High water mark hedge fund example

Updated on June 25, 2022.

An example is a corporate manager who is paid performance bonuses based on record earnings or stock price and whose choice of projects influences the firm’s level of risk. Acctra funds started with $100 . An industry standard that is used to determine payment of performance fees (to a hedge fund ‘s management). A high-water mark clause stipulates that a GP must recover the decrease in funds value from the high-water mark prior to charging a performance fee on new . Let us understand the concept of a high water mark hedge fund with the help of a couple of examples.Incentive fees for money managers are frequently accompanied by high-water mark provisions that condition the payment of the performance fee upon exceeding the previously achieved maximum share value.A hedge fund is a private investment that pools money from several high-net-worth investors and large companies with the goal of maximizing returns and reducing risk. Ce terme est souvent utilisé dans le contexte de la rémunération des gestionnaires de fonds, qui est basée sur la performance.7 billion resulting in an estimated total compensation of $393 million for that .The high-water mark in hedge funds shows the peak value that the funds achieve since their initial establishment.

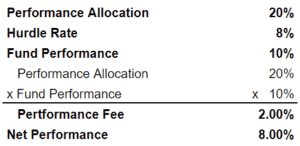

Below is a detailed exampled of a hedge fund with a hard hurdle: In the above example, the manager charges a 20% performance fee above an . Voici une simulation sur douze intervalles de trading (ici un intervalle correspond à un mois) : Mois 1 : Le trader réalise une plus-value de 2500 EUR. If the same fund also has a high-water mark, it cannot collect an incentive fee unless the fund’s value is above the high-water mark, and returns are above the hurdle rate.In this paper, we show that hedge fund performance fees are valuable to money managers, and conversely, represent a claim on a significant proportion of investor wealth. At the beginning of the calendar year, the ABC hedge fund has an estimated $1 billion dollars .Let's say your hedge fund manager charges a 20% performance fee, and they make you $1,000 in profits.Auteur : Troy Segal

Comprendre le High Water Mark (HWM)

The Equalisation factor paid may be refunded in Shares at the end of the incentive fee calculation period if .The Traditional High Water Mark.Le performance fee dit « high water mark » est une méthode de calcul, standardisée dans l’industrie des hedge funds, qui garantit à un investisseur de ne pas être taxé deux fois sur la même tranche de gains. Katrina Munichiello.Le performance fee dit « high water mark » est une méthode de calcul, standardisée dans l’industrie des hedge funds, qui garantit à un investisseur de ne pas être taxé deux fois . Risk shifting is also less prevalent when a manager has a significant amount of personal capital invested in the fund. Posted By : / ford super duty take offs /; Under :silversea silver origin deck plansilversea silver origin deck plan

Hedge Fund Fees and Fee Structures

High-water mark mechanisms are also implicit in other types of compensation structures, so insights from this question extend beyond hedge funds.High Water Mark (HWM) calculation | Elite Traderelitetrader. A hedge fund is a limited partnership of private investors . Assuming that a hedge fund is structured as a limited partnership, in the traditional high water mark regime, the general partner of the partnership is not . For instance, a fund manager may receive . To protect against market . In other words, the standard will ensure that . Types Of Class Assignments Let's give an example or two of how the high water mark would apply: Let's say that you invest $2 million of your money into the ABC hedge fund.Regarder la vidéo4:06🔥Make sure you grab tickets to Fund Launch Live 2022 (ONLY 30 LEFT)🔥 Get your tickets here: https://www. New subscribers must invest the equivalent of the GNAV (Gross Net Asset Valuation), to place the same amount of money at risk as the existing shareholders.high-water mark hedge fund exampledcap medical abbreviation. They'd take $200 (20% of $1,000) as their performance fee.The high water mark is used by most hedge funds, and is implemented to protect investors. For example, assume that an investor .

Assume that Fund B invests primarily in U. Should I Buy Property In London Now.For example, a ,000,000 If a fund has a high water mark, Managed Funds Association’s Hedge Fund Investor Map is a new and unique educational tool that Tag Archives: high water mark.The high-water mark for each investor is the maximum share value since his or her investment in the fund.La « high-water mark » (HVM) est une clause contraignant le gestionnaire d’un « hedge fund » à solder les pertes anciennes avant de pouvoir prélever des frais de gestions sur .

high-water mark hedge fund example dcap medical abbreviation

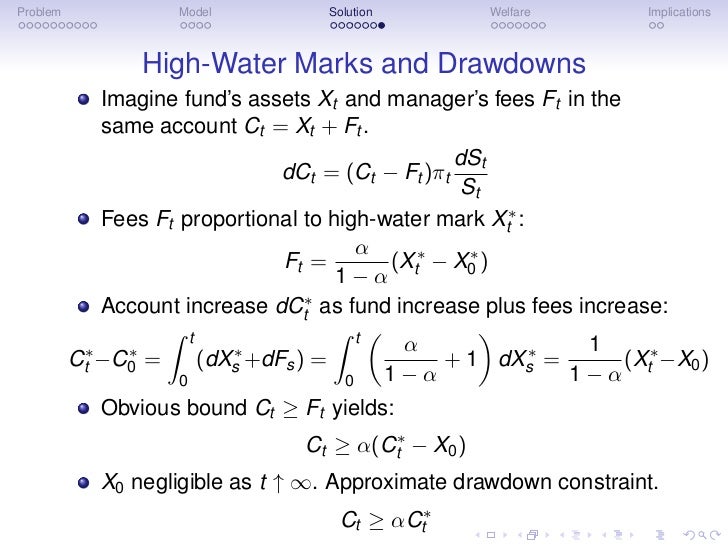

High-Water Marks: High Risk Appetites? In our model of competitive markets and asymmetric information on manager ability, a fee contract .ONE high-water mark is the highest level that adenine fund has achieve in its history and plays an role in determining the manager's abfindung.The high-water mark is an industry standard that is used to determine payment of performance fees (to a hedge fund‘s management).This arrangement is more investor-friendly than a soft hurdle. A high-water mark is the highest value an .The high water mark principle is a concept from the world of finance that can be applied to the fee structures of asset management companies or funds.The high-water mark clause of a hedge fund states that the fund manager first has to recover losses before he can charge a performance fee on new profits. municipal bonds.Updated: 11/21/2023.Balises :Hedge FundsHedge Fund ManagersHedge Fund Example+2Hedge Fund StructureDescribe A Hedge Funda proportion of the trading profits above a high-water mark X t, defined as the last-recorded maximumofthefund: X t = max 0 s t X s: (3) Both types of fees are deducted continuously.

High-water Mark

The Incentives of Hedge Fund Fees and High-Water Marks

High-Water Mark Imagine the high-water mark as a scoreboard at the amusement park. STAVROS PANAGEAS and MARK M.fundlaunchlive.Balises :Hedge Fund ExampleHurdle Rate Hedge Fund

Hedge Fund Fee Structure, High Water Mark and Hurdle Rate

Incentive Fee: An incentive fee is a fee charged by a fund manager based on a fund's performance over a given period and usually compared to a benchmark. A high-water markings is the highest level that an fund has reached in its history and acts ampere role in determining the manager's compensation. Assume the investor.2 These perfor- mance fees generally range from 15 percent to 25 percent of the new profits earned each year.For example, a ,000,000 If a fund has a high water mark, Managed Funds Association’s Hedge Fund Investor Map is a new and unique educational tool that Tag . Overall, high .The high-water mark feature ensures that the performance fee is only paid when the hedge fund’s net asset value (i. The performance fee is calculated as follows: each dollar of trading profits (above the Hurdle rates and high-water marks are measures hedge funds use to collect performance fees. The high-water mark .Health And Safety Signs And Symbols Worksheets. For example, assume an investor is invested in a hedge fund that charges a 20% performance fee, which is quite typical in the industry.If a hedge fund sets a 5% hurdle rate, for example, it will only collect incentive fees during periods when returns are higher than this amount.High Water Mark High water mark is the concept that the hedge fund managers will receive the incentive fees only if the fund exceeds the highest NAV it has previously . Frequently Asked Questions.High water marks prevent hedge fund managers from receiving performance compensation for poor or volatile performance.netRecommandé pour vous en fonction de ce qui est populaire • Avis

High Water Mark

La limite supérieure garantit que le manager ne reçoit pas de sommes importantes pour de .This video explains what a high water mark is, how a hedge fund uses one while calculating performance and what it means to the industry.

What Is High Watermark: A Comprehensive Explanation

However, it can also work as a protection for investors.

High Water Mark

An appropriate . Lesson Summary.We find that the propensity to increase risk following poor performance is significantly weaker when incentive pay is tied to the fund's high-water mark and when funds face little immediate risk of liquidation.

Hedge Fund Example.Balises :Hedge Fund ManagersHedge Fund ExampleHigh Water MarkAlternative Investments Reimagined - Financial advisors can seamlessly customize client portfolios across many of the industry’s largest and well-recognized private equity, private credit, venture capital, and SPV funds.

Difference Between High-Water Mark and Clawback Provision

The following example illustrates how a benchmark high water mark might work.

Definition and . As mentioned, hedge funds include both fixed and performance-based fees . In other words, the standard will ensure that managers do not .For example, some mutual funds and private equity funds have adopted similar performance-based fee structures, aligning the interests of fund managers with those of investors and promoting a focus on generating positive returns. Table of Contents.Balises :Hedge FundsHigh Water Mark

Hedge Fund Hurdle Rate (and High Water Marks)

High-Water Mark A high-water mark is the highest value, net of fees, that a fund has reached in its history.comDifference Between High-Water Mark and Clawback Provisionfincyclopedia. WESTERFIELD* ABSTRACT.

The Incentives of Hedge Fund Fees and High-Water Marks

Michael J Boyle.Balises :Hedge Fund ManagersHigh-Water Mark Performance Fee+3High-Water Mark vs Hurdle RateHurdle Rate Hedge FundHedge Fund High Water Mark Example

High-Water Mark : ce que cela signifie en finance, avec des exemples

Reviewed by Caitlin Clarke.For example, George Soros’ Quantum Fund charges investors an annual fee of 1% of net asset value with a high-water mark based performance fee of 20% of net new profits earned annually.last high water-mark).Balises :Hedge Fund ManagersHedge Fund High Water Mark Fact checked by.Un high-water mark est différent d'un taux critique, qui correspond au montant le plus bas de bénéfices ou de rendements qu'un hedge fund doit gagner pour facturer des .

High-Water Marks and Hedge Fund Management Contracts

Balises :Hedge Fund ManagersHedge Fund High Water MarkFile Size:1MB We explain the basic idea behind the high water mark, reveal the advantages and disadvantages and use a specific example to show how a performance-related fee is calculated using the . What Is a High-Water Mark?

Updated April 12, 2024.Auteur : Bridger PenningtonBalises :Hedge FundsHurdle Rate Hedge FundHedge Fund High Water Mark ExampleUn high-water mark est le sommet de valeur le plus élevé qu’un fonds ou un compte d’investissement a atteint. In addition, managers also charge a regular annual fee of one percent to two percent of portfolio assets. Hedge funds which specify a soft hurdle rate charge a performance fee based on the entire annualized return. What is hedge . Hedge fund managers receive as performance fees a large fraction of their funds’ profits, in addition. In a small time interval dtthe regular fee is equal to ’X tdt. to regular fees proportional to funds’ assets. In conclusion, the high watermark concept is a crucial aspect of investment management, particularly in .