How does credit card work

How Credit Cards Work?

How does a credit card EMI work? Credit cards can prove to be a great financial tool in case of emergencies but can make you careless as well.inWhat Is a Credit Card? And Should You Own One? - CNBCcnbc.A credit card lets you borrow money from a bank to make purchases.A credit card is a form of revolving credit — meaning you borrow with it when you want, up to your credit limit, and pay when your bill is due. After flirting with the cashier for a few minutes, you decide to pay for your purchase and hand your card over to make payment. A credit score is a rating that allows lenders, including card issuers, to determine your creditworthiness — or the risk they take on by approving you for a loan or credit card .How Does Credit Card Interest Work? The charges you make to your credit card are a loan, and just like a car loan or a home loan, you can expect to pay interest on your outstanding credit card balance. Rewards credit cards, for example, offer financial incentives like points, miles, or cash back bonuses. As opposed to cash-back cards, travel credit cards earn rewards as issuer points or miles that are racked up as you make purchases with your card.With credit card EMIs, the amount you owe your card issuer is converted into an EMI the same way a personal loan is.

How Credit Card Balance Transfers Work

How does a credit card work? A credit card is an unsecured revolving line of credit: it's unsecured because no asset is required for you to be approved for your .Empower Finance, best known as a cash-advance app, is buying credit card issuer Petal. Step #2 – The Validation.Learn how credit cards let you borrow money, build credit, earn rewards and more. Credit cards can be used to make purchases and boost your financial health. You should pay at least the minimum amount due each month on your credit card bill.Watch this video on setting up credit cards in YNAB.Learn the basics of credit cards, how to choose the best first card, and how to avoid fees and interest.Since a prepaid card doesn't allow you to carry a credit balance and pay later, it's not a credit card. April 19, 2023, at 4:40 p.

How Do Credit Cards Work?

The official term for a credit card is ‘revolving line of credit’.It is loaded with a balance ahead of time, and this balance acts as your spending limit.In a nutshell, a credit card lets you pay for things.

How do credit cards work?

Let’s say you have a -$2,400 balance on a Visa card.When you use a credit card, you’re effectively borrowing money to make a purchase or transaction.

How Is Credit Card Interest Calculated?

You’re then required to pay the money . It's connected to a revolving line of credit account with a bank. It comes with a set credit limit.

How do credit cards work?

How should I use a credit card?Here's how to use a credit card to your benefit:Only charge what you can affordStay well below your credit card limitAlways pay your card's full st.By Beverly Harzog.How Do Credit Cards Work? Credit cards offer a line of credit that you can use for a variety of purposes, including making purchases, completing balance transfers, .A credit card allows you the flexibility and convenience to make purchases today and pay off the amount due at a future date. It’s determined by the credit card issuer.When you download the Curve app, select the Curve card that's right for you and fill your digital Curve Wallet with cards. It works by giving you access to a pre-approved amount of money that you can spend, provided your account is in good standing, up to a predetermined limit. A credit card is a type of revolving credit account that involves borrowing money—generally up to a predetermined credit limit—and paying it back .A credit card gives you a line of credit you can use to make purchases up to the limit approved by your credit card company.

Credit Cards 101: How Do Credit Cards Work?

Credit cards offer a revolving line of credit that you can use to finance new purchases, shop securely or earn rewards. If you need longer, you’ll be charged interest — a percentage of the money you owe .

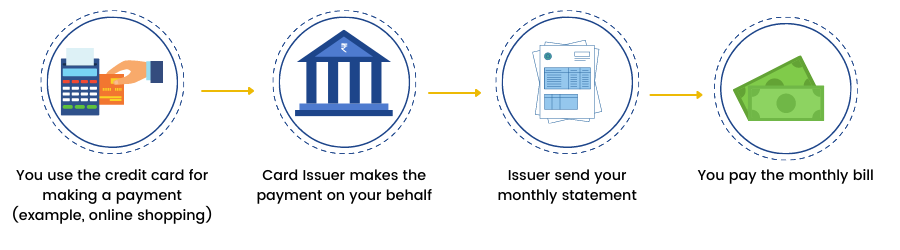

Credit cards have a pre-approved limit given to you as an advance, which . Some credit cards offer rewards for eligible purchases, such as cash back or Miles. Debit cards, credit cards and crypto cards are accepted. The issuer then sends you a monthly bill for the purchases you’ve made with your card.The minimum sum is a percentage of the outstanding balance you’re supposed to pay on your credit card. It's the interest rate you pay on charges t. Because a credit card balance is revolving .What is a credit card? - Credit card meaning and informationbajajfinserv.comRecommandé pour vous en fonction de ce qui est populaire • Avis That being said, nearly all credit cards offer an interest-free grace period. Here are some terms that will help you really understand how credit cards work: Credit limit: The amount of money you can spend on your card at one time, or the size of your ongoing loan.Understanding Credit Cards: A Beginner’s Guide (April 2024)cardrates. A credit card is a useful tool to help manage your cash flow and provide flexibility to pay for major purchases. Yet rather than taking money from your account each time you spend, the credit card company pays and .

How Does Credit Card Interest Work?

What is a credit card? A credit card can be a simple and flexible way of borrowing . Travel cards can be used like any other card, but they also offer valuable earnings rates (e. Essentially, a credit card issued by any financial institution allows you to make payments at Point-of-Sale (PoS) terminals or shop online. Put simply, a credit card is a type of loan.comRecommandé pour vous en fonction de ce qui est populaire • Avis

How Credit Cards Work: A Beginner's Guide

Improve your knowledge with this in-depth guide from our experts. Learn how credit cards work, how . Find out how to apply, pay, avoid interest and compare different types of credit .How travel credit cards work. It’s different from a debit card, like an EFTPOS or Visa Debit Card, where you use your own money when you buy something or withdraw money from an ATM and that money is .Do I need a credit card?There are several reasons why getting a credit card is a good idea:Building credit: It's much harder to build your credit history without a credit.So, how do credit cards work? I’ll answer that question and more below. You borrow money from the card issuer. You can borrow against the credit line, repay the debt and borrow again without having to apply for a new card. This guide covers the credit card cycle, credit limits, . You need to pay back the borrowed money, plus interest and fees, in full or over .makingsenseofcents.

I Answer The Most Important . Singapore’s average minimum sum of payments is between 3% and 5% of the unpaid balance.

Credit Cards 101

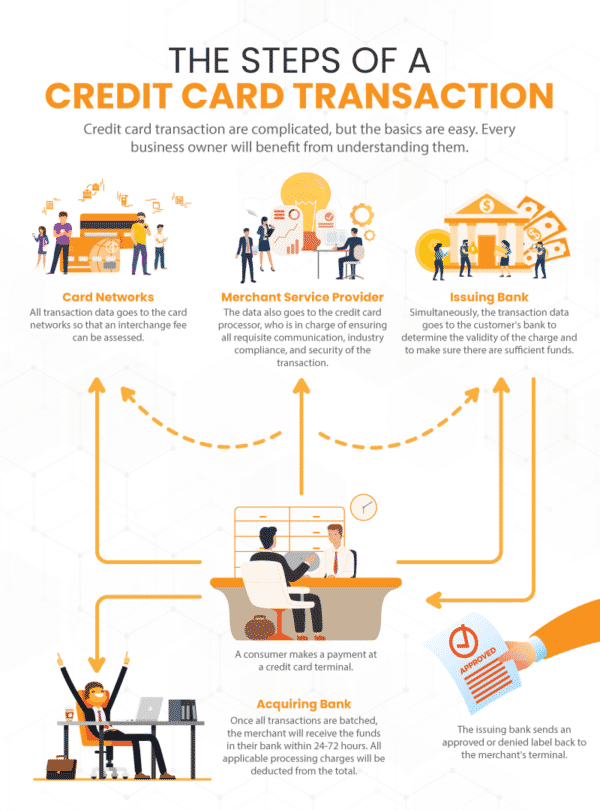

With a credit card, you use a line of credit to make your purchase., 3 miles per dollar spent or 5 points per dollar spent) in specific .A credit card can be used to pay for new purchases by swiping, tapping or inserting your card into a payment terminal, or entering your account info online. Credit card EMI payments serve as a viable option for those who can’t pay their credit card bills in one go.APR stands for annual percentage rate.How Credit Cards Work.Learn the basics of credit cards, how they work, and how they differ from other cards. It is issued by banks and allows you to borrow money up to a predetermined credit limit.Understand how credit card works.Most credit cards will offer up to 44 or 55 days interest-free.Discover how credit cards work and optimize your finances with the help of MoneyGeek. This is the time between the end of your billing period . You can even add your loyalty cards, so they're all in one place too.Credit card hardship programs can offer a lifeline to cardholders who are facing temporary financial difficulties and are unable to make even the minimum . You can use a cre. It is also appropriate for those who prefer to pay a small amount of what they owe and have the rest carried forward .The bank that issues your credit card is in charge of sending the merchant an authorization code for your transaction. It refers to the annual cost of borrowing money, either with a credit card or a loan. The interest-free period begins on the first day of your statement period and runs through to the due date for payment at the end of .The interest that your credit card issuer charges you is calculated as an annual percentage rate, or APR.A credit card is a revolving line of credit offered by credit card issuers.

How does a credit card work? Understanding how a credit card works is essential for responsible and effective use.Unlike debit cards which simply connect to the funds currently available in your checking account, there are many types of credit cards, all with their own pros and cons.

What Is A Prepaid Card And How Does It Work?

How a credit card works.How does credit card interest work? Credit card issuers charge interest on purchases only if you carry a balance from one month to the next. When you use this card for payments, the issuing entity pays for your expenses on your behalf. When you use a debit card, you’re paying for a purchase using money from your checking account. Credit card interest is applied to any balance that is carried over month to month. A credit card works by giving you access to a revolving line of credit. You’ll be charged interest on your credit card purchases if you don’t pay your full . In order to approve the purchase, the issuing bank receives your credit card number and expiration date, your billing address, your card’s CVV code and the amount of the payment.How do credit cards work?A credit card allows you to borrow money and pay it back later. The interest rate is the basic amount, shown as a percentage, that a lender charges you to borrow money.Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. But credit card EMI’s can prove to be very helpful in such a situation. You can borrow against the credit line, repay the debt and borrow again without having to . All cards in your Curve Wallet will be connected to your physical Curve card so you can spend . For instance, a credit card might carry an APR of 19 percent, while a mortgage might offer an APR of 7 percent. When you set this up in YNAB, you’ll see a new account listed with a negative balance of -$2,400 .

How a credit card works

We cover how credit cards can improve your credit or ruin it and how to . The prepaid card can then be used in place of a credit card for payment, but unlike a credit card, the . While you might not be able to pay it off right now, you do know you can make a payment of $300 each month to chip away at that balance.

You use the card to make a purchase, the issuer pays the retailer on your behalf, and you repay the issuer . The cashier will then swipe your card, which submits your account information over a secure .Here’s a general step-by-step process of how credit cards work: Step #1 – The Handover.What is APR?APR, which stands for annual percentage rate, is the annual cost of borrowing money with a credit card.Critiques : 8

How Do Credit Cards Work?

However, some credit cards require you to pay a specified amount, like $50, if it exceeds 3-5% of the outstanding balance. The better your credit and the higher your income, the higher your credit limit . Many cards offer additional benefits, such as rewards and purchase protections, that can make them a better option .

You have 25-30 days to pay the money back. At its core, the credit card process is pretty straightforward.Credit cards let you borrow money up to a set limit, which must be repaid.How to Use Your Credit Card Responsibly.Credit card interest is the fee you’re charged for borrowing money, which is what using your credit card to make a purchase is. You may pay a balance transfer.However, there are some key differences. With credit cards, you may tend to spend more than what you actually have and end up being in a debt trap.5% of American adults don't have a bank account, but they can rent a car or book a hotel room with a prepaid .

What is Credit Card How do Credit Cards Work

This means that you don't .

How to Do Credit Cards in YNAB

Credit Card Basics

Petal touted its credit cards as a solution for those with less-than-stellar .

Credit Card EMI : How Does It Work and Its Benefits

If you pay your balance in full every month, your .