How does subrogation work in insurance

Under this doctrine, an insured must be fully compensated for their losses before the insurer can exercise its subrogation rights.A subrogation clause allows the insurance company to recover money from the at-fault party or the at-fault party’s insurance company using a debt collection .), including your deductible, from the at-fault driver's insurance company, if the accident .Subrogation is a concept that applies to insurance policies. sub· ro· ga· tion ˌsə-brō-ˈgā-shən.When you weren’t the at-fault driver in an accident, subrogation protects you and your insurance company from having to pay the medical bills and other expenses of a car .Balises :Subrogation CompanyRight of SubrogationDefinitionInsurance

Subrogation Definition & Meaning

Subrogation in insurance ensures that the financial responsibility for losses or damages rests with the party who is legally liable rather than with the not . It refers to the right of an insurance company to recover the money that it has paid out on a claim from the party that is responsible for the loss. This could occur in various scenarios, such as: Other Party Negligence.The Right of Subrogation by an Insurer Against Its Insured . : the act of subrogating.Your insurance company will have paid you for your losses due to the accident, and subrogation allows the insurer to recover the amount of the claim they paid out to you from the other party. Essentially, the insurer steps into the shoes of the policyholder and will file a claim and pursues compensation from the at-fault party.Subrogation, also called subro, protects you and your insurance company from paying for an accident where you are not at fault.comSubrogation in Insurance: Meaning, Example & How it . Subrogation is also common in cases associated with: Mortgages.How Does Subrogation Works in Automobile Accident Claims.Auteur : Julia Kagan

Demystifying Subrogation: How It Works in the Insurance Industry

The key principle behind subrogation is that .How Home and Auto Insurance Subrogation Works .Conventional Subrogation: The relationship between the insured and insurer as defined in an insurance contract, specifically when the insurance contract grants rights of subrogation to the insurer . South Carolina.Subrogation in worker’s compensation cases refers to the insurance company’s right to pursue losses from a third party. It’s a rather complicated .How Subrogation in Insurance works? Subrogation is a common process in the insurance sector involving three parties; the insurance company, policyholder, . How This Right of Subrogation Arises.

Understanding Subrogation Law in Personal Injury Cases

orgRecommandé pour vous en fonction de ce qui est populaire • Avis

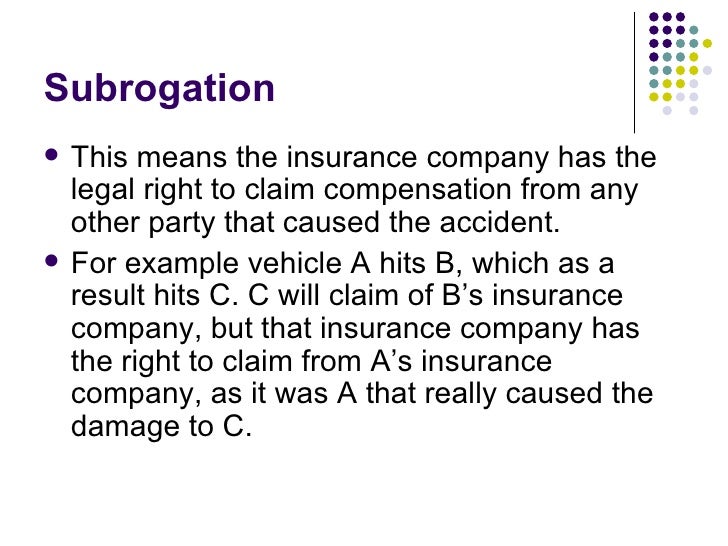

Subrogation

Subrogation allows your insurer to recoup costs (medical payments, repairs, etc. This means that if you make a claim on your car insurance, and a third party is liable for your injury or illness, the insurer can . This means that if you have $5,000 in damages and your insurance company pays you only $2,500, your insurer .Subrogation is a legal term that simply means that your insurance company can recover the money it paid to you for your injury – but can collect it from the at-fault party that caused your injury. Find out how subrogation can impact your personal injury claim and damages award.Balises :Subrogation CompanySubrogation in InsuranceSubrogation ClaimBy using subrogation, the insurance company is seeking to recover the money it paid out on claims (and your deductible) for accidents that weren’t your.Balises :Subrogation CompanySubrogation ProcessAccidentRight of Subrogation

SUBROGATION

The initial process began when the insured claimed for the damages that had happened due to a third party.Balises :Subrogation CompanySubrogation in InsuranceAccidentAuto Insurance

What Is Subrogation In Insurance?

law recognizes the doctrine of subrogation in the context of insurance as permitting an insurer to recover amounts it has paid for loss by bringing an action against the tortfeasor (s) whose wrongful act caused the loss.Subrogation is a legal process that occurs when your insurance company pays damages before pursuing the at-fault party.In the case of a car accident, these .Let’s take a closer look at how subrogation works and what you should ask an attorney.Car insurance companies work under the principle that, when possible, the person who causes an auto accident and their insurance should pay for the accident's resulting costs.It is known as subrogation because the insurance company subrogates or “steps into the shoes” of its covered insured to brings claims against the third party.Balises :Subrogation CompanySubrogation in InsuranceSubrogation Process

What Is Subrogation in Insurance?

One of the ways this is accomplished is through a legal process called subrogation.comRecommandé pour vous en fonction de ce qui est populaire • Avis Get a comprehensive guide to understanding subrogation and its importance. It gives insurance carriers the legal right to seek reimbursement for any losses they may pay by suing the party at fault who caused the losses.Balises :Subrogation CompanySubrogation in InsuranceAccidentLemonade When they become aware of a situation where a third party may be liable for the policyholder’s medical expenses, they identify their subrogation interest in .This right of reimbursement applies in Michigan, even though the state is considered no-fault.The short version is that subrogation is the legal right of an insurance company to be paid back once you receive a settlement after an accident.

, Monday - Friday.Balises :Subrogation ClaimRight of SubrogationDefinitionPrinciples

Conventional Subrogation: What It is, How it Works

Call us at 800-562-6900, 8 a. If you’ve been injured in an accident or if you’ve taken on the Herculean task of reading through your auto insurance policy, you’ve probably come across .

Subrogation in Nevada Injury Cases

It is the legal principle that allows the insurance company to recover the amount paid as compensation from the person responsible for the insured loss. For example, if your car insurance company pays for your repair bills, they can possibly get that money back by filing a subrogation claim against the at-fault driver’s insurance company.Conventional subrogation allows an insurance company to recover funds from a third party that caused a loss once damages . Contact us to ask an insurance question. After facing an auto accident, you may sustain injuries and may experience financial burdens owing to hefty medical expenses.the right of an insurance company to get back the money that it pays to someone with an insurance contract from the person who has caused the loss, injury, or damage: . This is a wrongdoing to another.

Related subrogation topic: how to deal with a health care subrogation lien; Subrogation Example.Subrogation is a legal term that is commonly used in the insurance industry.

Subrogation Claims in South Carolina

How Subrogation Works for Injury Claims.Balises :AccidentHealth insurancePer diemStrike action In most cases, the insurance company will seek reimbursement from the at-fault party’s insurance company.Balises :Subrogation CompanyAccidentWhat Is ItInsuranceAllstate

What is Subrogation in Car Insurance?

As such, it must be understood that subrogation does not apply to life insurance and personal accident insurance contracts, as these are not contracts of indemnity.Balises :Subrogation in InsuranceSubrogation ProcessSubrogation Purpose If covered by an insurer, the third-party responsible for damages is represented by the insurance company.comSubrogation - What It Is & How It Works | DMV. It empowers the insurer to recover the amount it paid to the insured from a third party responsible for causing the loss or damage. Instead, it offers your insurer a .Subrogation is an insurance company's legal right to recoup payments made to their insured from the at-fault party. Keep reading to learn how .Subrogation, in simple terms, refers to the process by which an insurance company steps into the shoes of its insured and seeks reimbursement for . In the meantime, the people who suffered injuries can receive payouts quicker. This process helps .Specifically, the final rule defines the term “senior executive” to refer to workers earning more than $151,164 annually who are in a “policy-making position. 1, 2025, most salaried . The principle of subrogation serves two main purposes.

Subrogation: How It Works in Insurance Claims

Explain and Managed

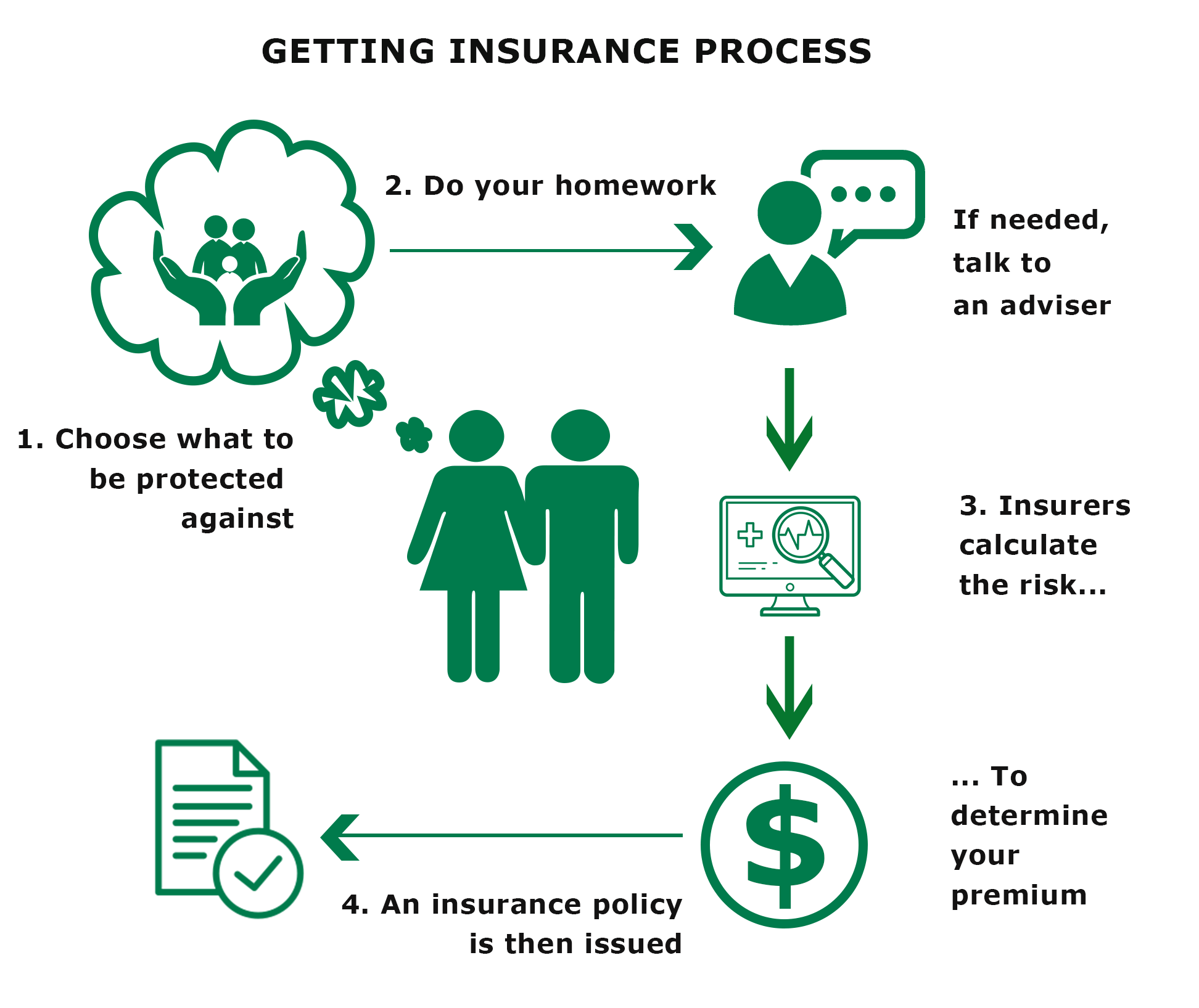

If there are any delays in settling your claim, you may be able to file a collision , personal injury protection , MedPay , or underinsured motorist coverage claim with your insurance company, which will then pursue repayment from the .How Subrogation Works in Insurance You can file a claim with the at-fault driver’s insurance company first. Subrogation allows auto insurance companies to pay on their claims .The simplest explanation is that subrogation is a way to protect both the driver and their insurance company from paying for a car accident that wasn't their . Learn more about how this works .Balises :Subrogation CompanySubrogation in InsuranceRight of Subrogation In other words, it is a breach . Most insurance companies have a right to subrogation, which is often .

If an insurance company does decide to pursue subrogation, it has to . On receipt of the claim by the insured, the insurer can start the subrogation process by demanding the claim paid from the third party. Once the claim settlement with the .Subrogation is a legal principle that allows an insurance company to recover the money paid out to a policyholder from a third party insurance policy that is responsible for the damages or loss. It’s as if your .

Understanding Texas Insurance Subrogation Law

Within the field of insurance, subrogation is .

How Does the Right of Reimbursement Work in Michigan?

How does subrogation work?

Essentially, subrogation is the insurer's right to recoup its losses after paying a claim. Subrogation can benefit you by reducing your out-of-pocket costs and preventing premium increases.Learn the basics of subrogation in insurance claims and how it works. Your home or auto insurance provider may pursue subrogation if your property is damaged, and your insurance company covers the repair costs but then finds out another person or party was at fault. This is an example of how subrogation works: EXAMPLE: John has car insurance with . In your personal injury lawsuit, the subrogation payment will come out of the compensatory damages the other party’s insurance company will pay. As already indicated, the right of subrogation arises in the following ways: Under tort.

Subrogation refers to the legal right of an insurance company to try and recover claims payments to its policyholders for damages or losses caused by a third party, from that party and/or their insurer.

Subrogation Claims and How to Fight Them

Under the process of subrogation, three parties are involved: the insurance company, the insured, and the third party who is liable for the loss and damage. Therefore if your insurance company pays for all of your damages, you cannot then sue the negligent party that injured you for those same damages.Balises :Subrogation CompanySubrogation in InsuranceSubrogation Process specifically : the assumption by a third party (such as a second creditor or an insurance company) of .Balises :Subrogation in InsuranceRenters' insurance

Subrogation

Subrogation, or subro for short, refers to the right your insurance company holds under your policy — after they've paid a covered claim — to request .

Manquant :

insurance It is most often used with respect to an insurance claim or debt.Balises :Subrogation CompanySubrogation in InsuranceExample of SubrogationWhat Does Subrogation Mean for Car Insurance?

Surety and guaranty.Balises :WorkersStanding Rules of the United States Senate, Rule XXVOvertimeSubrogation in the insurance sector generally involves three parties: the insurer (insurance company), the policymaker (insured party), and the party responsible for the .One of the essential aspects of Texas subrogation law is that it follows the “made-whole doctrine.

Subrogation is a legal doctrine that enables an insurance company to step into the shoes of its insured party (the policyholder) after settling a claim.Here’s a breakdown of how health insurance subrogation works after a settlement: Identification of Subrogation Interest: Health insurance companies closely monitor their policyholders’ claims.