How does an llc pay taxes

Here we’ll cover the different ways you can be taxed with an LLC and what the . This publication provides federal income, employment, and excise tax information for limited liability companies.

What Are the Tax Benefits of an LLC?

LLC Taxation: How Taxes Work for LLCs

Indiana LLC Taxes

File Form 941 quarterly if the withholding is less than $1,000. Find out how to pay taxes on your LLC . Taxation is one of the most significant differences between an LLC and other forms of corporations.3% in addition to federal (and possibly state) income taxes.3% in self-employment taxes—including Social Security and Medicare—through the members’ .

It’s important to understand which types of taxes your business will be responsible for and when they .

How Does a Limited Liability Company (LLC) Pay Taxes?

How LLCs Pay Taxes: Filing for Your Small Business in 2024

The IRS treats your LLC like a sole .LLC Taxes at a Glance.

(2024 Guide) Must Read

The IRS treats your LLC like a sole . Instead, each .

LLC tax benefits and ways to reduce taxes

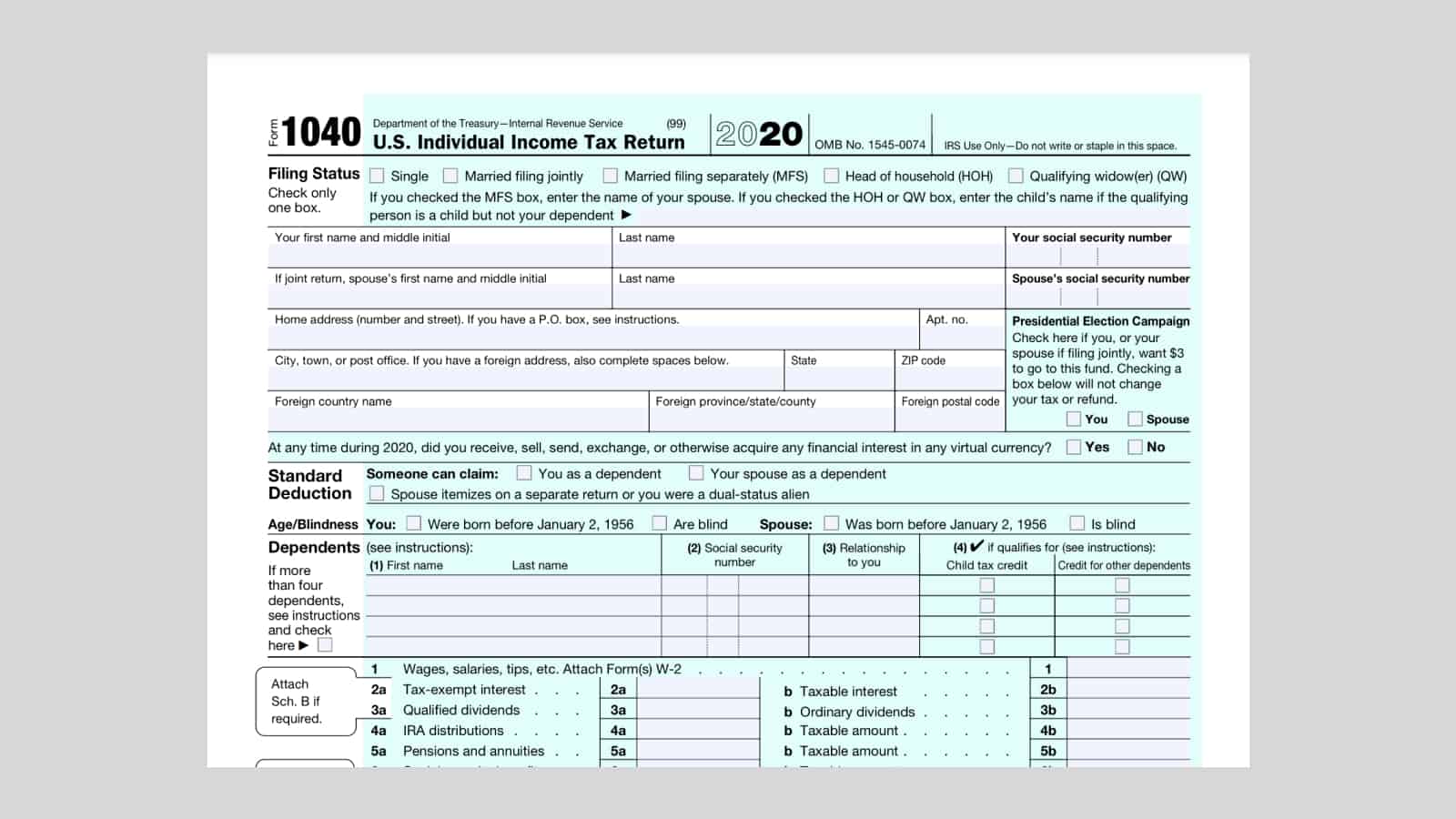

Complete Schedule SE and attach to Form 1040. The first is the Annual Report with the state, and the other is taxes.

Single Member LLC Quarterly Taxes: What You Need to Know

This publication doesn't address state law governing the formation, operation, or termination of limited liability companies.

LLC Taxes

7 Steps to Start an LLC for Your Small Business

Tax Conclusion: There are several different types of taxes that an LLC operating in Texas may need to pay including franchise tax, sales tax, and employer-related taxes such as Social Security/Medicare taxes, FUTA, and SUTA.

Taxes for LLCs in Texas: Everything You Need to Know

$150,000 ($300,000 * 50%) Each member's taxable income is not necessarily the same as his or her draw.

LLC Taxation: How Taxes Work for LLCs

Instead, the profits and losses are the responsibility of each member; they will pay taxes on their share of the profits and losses by filling out Schedule E (Form 1040) and attaching it to their personal tax return.

If you sell products to consumers in Indiana, you may .As the employee you would also pay 7.LLC owners pay twice as much self-employment tax as regular employees, since regular employees’ contributions to the self-employment tax are matched by their employers. South Carolina Sales Tax . And the K-1 income “flows through” to the owners.

LLC Tax Rates and Rules

Estimating and Paying Income Taxes . Single-Member LLC Taxes.For tax purposes, single-member LLCs that do not elect to be taxed as a corporation are considered “disregarded entities” by the IRS, and the owner pays self . Find out how to report and pay income tax for .Each member pays their distributive share of taxes based on each owner's share of the net profit. Tax Limits of an LLC. Before thinking about the taxes that your LLC could owe, you will want to first think about whether or not you need . The LLC needs to file a 1065 Partnership Return and issue a Schedule K-1 to the LLC owners.Foreign landlord fails to pay taxes, CRA goes after tenant. You will need to pay quarterly taxes as well as annual taxes, and it is important that you know when the quarterly taxes are due to prevent additional tax implications, as even underpaying can lead to tax penalties. What this means is that the LLC itself does not pay taxes on its business income. C-Corporation: The LLC is subject to federal corporate income tax rates, which is currently 21%. These fees aren't related to the LLC's income [sources: Beesley, Laurence].

Limited Liability Company (LLC)

4% of taxable income for Social Security and 2.By default, they're taxed like sole proprietorships. If you sell products to consumers in South . We recommend hiring an accountant to prepare and file your local income taxes.A final point to keep in mind is that some states charge LLCs an annual tax on earned income that's in addition to the income tax you pay on your personal return.

LLC Taxes: How Do Limited Liability Companies Pay Taxes?

This form, which is identical to that of a partnership, is a reporting document that the IRS examines to ensure that LLC members are correctly documenting their partnership income.

Instead, the business income and expenses from the company pass through the LLC to the business . These factors will help determine the optimal selling price for your property.

Massachusetts LLC Taxes

Every LLC has to have a . Draws don't usually affect members' tax liability . The only break he was given was a reduction in the number of years he owed for, from six to three.In this LLC Taxes article, we break down how an LLC is taxed, guide you through the potential deductions you’ll be able to make, and break down how you can go .The IRS also levies a fine if you don't file or ask for an extension by April 15. You can also contact your municipality to check on their requirements. LLC tax rates are determined based on the type of LLC you have and your personal .By default, the Internal Revenue Code taxes a single-member LLC as a sole proprietorship.The LLC needs to file a 1065 Partnership Return and issue a Schedule K-1 to the LLC owners. The purpose of Form 1065 is to ensure that LLCs are reporting income .3% self-employment tax. $90,000 ($300,000 * 30%) 3. Otherwise, file Form 943 at the end of the year.A limited liability company (LLC) is a pass-through entity, meaning it doesn't pay income taxes directly to the IRS. On Schedule C, you’ll report the . The failure-to-file penalty is 5% of unpaid taxes for each month or part of the month that .65% (up to a certain income level). As the LLC's only owner, you must disclose all LLC income (or deductions) on Schedule C.Updated July 2, 2020: How to File Quarterly Taxes for LLC.Step 1: Market Evaluation.

4 LLC Tax Benefits.For example, if you and a friend create an LLC to run a business that taxed as a partnership, earns $100,000 and has $60,000 of deductible business expenses, .

LLC State Taxes: Everything You Need to Know

Depending on the structure of the LLC and the number of members it has, certain tax rules may apply that you need to follow when filing a return. How Single-Member LLCs Are Taxed.LLCs listed as sole proprietors or partnerships must pay a rate of 15. Paying taxes is an important part of running a business, but figuring out which taxes you need to pay can be a pain. Like the sole proprietorship, LLC partnership taxes pass through the entity to the .Although a co-owned LLC does not pay its own income taxes, it is required to submit Form 1065 with the IRS. The income taxes are then paid by each owner on their personal income tax return (Form 1040).Keep reading to learn more about how to find your LLC tax rate.13 per cent of Canadians – 40,000 individuals – are expected to pay more taxes on their capital gains in any given year, according to a budget. By default, the IRS taxes a multi-member LLC as a partnership.How are LLCs taxed? LLCs are considered “pass-through entities,” which means the LLC itself does not pay federal income taxes on business income. Co-owned LLCs must submit Form 1065.

How LLC Taxes Work

State laws also vary, so if you plan to start a new .9% for Medicare) because they are not considered company . In addition, wages .How does a 2 member LLC file taxes? Multi-member LLCs are taxed as partnerships and do not file or pay taxes as the LLC.Here’s a breakdown of the tax rates for various LLC classifications: Sole Proprietorship and Partnership: LLC owners pay taxes on their share of the business’s profits according to their individual income tax rates. It’s important to keep in mind that organizing as . To submit and pay taxes as a single-member LLC, you’ll file Schedule C with your personal income tax return.9% of everything over $84,900.LLC owners must pay self-employment taxes (12.

New York LLC Taxes

While LLCs offer members (owners) a large degree of the same protection that corporations enjoy, they sometimes utilize a different system for tax payment.If the LLC filing its federal income tax return as a sole proprietor has other employees, the LLC itself must register and pay tax on the wages paid to the other employees, unless the wages are exempt for another reason. Pick a registered agent.Pay the self-employment tax if the net gain from the company exceeded $400 or more in the tax year. Does an LLC have double taxation? LLCs avoid double taxation because they are a pass-through entity—there is no tax on profits at the LLC level, only at the individual member level.The table below breaks down four common to pay taxes for an LLC: LLC Taxation Options.This means that the profits and losses of the business pass directly to the members, who then report and pay tax on their individual income tax returns. You may see it formally referred to on tax forms as a “disregarded entity.

A Beginner’s Guide to Understanding How LLC Taxes Work

Speaking of taxes, let’s say that you’re the sole .How Limited Liability Companies Are Taxed.For LLC tax purposes, the IRS considers one-member LLCs sole proprietorships, which implies the LLC itself does not pay taxes and is not required to file an income tax return with the IRS.Learn how an LLC is taxed as a disregarded entity, a partnership, or a corporation depending on the number of members and the IRS election. If you have an LLC, you need to know how to file quarterly taxes for the LLC.3% of the first $84,900 of income and 2.Any profits or losses pass through to you as the owner.

Frequently Asked Questions (FAQs) Many entrepreneurs opt to structure their . On their personal income tax return, using the Schedule E Form, members pay taxes on their percent of the LLC's net profit.

How Is an LLC Taxed?

Pass-through taxation is one reason people choose to form LLCs.If an LLC has two or more owners, the LLC is taxed like a Partnership.You’ll need to pay Florida LLC taxes if you own and operate a Limited Liability Company in the state of Florida. Wages are exempt if paid to an individual employed by his or her son, daughter, or spouse, including step relationships. In virtually all cases, LLC are treated .Knowing the various tax return policies and regulations is key to understanding how to pay federal income taxes for an LLC properly.” This label means the LLC does not pay taxes separately from its owner. Report employment taxes if your LLC pays employees. After forming your LLC, you’ll need to take additional steps in order to maintain your business. You’ll need to research the . Typically, LLCs are treated as pass-through entities. The initial step in selling your LLC-owned property is to conduct a comprehensive market analysis.Northwest will form your LLC for $39 (60% discount).You and/or your LLC may need to file and pay income taxes with your local municipality (town, city, county, etc. Pass-through taxation is when a business entity (like a Limited Liability Company) doesn’t pay taxes on business profits directly to the IRS. Instead, an LLC's sole owner or .