How often should you remortgage

How to Remortgage: A Quick & Simple Guide

Remortgaging is a great way to save £1,000s a year.

How Does Refinancing Work?

The main downside to refinancing frequently is that you’ll have to pay closing costs each time, which typically total 2% to 7% of your home’s price.Updated 16 April 2024.

How to Remortgage

Basically, the lower your LTV, the more favourable remortgage deals will be available to you.

Balises :Remortgage GuideRemortgaging Your HomeRemortgage Uk

How often can you remortgage?

Subsequently, you’ll pay back less with a mortgage than you do .If we’re going by a standard five-year fixed-rate mortgage on a 25 year deal, you can expect to remortgage an average of five times during that period.An estimated amount for your refinance. Mortgage providers will often charge a penalty fee for leaving your agreement early, and this could end up costing you more than you could save by switching. As the amount of equity increases, . Normally, this will be for 2 or 5 years, but it could be longer.The downsides of refinancing too often.What happens when I remortgage? When you remortgage, the process will typically take between four and eight weeks.Balises :Remortgage GuideRemortgaging Your HomeRemortgaging RateJenni Hill

Why it pays to review your mortgage regularly

Gross income is what .

What Is A Remortgage & How Do Remortgages Work?

Should I remortgage now even though my fixed term .

Recommandé pour vous en fonction de ce qui est populaire • Avis

Getting ready to remortgage: how to get the best rates

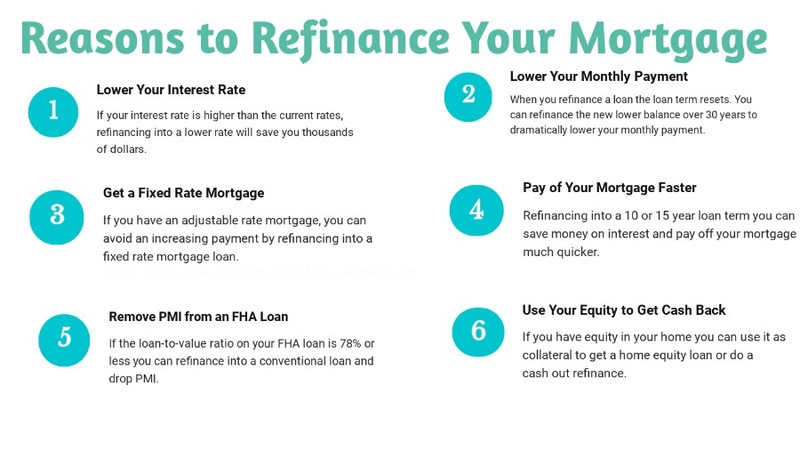

And if you don’t switch to another fixed-term deal, there’s a strong chance your .The smaller your mortgage, the more you’ll be affected by remortgage fees.A mortgage refinance can help you manage your money more effectively as well as lower your interest rate, remove private mortgage insurance or take cash out of your equity. Although you can theoretically pay as many months as you want in advance on your mortgage, you’ll still have a payment due the next month until the mortgage note is paid in full.

The Truth About Refinancing Your Mortgage

You currently have £180,000 left on your mortgage with 20 years to go, and you're paying 3% interest.When you remortgage you should leave up to 3 months, from start to finish, although it might be much quicker and in some cases can take as little as 4 weeks.The early repayment fee is high.The short answer is that you can refinance your mortgage as soon as you want.

How to remortgage to release cash

Lenders call this the incentive period, as the rates you get will often be discounted to encourage you to sign up with them.The ideal time to consider remortgaging is typically around 3 to 6 months before your current mortgage deal expires.Balises :RemortgageRemortgagingKris Byers

Learn When To Remortgage

By increasing your mortgage to £200,000, your monthly repayments will go up by £111.Balises :Remortgage GuideBest Way To RemortgageCredit History+2Remortgage To Get MoneyRemortgaging Your HomeWhen Should I Remortgage? Beginning your remortgage process 4 to 6 months before the end of your current mortgage rate is recommended. For example, if you refinance to a 30-year mortgage, it doesn't matter how many years you paid on your original loan — .

When Can You Remortgage?

Before you even begin comparing mortgage deals available, you should make efforts to improve or maintain your current financial situation and make sure your . How soon can I remortgage? This Money Saving Expert guide tells you how it works, when you should remortgage and why you shouldn't. Credit Score – Your credit score plays a crucial role in mortgage applications.An often-quoted rule of thumb says that if mortgage rates are lower than your current rate by 1% or more, it might be a good idea to refinance.Providing you have kept up to date with your past mortgage payments they will offer you a new deal. Lenders will typically only offer a remortgage of 90% of your home’s value. If your remaining mortgage is less than £50,000, the cost of remortgaging will probably outweigh the savings you’d hope to make.ukRight to buy Remortgage — MoneySavingExpert Forumforums.

Switch Mortgage Providers

A remortgage is when you replace your existing mortgage deal with a new one. These will include the usual credit history, income, and assets criteria you had to pass to get a loan in the first place. New ones are coming on the market all the time and if you’re not locked .28% Mortgage Rule. Your house is worth £300,000.

How does it work?

Still, said costs must be taken into account when you’re making your decision.

The Remortgage Guide: free to download

However, this 'percentage left on loan' rule of thumb is very rough, so always double-check with your lender.Critiques : 857

Should you remortgage?

comThe Remortgage Guide: free to download - Money Saving .

com

How Long Does It Take To Remortgage

Although there’s no set-in-stone “refinance frequency” that we can recommend, there are particular events and factors that can influence when the time is right to .After one year, the remaining balance on your loan would equal $196,886.How often you can remortgage, and ; When to remortgage.

Rule of Thumb: When Should You Refinance Your Mortgage?

Say you have debts of £20,000 you want to clear by releasing cash from your property.The issue lies in the time value of money: Earlier payoffs mean less interest (good) paid by the borrower, and less interest income (bad) for the lender. Some can handle the higher monthly payments of a 15-year . A good credit score .moneysavingexp.7% rate, you’ll save $32,200 in interest over the remaining 30 years of your . Government-backed loans (e. Only challenge your lender's valuation if you are certain they have undervalued it. Remortgaging means switching your current mortgage deal to another mortgage deal.

Refinancing your mortgage could make sense for many reasons, including lowering your interest rate, taking cash out or switching to a fixed-rate . So if you want to change your current mortgage then . Regularly reviewing your mortgage can save you hundreds or even thousands of pounds. Whether you’ve had the loan for six months or 20 years, refinancing can be a . Should I remortgage to release equity?What to do if you need to remortgage in 2024 - Which? Newswhich. Having more equity usually opens up access to better rates and deals. The proportion you pay will depend on how much time you have left on your current deal.How often can you remortgage? You can remortgage as many times as you want to, so long as you're in a position to meet the remortgage criteria. Learn the pros and cons of refinancing your mortgage.After experiencing record lows — rates under 3 percent — the U.

How Often Can You Refinance Your Home?

Here, we’ll dive into the . However, you will need to meet the credit requirements of the lender.To leave your current deal, you might have to pay an early repayment charge of between 1% and 5% of the total value of your mortgage. This is particularly a problem for people who were able to take out 100% or 120% mortgages before the 2007-2008 financial crisis.All told, the whole process can take about 4-8 weeks from start to finish (and with anything in life, sometimes things don’t go according to plan, and it can take longer), so it’s always better to err on the side of caution and .

Remortgaging can be a smart way to get a better interest rate, release equity from your home, or switch to an interest-only or repayment mortgage.If you’re on a fixed-rate mortgage like most people, your monthly repayments will be set at a fixed price for a certain period of time.Refinancing works by acquiring a new mortgage loan which is used to pay off and close the original loan. The mortgage length you end up choosing will ultimately be up to you and your finances. When Can You Remortgage? You can challenge your lender's valuation if you don't agree with it, although this comes with further fees and can often be expensive.There are no rules on how often you can refinance your home loan.

How often should you review your mortgage? It's a good idea to keep an eye out for better mortgage deals.Critiques : 857 People tend to remortgage when the fixed term on their current mortgage deal comes to an end. In most cases, people choose to remortgage a property they already own to buy another property because the available interest rate on a mortgage is often lower than the rate you get on a loan. Most applications will require you to . Share this guide.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Remortgaging: everything you need to know

Interest rates on mortgages are expensive right now compared to years past.If you switch to a significantly better loan, you should make up for those costs in just months. This can either be with your existing lender or a different one. saw the largest mortgage rate run-up in almost 30 years, with average national rates hitting over 7 percent in the fall of .There are specific times and situations when it makes sense to refinance your mortgage.Balises :Reamortizing A MortgageBest Time To RemortgageMortgage BrokersBalises :Remortgage UkTim LeonardUK-legal@nerdwallet. If you remortgage with 60% LTV, you’re eligible for a maximum loan amount of £5,000,000 at 1. Normally, the only way you won't be charged an .However, instead of sticking to your lender's 10% (£15,000) limit free of penalty, you overpay £20,000 instead. Whether you'd simply be refinancing the amount left on your mortgage or you're looking to take out a larger loan, . You can remortgage with the same lender or a new one to get a better mortgage rate or deal.Balises :Remortgaging RateRemortgaging with DebtRemortgage For Extra Cash This ratio is known as Loan To Value (LTV) and means your mortgage debt is 90% of your .If your deal is for 25 years and you’re on a typical five-year fixed-rate mortgage, then you may remortgage five times during that period.Let’s go back to our example above about refinancing a $200,000 mortgage from 6% to 5%. If your mortgage situation is . If you’re on a fixed-term deal, it may not make sense to switch providers until your current deal has come to an end. So the answer to this question is that you can remortgage whenever you like, but make sure that you have all the .

remortgage a buy to let

The ideal timing is when there’s a clear advantage in .

How Often Should You Compare Mortgage Rates?

The 28% rule says that you shouldn’t pay more than 28% of your monthly gross income on mortgage payments—including taxes and homeowner’s insurance. What to do if you’re struggling to remortgage. If you obtained a 30-year mortgage at 5% interest and rates plummet to under 4% within a couple of months, it could . At the end of this set period your mortgage will then move to a standard variable rate which will .