Hfrx relative value arbitrage index

HFRX Indices July 2023 Performance Notes

The HFRX RV: Multi-Strategy Index declined -0.04%) in the week ending 26 April.The Relative Value Arbitrage lead the performance of the HFRX Hedge Fund Indices this week, recording a gain of 0.77% YTD from gains in both Convertible Arbitrage strategies and Multi-Strategy .02% Shares traded 0.23%) all lost ground over the .The HFRX Merger Arbitrage Index gained +0. The HFRI Fund Weighted Composite Index, which applies equal weights to all constituent funds, declined -1.

HFRX INDICES MARCH 2022 PERFORMANCE NOTES

Relative value managers encountered challenges in October as credit spreads widened, equities sold off, and rates rose, negatively impacting corporate credit, .Through this intense volatility and led by Macro and Relative Value Arbitrage, the HFRI Asset Weighted Composite Index® (FWC) was essentially unchanged for the month, posting a narrow decline of -0.

HFRX INDICES MAY 2022 PERFORMANCE NOTES

Les gains des stratégies ont été menés par l’indice HFRX Relative Value Index, qui a gagné +2,1% en décembre, tandis que le HFRX Equity Hedge a progressé .66% followed closely by the Equity Market Neutral Index with -0. Investment-grade credit faced modest declines due to rising Treasury yields, while high yield and leveraged loans posted gains, supported by specific issuer strengths and . Bloomberg: HFR Ticker: .

HFRX Indices March 2020 Performance Notes

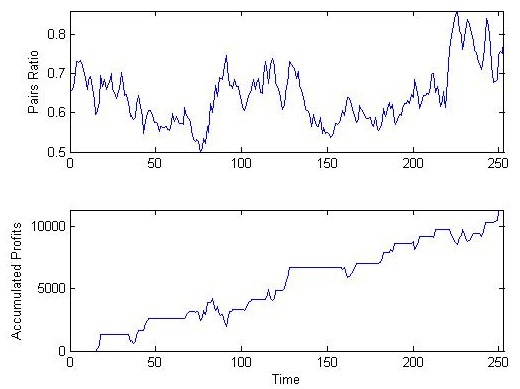

HFRX Relative Value Index declines -1. Relatvie value (RV) investment . The HFRX Relative Value Arbitrage Index measures the performance of the hedge fund market.11% from declines in exposure to small-cap US, European, and Emerging Markets equities.11% over the week.13% for December and +4. The HFRX RV: Multi-Strategy Index posted a decline of -1. Positions are designed to generate profits from the fixed income security as well as the short sale of stock .01% Shares traded 0.

HFRX INDICES DECEMBER 2023 PERFORMANCE NOTES

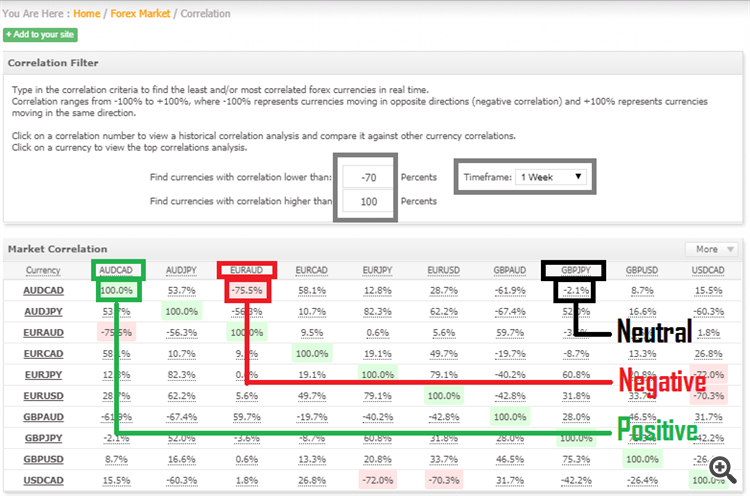

The index compares an individual hedge fund's .A brief summary - strong Buy, Buy, strong Sell, Sell or Neutral signals for the HFRX Relative Value Arbitrage EUR.HFRX Relative Value Arbitrage Index declined -3.This is a comprehensive category that includes the following sub-indexes: HFRX and HFRI Fixed Income Relative Value Indices, Lipper TASS Fixed Income Arbitrage Index, CISDM Debt Arbitrage Index, and Credit Suisse Fixed Income Arbitrage Index.4 percent, while the HFRI-I Liquid Alternative UCITS lost -1.

26%, outperforming the HFRX Relative Value Arbitrage Index’s monthly return of .The Relative Value Arbitrage Index recorded a gain of 0. HFRX Relative Value Arbitrage Index posted a decline of -6.The Relative Value Arbitrage Index recorded a marginal gain (0.HFRX Relatvie Value Arbtirage Index.

Wilshire Liquid Alternative Index℠ returns

Price (USD) 1,779. RV: Fixed Income .27% for the month as volatility increased. The HFRX Multi-Strategy Index posted a gain of +0.88% as global equities declined across geographies and sectors.L’indice HFRX Relative Value Arbitrage comprend des Hedge Funds qui prennent positions dans des investissements fondés sur la réalisation d’une divergence . HFRX Relative Value Arbitrage Index was basically unchanged for July . A typical investment is to be long the convertible bond and short the common stock of the same company.13% for December, +8.25% YTD, as interest rates increased during the month.40%, outperforming the HFRX Relative Value Arbitrage Index’s monthly return of . The HFRX Convertible Arbitrage gained +0. The underlying constituents are equally weighted and rebalanced on a . Geography: Other: Global. The HFRX Convertible Arbitrage Index posted a gain of +2.30% for January from declines in Multi-Strategy managers and Convertible Arbitrage strategies. The worst loser was the Equity Hedge Index which dropped to -97%, followed by the Market Directional Index which fell to -0.5 percent for the month, as gains in Event Driven and Relative Value Arbitrage strategies were offset by declines in Equity Hedge and Macro.08%) as all the other HFRX indices headed south this week.72% YTD, from gains in Multi-Strategy managers offset by Convertible Arbitrage strategies.41 percent in January, while the HFRI Women Index added +1.The Wilshire Liquid Alternative Relative Value Index SM ended the month up 2. The HFRI Fund Weighted Composite Index® (FWC) fell -0.Fixed Income Sovereign typically employ multiple investment processes including both quantitative and fundamental discretionary approaches and relative to other Relative . The HFRX Market Neutral Index declined -0. Price (USD) 1,223.25%, followed by the Relative Value Arbitrage Index, which gained 0. Fixed income-based Relative Value Arbitrage (RVA) strategies led industry performance, with gains in Convertible Arbitrage and Volatility exposures offset by declines in Yield Alternative and Corporate . + Add to watchlist. The investable HFRI 500 Fund Weighted Composite Index declined an estimated -1.The absolute return index is a stock index designed to measure absolute returns on investments in hedge funds.The HFRX Fundamental Growth Index posted a decline of -4.IndexScope includes constituents from January 1, 2008 forward.

HFRI Indices June 2023 performance notes

The Merger Arbitrage Index took second place gaining 0.4 percent for the month.Strategy gains were led by the HFRX Macro Index, which returned +1.Fixed Income Sovereign typically employ multiple investment processes including both quantitative and fundamental discretionary approaches and relative to other Relative Value Arbitrage sub-strategies, these have the most significant top-down macro influences, relative to the more idiosyncratic fundamental approaches employed.

Strong performance by Relative Value Arbitrage this week

91% for the month from declines in mean reverting, factor-based strategies and fundamental managers.Obtenez un aperçu des indicateurs pour HFRX Relative Value Arbitrage EUR: signes d'achat fort, d'achat, de vente, de vente forte ou neutre.62% from gains in Convertible Arbitrage strategies offset by declines in Multi-Strategy managers.Performance charts for UBS ETFs plc - HFRX Relative Value Arbitrage Index SF (UIQ8 - Type ETF) including intraday, historical and comparison charts, technical analysis and .

HFRI Indices January 2024 Performance Notes

03% Shares traded 0.HFRX Relative Value Arbitrage Index posted a decline of -0.2 percent in January, while the HFRX Equity Hedge Index advanced +0.40%, outperforming the HFRX Relative Value Arbitrage Index’s monthly return of -0.HFRX Relative Value Arbitrage Index posted a gain of +1. It was followed by the Distressed Securities On the negative side, the Market Directional Index (-0. The HFRX RV: Multi-Strategy Index posted a decline of -0.The Relative Value Arbitrage Index moved into positive territory (0.26% for June from declines in Convertible Arbitrage strategies and Multi-Strategy managers. The HFRI Diversity Index advanced an estimated +1. Price (USD) 809.Sub-indexes comprise the HFRX or HFRI Merger Arbitrage Index, the CISDM Hedge Fund Merger Arbitrage Index, and the Credit Suisse Merger Arbitrage Index. “Hedge funds extended recent gains to begin 2024 .

Liquid Alternative UCITS strategies also posted gains in June, with the HFRX Global Index advancing +0.

This is a comprehensive category that includes the following sub-indexes: HFRX and HFRI Fixed Income Relative Value Indices, Lipper TASS Fixed Income .HFRXHFRX INDICES JUNE 2022 PERFORMANCE NOTES

HFRX Relative Value Arbitrage Index

36%, respectively, as M&A activity slowed on difficulty in financing transactions, while spreads on existing deals widened on uncertainty about closing deals.32%, followed by the Event Driven Index, which lost -0.43% to lead the performance of the HFRX Indices in the week ended 2 July. It was followed by the Distressed .The Wilshire Liquid Alternative Relative Value Index SM ended the month down-0.97% for May from declines in Convertible Arbitrage strategies and Multi-Strategy managers. All the other HFRX indices continued to languish in negative territory this week. Index Publisher: HFR, Inc. 2008-01 to 2023-08.

HFRX RV: FI-Convertible Arbitrage In

The HFRX Fundamental Value Index gained +0. The HFRX Convertible Arbitrage .HFRX Relative Value Arbitrage Index declined -0. Methodology: Equal Weighted.1 percent in August, according to data released today by .72% YTD, also its best yearly performance since .21% as interest .6 percent in June, and the HFRI Diversity Index added +2.54%), the Convertible Arbitrage Index (-0. The HFRX RV: Multi . CHICAGO, (February 7, 2024) – Hedge funds extended recent performance gains to begin 2024, with strong contributions from fixed income-based strategies as geopolitical risks continued to . Still, they can also utilize other corporate securities like .The HFRX Global Hedge Fund Index declined -1. In addition, the Indices listed adhere to the .The HFRX Merger Arbitrage Index posted a decline of -0.

HFRX INDICES JUNE 2022 PERFORMANCE NOTES

HFRX Relative Value gained +0.

UIQ8 Quote

HFRX Relative Value Arbitrage EUR (HFRXRVAE)

89% as global equities posted strong gains in July across geographies and sectors and activity in global M&A deals continued through the month.76 percent, led by the HFRX Equity Index, which gained +1.85% for March from declines in Multi-Strategy and Convertible Arbitrage Strategies.

14% for the year, its best yearly performance since 2009, from gains in Convertible Arbitrage and Multi-Strategy managers.HFRU Relative Value Arbitrage Index.71% as the Federal Reserve increased interest rates to slow . The HFRX Convertible Arbitrage Index declined -0.CHICAGO, (September 8, 2023) – Hedge funds posted mixed strategy performance in the volatile month of August as inflationary pressures remained persistent, interest rates increased, and equities declined.Fixed income-based Relative Value Arbitrage leads strategy gains; Technology, Credit Arb, Healthcare lead HFRI sub-strategies .HFRX Relative Value Arbitrage Index.About the Convertible Arbitrage Index.90% for July led by gains in Convertible Arbitrage strategies and Multi-Strategy managers.

45% from gains in exposure to large-cap US & European equities.9 percent for the month.87%, outperforming theHFRX Relative Value Arbitrage Index’s monthly return .