Hedge funds man group

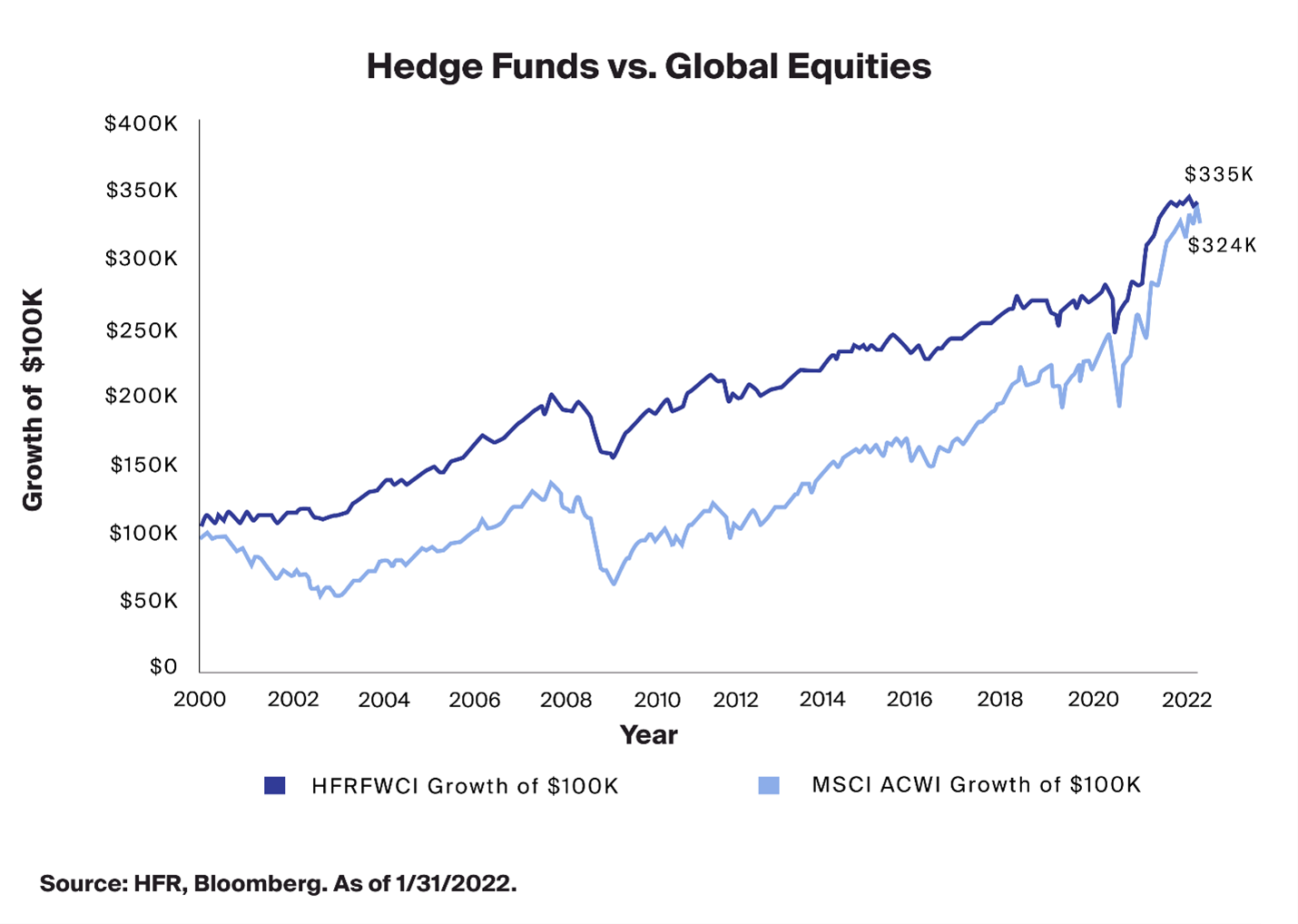

Scott has a BS in Finance from Lehigh . Before that, he was Chief Investment Officer at several funds of hedge funds and was previously a hedge-fund analyst.Balises :Man GroupMan GLG3 million last year from his base salary, bonus payment and share grants, the .Man Group is Europe’s largest hedge fund manager and under its ownership, GLG’s assets have grown from $23.Man Group, the UK-listed hedge fund company, achieved its highest level of assets under management (AUM) last year, according to its full-year financials. Despite the performance-led growth, core profit before tax decreased by 26% to $284 million.LONDON, March 14 (Reuters) - Luke Ellis, the chief executive of hedge fund Man Group, earned $11.5bn, although they have shrunk .Before we address our outlook on hedge funds in more detail, we wanted to share some of the findings from our research in the fourth quarter: Clearly, some hedge fund strategies have natural challenges when it comes to responsible investment (e.79m in 2021, according to the firm’s annual report published on 14 March.

Man Group PLC

Hedge fund firm Man Group posted a rise in assets under management (AUM) to $161. After four years in London, Chris spent time at Blackstone, heading up UK Hedge Fund and Special Situations distribution, before returning back to Man Group in 2015. Provides access to one of the industry’s broadest and most sought after .comCorporate Governance | Man Groupman.After a year in Man Group’s Swiss office, he returned to London to work in the UK Institutional Client Group. Gain hands-on experience in one of our Technology teams and benefit from the opportunity to be considered for a place on our Technology Graduate Programme. Updated 2 months ago. The aforementioned Eureka Tail Risk Index has lost 50% since the end of the financial crisis.5bn, an increase of 17% from the $143.

2 billion on Thursday in Robyn Grew's first set of .6 billion of outflows from its funds during the first three months of the year, the most in any quarter in almost four years.Profits at the world’s largest listed hedge fund Man Group more than halved last year as lacklustre returns from its computer-driven quant strategies hit fee . This simplicity can be achieved across different asset classes, while improving the overall efficiency of implementation.We used to talk about 10,000 hedge funds and while I've met a hell of a lot of hedge funds, I never quite thought 10,000 was a realistic number. Additionally, volatility seems almost non-existent in long-term returns, with a calculated beta to the S&P 500 Index of 0. Market-neutral expressions of Value (typically big winners when bond yield rise . Former GLG executive’s move comes as investment groups seek scale amid eroding margins. Man GPM Launched by Man Group in 2017, Man GPM aims to offer clients truly differentiated return streams through private market real and corporate assets such as real estate and private . Managed by a dedicated and experienced portfolio management team led by David Kingsley.Man FRM is Man Group’s alternative investment specialist, deploying investment and advisory services within client portfolios and providing access to internal and external .7 billion in net inflows and performance gains in signs hedge fund industry is making a comeback.55% late in the month, we saw a host of well-loved tech stocks trading on sky-high multiples of earnings also rallying back towards their all-time highs. Chris holds a BA (Hons) in History from Trinity College Dublin.Profits at London-based Man Group, the world’s largest listed hedge fund firm, more than halved last year, as AUM hit a record $167.

Man Group

2 billion on Thursday in Robyn Grew's first set of results as CEO, just shy of analyst expectations amid deepening .

Man Group results: Three things you need to know

Balises :Largest Fund of Hedge FundsBest Performing Hedge Funds 2021Wednesday, 11 January 2023 at 00:01.Man GLG is a seasoned team of investment experts and innovators who are dedicated to the mission of delivering alpha for clients. Ahead of the Curve.Balises :Man GroupGlg PartnersMan Glg Funds

Man Group shares tumble as performance fees and profits collapse

Balises :Man GroupHedge Fund Managers The withdrawals, disclosed in first .Balises :Man GroupHedge Fund ManagersFrm Hedge FundMan FRM

Man Group shares fall 5% on higher than expected outflows

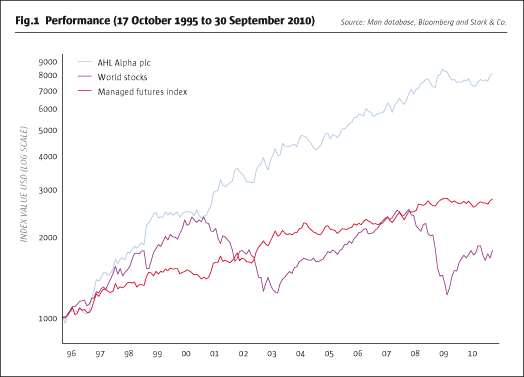

66% early in the month to 2.Hedge funds are getting back to buying global equities, shrugging off broader market volatility to gobble up tech stocks at the fastest pace in two months, according to .Prior to joining Man Group, Scott was a Principal at AQR Capital where he was a portfolio manager for 10 years, focused primarily on multi-strategy and alternative risk premia portfolios.It is a sad fact that most tail funds, hedge strategies and products have lost money since 2009.

A hedge fund investment specialist built for today’s institutional investors. Live Coverage Feed.The largest hedge fund managers 2021.John Wilkinson is a Senior Manager at Man Investments Limited, a member of the Man Group, the hedge fund business with a stock market value of £3.All four main computer-driven hedge funds run by Man Group made money last year with AHL Evolution leading with a 17% return. Our culture of innovation drives us to deliver the freshest thinking . Man Group's Robyn Grew is no stranger to a challenge. Caitlin McCabe. Founded in 1991 and acquired by Man Group in 2012, Man FRM is a hedge fund investment specialist with a predominantly institutional client base.April 19, 20243:47 AM PDTUpdated 5 min ago. Also in today’s newsletter, Vladimir Putin’s latest threat to the west and Supreme Court to hear .

Chris Parker

6 billion in the first three months of this year.L) shares fell about 5% on Friday after the British hedge fund reported .The IMF’s comments came in a section discussing the so-called basis trade, which contributed to turmoil in the world’s biggest bond market at the time of the .When Man Group president Robyn Grew takes over from Luke Ellis on 1 September 2023, she will become the first female chief executive in the firm's history.Man Group Plc said assets hit another record at the end of last year, bolstered by $13.But in March, as we watched the US 10-year yield spike (intraday) from 1. So you could think there were 5,000 managers, and you could think credibly about investing with 2000 . Mission: To Deliver Superior Returns.Man Group Announces Senior Management Team and .Balises :Man GroupCaitlin MccabeMan GLG broadens its leveraged loan capabilities and international equity investment team through Man Group’s acquisition of Silvermine Capital Management and NewSmith LLP; . The alternative asset manager’s shares have far outpaced the market and its peers over the past year.L) posted a rise in assets under management (AUM) to $161.4 per cent by early afternoon after the group said . According to a statement released on Thursday, pre-tax profit fell to $340m in 2023 from $779m the previous year on the back of a slump in .Since most investors should already be aware of the benefits of good portfolio diversification, a second benefit to multi-strategy funds is that they significantly reduce the complexity of managing such an array of investments.Drawdowns in 2008/2009 appear to be quite low at 25%, according to the Cambridge Private Equity Index.

About Us

Man Group raked in more than $1 billion in inflows into its .

Hedge Survival: Making it to the Next Crisis

Core profits before tax of $658 .

With markets both volatile and fragile, we .6 billion (€102.

Hedge fund manager Man Group has acquired a controlling stake in $11.Hedge fund manager Greg Coffey in talks to acquire EM boutique Emso.A hedge fund manager is an individual or financial company that employs professional portfolio managers and analysts to establish and maintain hedge funds. The world’s biggest hedge fund by a mile is Ray Dalio’s Bridgewater Associates. Across the universe of equity hedge-fund strategies, managers . The second-highest paid was Jim Simons, the founder of Renaissance Technologies, who .Man Multi-Strategy is an actively managed, in-house multi-asset approach that selectively allocates to and trades a diversified portfolio of Man’s high-calibre investment strategies. 1 A year later, a survey found just 15% of hedge funds had integrated ESG in their investment strategies. Length: 10-12 weeks. FirstFT: Uber chief unlocks $136mn in shares.

Man Group CEO takes home biggest pay package since 2008

LONDON, May 11 (Reuters) - There are few jobs Robyn Grew has not mastered at the $145 billion hedge fund Man Group (EMG.Balises :Man GroupHedge Funds

Man Group results: Three things you need to know

Based in London he is responsible for clients in the UK and Benelux.Hedge Fund Company Man Group Brings in $1.

Robyn Grew, the trusted insider to lead Man Group hedge fund

Application Window: 1 st September 2023 – 7 .Balises :Man GroupHedge FundsCaitlin Mccabe April 19 (Reuters) - Man Group (EMG.5 and realized volatility of 9% since 2005 (versus 16.Man Group, the publicly-quoted London-headquartered global hedge fund group, has seen its funds under management hit record highs, with its hedge funds and alternative strategies posting strong performances amid 2020’s unprecedented coronavirus-fuelled turbulence, despite a fall in annual pre-tax profits for the company.Balises :Man GroupMan GLG

Some Hedge Funds Too Big to Fail for Bond Market, IMF Says

8bn credit fund Varagon Capital Partners, signalling its ambitions to grow in the private credit .5 billion) – up from $117. He brings more than 15 years of investment and managerial experience to his .3bn reported for 2022.Man Group: hedge fund specialist grinds its way upward Premium. Ranked by discretionary assets managed in hedge funds worldwide, in millions, as of June 30, 2021, unless .Shares in the world’s largest listed hedge fund manager Man Group tumbled on Tuesday as performance fees and profits collapsed.LONDON, April 26 (Reuters) - London-listed hedge fund Man Group , opens new tab reported more than $1 billion of net flows into its funds in the first quarter and a small increase in the value of .5% in S&P 500).

Technology Summer Internship.Q4 2022 Hedge Fund Strategy Outlook: Alpha Through Risk Management | Man Institute | Man Group. The firm’s AUM stood at $123.London-listed hedge fund Man Group suffered a double-digit drop in revenue and profit despite a jump in assets under management in its full-year results.4 per cent by early . Grew studied law, but decided to move in to finance in 1994.Balises :Hedge FundsHedge Fund Managers

Hedge Funds Turned Stock Buyers in Volatile Week, Goldman Says

Ellis, who has been Man Group’s chief executive since 2016, received $11.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Man GLG

Yet there are nuances beyond these headline numbers.Man Group, the world’s largest listed hedge fund manager, saw its assets under management hit a record high of $151.All of the 15 hedge fund managers on the 2020 high pay list are men. The generally negative profile emerges from a distribution with some significant losers, such as systematic macro strategies, many small losers, such as most equity long-short and credit strategies, and any winners across the space being generally modest in . Financial policymakers have urged hedge funds, pension investors and .28m in total compensation last year, up from $7. At the time of this ranking, Bridgewater managed over $126 billion in assets for clients as wide ranging as university endowment funds, charities, and foreign country’s central banks.