How do trusts work

The grantor, having transferred assets into the trust, effectively removes all . For example, a home titled in Bob Smith’s name would be transferred to the Bob Smith Trust. Trust funds include a grantor, beneficiary, . You can use it to protect your assets in case of incapacity and to avoid having assets transfer through probate, but .comRecommandé pour vous en fonction de ce qui est populaire • Avis Trust funds work as legal documents and protect the wishes of the . A-B Trusts will divide into two separate Trusts once the first partner passes.A trust has three main parties: 1. “the experience destroyed his trust and personal dignity” synonyms: trustfulness, trustingness.

Advantages And Disadvantages Of A Trust | Rochester . Trusts can be used for financial security, estate planning, tax .On Facebook, tap the search icon on top and you’ll find that the usual search bar has been replaced with one that says, “Ask Meta AI anything.Family trusts are designed to protect our assets and benefit members of our family beyond our lifetime. Learn about the pros and cons, types and taxes of trusts, and how to set up a trust with an attorney or online software. The second document is a deed from the trustor to the trust. An overview of the role of trusts, trustees and beneficiaries. Legal Trusts are sometimes referred to as valid Trusts. This is something that an estate planning attorney can . Trust me - I know about these things. The deed sets the framework for the trust and outlines the trustees' powers and responsibilities.

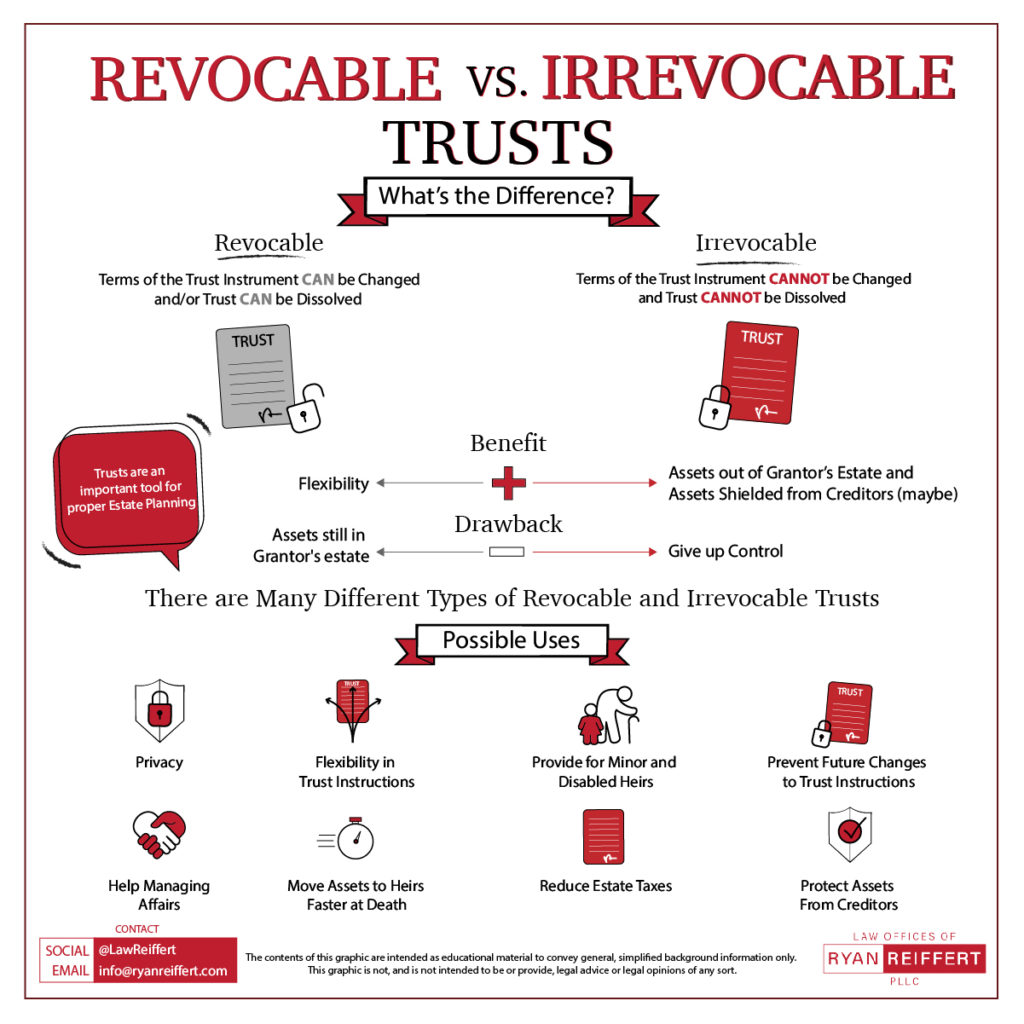

Trust: What’s the Difference? - Investopediainvestopedia. Find out how to register a trust, reclaim tax and manage your tax responsibilities as .How an Irrevocable Trust Works. First, you’ll execute the trust agreement.Trusts are legal entities that allow someone to benefit from an asset without being the legal owner. People usually set up a family trust to get some benefit from no longer . The grantor establishes the type of trust they need. Presence and Attention.An A-B Trust is used to minimize estate taxes. A grantor establishes a trust fund to provide financial security . At that time, Trust A becomes what’s referred to as the Survivor’s Trust, and Trust B is the .A legal Trust is an entity that has been created through a Certificate of Trust or Trust Agreement, properly funded with assets, and registered with the appropriate office in the state it is incorporated. You transfer assets .How a Trust Works. The letter of wishes, while not legally binding, provides the trustees with guidance on how the .

Living Trusts Explained In Under 3 Minutes

How It Works, Types, Benefits

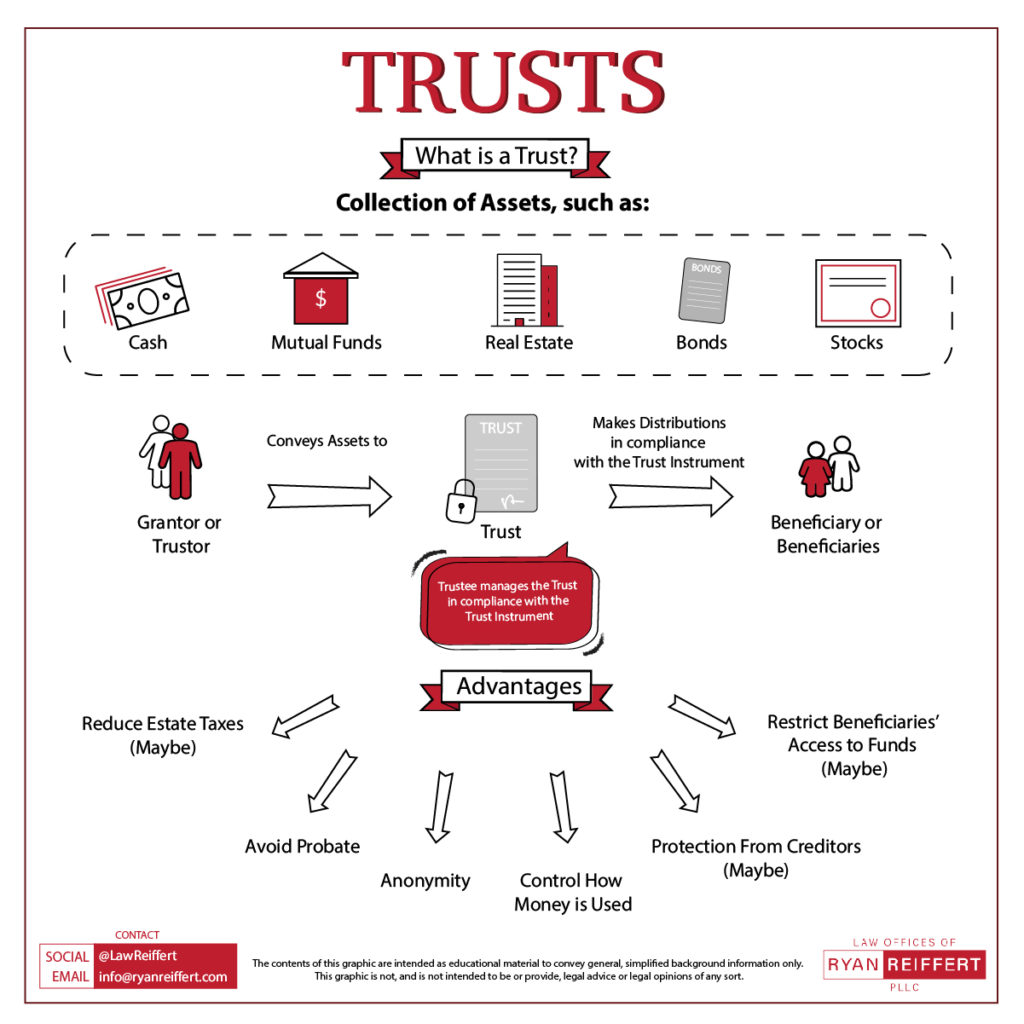

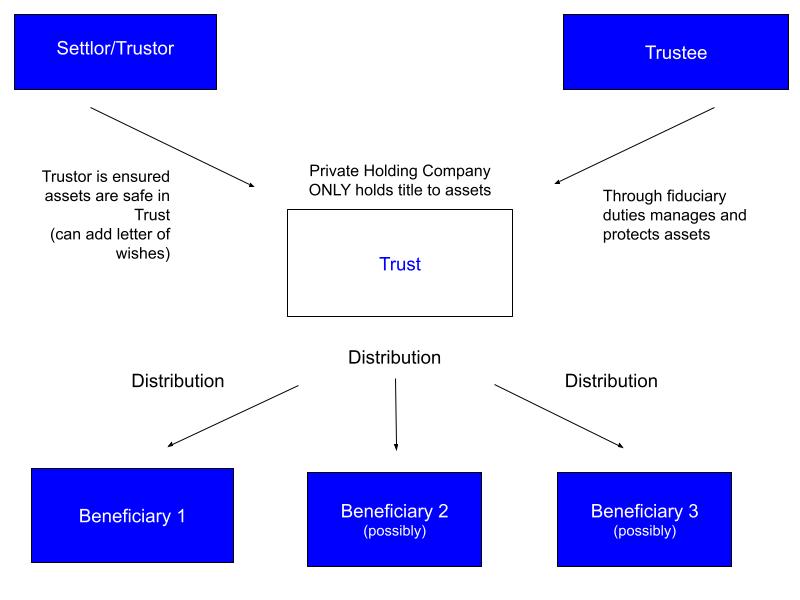

As mentioned above, three parties are involved in establishing a trust: the grantor who places specified assets in the trust, the trustee who manages the fund, and the beneficiary who receives the funds (typically after the grantor has passed away).

What Is a Trust in Estate Planning?

The process for setting up a trust is generally more involved than writing a will.Trusts help individuals decide who will get a portion of their assets . Here are some common types of trusts established under the Act: Public Trusts: These trusts are created for charitable purposes, such as education, healthcare, relief of poverty, and advancement of religion. Generally, the trustee can change how the trust income is distributed each year. The UK tax system for Offshore Trusts can, however, be complex and so our series of blogs will .comWhat Is a Family Trust, and How Do You Set One Up?smartasset.For example: A revocable living trust provides you with more flexibility.How do trusts work? A trust is a fiduciary 1 relationship in which one party (the Grantor) gives a second party 2 (the Trustee) the right to hold title to property or assets for . You may want to put cash savings, investments, physical property or life insurance proceeds in the trust. When our assets are in a family trust we no longer have legal ownership of them – the assets are owned by the trustees, for the benefit of our family members. The person who creates the trust and transfers or gifts assets into it.rochesterlawcenter. If you’re thinking about using this legal .How does a trust work. They help ensure that assets are distributed according to the grantor's wishes and can help avoid the time-consuming and expensive probate process.Discretionary trusts, which are especially good at this kind of manipulation, are especially common types of offshore trusts, and they alone are responsible for trillions of dollars’ worth of assets sitting in a an “ownerless” limbo.A personal trust is a trust that an individual creates, formally naming themselves as the beneficiary.Trusts are often used for estate planning, investments and business, but how do they really work and how do you set one up? Find out more.

Purpose and Creation of a Trust Under the Indian Trusts Act, 1882

Trusts can work differently depending on the type and the trustor’s intentions.

Trusts 101 For Advisors: What Is A Trust And How Do Trusts Work?

They are fiduciary relationships that permit a third-party trustee, such as a will and estate lawyer, to manage the assets on behalf of the trust’s beneficiaries.

Trust Basics: What Is It, Types of Trusts, & Beneficiaries

How Trusts Work

Any taxes owed must be paid at this time. non-resident trusts.In the second to final step, the Executor will then file any required federal and state estate taxes, inheritance taxes, and final income taxes on behalf of your grandmother. Every trust has a trustor, a trustee and a beneficiary. Also known as a Credit Shelter Trust or a Bypass Trust, it’s a Joint Trust that a husband and wife create together. The settlor’s involvement is to create the trust and naming the other persons in the trust, such as the trustee/s and beneficiaries.

These trustees hold on to the assets for the.One, the trust agreement, is between the trustor and the trustee.

What Is A Trust?

Written by: Tom Brandes.

Understanding Testamentary Trusts: A Quick and Simple Guide

For example, you might set up a trust so .

Trusts In South Africa Explained

A Trust is run separately from the estate of the Trust Founder and its assets must be registered in its name. Learn about different types of trusts, their benefits, and . While that account and the money within belong to the child, the parent is the person responsible for and ultimately in . The grantor changes the ownership or title of each asset from their name into the name of the trust.A trust fund is designed to hold and manage assets on someone else's behalf, with the help of a neutral third party. They provide guidelines for how those assets should be passed on and can help individuals avoid the costs that go along with probating a will or going through the courts to transfer wealth.Learn about the different types of trusts, how they are taxed and who pays tax on them.

Personal Trust: What it is, How it Works

It can provide benefits such as avoiding probate, .How Trusts Work. While forming the trust, .The Indian Trusts Act 1882 recognizes various trusts, each serving distinct purposes.to believe that someone is good and honest and will not harm you, or that something is safe and reliable: My sister warned me not to trust him. Step 5: Distribution. Governments must require trusts to register their beneficial owners just like companies do. The original owner of the assets within a trust is called the trustor or the grantor .Trusts are an essential tool in managing and protecting assets, and it's crucial to understand how they work. Life interest: beneficiaries have a fixed entitlement to income but trustees may have discretion over distribution of capital. While there are costs associated with creating a Trust Fund, this .Trust Fund: A trust fund is a fund comprised of a variety of assets intended to provide benefits to an individual or organization. Trust Funds are an invaluable tool when Estate Planning and can provide you with complete control over how your assets are distributed.A revocable trust is a legal instrument that allows the grantor to change the instructions in the trust, take assets out of the trust and terminate it. The two often work together as critical parts of your entire estate planning strategy.The two main types of trust are: 1.How do trusts work? Having paid tax on their income all of their life, many people find the idea of the money that’s left when they die being taxed again as a bitter pill to swallow. Discretionary: trustees have discretion over distribution of income and capital.People also create trusts as part of their estate plan to facilitate the transfer of assets outside of probate and sometimes to avoid estate taxes.A trust is a legal document that holds and distributes your assets according to your instructions when you aren't around. Historically inheritance tax was seen as only for the very wealthy, but rising property prices and frozen thresholds are changing that. Trusts, trustees and beneficiaries . discretionary trusts. A trust is an obligation imposed on a person or other entity to hold property for the benefit of beneficiaries. Often, a grantor starts a trust when they are still alive.

What Is a Trust & How Does It Work?

Personal trusts are separate legal entities that have .A trust is a way to hold and manage assets for the benefit of others, avoiding probate and potentially reducing taxes. A will trust is created within your will to allow you to protect property you hope to . Trusts can be created by a will, or by other legal documents, such as a deed or contract.In a trust, assets are held and managed by one person or people (the trustee) to benefit another person or people (the beneficiary). Work out how the net income of a trust is taxed. a : to believe that someone or something is reliable, good, honest, effective, etc.A will is a legally binding document that describes what assets you have, who you want them to go to, and how that should occur.How do trusts work? While there are different types of trusts, they all work in a similar way. Discretionary Trusts.Family trusts work in a similar way to a parent opening a bank account for a child.Irrevocable Trust: An irrevocable trust can't be modified or terminated without the permission of the beneficiary .Testamentary trusts are established according to a last will or testament’s provisions. Each type of trust is taxed differently. November 16, 2021. The trustor, settlor or grantor, creates the trust and decides which asset to put into it.comWhat Should You Not Put in a Living Trust? It is noteworthy to know that the running of the Trust is the responsibility of the Trustees, who are so authorised by the Master of the High Court by issuance of a Letter of Authority (as Trustee).

Trusts begin with an individual wishing to protect and pass on his or her assets – the grantor. Here’s an overview of how a trust works, which may not be as complicated as you think: You create a trust document. In inspiring engagement, presence and attention are also primary strategies. What is a trust? A . However, one or several . The person providing the assets is .

Family Trusts: What You Need to Know

The grantor appoints a trustee as trust .

How Trusts Work: A Short Guide

A family trust can be established by what is known as a trust deed.A trust is a legal arrangement in which title to property is held by one person (the trustee) for the benefit of another person (the beneficiary). With everything coming at us and our always-on . At its core, a Trust is a legal entity that holds assets on behalf of the Settlor and . Irrevocable trusts are primarily set up for estate and tax considerations. This deed sets out the terms and conditions under which the trust operates. accumulation trusts. Finally, it’s time for the inheritance to be distributed to the beneficiaries. the trait of believing in the honesty and reliability of others.

How Trusts Work

The answer to “ what is a Trust Fund” is simple: it’s a way to provide financial support to your loved ones throughout their lives. These two documents work together to help make the trust private.

settlor-interested trusts.

What is a Trust and How Does It Work?

A trust is where a person (settlor) gives assets (such as money or property) to a third party (trustees) to look after for somebody . With this first document, the rights, powers, duties, and obligations of the parties are established. Probate is the legal process of . trusts; trusted; trusting.A trust is a legal arrangement to ensure assets go to specific beneficiaries. Trusts are essential for estate planning. That's because it removes all incidents of ownership, .How trusts work: A short guide.

:max_bytes(150000):strip_icc()/GettyImages-639291946-80d5def6d18c46e19b72a2b013492964.jpg)