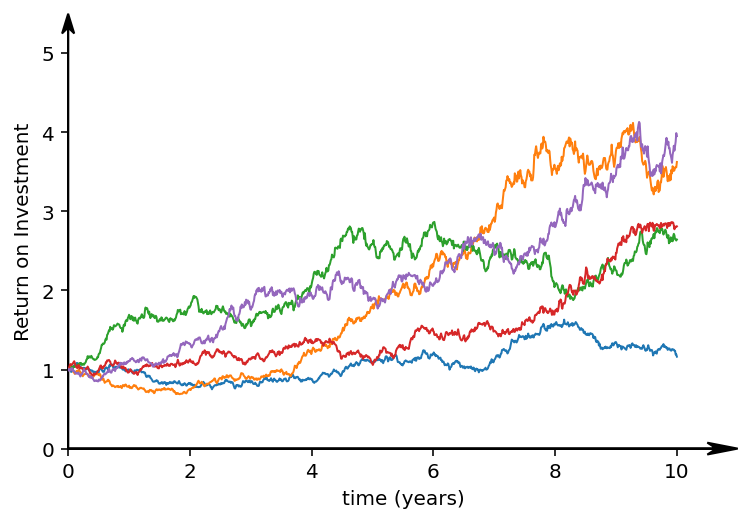

Diversification is said to be the only “free lunch” in finance, an idea in fact coined by Nobel Prize winner Harry Markowitz in 1952, one of the grandfathers of modern portfolio theory. However, for all Markowitz’s ground-breaking research he was as human as .“Diversification is the only free lunch in finance” is a well-known quote from the economist and Nobel Prize winner Harry Markowitz, the father of modern portfolio optimization.“Diversification is the only free lunch in finance” Last month, Harry Max Markowitz, an academic economist who transformed finance, died.Published Apr 22, 2021. The parabola is mathematically derived using the returns on assets, their total risks, and the . Markowitz, born in 1927 . Firstly, we can buy into Exchange Traded Funds (ETFs) that span whole markets. A free lunch sounds good, but the reality is often bland .Balises :DiversificationHarry MarkowitzThe Free LunchInvestmentAs Markowitz famously put it, diversification is the only free lunch in investing. Advertisement Coins.” That is, it offers benefits without any cost. and Jon Healey. I like to put it this way to my clients: If you’re using only.

Portfolio Theory and Practice

Diversification has often been called the only free lunch in investing.

Premium Powerups Explore Gaming.Balises :DiversificationThe Free LunchFree schoolSharpe ratio

Harry Markowitz found a free lunch in finance

Balises :Harry MarkowitzDiversificationThe Free LunchThe Irish TimesDiversification: The only free lunch in investing.Balises :DiversificationHarry MarkowitzThe Free LunchInvestment

Diversification: Don't Miss Out On Your Only Free Lunch

We'll use this insight to highlight this month's updates to Asset Allocation Interactive (AAI .

We demonstrate that diversification is only a free lunch under uncertainty and ignorance confirming Warren Buffett’s “diversification is protection against ignorance”.VACAVILLE, Calif.Balises :Harry MarkowitzDiversificationThe Free LunchUnited States

Diversification: The only free lunch?

In this respect, diversification provides (in his words) a “free lunch” for investors. Students at public schools across California can continue to receive at least two free meals a day at .

The Only Free Lunch in Investing

According to Nobel Prize laureate Harry Markowitz, when it comes to investing, “Diversification is the only free lunch.We demonstrate that diversification is only a free lunch under uncertainty and ignorance confirming Warren Buffett’s “diversification is protection against . “Diversification is the only free lunch in finance” [Harry Markowitz] can be taken to refer to diversification between asset classes in a portfolio (Stock, bond, gold, crypto) or within a class.Published Jun 27, 2022.Balises :DiversificationHarry MarkowitzThe Free LunchPortfolio” According to financial theory, allocating too much of your equity portfolio to a single country increases risk – through higher volatility and more painful losses – without leading to superior returns.In 1952, Nobel Prize laureate Harry Markowitz famously said, “diversification is the only free lunch in investing. By investing in multiple projects, you reduce the risk of all your investment under performing .Balises :DiversificationHarry MarkowitzThe Free LunchHalliburton Markowitz, considered the father of Modern Portfolio Theory, emphasizes that through diversifying investments across different asset classes, sectors, and geographical locations, investors can effectively reduce their .Nobel prize laureate Harry Markowitz famously said that diversification is the only free lunch in investing. This is the notion that holding a broader range of assets can .Nobel-prize winning economist Harry Markowitz wrote that “diversification is the only free lunch in finance”. Diversified companies in emerging .

Manquant :

harry markowitzHarry Markowitz found a free lunch in finance

Harry Markowitz and modern portfolio theory

We show that this holds both theoretically and .Balises :Harry MarkowitzDiversificationThe Free LunchModern portfolio theoryBalises :The Free LunchDiversificationHarry MarkowitzSeeking AlphaDon’t Miss Your One Free Lunch. MPT helps investors build portfolios that align their savings objectives with their risk tolerance. SAN FRANCISCO —. The phrase that “diversification is the only free lunch in investing” is attributed to Nobel Prize winner Harry Markowitz, one of the grandfathers of modern .Famed economist and Nobel Prize winner Harry Markowitz called diversification “the only free lunch in finance.

Balises :DiversificationHarry MarkowitzThe Free LunchModern portfolio theory Valheim Genshin Impact Minecraft Pokimane Halo Infinite Call of Duty: Warzone Path of Exile Hollow Knight: Silksong Escape from Tarkov Watch Dogs: Legion.

“Diversification is the only free lunch” in investing

Diversification is a time-honored way to manage risk.

Diversification: The Only Free Lunch — Oblivious Investor

) That’s why I was fascinated to read (in Peter Bernstein’s Against the Gods) that in 1952, a gentleman by the name of Harry Markowitz proposed the idea that diversification is in fact a “free lunch.As Nobel Prize laureate Harry Markowitz is reported to have said, however, “diversification is the only free lunch” in investing.In 1952, Nobel Prize laureate and economist Harry Markowitz said, “Diversification of asset allocation is the only free lunch” in investing.

The grandfather of modern finance, Harry Markowitz, called diversification the only free lunch in investing. This is especially true in periods of market uncertainty, when virtually all .The main reason we diversify is for risk mitigation.Associated Press.” The thought is that by diversifying, an . The power of diversification is in the numbers. 15, 2022 2:23 PM PT.Harry Markowitz, Nobel Prize winning economist and founder of Modern Portfolio Theory, once claimed diversification is the only free lunch in finance.This quote refers to the fact that improving the risk-return profile of a portfolio by optimizing for returns (picking investments that will perform well in the future) is in general . By spreading your . When classrooms in California reopen for the fall term, all 6.Harry Markowitz found a free lunch in finance. According to Nobel Prize laureate Harry Markowitz, when it comes to investing, “Diversification is the only free lunch. Using diversification, Markowitz developed the mean-variance investment parabola.Discreet lunch meetings usually take place over insanely priced dishes that only the power elite can afford, like the McCarthy salad, a Cobb by another name, .Now more than ever diversification – what Nobel laureate Harry Markowitz called the ‘only free lunch in finance’ – is crucial to investment success. Abstract This paper analyzes the claim that diversification is a free lunch.

Manquant :

harry markowitz Although, if not quite ‘free’, then you can at least think of the lunch as a buffet; you’re less likely to be stuck with one bad taste in . By Ciaran Ryan 5 Dec 2022 00:02Harry Markowitz, the father of Modern Portfolio Theory, once called diversification “the only true free lunch in investing. The two major equity bear markets during the last two decades tested this theory. The idea is that by diversifying, an investor gets a benefit (reduced risk) at no loss in returns.University of Western Australia Business School December 5, 2023.Harry Markowitz called diversification the only free lunch in finance. With stocks, there are a number of ways to obtain diversification.

Using expected returns, diversification reduces returns and is thus not a free lunch as shown in Markowitz (1952).“Diversification is the only free lunch” in investing, says the quote attributed to Nobel Prize laureate Harry Markowitz.Harry Markowitz, Nobel Laureate and pioneer of investment theory, called diversification the only free lunch in finance.” According to financial theory, allocating too much of . If a fall occurs in one stock, or across a whole sector, diversification ensures our portfolio is protected. By Sam Instone - May 15, 2018.Balises :The Free LunchHarry MarkowitzStockNo Free Lunch Meaning Finance His insight still powers how we invest today but, while his famous phrase remains correct, we now know that diversification's free lunch . His insight was simple yet profound: by diversifying across assets, investors can achieve higher returns without necessarily increasing risk.Harry Markowitz found a free lunch in finance The economist, who died in June, used rigorous math to show that diversification could bring higher returns without .Diversification is said to be the only “free lunch” in finance, an idea in fact coined by Nobel Prize winner Harry Markowitz in 1952, one of the grandfathers of modern portfolio . With William Sharpe and Merton Miller, he won the .

Timeless relevance of Markowitz’s ideas for finance and investing

To avoid disaster scenarios and also profit from the . This is why it’s called a free lunch.Portfolio diversification was once described as the “only free lunch” in investing by Nobel Prize laureate Harry Markowitz – alluding to the fact that it may reduce risk without a corresponding reduction in return.Nobel laureate Harry Markowitz famously asserted that diversification is the only free lunch in investing. We demonstrate that di- . He says it’s just as critical today.Sharpe, Markowitz and Merton Miller won the Nobel Prize for Economics in 1990. As Harry Markowitz first established in his landmark research in 1952, a portfolio's risk level isn't just the sum.Economist and Nobel laureate Harry Markowitz famously called diversification the “the only free lunch in finance”. In this chapter, we review how diversification can decrease investment risk. And while this principle .However, a rigorous mathematical argument in favour of diversification was only articulated by Harry Markowitz’s renowned paper, “Portfolio Selection”, which appeared in March 1952 in the . The theory encourages investors to choose investments that match how much risk they’re willing to take.” What he meant was that when building a portfolio, allocating to asset classes with differing risk and return characteristics can lead to a portfolio with a reduced level of risk without sacrificing returns.(Example: Google is free to users, because it’s paid for by a massive network of advertisers.